Forex Trading Week Ahead: Key Highlights to Watch

Market Outlook

This week's events could create significant volatility in the forex markets. The USD could strengthen if inflation data beats expectations or if the Fed maintains a hawkish tone. Conversely, the yen's direction will largely hinge on any policy tweaks from the BoJ.

The USD roller-coaster continues after a surprising NFP release. But don't think that this ride is going to end any time soon. We have more USD coming up this week including CPI (Consumer Price Index), Fed Funds rate decision as well as PPI (Producer Price Index).

Non-Farm Payrolls Surprise

Last Friday, the U.S. Non-Farm Payrolls (NFP) report delivered an unexpected jolt to the markets. The economy added 272,000 jobs in May, surpassing the forecast and previous month's revised figure of 165,000. This robust job creation indicates a resilient labor market, which could have lasting implications for U.S. dollar strength and Federal Reserve policy. Unsurprisingly, we saw the unemployment rate uptick slightly from 3.9% to 4.0% showing some underlying pressure in the labor markets.

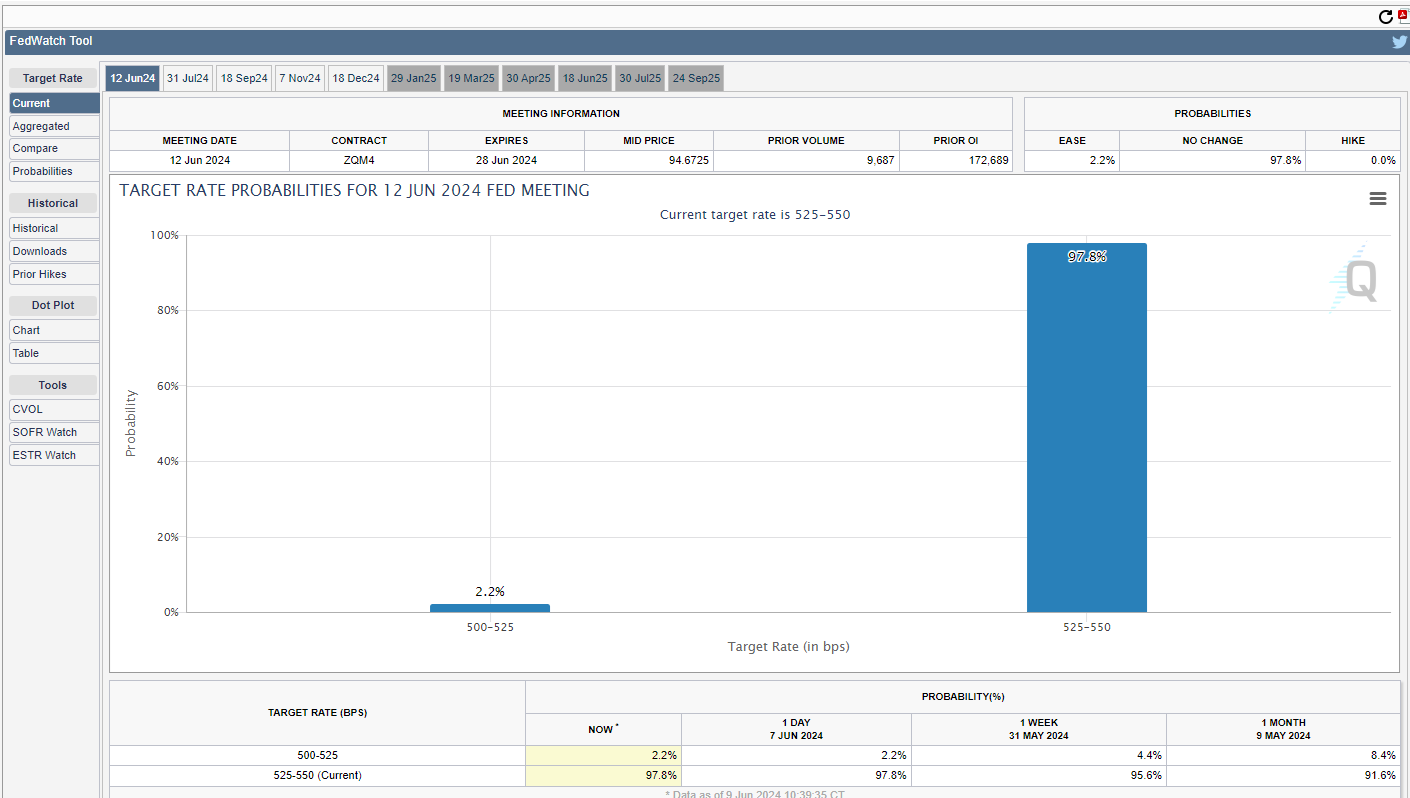

Federal Reserve Interest Rate Decision

The Federal Reserve is set to announce its latest interest rate decision this week. While the market consensus is that rates will remain unchanged at 5.50%, there is growing speculation about the timing of future rate cuts. Recent data has pushed expectations for the first cut back to November. This cautious stance is likely a response to the strong labor market and persistent inflationary pressures.

