Converging trendlines form triangle chart patterns in forex. Triangles represent periods of consolidation, showcasing potential breakout points. Breakouts from these patterns signal significant price movements, helping traders anticipate trend continuations or reversals.

The visual simplicity and predictive value of triangles make them essential tools for technical analysis, aiding traders in making informed decisions and managing risks in dynamic currency markets.

In this article, we will discuss the top triangle chart patterns in forex and what they indicate.

What are triangle chart patterns in forex?

Triangle chart patterns are formations in forex trading where converging trendlines create a triangular shape on a price chart. There are three main types: ascending (bullish), descending (bearish), and symmetrical (neutral).

Traders often look for breakouts from these patterns, either above or below the trendlines, to identify potential bullish or bearish trends. The triangle's height can be used to estimate price targets. Still, it's important to use these patterns in conjunction with other analysis tools and practice risk management due to the possibility of false breakouts.

Types of triangle chart patterns in forex

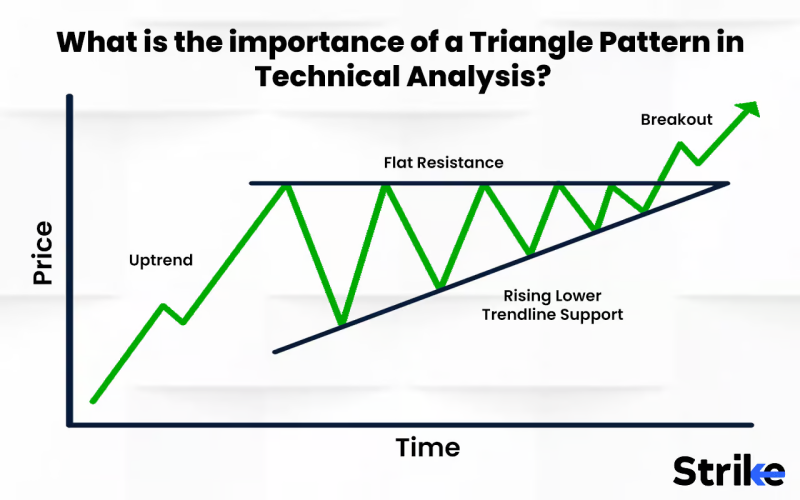

Ascending triangle

An ascending triangle is a bullish chart pattern formed by a horizontal resistance line converging with an upward-sloping support line. This pattern suggests that long traders are gaining strength, increasing prices, and testing the resistance level. Traders often interpret the ascending triangle as an indication of potential bullish continuation, anticipating a breakout to the upside. Breakouts from this pattern are closely monitored, especially with increased volume, as they can signal favorable trading opportunities.

Descending triangle

The descending triangle is a bearish chart pattern in forex, characterized by a horizontal support line and a downward-sloping resistance line. This pattern signifies increasing short trading pressure, pushing prices lower, and testing support levels. Traders often view the descending triangle as a potential precursor to bearish continuation, anticipating a breakout to the downside. Monitoring the breakout, particularly with attention to volume changes, is crucial for traders seeking to capitalize on potential downward trends in the market.

