The piercing line pattern is a bullish reversal pattern that enables traders to identify trend reversals from a downtrend to an uptrend. It signifies bulls overcoming bears, suggesting a potential long opportunity.

In this article, we will discuss the piercing line pattern in depth.

What is the piercing line pattern?

The piercing line candle pattern is a two-candlestick formation that suggests a potential bullish reversal from a downtrend to an uptrend.

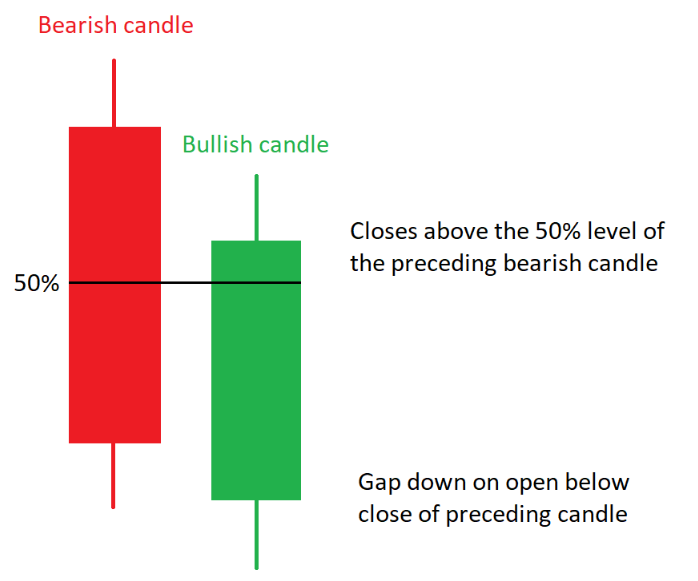

The piercing pattern consists of two candlesticks:

- First candlestick: This bearish candlestick has a long red body

- Second candlestick: This bullish candlestick of the piercing pattern opens lower (gaps down) compared to the first candlestick's close. Ideally, the second bullish candlestick should close at least halfway up the body of the first red candle

The piercing line candlestick pattern suggests that sellers initially pushed prices down (first candle that is red ), but then bulls stepped in, driving the price higher (second green candle). It signals a potential shift in momentum and a possible trend reversal. Note: It's important to be careful when tracking the bearish candlestick and bullish candlestick.

How to identify the piercing line pattern?

To identify the piercing pattern, look for these characteristics:

- Downtrend: The piercing line candlestick pattern typically appears at the end of a downtrend. Before the pattern forms, the price action should show a series of lower lows and lower highs

- Bearish first candlestick: The first candlestick of the piercing pattern should be a bearish candlestick, signifying continued exit pressure

- Downward open: The second candle opens at a price significantly below the closing price of the first candle

- Bullish close: Despite opening lower, the second candlestick patterns should end up closing above the midpoint of the first bearish candlestick's body. This signifies long pressure pushing prices back up. Ideally, the close should be in the upper half of the first candle's body

Mistakes to Avoid with Piercing Pattern

Ignoring confirmation signals

The piercing pattern suggests a potential trend reversal, but it is not definite. Traders should not base their trading decisions solely on this pattern. Look for confirmation signals from other technical indicators like:

- Increased long volume: A surge in entry volume after the piercing line formation strengthens the bullish reversal notion

- Moving average crossovers: If a shorter-term moving average crosses above a longer-term one after the piercing line, it indicates a potential shift in momentum

- Relative Strength Index (RSI) or Stochastic Oscillator: If these indicators move out of oversold territory after the piercing line, it suggests a potential long opportunity

Overlooking volume

Volume plays a crucial role in confirming the strength of the piercing candlestick pattern. Low volume during the second candlestick's rally can indicate a weak reversal signal. For a more reliable bullish indication, look for a significant increase in volume alongside the price rise in the second candle.

Ignoring trend context

The piercing line candlestick patterns hold more weight when it appears at the end of a well-established downtrend. If the downtrend is weak or has not been in place for long, the piercing line might be a temporary pause rather than a true reversal. Consider the overall trend direction before placing a trade based on this pattern.

Entering premature trades

It is tempting to jump into a long position right after seeing the piercing line. However, traders should wait for confirmation from volume and other indicators before entering a trade. Additionally, consider placing a stop-loss order below the low of the piercing line candlestick patterns to manage risk in case the reversal fails.

How to Trade Forex with the Piercing Line Candlestick Pattern

Identify the downtrend and piercing line

Open the forex trading platform and identify a downtrend on the chosen currency pair chart. Look for a series of lower lows and lower highs. Within the downtrend, locate the piercing line pattern itself. This consists of two candlesticks discussed above.

Look for confirmation signals

Do not jump into a trade right after locating the piercing line. Look for additional confirmation to increase confidence:

- Volume: Check if a significant increase in long volume accompanies the second candlestick's rally. This suggests stronger long-pressure

- Technical indicators: Analyze other technical indicators like moving averages or oscillators. Look for signals that support a potential trend reversal, like a shorter-term moving average crossing above a longer-term one or an RSI/Stochastic Oscillator exiting oversold territory

Consider trend context and potential entry

While the piercing line suggests a reversal, consider the overall trend's strength. A piercing line during a strong downtrend might be less reliable than one at the end of a weaker trend.

Ideally, wait for a break above resistance. This could be a previous swing high or a resistance level. A price move above resistance after the piercing line strengthens the bullish case.

Enter the trade

Only after confirmation from volume and potentially other indicators consider entering a long position in the forex pair. Here's how to approach entry:

- Entry point: Don't chase the price up. A long order slightly above the broken resistance level is a good starting point

- Position sizing: Only a small percentage of the capital is allocated to this trade

Manage risk

Place a stop-loss order below the low of the piercing line pattern. This limits potential losses if the reversal fails. Traders can also consider a trailing stop-loss order to lock in gains as the price moves in the trader's favor.

Exit strategy

Have a predetermined take-profit level based on technical analysis or price targets. If the price breaks below the low of the piercing candlestick pattern with strong exit volume, exit the trade to minimize losses.

Navigating the Advantages and Risks of the Piercing Line Pattern

The piercing line pattern enables traders to identify support levels and reflect a change in market sentiment, with bulls overcoming initial short pressure. However, the pattern can also generate false breakouts. Hence, confirmation from volume and other indicators is crucial when trading with piercing line patterns.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.