Meme coin trading has surged in popularity due to its community-driven hype and potential for quick gains, with an overall market cap of over $39 billion. Unlike traditional cryptocurrencies, meme coins thrive on social media trends, celebrity endorsements, and speculative trading. Investors are drawn to their high volatility, but the risks remain significant due to their unpredictable nature.

In this guide, we bring traders everything about meme coin trading that they need to know to start.

What is a meme coin?

A meme coin is a cryptocurrency inspired by internet jokes, memes, or pop culture references. Unlike traditional cryptocurrencies, meme coins often start as humorous or community-driven projects rather than serious financial innovations.

Many of these coins gain massive followings through social media hype. Meme coins are highly volatile, driven largely by speculation and online trends. While some traders gain from price spikes, some meme coins also lack strong use cases or long-term utility.

Here are a few examples of meme coin’s utilities -

- Payment & transactions: Coins like Dogecoin (DOGE) are accepted by brands like Tesla and AMC for payments, making them more functional than just memes.

- Tipping & microtransactions: Meme coins like Shiba Inu (SHIB) can be used for tipping content creators on social media, fostering online engagement.

- Gaming & metaverse: Some meme coins, like Floki Inu (FLOKI), integrate into blockchain-based games, offering rewards and in-game purchases.

The role of influencers and pop culture

High-profile individuals or influencers significantly influence meme coin valuations. Elon Musk's tweets have historically triggered sharp price surges in Dogecoin. Similarly, former US President Donald Trump's launch of the $TRUMP coin in January 2025 garnered immense attention, generating approximately $350 million in just three weeks.

Meanwhile, viral trends shape meme coin markets, as seen with the 'Chill Guy' meme, whose token reached a $500 million market cap before legal issues arose. However, these rapid gains often lead to high price volatility, with coins crashing just as quickly. Ethical concerns persist, particularly regarding potential conflicts of interest and retail investors bearing the losses.

Additionally, First Lady Melania Trump has launched $MELANIA, following Donald Trump's $TRUMP coin. The coin is already valued at $1.7 billion. Social media hype, viral trends, and NFT-style collectability have amplified this demand.

Benefits and risks of trading meme coins

Benefits

High social media-driven momentum

Meme coins thrive on viral trends, often experiencing explosive growth fueled by social media. A single tweet or Reddit post can trigger massive price surges.

Unlike traditional assets, meme coins rely heavily on digital community engagement, making social sentiment analysis a crucial trading tool for spotting opportunities.

Low entry barrier for retail traders

Unlike major cryptocurrencies that require significant capital, meme coins often start at fractions of a cent. This allows retail traders to purchase large quantities with minimal investment.

Such accessibility makes them attractive to beginners looking for high-risk, high-reward trades. While affordability is an advantage, traders should be cautious of investing blindly without understanding the project's fundamentals or long-term viability.

Innovative community-driven growth

Unlike conventional cryptocurrencies, meme coins often evolve based on community participation. Strong, engaged communities can drive continuous development, partnerships, and token utility expansion.

Some projects transition from being mere jokes to offering real-world applications, like tipping systems or staking mechanisms. Investing in meme coins with a committed user base and active development teams increases the chances of long-term value appreciation.

Opportunities in copy trading and signal groups

Many traders leverage meme coin hype by following expert traders or joining signal groups. Copy trading allows beginners to mirror expert strategies, reducing the learning curve.

Signal groups also provide insights into crypto space market trends, helping traders identify early entry points. However, relying solely on signals without personal research can be risky, as not all recommendations are accurate or ethical.

Cross-chain expansions and smart contract upgrades

Meme coins are evolving beyond single-chain tokens and expanding into multi-chain ecosystems. Projects integrating with Ethereum, Binance Smart Chain, and other networks gain broader adoption and liquidity.

Smart contract upgrades also introduce staking, governance, or gaming features, increasing overall token utility. Traders who identify meme coins with strong cross-chain potential can position themselves early for major price surges.

Risks

Rug pulls and developer abandonment

Many meme coins are launched by anonymous teams with no long-term commitment. Developers can abandon the project after raising significant funds, leaving investors with worthless tokens.

Without proper research, traders risk falling for projects designed purely to scam. Always verify team credibility, audit reports, and liquidity lock periods before investing in any meme coin. This helps avoid becoming a victim of rug pulls or sudden developer exits.

Flash crashes due to whale activity

Meme coins often have low liquidity, making them vulnerable to large holders, or 'whales,' who can manipulate prices. A single whale dumping a massive amount of tokens can trigger a flash crash, wiping out smaller traders.