US Consumer Price Index (CPI)

On the inflation front, the US Consumer Price Index (CPI) is projected to hold steady at 3.4% year-over-year for June. Any unexpected increase in this figure could reinforce USD strength, as it would signal that inflation remains sticky, potentially delaying the Fed's timeline for easing monetary policy. Conversely, a lower-than-expected CPI could renew speculation about earlier rate cuts, influencing the dollar's trajectory.

Bank of Japan Policy Meeting

Across the Pacific, the Bank of Japan (BoJ) is also scheduled to meet this week. While the central bank is expected to keep its interest rate unchanged at 0.10%, there is anticipation that it might adjust its bond purchasing strategy. Any reduction in bond buying could be seen as a step toward tightening policy, which might impact the yen's value against other currencies.

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the USD Index rebounded from the $104.00 handle after a surprising uptick in NFP.

- Buyers are now facing key daily highs as resistance at $105.00.

- A break above this resistance this week could be based on the Federal Funds rate decision and press conference.

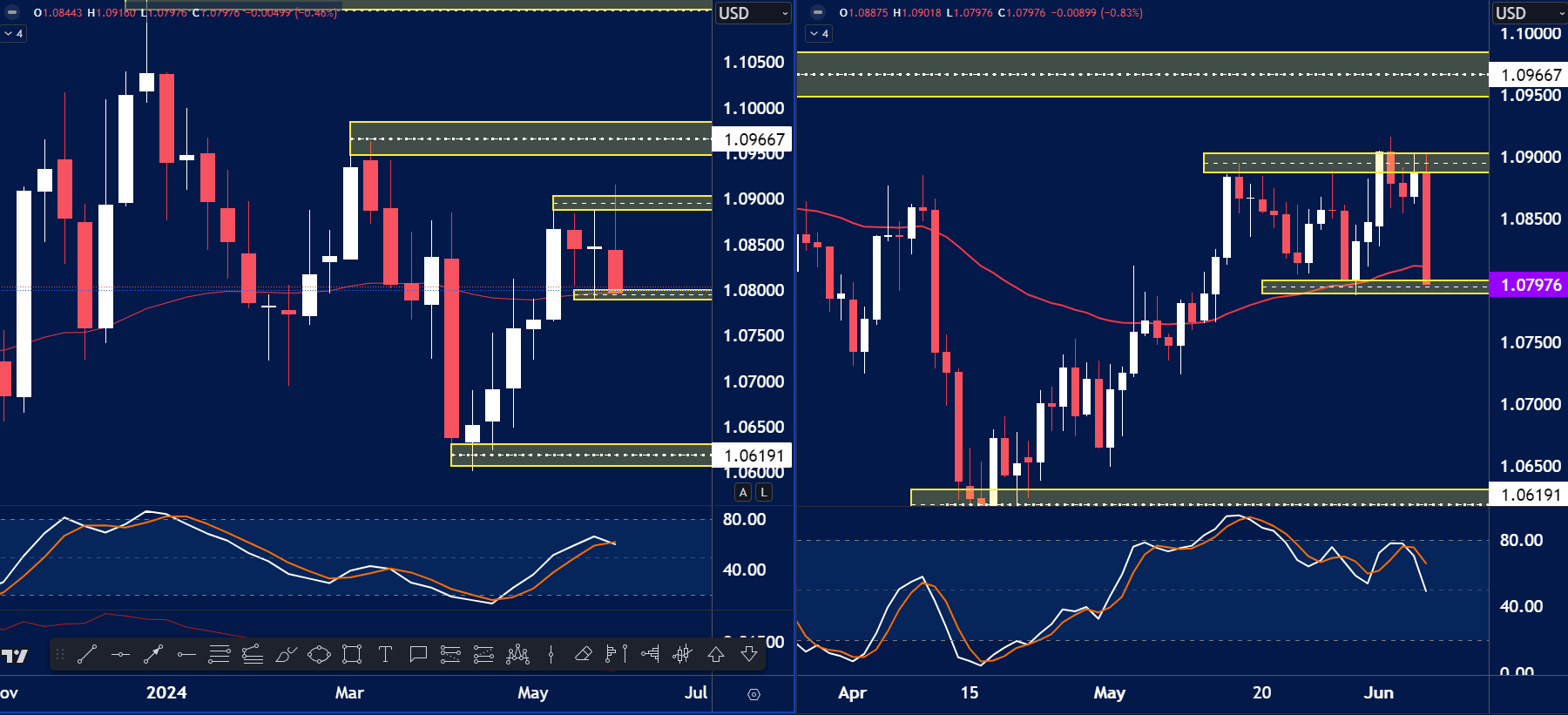

EURUSD

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the EURUSD rejected the key resistance highs of 1.0900 last week.

- After the NFP number price fell to the daily supporting lows of 1.0800.

- A defined range could be a play for traders this week especially as we head into high impact data releases.

USDCAD

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the USDCAD seems to be supported at 1.3600 for now.

- Buyers of the loonie could target the weekly range highs of 1.3900.

NZDUSD

The price on the chart has traded through multiple technical levels and some observations included:

- The price of the NZDUSD respected the key Value Area High of 0.6200.

- If sellers do continue to sell NZD against USD then we could see price test the lower volume zones around 0.6025.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.