Advanced technical analysis requires a systematic framework for decision-making to manage risk and ensure consistency. Without a well-defined strategy, traders may succumb to impulsive decisions.

Let’s discuss the top five key strategies for advanced forex trading analysis.

Fibonacci retracement

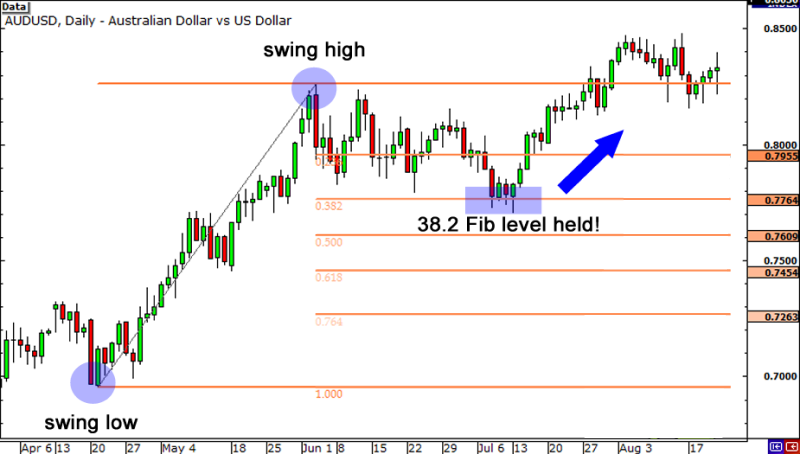

Fibonacci retracement utilizes the Fibonacci sequence to identify potential reversal levels in a financial market. Traders apply Fibonacci ratios to significant price moves, creating retracement levels at 38.2%, 50%, and 61.8%. These levels represent potential support or resistance zones in a trend, indicating likely points for market reversals or continuations based on the degree of price retracement. Advanced practitioners combine Fibonacci retracement with other indicators to confirm signals, helping to identify optimal entry and exit points. For example, combining

Fibonacci levels with support and resistance zones enhance the precision of trade execution, such as:

- In a bullish market, the 38.2% retracement level is used to identify potential support levels during a price pullback.

- In a bearish market, the 50% retracement level could be considered a potential counter-trend bounce area.

- In a neutral market, the 61.8% retracement level can be used as a level of interest for potential reversals or trend continuations. The same level in a bearish market could indicate a resistance level.

**This is an example only to enhance a consumer's understanding of the above strategy and is not to be taken as Blueberry providing personal advice.

Elliott wave theory

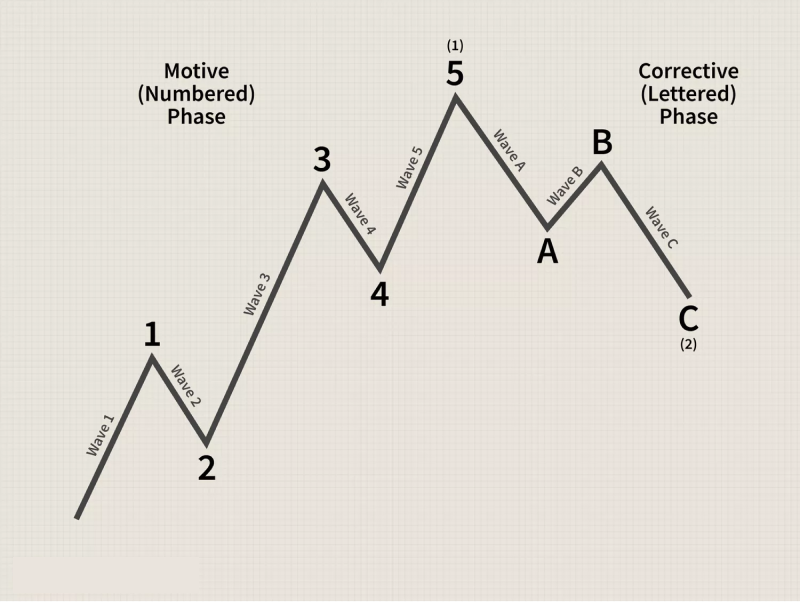

Elliott Wave Theory is based on wave patterns, emphasizing market psychology and crowd behavior. Advanced traders use wave counts and ratios to predict potential price movements, enhancing decision-making.

The types of waves in this strategy are –

- Impulse waves (trending): Five-wave sequences (1-2-3-4-5) represent the direction of the dominant trend.

- Corrective waves (retracing): Three-wave sequences (A-B-C) depict temporary counter-trend movements.

Traders can integrate Fibonacci retracement levels with Elliott Wave counts to identify precise entry and exit points. By understanding the fractal nature of waves, traders gain insights into the market's future direction and use corrective and impulse waves for strategic entry and exit strategies. In advanced technical analysis, the trader can follow the waves to enter a long or short position accordingly –

Entry (long) signals

- End of corrective waves: Enter long positions at the end of corrective waves (Wave 2 or Wave B) within an overall uptrend.

- Completion of Wave 4: In a bullish trend, entering long positions near the completion of Wave 4 can be an entry point.