Such volatility creates both opportunities and dangers, requiring traders to monitor whale movements and avoid overleveraging positions in such unpredictable markets to prevent catastrophic losses.

Fake hype and social media manipulation

Meme coins thrive on viral marketing, but not all hype is organic. Pump-and-dump schemes are common, where influencers artificially inflate prices before dumping their holdings.

Many traders enter the meme coin market at the peak, only to suffer heavy losses when the hype fades. Always verify news sources, check on-chain activity, and avoid investing based solely on celebrity endorsements or trending hashtags.

Exchange delisting risks

Unlike established cryptocurrencies, meme coins rely heavily on exchange listings for liquidity. If a meme coin loses popularity or faces regulatory scrutiny, exchanges may delist it, making it difficult for holders to exit.

Such risk is particularly high for newly launched or low-volume meme coins. Before investing, traders should diversify their holdings and ensure their chosen exchange has a stable trading volume.

Short-lived popularity cycles

Most meme coins experience a short-lived surge before fading into obscurity. Hype drives initial price spikes, but when attention shifts to newer trends, value collapses.

Traders who fail to exit at the right time end up holding depreciated tokens. Staying updated on market trends and timing exits wisely is crucial to avoid getting stuck with dead meme investments.

Scam projects masquerading as community tokens

Many meme coins present themselves as decentralized, community-driven projects while secretly being controlled by insiders. Scams like pre-mined tokens, hidden developer wallets, or misleading whitepapers lure traders in.

Investors may fall for such schemes without proper due diligence. Checking blockchain transparency, smart contract audits and real community engagement helps filter out scams from genuine meme coin projects.

Top meme coins in 2025

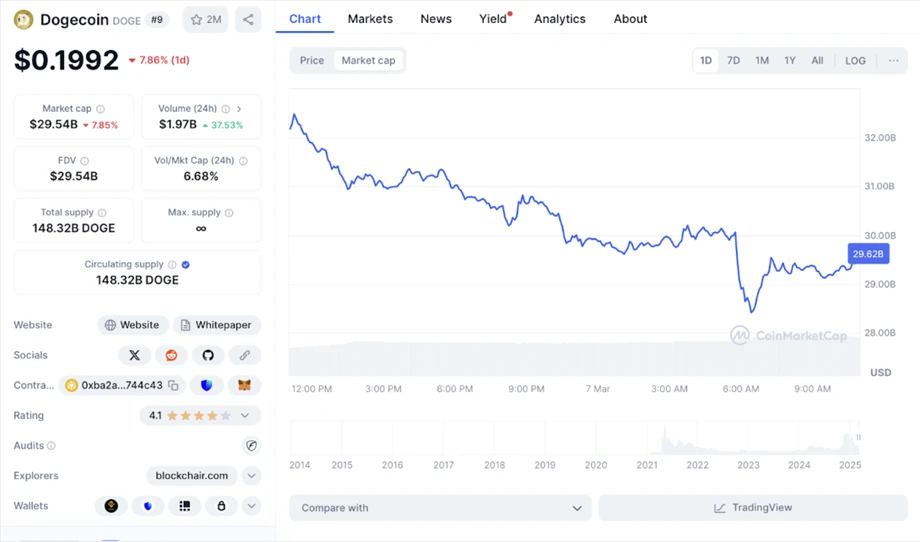

Dogecoin (DOGE)

Dogecoin, launched in December 2013 by software engineers Billy Markus and Jackson Palmer, started as a joke but quickly became one of the most recognized meme coins. Inspired by the popular Shiba Inu ‘Doge' internet meme, it was initially meant to be a fun alternative to Bitcoin.

However, it gained real-world traction, particularly in online tipping and crowdfunding. Dogecoin's appeal lies in its low transaction fees and strong community support. Over the years, it has been used for charitable donations and microtransactions. As of 2025, its market capitalization stands at approximately $29.54 billion, making it one of the most popular meme coins.

