Traders can enter counter-trend trades to capitalize on market trend reversals before they occur. This helps traders achieve better entry points and gains during market corrections.

This article will discuss the top counter-trend trading strategies and tips for using them in the forex market.

What is counter-trend trading?

Counter-trend trading strategy involves placing trades against the current market trend, based on an anticipation that the market is going to reverse. Counter-trend trading enables traders to predict a change in the direction and position themselves against the trade before it actually reverses to gain from the reversal.

Top counter-trend trading strategies

Reversal patterns

Reversal patterns are technical indicators that signal a shift towards an opposite trend from the current market trend. Such patterns, like the head and shoulders and double top/bottom formations, often appear right when a trend is about to end, suggesting a market reversal.

For instance, a double top pattern occurring in an extended uptrend may lead to a bearish reversal. This would signal traders to place short trades in the current market to take advantage of the downtrend as a counter-trend trading strategy. By anticipating potential reversal points, traders can position themselves to capitalize on the nascent opposing trend.

Divergence analysis

A divergence refers to a discrepancy between a currency pair’s price and an indicator’s signal. When the price and indicator move in opposite directions, a divergence on the price chart appears. This signals a weak current trend and provides counter-trend traders with a reversal signal coming soon.

Traders can look for divergences between the currency pair's price action and the signals sent by the technical indicators to spot a confirmed market reversal. For example, if the price makes a higher high but an indicator such as the RSI or MACD makes lower highs, it indicates that the uptrend may be weakening and that a downtrend reversal is possible. In this case, traders can enter long positions to capitalize on an upcoming downtrend.

Mean reversion

Mean reversion strategies signal market momentum where currency prices revert to their average price level or mean value over a specific time period. In this strategy, traders can identify extreme price movements and speculate that prices are going to return to their average levels soon, placing orders accordingly.

Traders can use this strategy to identify counter-trend or overextended moves in the forex market. For example, if a currency pair’s price moves significantly up or down from its moving average, it is a sign for traders to make a counter-trend move as they expect prices to revert to the mean. Hence, in case the price moves significantly down from the average, traders can place long trades anticipating an upward reversal and vice versa.

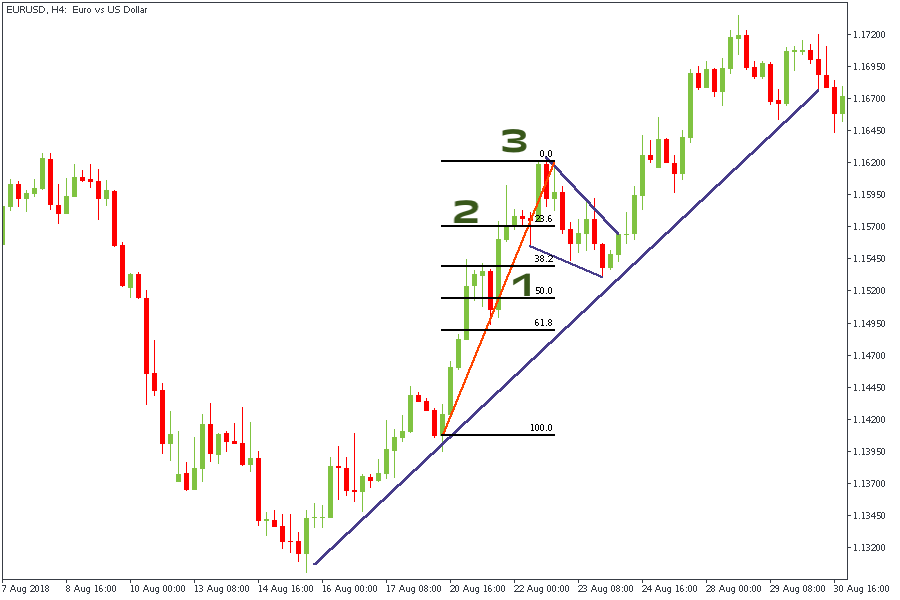

Trend line breaks

Trend lines are diagonal lines drawn on a price chart by connecting significant price highs and lows. They depict the current direction of market trends. A trend line can break as soon as the currency pair's price crosses it, indicating a market reversal.

Traders can use the trendline break strategy to counter-trend trades by monitoring timeframes where forex prices cross the trend lines from above or below. An uptrend break signals the end of a bullish trend and signals traders to enter a short trend to leverage the upcoming downtrend, whereas when prices break the downtrend line by crossing it from above and moving significantly lower, it signals traders to enter long trades with an anticipation of an uptrend reversal.

