Today marks a crucial day for market participants as the Federal Reserve is set to announce its decision on the Federal Funds Rate. This highly anticipated event is preceded by the release of key inflation data, making it a pivotal moment for traders and investors alike. Let’s dive into what to expect and how to navigate the potential market movements.

Key Events to Watch

US CPI and Core CPI Data

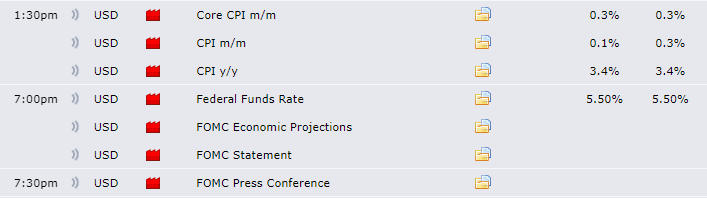

At 1:30 PM GMT, the latest figures for the US Consumer Price Index (CPI) and Core CPI will be released. These metrics are essential for gauging inflation trends, with forecasts indicating a slight decrease from previous levels. Given the current economic landscape, this data will set the stage for market volatility leading into the Federal Reserve's announcement.

image source

Federal Funds Rate Decision

Later in the day, at 7:00 PM GMT, all eyes will turn to the Federal Reserve as they reveal their decision on the Federal Funds Rate. The market consensus is that the Fed will maintain the rate at 5.50%, but the commentary and projections accompanying this decision will be closely scrutinized for hints about future monetary policy.

Inflation and Economic Outlook

Sticky Inflation

Despite recent reductions in GDP and employment figures, inflation remains persistent. The year-over-year inflation rate is projected to hover around 3.4%, well above the Fed's target of 2%. The Fed's statements today will likely address factors contributing to this 'sticky' inflation and potential paths to achieving their inflation goals.