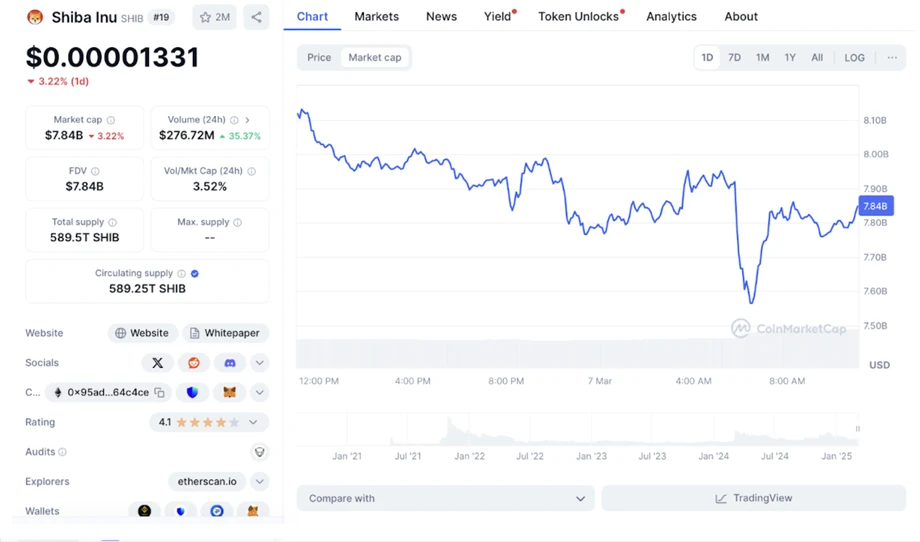

Shiba Inu (SHIB)

Shiba Inu was introduced in August 2020 by an anonymous individual, Ryoshi. Dubbed as the 'Dogecoin killer,' it was designed as a decentralized, community-driven token built on the Ethereum blockchain.

Unlike Dogecoin, SHIB expanded its ecosystem with ShibaSwap, a decentralized exchange, and upcoming metaverse projects like Shiberse. Its strong social media presence and passionate community have contributed to its rapid growth.

While initially dismissed as a joke, SHIB has gained legitimacy through various developments like metaverse initiatives, donations to crypto-relief funds, and more. As of 2025, its market capitalization is approximately $7.84 billion.

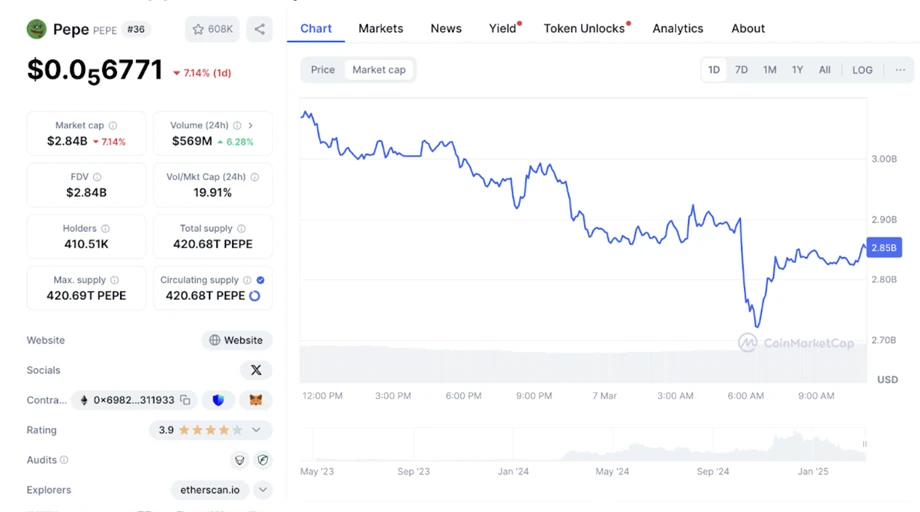

Pepe Coin (PEPE)

Inspired by the internet-famous Pepe the Frog meme, Pepe Coin was launched to celebrate meme culture within the crypto space. It was designed primarily as a community-driven token, relying on social media momentum and speculative trading.

While its use case remains limited, plans to integrate NFTs and gaming applications have been hinted at. The coin's popularity is driven by internet trends, making it highly volatile. Despite this, it has attracted significant trading interest. As of 2025, its market capitalization stands at approximately $2.84 billion.

