Retail traders brace yourselves as this week could get off to a rocky start. Before the market closed on Friday President Trump announced plans to tax Canadian imports by 25% on the 4th of February. Canada then responded with an announcement of tariffs imposed on US goods and consumer products. This may cause some early volatility within the market, tariffs have been positive USD so far, but will we see if heightened volatility will lead to haven positivity?

Key market events this week include retail sales from Australia, unemployment rates out of New Zealand, an interest rate decision in the UK and non-farm payroll out of the United States.

Forecast for January 27, 2024

USD Outlook

The USD Index (DXY) closed higher last week after finding support at $107.50. This weekly rejection of this level could suggest the USD strength will continue. Trump tariff announcement saw the USD strengthen at the end of the week. At the moment the market is reacting USD positive to threats of tariffs and negative USD when tariffs are removed. In other data this week we have non-farm payrolls out of the US. Forecasts show a decline in job growth is expected with January to show +154k in jobs.

Before this, we will see the release of ISM manufacturing and services PMIs. If we see upticks in both of these then this will more likely be USD positive. The USD remained unchanged on currency strength and weakness analysis offering less insight into the USD this week.

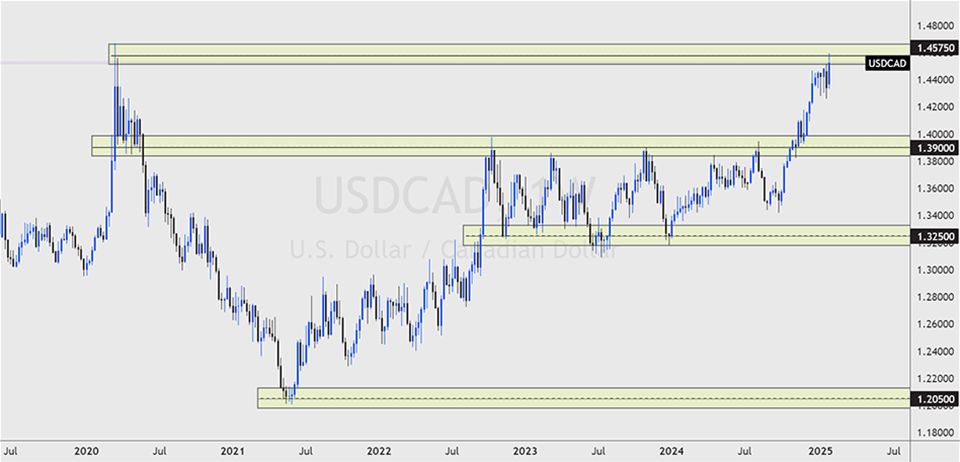

CAD Outlook

The USDCAD price will be an interesting watch this week. The tariff war between the US and Canada could cause the pair to range. The price of USDCAD has reached the 2020 highs of around 1.4575. Increased escalation of tariffs could cause the price to break through the 2020 highs, but if Trump backs down then USDCAD prices could find resistance here.

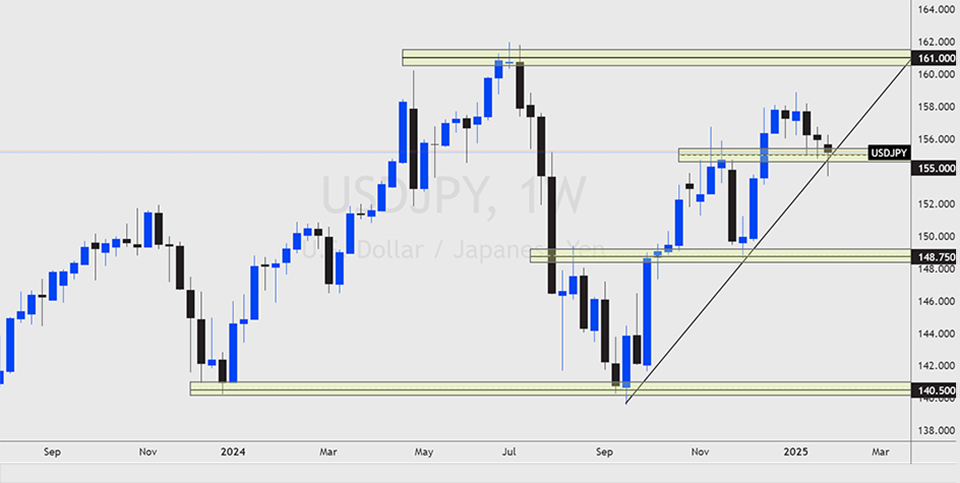

JPY Outlook

As volatility rises we often see the market rush to the Japanese Yen for safety. The USDJPY price is at a critical point. The 155.00 support zone formed from the previous weekly highs could be important to what happens next. If the price breaches and closes below then we could assume the price could trade lower. However, a hold above this support could see the price climb toward the intervention high of 161.00.

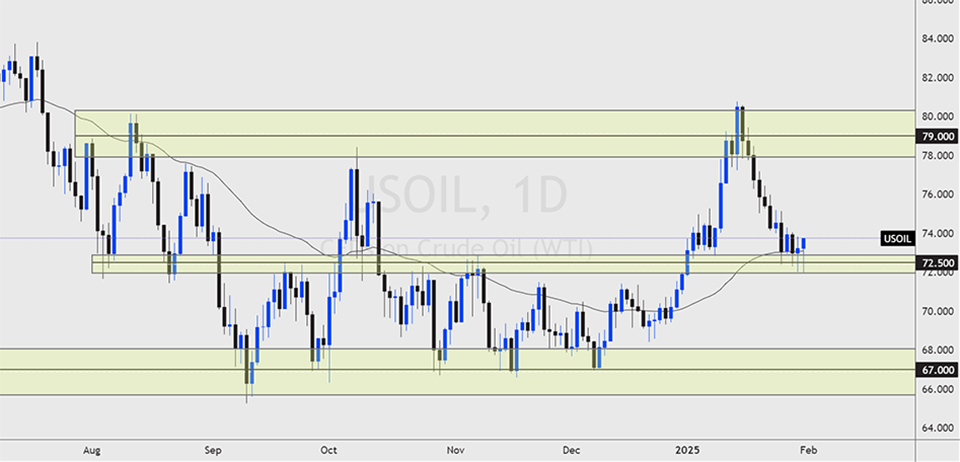

WTI Crude Oil Outlook

“Drill, baby drill” were the comments of Trump when he was inaugurated on the 20th of January, since then the oil prices have fallen over 7%. But is this the end of the story for oil and will prices continue to fall? Well, the price is currently sitting at key support of $72.50 and when Trump announced tariffs on Canada, the price rallied on the day by 2.53%. This tells us that tariff threats could boost oil prices in the near term, and if the price does rise we could see oil hit the highs of $79.00 again.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.