Fibonacci retracement strategies help traders identify the market's support and resistance levels, trend reversal points, and entry and exit decisions. The Favourite Fib Fibonacci is a Fibonacci-based strategy that can be used across various timeframes, and it works across all the major markets of the world. In this article, we discuss everything you need to know about the Favourite Fib Fibonacci strategy.

Understanding the Favourite Fib Fibonacci Retracement

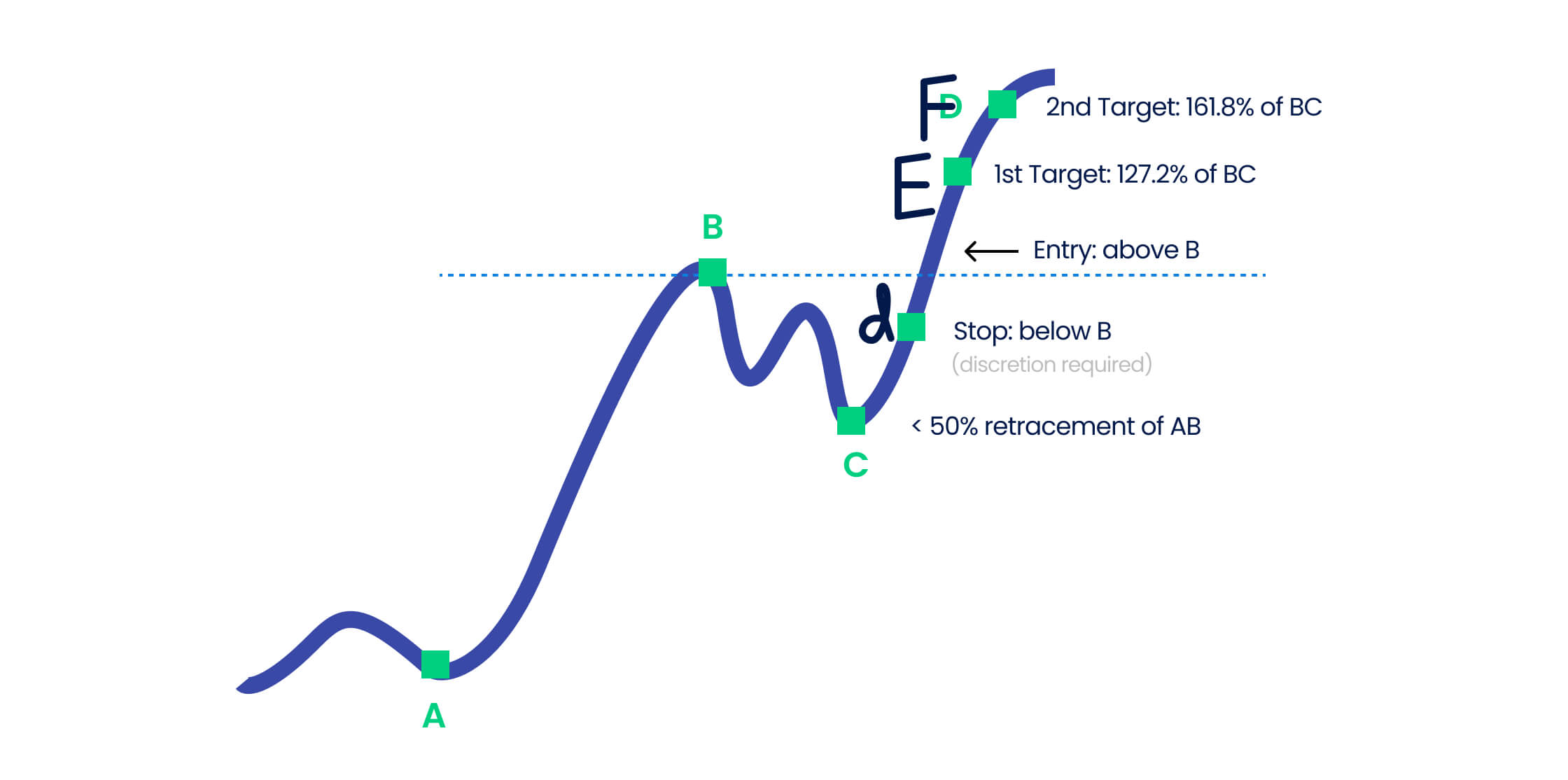

The Favourite Fib strategy is a momentum strategy that uses the Fibonnaci ratios. To use this strategy effectively, you will first need a market that has a strong and clear trend. A market that is recently hitting a multi-month high or multi-year highs or low is ideal for this. As the name suggests, the Favourite Fib strategy is purely based on the Fibonacci retracement levels. Retracement refers to a temporary change in the market direction, and the retracement levels are identified as horizontal lines indicating the exact point where a market reverses. 38.2% and 50% are considered the ideal Fibonacci retracement levels to work out the Favourite Fib strategy as these levels provide the ideal buying/selling signals. It is generally more effective on longer time charts. Most traders prefer to use this strategy for 1-hour to 4-hour charts. There are always three price swings in the Favourite Fib strategy:

- A price increase from the initial point A to B

- A price correction when the price falls for a brief time from point B to C

- A price extension after which there is a continuous increase in the currency pair prices from point C to F (and beyond)

How does the Favourite Fib strategy work?

Let's assume you are trading USD/EUR, and the currency pair is currently in an uptrend, increasing from point A ( where USD/EUR = 1) to point B (Where USD/EUR = 4), as suggested in the graph. From point B, the currency pair retraces first to a level of 3.6, then increases back to 3.8, before finally falling to point C (where USD/EUR = 2), which can also be called a 50% retracement from the original uptrend of AB. This increase and decrease in the price of USD/EUR is a result of traders taking profit by selling the currency pair in the uptrend. After point C, the market continues going in its original direction and even surpasses the original price level of 4. It continues rising beyond point D, bringing the new price of USD/EUR at 7. As per our graph, new traders can enter the trade at point B (where USD/EUR = 4), and existing traders can continue to take long positions in the currency pair at the same point B to maximise profits. Right below USD/EUR = 4, a stop-loss order can be placed at USD/EUR = 3 to minimise losses if the market reverses due to a sudden shock in the economy. The first target point should be taken above the entry point when USD/EUR = 4.25 at point E. This will be an extension level of 127.2% of the BC line. The second target is placed at a point named F, where USD/EUR = 5.2, to maximise returns. Beyond this point, the USD/EUR prices will keep increasing until they reach a resistance level.