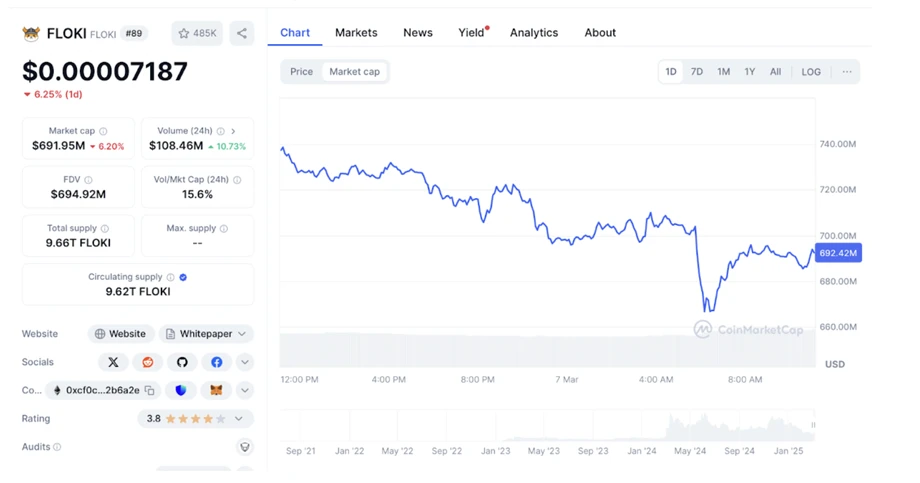

Floki (FLOKI)

Floki Inu entered the market in 2021, inspired by Elon Musk's Shiba Inu dog named Floki. Unlike many meme coins, Floki aims to combine internet humor with real utility. It has expanded its ecosystem through 'Valhalla,' a metaverse game where players can earn FLOKI tokens, and FlokiFi, a decentralized finance platform.

The dual focus on entertainment and finance differentiates Floki from its competitors. Its growing adoption in gaming and DeFi contributes to its increasing market presence. As of 2025, Floki's market capitalization is approximately $692.32 million.

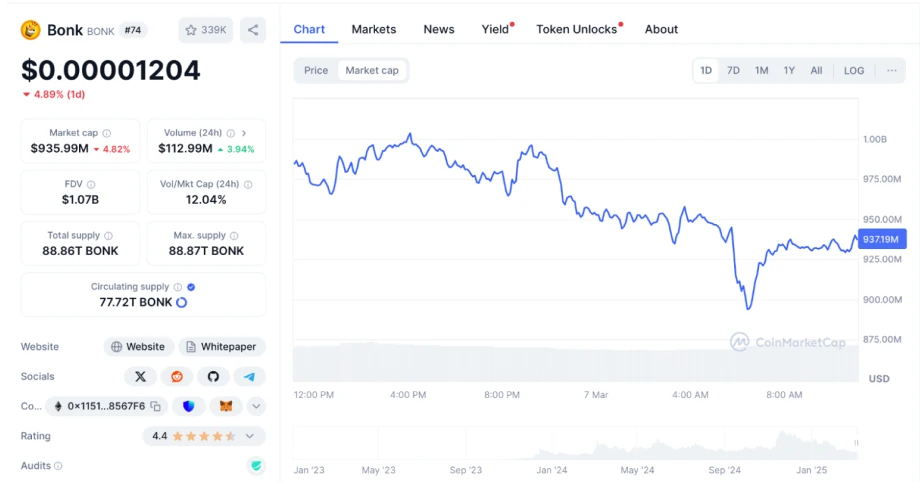

Bonk (BONK)

Bonk made its debut on December 25, 2022, as the first dog-themed token on the Solana blockchain. It was created to inject liquidity into Solana's decentralized exchanges (DEXs) and provide a truly community-driven alternative to other meme coins.

Bonk's rapid adoption within the Solana ecosystem has helped it gain traction as users embrace it for transactions and DeFi applications. Its emphasis on decentralization and fair distribution sets it apart. As of 2025, Bonk boasts a market capitalization of $935.96 million.

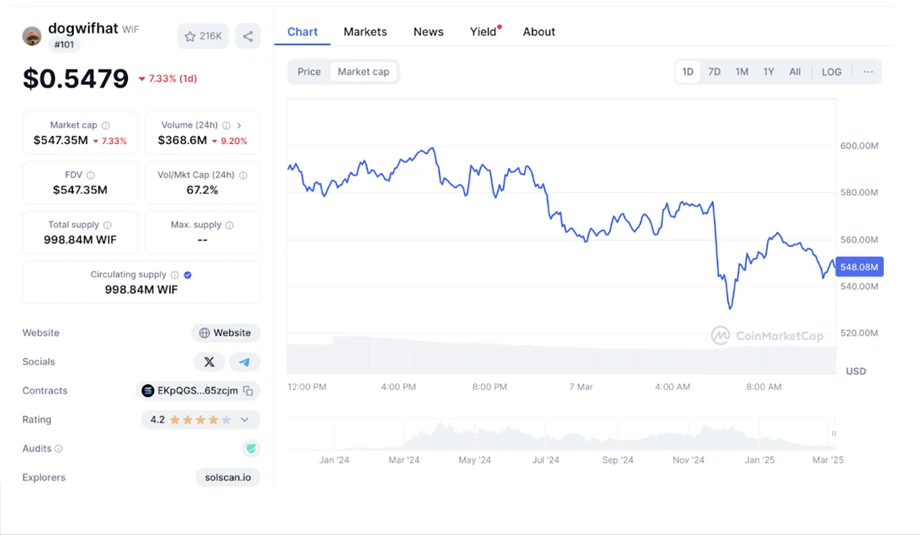

Dogwifhat (WIF)

