WTI has been trading around $73.76 per barrel in January 2025, up from $56.99 in 2019. Since WTI is one of the most liquid commodities in the world, traders have enough opportunities to gain in both rising and falling oil markets.

Adding WTI to one’s investment portfolio can help diversify one's holdings and reduce overall risk. Crude oil prices often move independently of other asset classes like stocks and bonds, providing potential diversification gains.

This article will discuss everything about WTI crude oil and ways to trade it.

What is WTI crude oil?

WTI crude oil stands for West Texas Intermediate. It's a specific grade of crude oil produced primarily in the United States, specifically in the Permian Basin region of Texas. WTI is considered a high-quality crude oil because it's light in density and low in sulfur content, making it easier to refine into gasoline and other products. It's one of the main benchmarks used in global oil pricing and can be traded as crude oil futures contracts on the New York Mercantile Exchange (NYMEX).

Historical trends of the West Texas Intermediate (WTI)

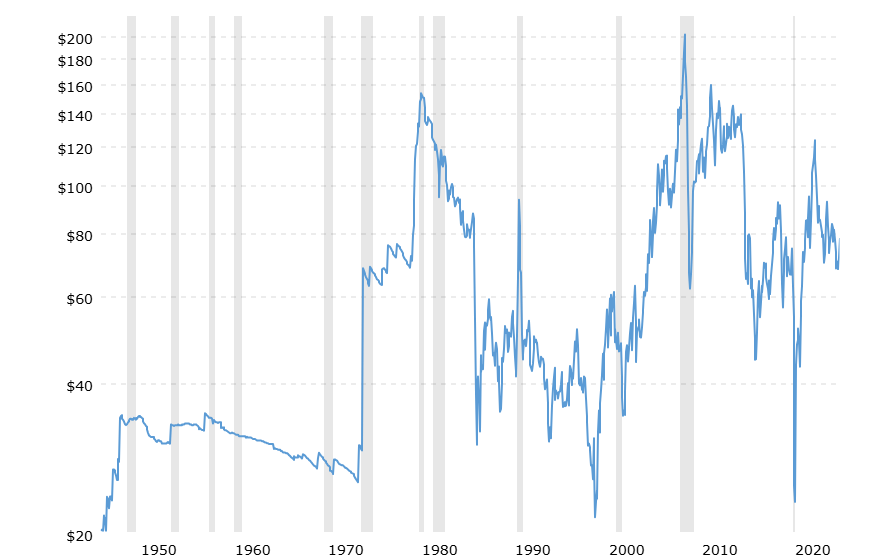

West Texas Intermediate (WTI) crude oil has experienced significant price fluctuations throughout its history, influenced by various factors, including global supply and demand, geopolitical events, economic conditions, and technological advancements.

- Post-WWII boom: Following World War II, WTI crude oil prices experienced a steady increase, reflecting growing global demand for oil as economies recovered and industrialized. It started from $20.11 per barrel in 1946 and continued rising.

- 1970s oil crisis: The Arab Oil Embargo of 1973-1974 led to a dramatic surge in WTI crude oil prices as OPEC nations reduced oil production to exert political pressure. This event marked a turning point in the global crude oil market, highlighting the vulnerability of industrialized nations to crude oil supply disruptions. This led to the price peaking in the 1980s.

- Price volatility in the 1980s: The 1980s witnessed a period of price volatility for WTI. Prices reached a historical high in 1980, touching $153.38, but subsequently declined as global economic conditions weakened and crude oil production increased.

- 2000s surge: The early 2000s saw a resurgence in WTI prices, driven by factors such as increasing global demand, geopolitical tensions in the Middle East/Gulf Coast, and a weakening US Dollar.

- 2020 price crash: The COVID-19 pandemic led to a dramatic decline in global crude oil demand, resulting in a historic plunge in WTI prices, touching $24.97 per barrel. In April 2020, prices briefly turned negative, indicating that producers were willing to pay buyers to take their oil.

