Cuts are coming!

That’s what the Federal Reserve Chairman Jerome Powell signaled in his speech at the Jackson Hole event. This had a significant impact on the USD with the USD Index (DXY) falling to 2024 lows of 100.65. However he said the ‘pace of cuts’ will be determined by the ‘upcoming data’. The FOMC meeting on the 18th September will be highly anticipated as market participants battle to figure out whether it will be a 25 or 50 basis point cut.

One of the most anticipated data releases this week is the Core PCE Price Index, scheduled for Friday. This measure of inflation is closely watched by the Federal Reserve. Current forecasts suggest that the index will hold at 2.2%, but any reading below this level could influence further USD weakness.

The latest Commitment of Traders (COT) reports show that hedge funds have been aggressively buying gold, with positions now exceeding levels we haven’t seen since 16th July. This caused the Gold prices to form a short term top. Could this be an insight into future gold prices? with the market approaching all time highs again.

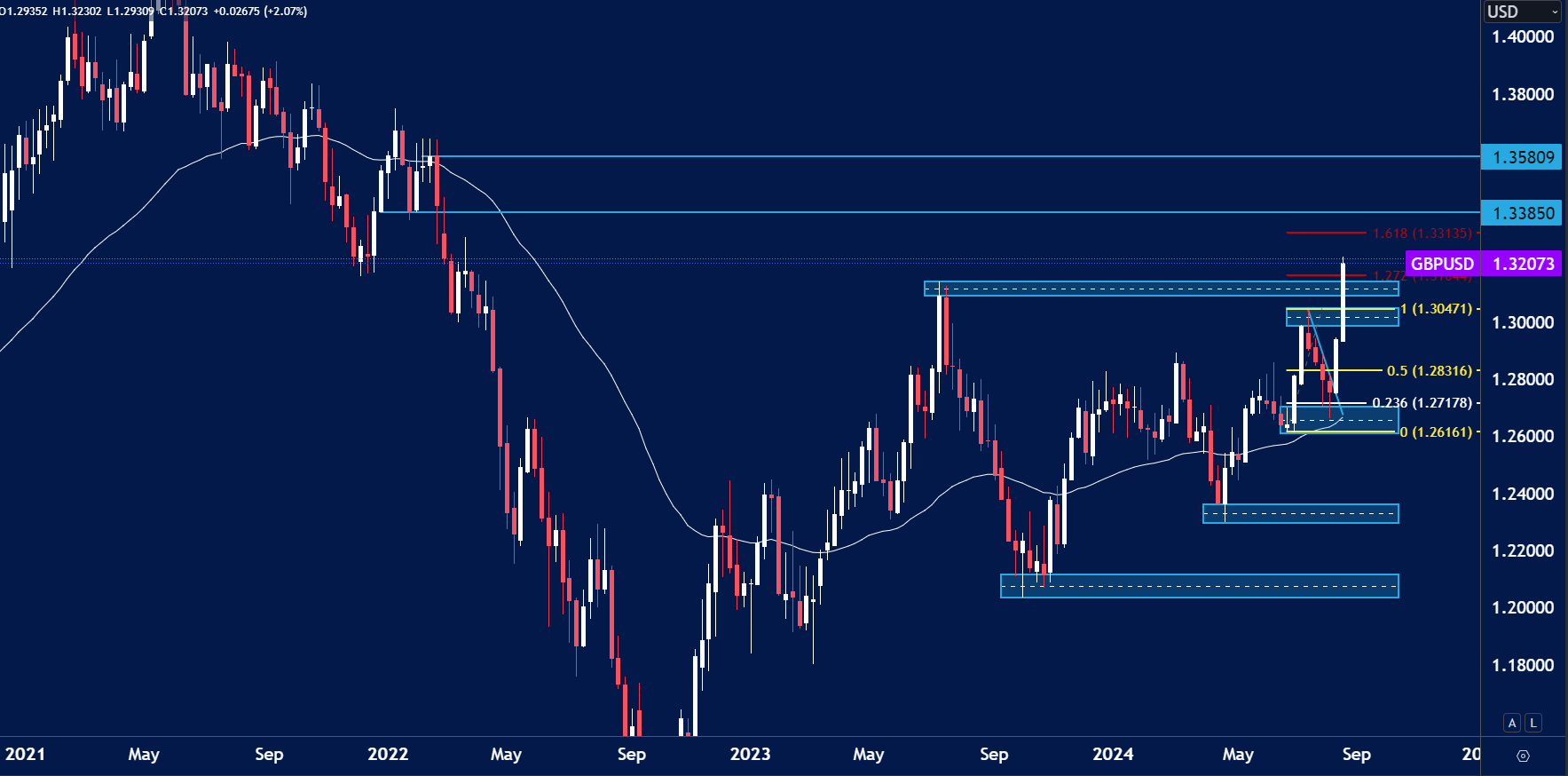

The price of GBP/USD has been on a bullish run recently breaching the 1.3200 level. Market participants are now eyeing a potential rally towards the 2022 highs around 1.3500. The pound has been one of the currencies to benefit the most from the USD weakness and is leading the way in breaking significant levels within the market.