Dogwifhat, commonly referred to as WIF, is a meme cryptocurrency featuring a Shiba Inu dog wearing a hat. The coin gained attention due to its unique branding and lighthearted appeal, resonating with meme enthusiasts.

While viral trends fueled its initial rise, its developers have hinted at future plans, including a decentralized exchange and metaverse projects. As of 2025, its market capitalization stands at approximately $547.36 million.

Emerging trends and new meme coins

Emerging meme coins are evolving beyond hype, with several projects, such as Meme Bank, MemeVault, and Sloco, introducing staking.

- Meme Bank stands out by integrating staking, token burns, and real-world financial utilities. Backed by Choise.ai and Vault, it ensures protected transactions and banking solutions

- MemeVault enables cross-chain staking, supporting popular meme coins but with a two-year vesting period. Popular meme coins like $FLOKI, $BRETT, $SHIB, and $PEPE will be supported from launch, with more expected in the future

- Sloco, a GameFi platform, allows users to stake meme tokens for monthly rewards. This adds a new layer of engagement, making meme coins more than just speculative assets

Additionally, the SEC clarified that meme coins are not securities, removing regulatory concerns but urging caution against fraud. Meanwhile, the Meme Index offers structured investments to reduce meme coin volatility.

How to trade meme coins?

1. Choose the right exchange

Meme coins are available on centralized exchanges (CEXs) and decentralized exchanges (DEXs). Liquidity and protection should be key considerations when selecting an exchange.

Some meme coins debut on DEXs before being listed on major platforms. Traders should verify that the exchange supports the chosen meme coin, offers sufficient liquidity, and has protection features. Newer platforms with low trading volumes should be approached cautiously, as they may be prone to manipulation and rug pulls.

2. Set up a crypto wallet

Since most meme coins operate on Ethereum (ERC-20) or Binance Smart Chain (BEP-20), a compatible wallet is essential. The right wallet ensures private key ownership and protects assets from exchange vulnerabilities. For long-term holding, a hardware wallet provides additional protection. Verifying contact addresses is also crucial to avoiding counterfeit tokens.

3. Fund the account

Trading requires funding an exchange account with fiat, stable coins (USDT, BUSD), or native blockchain tokens like ETH or BNB. DEX users must also account for network fees, which can be high during peak trading periods. Proper fund allocation ensures seamless transactions and minimizes delays.

4. Research meme coin projects

Due diligence is crucial before investing in meme coins. Evaluating the whitepaper, developer transparency, and community engagement helps identify legitimate projects.

Coins with strong use cases, like NFT integration or gaming utilities, tend to have more staying power than those driven purely by hype.

5. Identify reliable entry points

Meme coins are highly volatile, requiring precise timing for entry. Technical analysis, volume spikes, and market trends provide insights into potential long opportunities.

Chasing pumps often leads to losses, so waiting for retracements improves trade execution. Monitoring price action also prevents impulsive decision-making.

6. Place the trade

On CEXs, users can select the meme coin trading pair and place market or limit orders. On DEXs, token swaps require verifying contract addresses to avoid scams. Adjusting slippage settings also becomes essential to prevent failed transactions, especially in high-volatility markets.

7. Implement risk management strategies

Meme coin investments should align with individual risk tolerance. Stop-loss orders protect against sudden drops in CEXs, while DEX traders must monitor price action manually. Diversification and gain-taking strategies help manage risks in highly speculative markets.

8. Monitor price action and market sentiment

Social media trends and influencer endorsements heavily influence meme coin prices. Tracking discussions on Twitter, Reddit, and Telegram helps understand market sentiment. Research tools that provide insights into social volume and whale movements, enabling informed trading decisions.

What lies in the future of meme coin trading?

Meme coin trading is shifting toward a more structured market. Staking, cross-chain support, and real-world applications are improving their utility. Regulatory developments may provide further legitimacy, yet speculation will remain a driving force. Investors should balance enthusiasm with caution as the landscape continues to mature.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.