Well President Trump likes to start and end the week strong by the looks of things. On Friday the President announced the ‘reciprocal’ tariffs could be imposed by Monday or Tuesday next week. Which caused some volatility in the markets. The S&P500 America’s largest index closed lower on the day by 0.93% whilst the Nasdaq closed 1.28% down. This overshadowed the Prelim Inflation Expectations report which showed consumer expected inflation to be at 4.3% vs the previous 3.3%. This showed us that consumers are becoming worried about higher inflation, which might change their spending habits.

This week the market’s attention will turn to more inflation data in the United States with the Core Consumer Price Index m/m out on Wednesday. Rising inflation rates will be a concern for the Federal Reserve who meet on the 19th March.

Forecast for February 10, 2025

USD Outlook

The USD was pulled from pillar to post last week as we see the currency react to President Trump announcements. When the President goes to impose high tariffs we see the market move to the USD. However, once this negotiation tool has been used and tariffs are paused or not implemented, well the market seems to sell USD. This makes trading the USD tricky for now. However, if we see the Consumer Price Index rise this week, then the chance of the Federal Reserve cutting rates in March will be lower. This could influence the market to buy USD once again.

On another note, USD bonds rallied last week which had a negative impact on the USD. Rising bonds means the yields are falling, if this sentiment were to continue then the USD may see a short term sell off.

Looking at the sentiment data, the commitment of trader reports highlight commercial entities are selling USD at similar levels to those back in June of 2024. In that period the USD Index fell from 105.60 to 100.00.

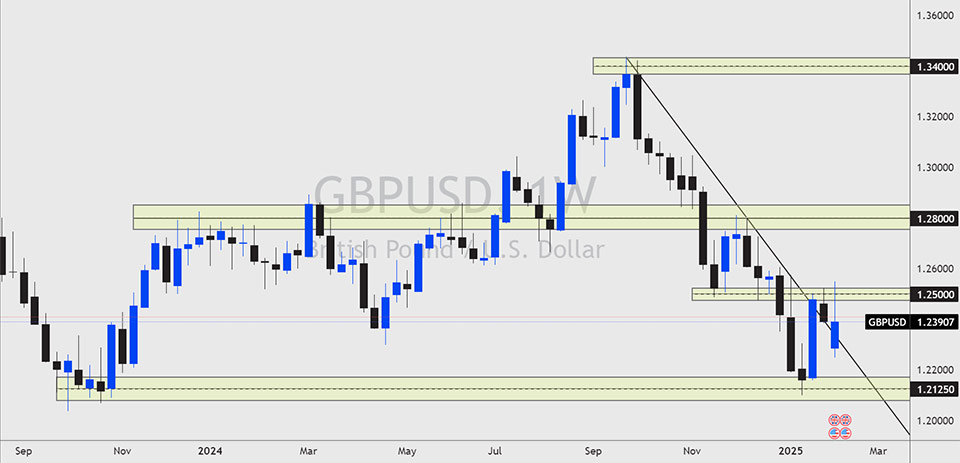

GBP Outlook

The Great British Pound closed bullish last week after gapping significantly on the open. The Bank of England cut interest rates by 25 basis points in line with the forecasts. England’s central bank slashed growth forecasts in half to 0.75% for this year. Inflation is forecast to rise to 3.7% which is due to higher energy prices. On Thursday we get the latest GDP (Gross Domestic Product) figures which forecasts growth 0.1% for the month of January. Any downside misses could really put pressure on the GBP against other currencies.

NASDAQ100 (NAS100) Outlook

The US stock market is likely to see some growing pains this week as we see the release of CPI, PPI and Retail Sales. The inflation data on Friday pointed to consumers being concerned about rising prices which could see Americans think differently about how they spend their money. The Nasdaq, largely made up of technology companies declined by 1.28% on the news. It seems like the stock market could continue to have a rocky start to the year, trying to balance inflation concerns and Trump tariff headlines.

Natural Gas Outlook

The price of natural gas could be in focus over the next few weeks as hedge funds and commercials have reached an extreme position on the commitment of trader reports. Commercials in particular are selling Natural Gas at levels similar to those back in August and March of last year. This could signal a short term pullback in the price which has fallen over 30% since the beginning of 2025. According to the S&P Global Commodity Insights, the average total supply of natural gas rose by 1.6% (1.8 Bcf/d) compared with the previous report week.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.