Another weekend full of political swings could see the market open volatile this week. Reports of tensions between Europe and the US are circulating after Vice President JD Vance spoke at a European conference, which left European leaders with a sour taste in their mouths. This, combined with the likelihood of tariffs on Europe by the US, could see EURUSD trade lower, a contrast to what happened this week.

Forecast for February 17, 2025

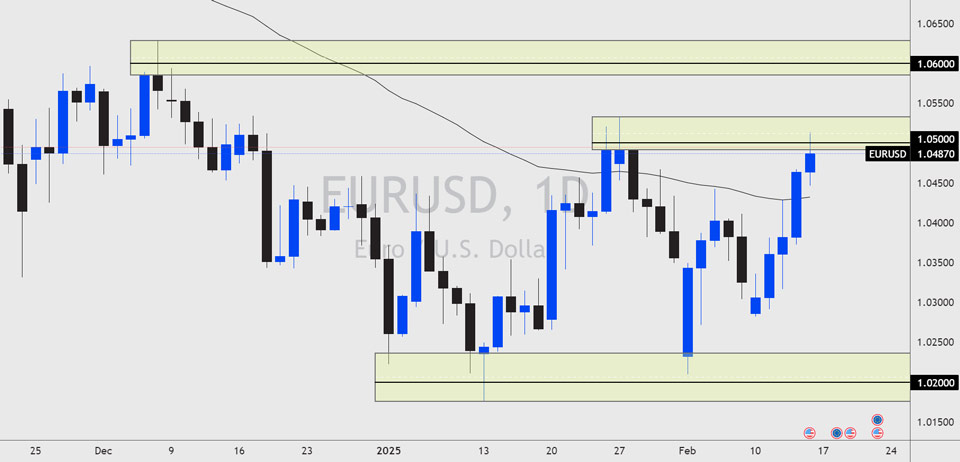

EURUSD Outlook

The EURUSD price closed bullish for a fifth consecutive week as the market begins to understand the fiscal challenges that Trump presents. We have seen USD buying on Trump's tariff announcement, but once this negotiation tactic has faded and an agreement is made, USD gives back those gains. The market is starting to wake up to this narrative, and tariff announcements are beginning to have less impact.

That being said, data out of the US hasn’t been great of late which is driving US bond yields lower, helping with that USD weakness. EURUSD is now testing the 27th January high around 1.0500. This level saw heavy selling in the past and if broken then EURUSD prices could move to the next level of resistance which resides at 1.0600.

NZDUSD Outlook

We have been waiting for this pair to move for a while. On the 13th of January, the NZDUSD price reclaimed the 2022 lows of 0.5550. Alongside this, the commitment of trader reports highlighted extreme short positions by hedge funds, who held a net position of -54,624 contracts. This was the highest level in history. When this happens we often see a shift in the price as hedge funds re-position or close positions out. Well after 3-4 weeks the price now looks to be moving and heading higher towards the resistance lows of 0.5800.

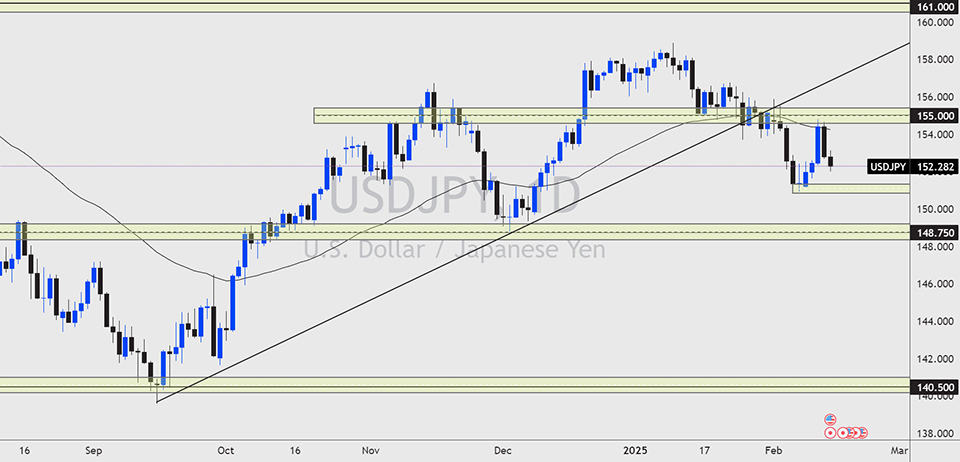

USDJPY Outlook

The USDJPY price closed bullish on the week but not by much. The price tried to breach back above the key resistance of 155.00 but was met by sellers once again. The price closed at 152.28 and with political tensions rising between the US and Europe the JPY may benefit further. If the price breaks the current week's lows, then the next support can be found at 148.75. These are the lows that formed at the beginning of December last year.

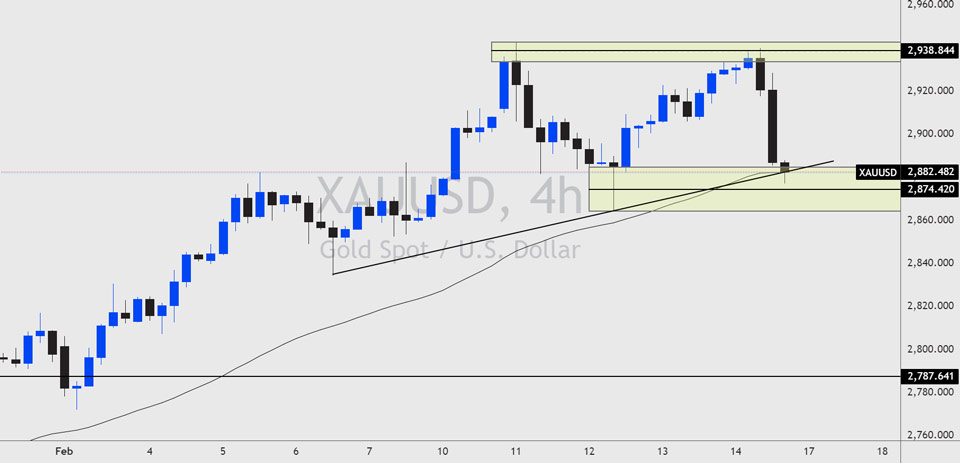

GOLD Outlook

Well, Gold prices continue to be the talk of the trading town and for good reason. Last week we saw the price reach a new high of $2,942.78 edging closer to the $3000.00 psychological level. However, the price on Friday did shoot lower after US retail sales shocked the market. Core retail sales in particular fell from 0.7% to -0.4% month on month. This tells us that the US consumer is not spending as much, which could therefore lead to a slowdown in economic growth. On the 4hr chart the price of Gold is trading back at supporting lows of $2875.00, a hold of this level could encourage some buying again, however, a break and close below may see buyers get out and sellers take over.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.