- Post-pandemic recovery: Since the pandemic, WTI prices have gradually recovered, reflecting a rebound in global economic activity and increased demand for oil, reaching $78.35 as of August 2024. However, the market remains subject to fluctuations due to geopolitical factors, supply disruptions, and economic uncertainties.

Factors affecting WTI crude oil

OPEC production

The Organization of the Petroleum Exporting Countries (OPEC) regulates global oil supply significantly. Changes in OPEC production quotas or compliance levels can significantly impact WTI prices.

Non-OPEC production

Oil production by non-OPEC countries, such as the United States, Russia, and Canada, also affects global supply and WTI prices.

Global economic growth

Economic growth in major economies like the United States, Europe, and China drives demand for oil, which can lead to higher prices.

Inventory levels

Global oil inventories can influence prices. Low inventories may suggest a tight supply and drive prices up, while high inventories can put downward pressure on prices.

US Dollar

As WTI is priced in U.S. dollars, fluctuations in the Dollar's value can affect the price of oil. A weaker dollar can make crude oil more attractive to foreign buyers, increasing prices.

Inventory costs: The cost of storing oil can influence prices. If storage costs are high, it can incentivize producers to short crude oil immediately, putting downward pressure on prices.

Hydraulic fracturing (fracking)

Advances in fracking technology have increased crude oil production in the United States, potentially putting downward pressure on prices.

Middle East tensions

The Middle East is a major oil-producing region. Political instability, conflicts, or sanctions in the region can disrupt crude oil production and supply, leading to price spikes.

WTI crude oil vs Brent crude oil

West Texas Intermediate (WTI) and Brent crude oil are two of the world's most widely traded crude oil benchmarks. They are used as reference points for pricing other oil products. While both are high-quality crude oils, they differ in several key aspects:

Origin

WTI is primarily produced in the United States, specifically in the Permian Basin region of Texas. Whereas, Brent crude oil is produced in the North Sea, primarily in the United Kingdom and Norway.

Quality

WTI is known for its light density and low sulfur content, making it easier to refine into gasoline and other products. However, Brent crude oil, although also considered a high-quality oil, tends to have a slightly higher sulfur content than WTI.

Trading

WTI can be traded as crude oil futures contracts on the New York Mercantile Exchange (NYMEX). However, Brent crude oil can be traded as crude oil futures contracts on the Intercontinental Exchange (ICE).

Global influence

Historically, WTI was the dominant benchmark in the United States and Canada. However, increased US oil production has led to a growing global influence for WTI. Brent crude oil is the global benchmark for oil prices, particularly in Europe and Asia. Its price is closely watched by investors, traders, and consumers worldwide.

How to trade WTI Crude Oil

- Select the trading platform: Open an account with a reputable broker that offers WTI crude oil trading. Ensure the platform provides access to crude oil futures, CFDs, or ETFs. Fund the account with the necessary capital.

- Conduct supply and demand analysis: Check the latest US crude oil inventory levels from the EIA’s weekly report. Monitor OPEC production announcements and any geopolitical tensions that could affect crude oil supply. Also, assess global economic indicators (like GDP reports) to gauge potential changes in crude oil demand.

- Apply technical analysis: Open the crude oil chart on the trading platform. Add moving averages (such as 50-day and 200-day) to identify trends and use the RSI to determine overbought or oversold conditions. One can also set Bollinger Bands to spot potential price breakouts.

- Apply technical analysis: Open the crude oil chart on the trading platform. Add moving averages (such as 50-day and 200-day) to identify trends and use the RSI to determine overbought or oversold conditions. One can also set Bollinger Bands to spot potential price breakouts.

- Stay informed with news: Subscribe to real-time oil market news services. Set alerts for key reports, such as the EIA status report and OPEC meeting outcomes. Traders/investors should also monitor global news for unexpected events affecting oil prices.

- Develop a trading plan: Define your risk tolerance and set a maximum loss per trade (like 2% of your trading capital). Choose a strategy, such as trend-following or breakout trading, and set specific entry and exit points based on the technical analysis.