Symmetrical triangle

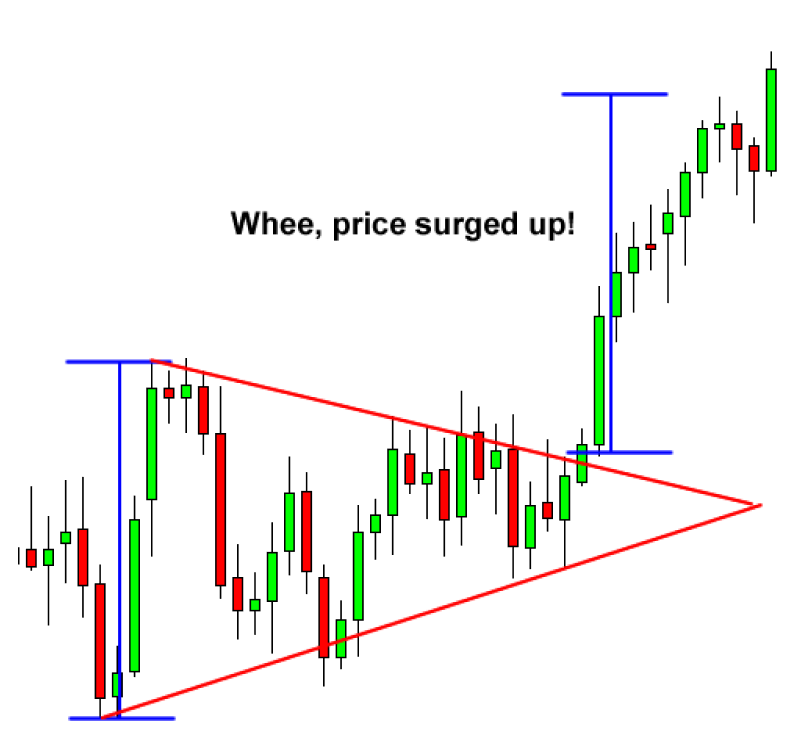

A symmetrical triangle is a neutral chart pattern formed by converging trendlines, with both support and resistance sloping towards each other. This pattern suggests a phase of market consolidation, indicating a balance between long and short traders. Traders anticipate a breakout in either direction, leading to a potential continuation of the existing trend or a reversal. The symmetrical triangle serves as a versatile indicator, and traders closely watch for breakouts, often accompanied by increased volume, to make informed decisions about potential market movements.

Advantages and risks of trading with triangle chart patterns

Advantages

- Clear trend continuation signals: Trading with triangle chart patterns offers the advantage of clear signals for trend continuation. Ascending triangles may signal a bullish continuation, while descending triangles may indicate a bearish continuation. This clarity assists traders in aligning their positions with the prevailing trend.

- Defined breakout points: Triangle patterns provide well-defined breakout points, usually marked by the breach of either the support or resistance line. This clarity assists traders in setting specific entry points for their trades, enhancing precision and reducing ambiguity in decision-making.

- Risk reward ratio: By identifying breakout points and potential price targets using the triangle's height, traders can establish a clear risk-reward ratio before entering a trade. This helps in managing risk effectively and making informed decisions about whether a trade is worth pursuing based on potential gains relative to potential losses.

Risks

- False breakouts: One significant risk associated with trading triangle patterns is the occurrence of false breakouts. Sometimes, a price may breach a trendline only to reverse direction quickly. Traders must be cautious and consider additional confirmation indicators to reduce the likelihood of falling victim to false signals.

- Market noise: Market noise, or random price fluctuations, can be challenging when trading triangle patterns. Sudden price movements unrelated to the pattern itself may lead to false signals. Traders should be aware of market conditions and use additional tools, such as volume analysis, to filter out noise and confirm the validity of a breakout.

- Over-reliance on patterns: Relying solely on triangle patterns without considering other technical analysis or market fundamentals aspects can be risky. Over-reliance on patterns may lead to missed opportunities or incorrect decisions. Traders should use triangle patterns as part of a comprehensive trading strategy rather than as the sole basis for their trades.

Top triangle chart patterns

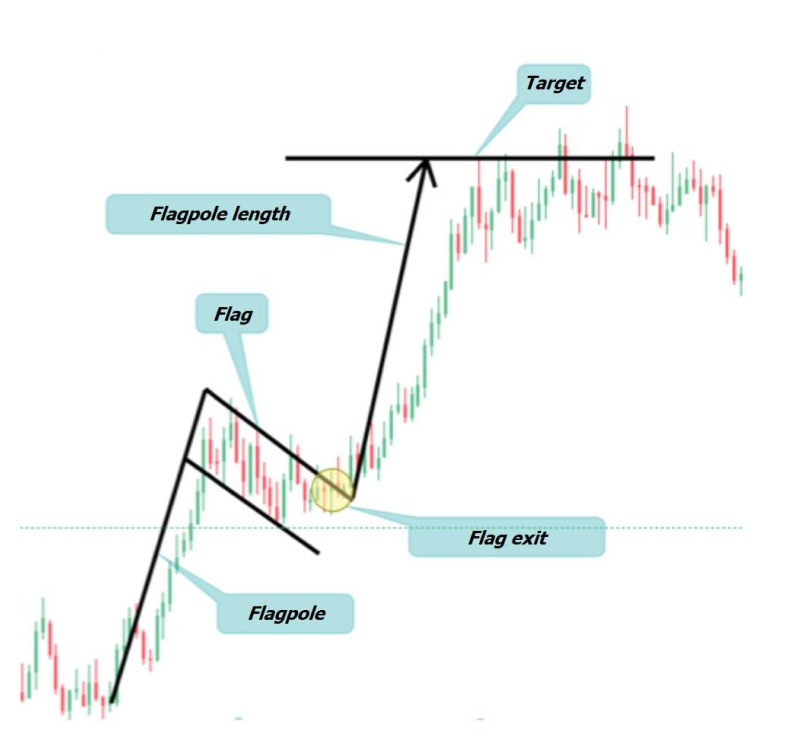

Flags

Flags are rectangular-shaped patterns that form after a strong price movement. The flag resembles a rectangular banner, with parallel trendlines that slope against the prevailing trend. In the context of forex trading, flags represent crucial patterns that can signal a pause in a prevailing trend, allowing traders to identify potential opportunities for continuation trades. For instance, if a bullish flag forms after an upward price movement, it suggests a brief consolidation before the uptrend resumes, signaling traders to place a long order and vice versa.