- Impulse wave start: Enter positions at the start of a new impulse wave. This is typically after a corrective wave (Wave 4 or Wave B).

Exit (short) signals

- End of impulse waves: Consider exiting long positions at the end of five-wave impulse moves (Wave 5).

- Completion of corrective waves: In a bullish trend, exit long positions near the completion of corrective waves (Wave 2 or Wave B).

- Start of corrective waves: In a downtrend, consider holding short positions as corrective waves (Wave 2 or Wave B) begin.

Ichimoku cloud

Ichimoku cloud analysis provides a comprehensive view of price action, support, and resistance levels. Traders use the cloud's various components, including the Kumo and Tenkan-Sen, to gauge trend strength and identify potential reversal points.

Advanced practitioners combine Ichimoku signals with other indicators for confirmation, employing multiple time frames to refine their analysis. For instance, using the cloud's thickness to assess volatility aids traders in adjusting position sizes based on market conditions. Advanced traders can consider the following scenarios to enter long or short trades –

Entering long (short) trades

- Kumo twist and Tenkan-Sen above (below) Kumo: Look for a bullish (bearish) signal when the Kumo changes color (twist) from red to green (green to red), indicating a potential shift in trend direction. Additionally, ensure that the Tenkan-Sen is above (below) the Kumo. Then, enter a long (short) trade when the price moves above (below) the Kumo, with confirmation from the Tenkan-Sen's position.

- Kumo bounce: If the price retraces to the Kumo and bounces (breaks) off it, consider entering a long (short) trade. This indicates potential support (resistance), especially when the trend is bullish (bearish).

- Tenkan-Sen and Kijun-Sen cross: A bullish (bearish) crossover where the Tenkan-Sen (fast line) crosses above (below) the Kijun-Sen (slow line) within the Kumo or above (below) it can be a long (short) signal.

- Chikou Span above (below) price: Confirm bullish (bearish) momentum by ensuring that the Chikou Span (lagging line) is above (below) the historical price, suggesting potential upward (downward) movement.

Harmonic patterns

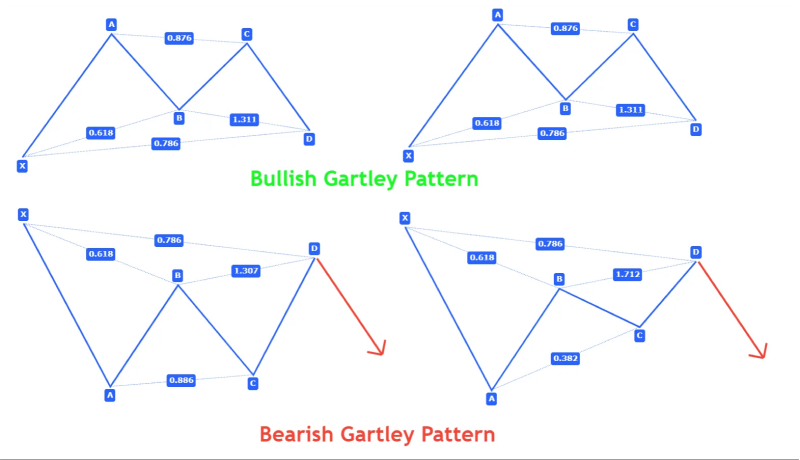

Harmonic patterns involve identifying geometric price patterns that signal potential trend reversals. Advanced traders use ratios such as the Fibonacci retracement levels to validate harmonic patterns, enhancing their accuracy.

Traders often use Fibonacci extension levels to set precise price targets for taking gains. These extension levels are projected from the initial move (XA leg) and provide insights into potential future price levels.

Traders can validate the pattern's accuracy by aligning specific points of the pattern with key Fibonacci ratios, such as 38.2%, 50%, and 61.8%. For instance, confirming that the XA, AB, BC, and CD legs correspond to these ratios enhances confidence in the pattern's reliability. Once the harmonic pattern is identified and validated, traders set entry orders near the completion point (D point), allowing them to enter the trade with a more robust signal.

Divergence analysis

Divergence analysis is an advanced forex strategy that involves comparing price movements with corresponding indicators to identify potential trend reversals. Traders look for price discrepancies and indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD).

Advanced practitioners incorporate multiple divergence signals across different time frames for confirmation, enhancing the reliability of their predictions. They analyze the consistency of these divergence signals, giving greater weight to those on higher time frames and aligning them with the prevailing trend for added confirmation.

Combining the advanced technical analysis indicators in forex

Combining advanced technical analysis indicators in forex provides a holistic and robust approach. On top of that, traders can gain deeper insights into market dynamics, enhance trade precision, and improve risk management, potentially resulting in more informed decisions for better trading strategies.

While the advanced technical analysis strategies discussed offer a holistic and robust approach to forex trading, it is crucial for traders to be aware of the challenges and risks associated with their implementation. Advanced strategies require a deep understanding of market dynamics and meticulous application of various indicators, increasing the complexity of decision-making. Traders should approach advanced technical analysis with a balanced perspective, combining these strategies with thorough research, risk management, and continuous improvement to navigate the complexities of the forex market successfully.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.