*This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

Trading strategies for WTI

Range Trading

Range trading involves identifying a price range within which the market is expected to trade. Traders can use technical indicators like Bollinger Bands or support and resistance levels to identify price ranges. Bollinger Bands plots a moving average and two standard deviations above and below it, creating a channel within which the price is expected to trade.

When the price approaches the lower Bollinger Band or a support level, traders may long, anticipating a rebound to the upper Bollinger Band or resistance level. Conversely, traders may short when the price approaches the upper Bollinger Band or resistance level, expecting a decline to the lower Bollinger Band or support level.

Breakout trading

Traders use technical analysis to identify horizontal or sloping lines that act as support or resistance. These levels are often found at previous highs, lows, or trendline intersections. When the price breaks above a resistance level, traders may enter a long trade, anticipating a continuation of the upward trend.

However, waiting for a pullback or retracement before entering the trade is important to reduce risk. Similarly, traders may short the trade when the price breaks below a support level, expecting a downward trend.

News trading

In this strategy, traders closely follow global supply and demand news, geopolitical events, economic indicators, and OPEC decisions. This includes news about production cuts, increased demand, geopolitical tensions in oil-producing regions, and economic data releases.

When a major news event occurs, traders may quickly assess its potential impact on WTI crude prices and enter trades accordingly. For example, if a major oil-producing country announces a production cut, traders may long WTI futures, anticipating a price increase.

Pairs trading

Traders often use correlation analysis to identify pairs of assets that have a historical relationship. In the case of WTI, potential pairs could include other energy commodities like natural gas or heating oil.

When the price difference between the two assets deviates significantly from its historical mean, traders may long the undervalued asset and short the overvalued one. For example, if the price of WTI is significantly higher than the price of natural gas, traders may enter long trades for natural gas and short WTI, anticipating a convergence of the crude prices.

Seasonal trading

In the seasonal trading strategy, traders analyze historical data to identify patterns in WTI crude prices that occur at certain times of the year. For example, oil demand tends to increase during the summer driving season, while it may decrease during economic downturns. Based on these trends, traders may position themselves to gain from anticipated price movements. For example, if the summer driving season is expected to be strong, traders may long WTI crude oil futures in anticipation of rising crude prices.

Top tips to trade WTI

- Monitor inventory levels: Monitor global oil inventory levels, as they can significantly impact WTI prices. Low inventory levels can suggest a tight supply and drive crude prices up, while high inventories may put downward pressure on crude prices.

- Monitor US crude oil inventory reports: Keep a close eye on the weekly U.S. Energy Information Administration (EIA) inventory report. A larger-than-expected build can lead to price drops, while a drawdown often increases crude prices. Plan your trades around these reports, either by positioning yourself before the release or reacting quickly to the news.

- Pay attention to OPEC meetings and announcements: Decisions by the Organization of the Petroleum Exporting Countries (OPEC) regarding production cuts or increases significantly impact WTI prices. Track OPEC meeting schedules and be prepared to act on any announcements related to production levels. If OPEC signals a production cut, consider going long on WTI, as reduced supply typically drives crude prices higher.

- Hedge against geopolitical risks: Geopolitical events, such as conflicts in oil-producing regions, can cause sudden spikes or drops in WTI prices. Stay informed about global geopolitical developments, especially in the Gulf Coast/Middle East. Consider using options or crude oil futures contracts to hedge positions if one anticipates volatility due to geopolitical tensions.

- Track the US Dollar strength: WTI crude oil is priced in USD, so fluctuations in the Dollar's strength can impact oil prices. A stronger dollar typically leads to lower oil prices, while a weaker dollar can boost prices. Monitor the US Dollar Index (DXY) or the value of the Dollar against major currencies.

Entering the commodities market with WTI trading

Trading WTI Crude Oil requires combining technical analysis, fundamental analysis, and risk management. By understanding the factors that influence WTI prices, developing a sound trading plan, and staying updated on market news, traders can increase their chances of appropriate entries.

However, it's important to remember that trading involves risk, and gains are not confirmed. Hence, traders should always conduct thorough research, practice proper risk management, and consider consulting with a financial advisor if they’re new to trading or need personalized guidance.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.