Forex traders often leverage flags to fine-tune their entry and exit points, closely monitoring breakouts for confirmation and utilizing technical indicators to validate signals. The reliability of flag patterns in forex is based on factors such as market conditions, the timeframe, and confirmation through additional analysis.

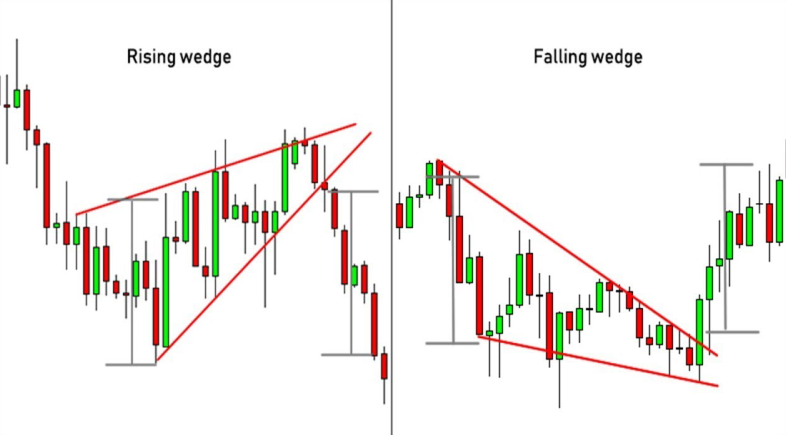

Wedges

Wedges are particularly significant as they signify potential trend reversals or continuations and are characterized by converging trendlines. Traders pay close attention to rising wedges, which may indicate a weakening uptrend, signaling trades to place a short order, or falling wedges, suggesting a potential reversal in a downtrend and signaling traders to place a long order.

Forex traders use wedges to anticipate breakouts and adapt their strategies accordingly. They consider factors like trend strength, volume analysis, and other technical indicators to increase the reliability of their wedge pattern analysis.

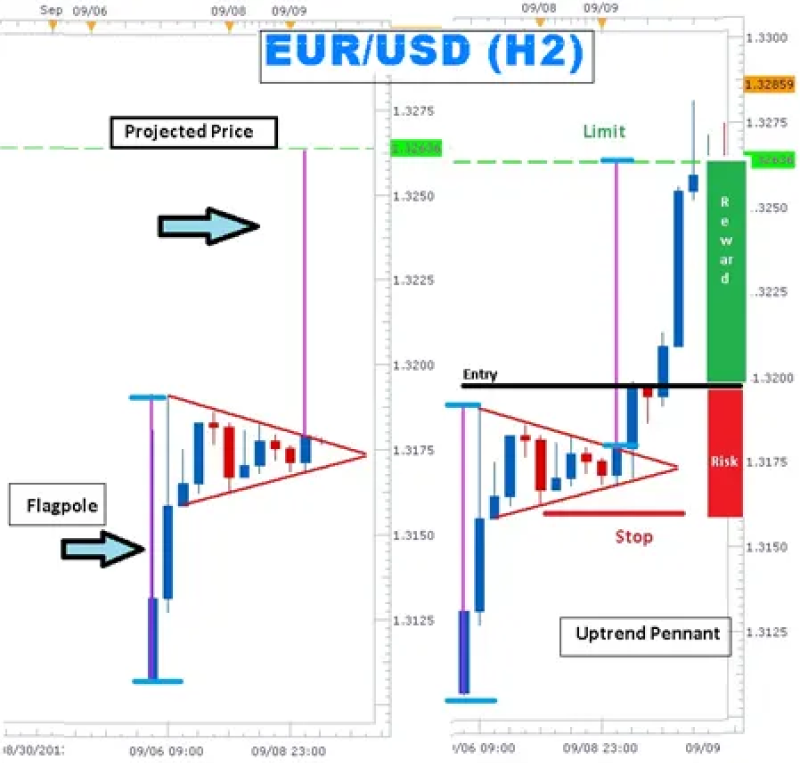

Pennants

Pennants in forex trading serve as vital indicators of brief market consolidations, offering traders insights into potential continuation patterns. These small symmetrical triangles suggest a temporary pause before resuming the prevailing trend. Traders typically place long orders when they observe a bullish pennant and short orders when they identify a bearish pennant, anticipating the direction of the price trend based on the pattern.