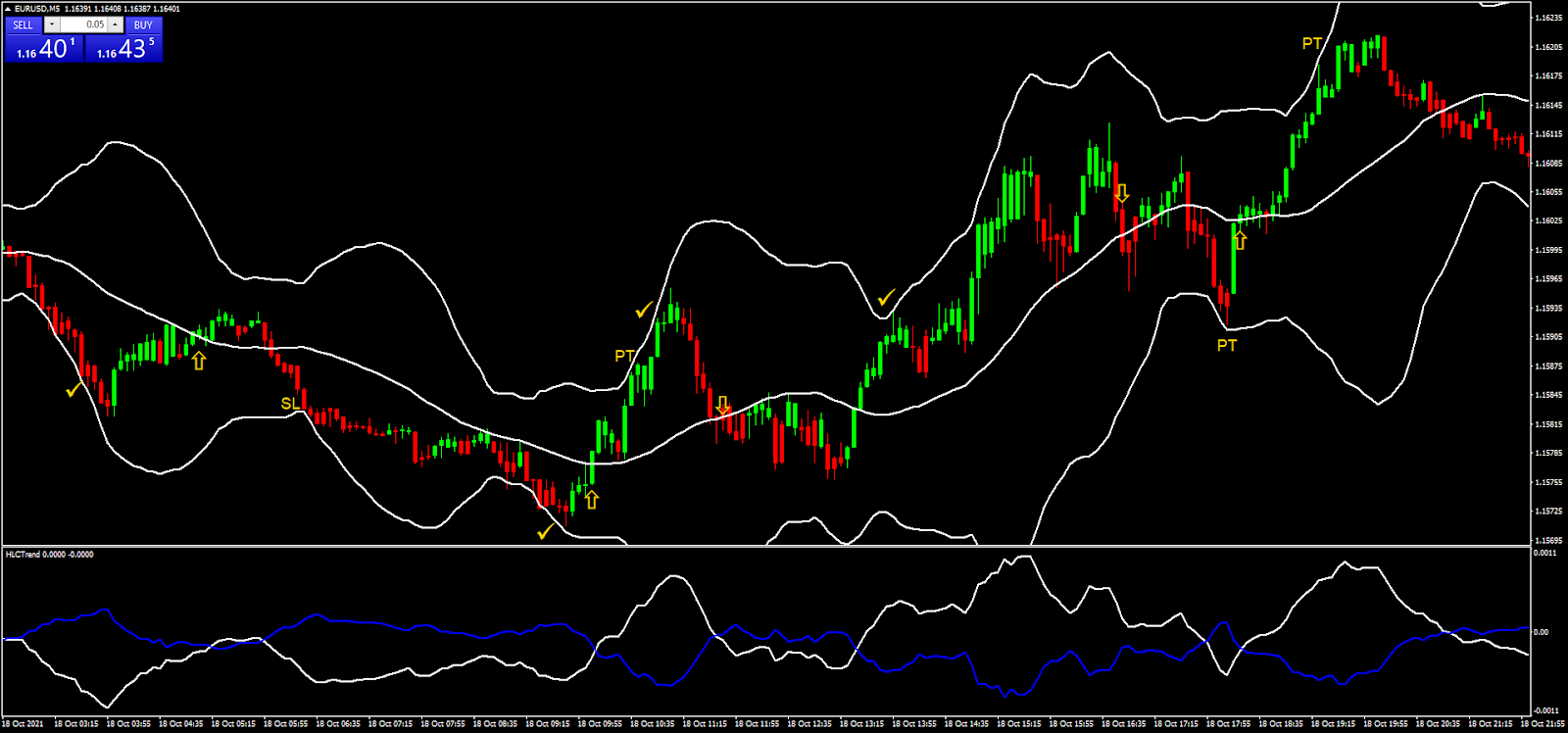

Bollinger band reversals

Bollinger bands are momentum indicators, consisting of three bands:

- A middle band which is the moving average of the prices,

- An upper and lower band placed two standard deviations away from the middle band.

Prices that touch or move above/below these bands indicate overbought/oversold market conditions. Traders can use the Bollinger band trend reversal strategy to counter trade forex by identifying prices near the outer bands. If the price touches the upper band and starts falling, counter-trend traders can enter short trades with the anticipation that the market is overbought and will reverse in a downtrend anytime and vice versa.

Overbought/oversold zone strategy

The overbought/oversold zone trading strategy includes identifying these zones with the help of indicators like the relative strength index (RSI) or stochastic oscillators (momentum indicators). These indicators identify when a currency pair is trading at extreme price levels and can reverse soon.

Traders can monitor the values these indicators signal to identify overbought (when the RSI is above 70) and oversold zones (when the RSI is below 30). When the prices are overbought, traders can enter short trade as there is a strong chance of a bearish reversal and vice versa.

Top tips to counter-trend trades

- Focus on high-probability reversal zones: Monitor areas such as support, resistance, overbought and oversold conditions where price reversals are more likely. These zones provide better entry and exit points for counter-trend trades<

- Monitor trading volume for validation: Volume confirms the strength of reversal signals. when there is more volume at a reversal point, it indicates stronger conviction and leads to more accurate trades

- Avoid trend trading during high volatility: Counter-trend trades may not work well in periods of high volatility as they come with unpredictable price swings. Traders should wait for the prices to be a little more stable before placing an order to reduce the risk

- Consider using trailing stops: Implementing trailing stop orders when prices move in the trader’s favor allows traders the flexibility to still gain if the trend continues and does not reverse

Balancing the pros and cons of counter-trend trading

Counter-trend trading enables traders to diversify their strategies by trading even overextended market conditions. However, there are risks involved like the difficulty in predicting exact potential reversal points and the possibility of losses if the trend continues. Hence, traders should always combine counter-trend strategies with fundamental and technical analysis to receive accurate signals before entering a long/short trade.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.