One important piece of data this week will be in Japan, where the Tokyo Core CPI m/m data is set to be released on Friday. Although the Bank of Japan said they will not consider any rate hikes whilst the market is ‘unstable’ any surprise shift in CPI could prompt hikes from the central bank.

USD Index

- The USD Index weekly chart shows the price closing below the key $101.00 zone of support.

- If we see more USD weakness then the lows of 2023 could be the target of $99.75.

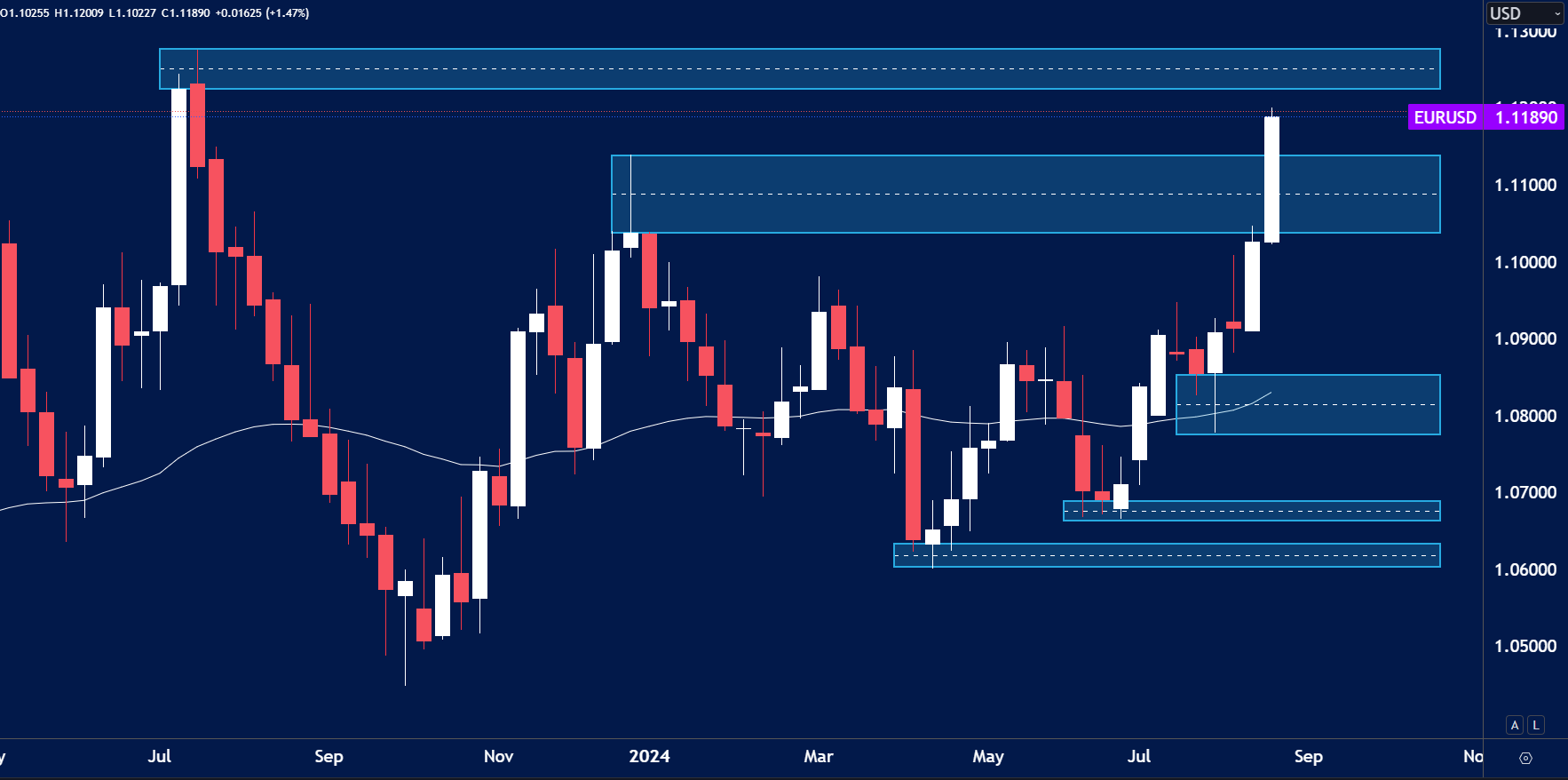

EUR/USD

- The price of EUR/USD continued to trade higher in line with the USD weakness. Price is now reaching the key resistance of 1.1250.

- A break above this zone would be a significant shift in the dynamic of the USD.

GBP/USD

- The price of GBP/USD climbed above the 1.3200 resistance zone.

- Traders could look to target the 2022 highs around 1.3500.

XAU/USD

- The price of Gold will be an interesting watch this week. Despite significant USD weakness Gold prices remained fairly subdued. This was largely due to market participants pausing Gold longs and heading back to equities.

- However the CoT reports highlight a significant shift in long contacts by the commercials. This could be indicative of a short term market top.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.