Forex traders consider pennants in conjunction with broader market conditions, economic indicators, and geopolitical factors to enhance the accuracy of their analysis. Breakouts from pennant patterns, accompanied by strong volume, are key moments for forex traders, influencing their decisions on trade entries and exits.

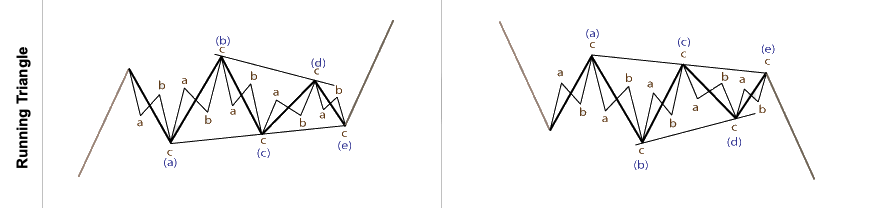

Running triangles

Running triangles are a less common yet noteworthy pattern in forex markets. Recognizing a running triangle is crucial as it suggests accelerated momentum and potential swift market movements. Instead of a complete triangle, running triangles often look like truncated or incomplete patterns, with a breakout occurring before the price reaches the triangle's apex.

Forex traders incorporate running triangles into their strategies, considering the unique implications of these patterns on volatility and trend continuation. As with any pattern, confirmation through additional technical analysis tools and risk management strategies is essential when trading with a running triangle pattern.

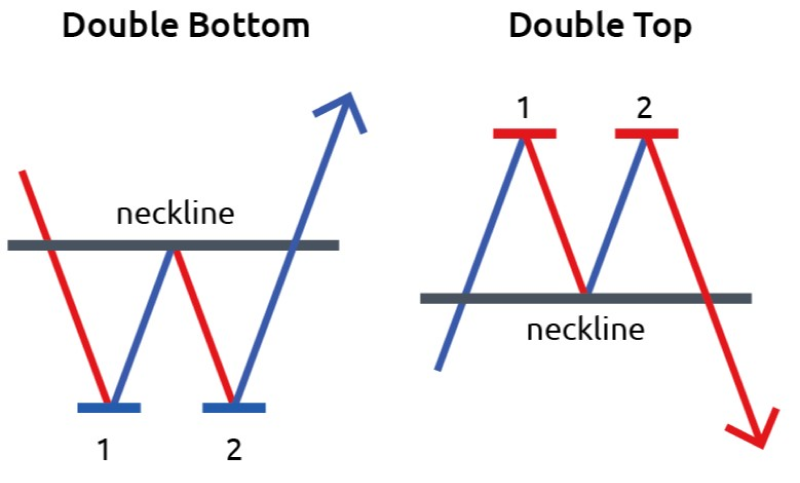

Double bottom/top triangle

Double bottom/top triangles in forex are variations of reversal patterns. These patterns, marked by triangular consolidations between significant price movements, offer forex traders insights into potential trend reversals. The pattern resembles two distinct peaks or troughs connected by a triangular consolidation phase. It resembles a standard triangle with an additional peak or trough on either side.

A double bottom triangle is a bullish reversal chart pattern characterized by two consecutive troughs, forming a W shape, suggesting a potential upward price reversal. A double-top triangle is a bearish reversal chart pattern marked by two consecutive peaks forming an M shape, indicating a potential downward price reversal. Traders carefully evaluate the symmetry of the pattern, its alignment with the prevailing trend, and additional indicators to enhance the reliability of their analysis. Breakouts from the double bottom/top triangles guide forex traders in making trend continuation or reversal decisions.