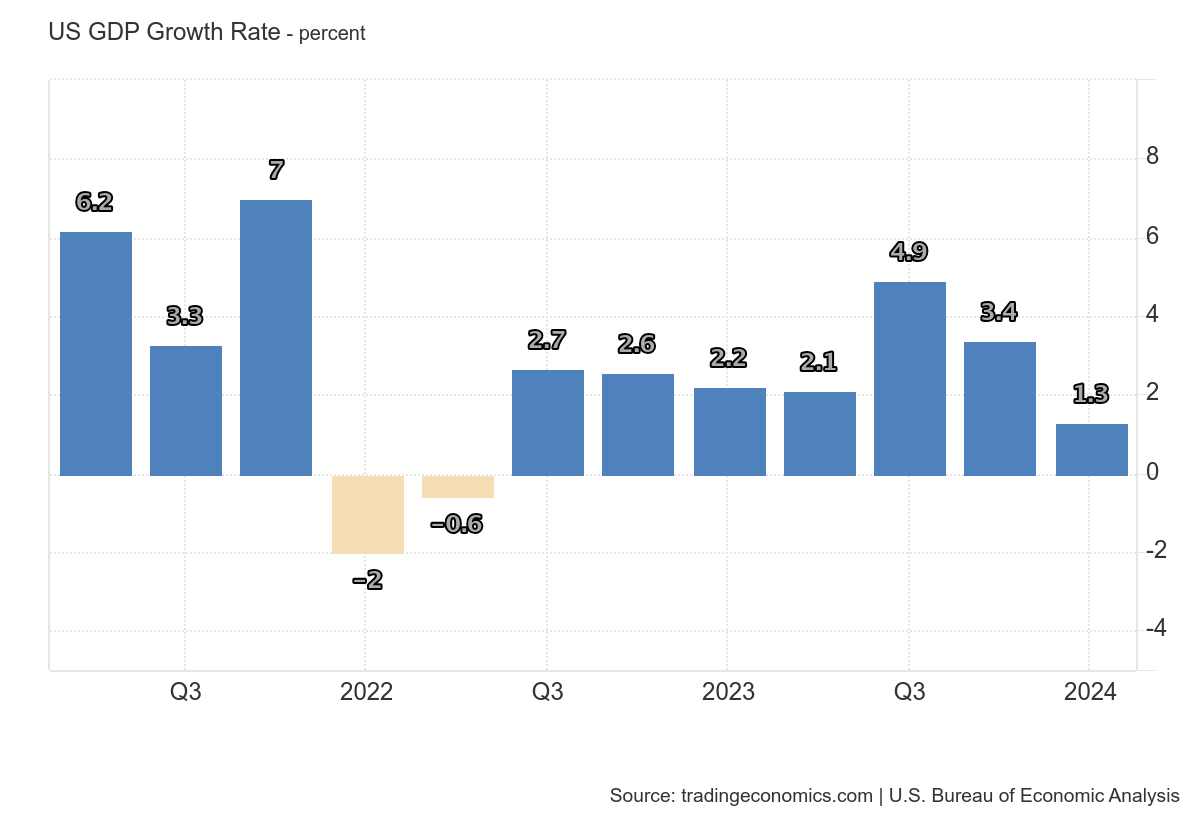

Economic Growth Concerns

The US economy has shown signs of slowing, with GDP growth falling from 3.4% to 1.3% in the first quarter of 2024. This decline, largely due to weaker consumer spending, suggests that there might be room for the Fed to consider rate cuts later in the year to stimulate economic activity.

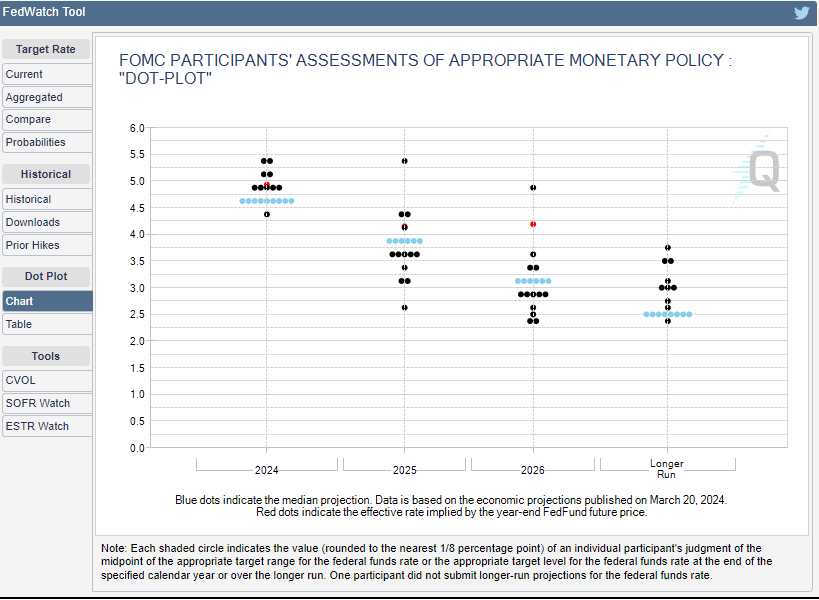

The Fed’s Dot Plot Insights

The Federal Reserve’s dot plot, a chart that illustrates policy makers' interest rate forecasts, has evolved throughout the year. Initially, it indicated the possibility of 3-4 rate cuts in 2024. However, as we approach mid-year, the consensus has shifted towards expecting just 1-2 cuts, potentially starting in November, post-election. This cautious approach may allow the Fed to retain flexibility in their policy adjustments.

image source

Market Impact and Trading Strategy

Anticipating Fed’s Tone

The tone of the Fed’s announcement could lean 'hawkish' if the dot plot suggests fewer rate cuts, possibly strengthening the USD in the short term. However, given the current economic indicators, a balanced or slightly dovish stance could be on the cards unless today's CPI data surprises to the upside.