Three important components of the Favourite Fib strategy

Entry levels

When using this strategy, the entry-level is fixed where the currency pair price is first retraced from. According to our example taken above, we consider USD/EUR = 4 as our entry price (point A) after the first retracement of 50%. (This is also applicable in bull markets).

Target levels

While using the Favourite Fib strategy, a trader can target two profit levels at once. The first is the 127.2% level (at point E), and the other is the 161.8% level (at point F), which signals traders to exit before the market retraces again.

Stop-loss levels

When you are in a bull market with a long position, you can place a stop-loss order some distance below the price, after which there was a market retracement (in our case, point B). Always make sure that your distance between the stop-loss and entry point does not exceed the distance between your entry price and profit target price, implying your returns to be more than your risk.

Benefits of the Favourite Fib Fibonacci Retracement strategy

1. Use with multiple time frames

It provides results in multiple time frames, from the 15-minute chart to daily, weekly and monthly charts. The higher the time frame you choose, the more effective the strategy will be, as it will allow more room for the retracements and extensions to work accurately.

2. Applicable in both bull and bear markets

It can be applied in the bull market right after positive economic news, as the prices continue to increase. Due to market movement, the price will eventually retrace to a lower level before extending to over 161.8% above the levels it initially fell to reap traders significant profits. However, when the prices continuously fall in a bear market, the currency pair price will retrace to an upper level for a brief time before it continues falling. This mostly happens immediately after a negative economic sentiment in the market. With falling prices, this strategy can be applied to short the trades.

3. Works with all instruments

Whether you are trading currency pairs, commodities, stocks or any other asset — the Favourite Fib strategy works with all kinds of financial markets as long as there is a strong trend.

Maximise your trading potential with the Favourite Fib strategy

The Favourite Fib strategy is one of the most effective and flexible Fibonacci Retracement strategies. From working in multiple timeframes to being applied to different markets, this strategy works in favour of every type of trader with all kinds of trading goals. Ready to give this strategy a try? Sign up for a live trading account or try a demo account on Blueberry.