Get ahead in the Forex market with our latest analysis! 'Forex Week Ahead Analysis' covers crucial data - CAD CPI, BoE insights, US Retail Sales, and more. Stay informed, stay ahead! #ForexAnalysis #Trading #TradingInsights #Forex

Watch the video to learn more...

Forex Week Ahead Analysis

As traders gear up for another exciting week in the Forex markets, several key economic indicators across major economies are set to create waves. Here's a quick look at what's on the horizon and how it might shape the trading landscape.

Canadian CPI and the BoC's Next Move

Firstly, eyes are on the Canadian Consumer Price Index (CPI). The forecast suggests a dip from 0.1% to -0.3%, a significant shift that could spark discussions about the Bank of Canada's (BoC) monetary policy. This decline in CPI is critical as it might fuel speculations of a potential rate cut by the BoC within the year. Traders holding CAD or trading in CAD-linked pairs should brace for potential volatility, as any rate cut talk tends to stir the currency markets.

BoE Governor Bailey's Speech and UK CPI

Across the pond, the UK's economic scene will also be in the spotlight. Bank of England (BoE) Governor Bailey is scheduled to speak, and his comments are always keenly watched for hints about future monetary policy. His speech comes right before the release of the UK Consumer Price Index year-over-year (CPI y/y), which is forecasted to see a slight decline of 0.1%. Any deviation from this forecast, especially coupled with insights from Governor Bailey's speech, could lead to significant GBP movements.

US Retail Sales and Unemployment Claims

Over in the United States, the focus shifts to consumer behavior and job market health. Retail Sales are anticipated to show an uptick, rising from 0.3% to 0.4%. This increase, if realized, could signal robust consumer confidence and spending - a positive sign for the US economy. However, in contrast, Unemployment Claims are expected to see a slight increase from 202k to 204k. While not a drastic change, this increase could raise questions about the job market's strength.

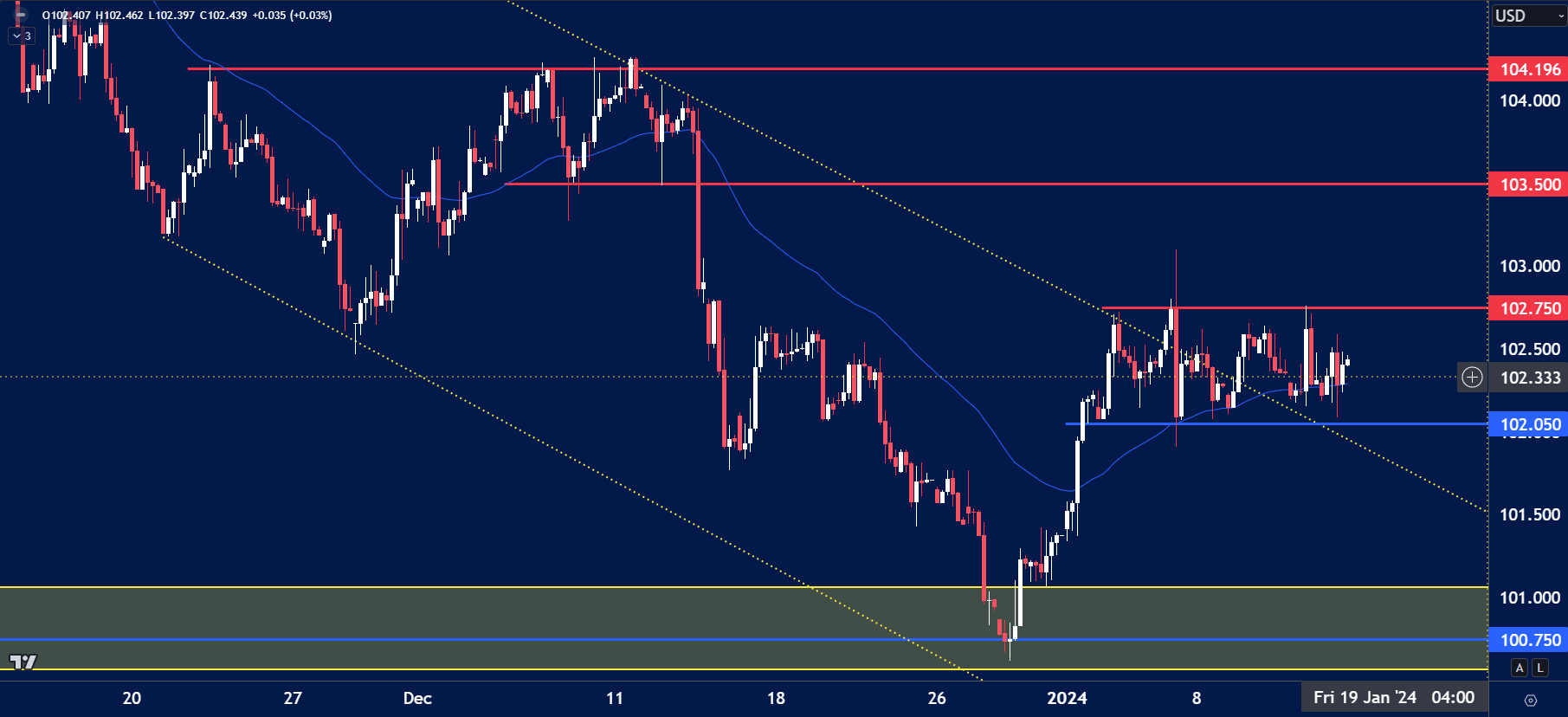

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- Last week the USD Index ranged between 102.75 and 102.05.

- This was largely due to the mixed outcomes of data.

- H4 chart shows price in the trading range, a breakout would be needed to identify any direction.

USD/JPY

The price on the chart has traded through multiple technical levels and some observations included:

- USDJPY rallied from support of 143.75 which formed by previous breakout highs on the H4 time frame.

- Recent resistance was found at December 11th highs at 146.25.

- If JPY weakness continued we could see a move back towards 146.25 resistance.

EUR/JPY

The price on the chart has traded through multiple technical levels and some observations included:

- JPY is the currency to watch again this week after weakness flooded the market. EUR/JPY is trading above previous Daily highs of 158.00.

- Traders could be looking to add into positions around these levels.

- If price finds support the next level of resistance could be found at 161.50.

GBP/JPY

The price on the chart has traded through multiple technical levels and some observations included:

- GBP/JPY was on our watchlist last week as price consolidated below resistance of 184.00.

- Now the price is above 184.00, it could be used as support.

- High volumes sit at 187.15 and could be targets for traders long.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.