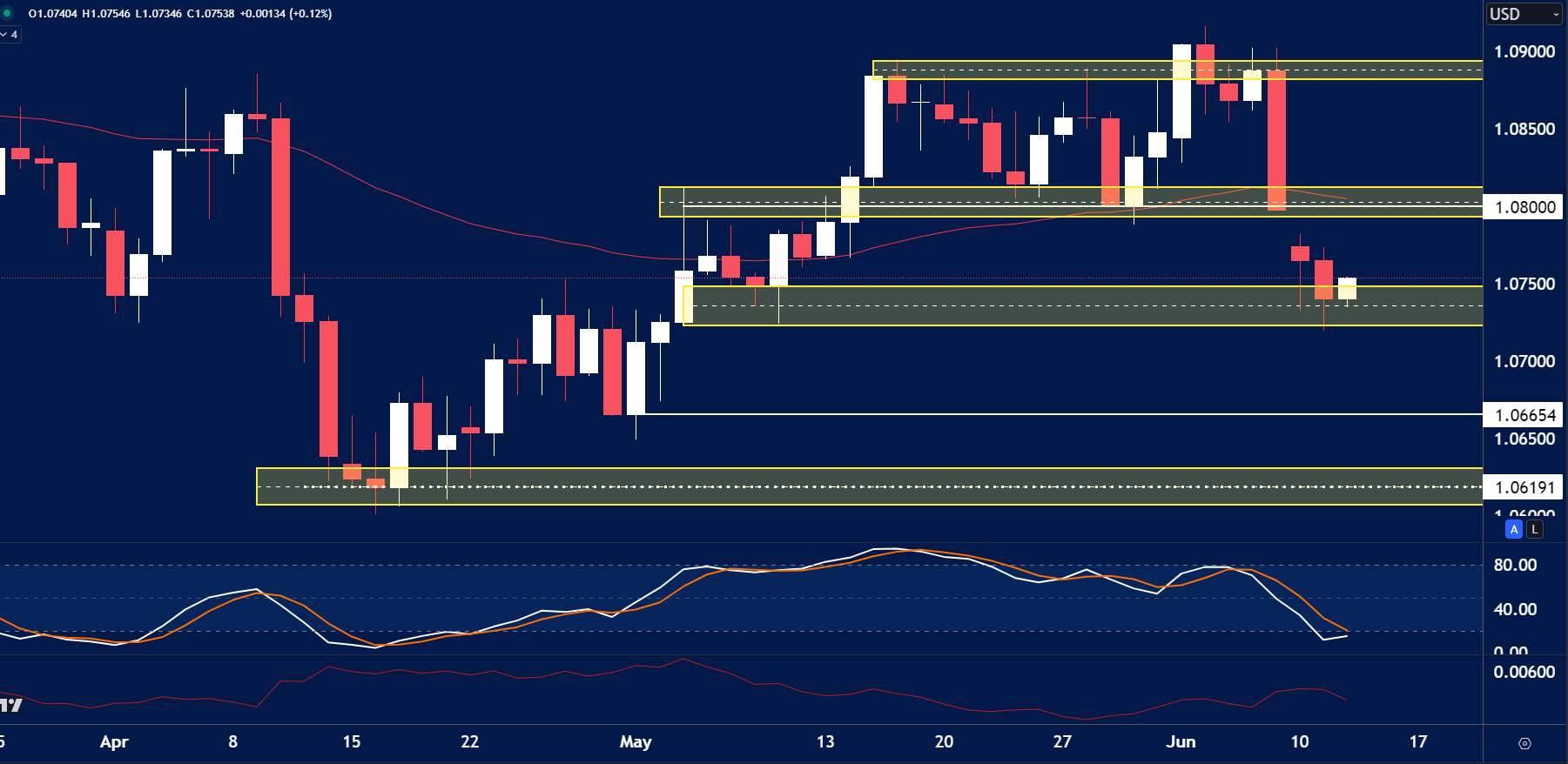

Focus on EURUSD

The EURUSD pair is poised for significant movement today. Recent declines in this pair, spurred by stronger-than-expected US employment data and political uncertainties in Europe, have set up a potentially volatile trading environment.

Key Levels to Watch

- Scenario One: A higher-than-expected CPI print could trigger USD strength, driving EURUSD lower towards the support level around 1.06650. This level corresponds with the daily lows observed on May 1st, and traders might look to buy on dips if the Fed adopts a calming tone post-release.

- Scenario Two: Should CPI data meet or fall below expectations, we could see USD weakness, pushing EURUSD towards the option expiry level at 1.0800. If this resistance holds, the pair may retreat back to around 1.0735, the current daily low.

Final Thoughts

Today promises to be a rollercoaster for traders, especially in the US session, which kicks off at 2:00 PM GMT and officially opens at 2:30 PM GMT. Staying updated with real-time data and market sentiment is crucial.

Watch Our Analysis

Check out our latest week-ahead analysis video for more insights.

Ready to Trade?

Experience low spreads and quick trade executions with Blueberry. Our dedicated customer support team is here to assist with your account setup and trading needs. Start trading with confidence today.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.