Volatility in the forex market represents the degree of price variability. Traders find it advantageous as it creates opportunities for substantial gains, with the potential for quick and significant market movements.

This article discusses the top five trading strategies for a highly volatile market.

What is a highly volatile forex market?

A highly volatile forex market occurs when currency prices experience rapid and significant fluctuations over a short period. This heightened volatility is driven by various factors that can swiftly impact market dynamics. Economic indicators, such as employment figures or GDP growth, central bank announcements, and unexpected geopolitical events, are some of the key contributors to increased volatility.

During periods of high volatility, traders may witness sharp and unpredictable currency swings, creating both opportunities and challenges.

Advantages and risks of trading a highly volatile market

Advantages

- Increased gain potential: High volatility often leads to larger price movements, presenting traders with opportunities for significant gains.

- Diverse trading opportunities: Volatile markets offer a variety of trading opportunities across different strategies.

- Enhanced liquidity: Highly volatile markets typically have increased trading volumes, leading to enhanced liquidity. Higher liquidity levels make it easier for traders to enter and exit positions, reducing the risk of slippage and ensuring more efficient order execution.

Risks

- Greater risk of losses: Rapid and unpredictable price movements can result in traders experiencing substantial drawdowns, especially if risk management is not effectively implemented.

- Increased emotionality: High volatility can evoke strong emotions like fear and greed, leading to impulsive and emotionally driven trading decisions.

- Challenging risk management: Stop-loss orders may be triggered more frequently due to sharp price fluctuations, and market gaps can occur, leading to slippage. Traders must adjust their risk management strategies to account for the heightened volatility.

Top 5 trading strategies for highly volatile markets

Trend following strategies

Trend-following strategies in highly volatile markets involve identifying and riding the prevailing trends. Traders commonly use technical indicators like moving averages to confirm trend directions.

In forex trading, a popular approach is to use a combination of short-term and long-term moving averages. For instance, a trader might look for a golden cross where the short-term moving average crosses above the long-term moving average, signaling a potential uptrend.

Conversely, a death cross indicates a potential downtrend and signals traders to short the trade. Traders may also incorporate momentum indicators, such as the Relative Strength Index (RSI), to confirm the strength of a trend. It is crucial to use risk management tools like stop-loss orders to protect against sudden reversals in volatile markets.

However, trend-following strategies can face risks if trends suddenly reverse or the market enters a prolonged sideways phase, leading to potential losses if not managed effectively.

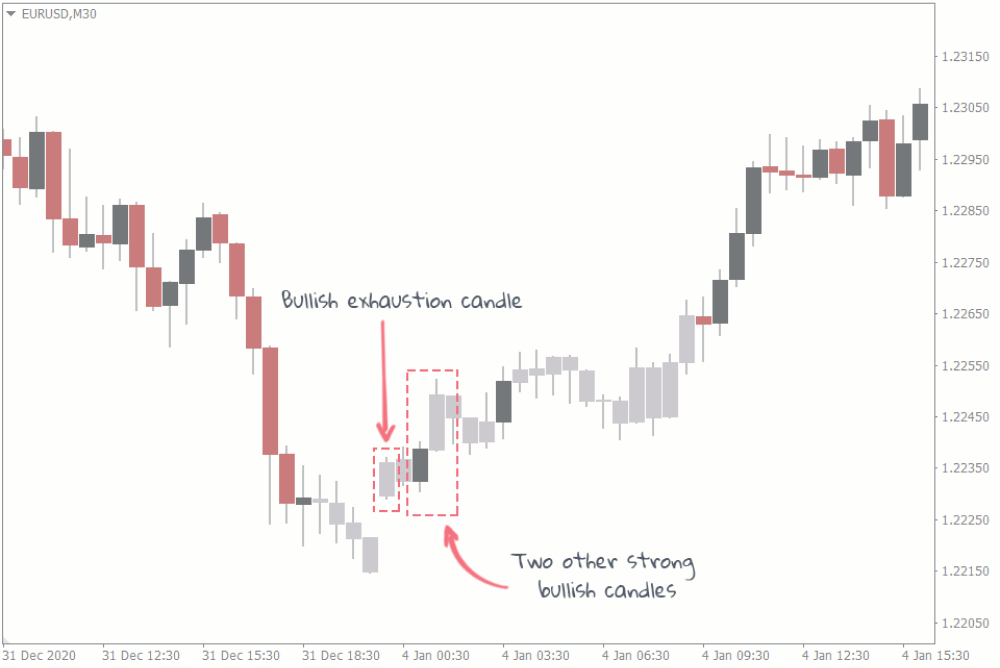

Breakout trading strategies

Breakout trading in forex involves identifying key support and resistance levels and taking positions when the price breaks through these levels. In highly volatile markets, breakouts can be more frequent and powerful. Traders might use technical analysis tools like Bollinger Bands to identify periods of low volatility followed by potential breakout opportunities.

For instance, a breakout might occur with increased volatility when the price squeezes within the bands. Setting pending orders above or below key levels and incorporating volatility measures, such as the Average True Range (ATR), can help traders fine-tune entry and exit points.

However, breakout strategies carry the risk of false breakouts, where the price briefly moves beyond a level and then reverses. Traders should use confirmation tools and manage risks with stop-loss orders.

Range-bound trading strategies

Range-bound strategies focus on trading within established price ranges. In forex, traders might identify horizontal support and resistance levels. In highly volatile markets, price fluctuations within the range can be pronounced. Traders may use oscillators like the Relative Strength Index (RSI) to identify overbought or oversold conditions within the range. A popular approach is to enter the market near support levels and exit near resistance levels. Volatility indicators, such as Bollinger Bands, can assist in identifying potential breakout points within the range.

However, range-bound strategies face risks when the market unexpectedly breaks out of the established range. Traders should adapt quickly and use risk management tools to mitigate potential losses.

Algorithmic trading strategies

Algorithmic trading strategies in highly volatile forex markets involve the automated execution of trades based on predefined criteria. Traders can use algorithms to react to rapid price changes, news releases, or specific technical patterns. For example, an algorithm may trigger trades when a currency pair crosses a certain moving average or when volatility reaches a predefined threshold. Developing and testing algorithms is crucial, and traders should continuously monitor their performance. Algorithmic traders in forex often utilize backtesting to assess the historical performance of their strategies before deploying them in live markets.

However, algorithmic trading carries the risk of technical failures, unexpected market conditions, and potential over-reliance on historical data. Continuous monitoring and adaptability are essential.

Gap and go strategy

The gap and go strategy capitalizes on significant price gaps between the closing and opening prices, often occurring due to overnight news or events. In forex, traders can use this strategy by identifying gaps resulting from major economic releases or geopolitical events. A trader employing this strategy might wait for a gap, then enter a position toward the gap. It is essential to use risk management tools such as stop-loss orders to manage potential losses if the price does not continue in the anticipated direction. Additionally, traders should be cautious of weekend gaps subject to high volatility when markets reopen.

However, gap and go strategy risks include price reversals, especially if the gap is quickly filled, and potential market gaps during low liquidity periods.

Placing trading orders based on volatilities

Traders should trade highly volatile markets for enhanced gain potential and diverse trading opportunities. However, caution is paramount due to the elevated risk of significant losses, increased emotional decision-making, and the challenges associated with effective risk management in rapidly changing and unpredictable market conditions.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.