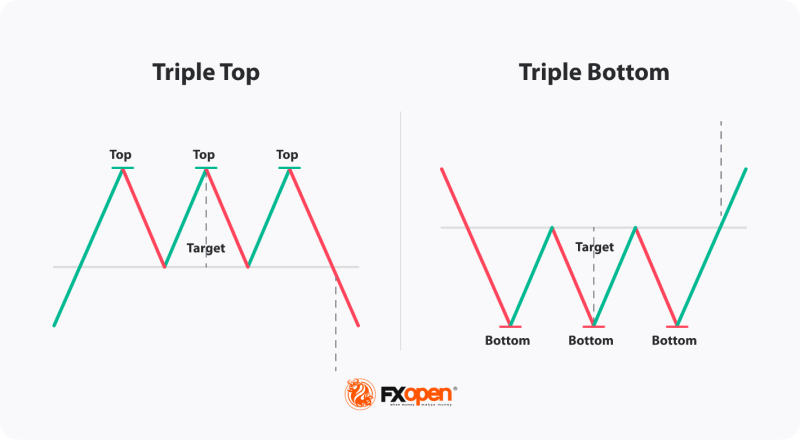

Triple top/bottom triangle

Like their double counterparts, triple top/bottom triangles in forex offer insights into potential trend reversals or continuations. Forex traders recognize the significance of the triangular consolidation phases and employ technical analysis to validate their expectations. These patterns, formed by three distinct peaks or troughs, contribute to the overall assessment of market sentiment and influence traders' decisions regarding trade entries and exits.

Bilateral triangle

Bilateral triangles are characterized by converging trendlines, indicating periods of market consolidation. Here, both the support and resistance lines slope towards each other. Forex traders recognize these patterns as providing balanced insights into trader dynamics. The anticipation of breakouts in either direction prompts traders to consider broader market conditions, economic indicators, and geopolitical factors to make informed decisions.

Breakouts from bilateral triangles, supported by increased volume, often guide forex traders in predicting potential trend continuation or reversals. If the price breaks out of the bilateral triangle in the direction of the prevailing trend, it is typically considered a continuation pattern, and vice versa for a reversal pattern.

Squeeze triangle

Squeeze triangles in forex, reflecting decreasing volatility and a tightening range, offer traders unique insights into potential market shifts. The compression of price movements signals energy buildup, and traders closely monitor for breakouts. The pattern resembles a contracting triangle where the distance between the support and resistance lines narrows, creating a coiled or squeezed appearance.

Traders may place long orders if there is a breakout to the upside of the squeeze triangle. Conversely, traders might place short orders if there is a breakout to the downside of the squeeze triangle.

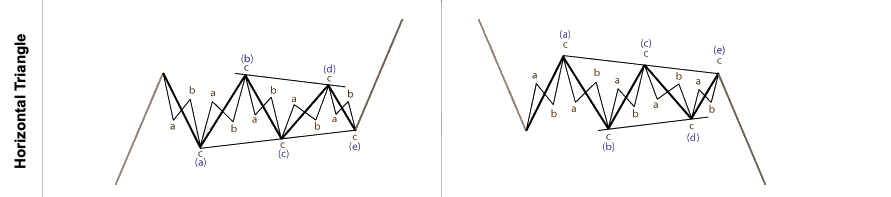

Horizontal triangle

Horizontal triangles in forex denote periods of consolidation with flat support and resistance lines. Forex traders use these patterns to anticipate breakouts. The flatness of the triangle emphasizes the need for careful analysis and confirmation before executing trades. Traders may place long orders if there is a breakout to the upside of the horizontal triangle and vice versa for short orders.

Converging/diverging triangle

Converging and diverging triangles in forex signify the direction of trendlines, providing insights into potential market movements. Forex traders recognize converging triangles as indications of consolidation, while diverging triangles suggest potential breakout or breakdown scenarios.

A converging triangle is recognized with a chart pattern marked by decreasing price swings, forming converging trendlines, indicating a potential breakout as volatility decreases and the market approaches a decision point. On the other hand, a diverging triangle is recognized with a pattern marked by increasing price swings, forming diverging trendlines, suggesting a potential breakout as volatility rises and the market reaches a point of indecision.

Inverted triangle

Traders consider an inverted symmetrical triangle when a triangle occurs in a chart pattern, flipped upside down. In this case, the usual interpretation of a symmetrical triangle would be reversed. Traders may consider placing short orders if there is a breakout to the downside of the inverted triangle and vice versa. Forex traders, however, should exercise caution with unconventional terms and focus on established patterns for more reliable analysis.

Coiled triangle

Coiled triangles are particularly intriguing as they signify a potential buildup of energy before a significant breakout, indicating a tight consolidation phase. They are characterized by tightly wound trendlines. Forex traders incorporate coiled triangles into their strategies, considering the compression of price movements as an indication of impending volatility. When supported by technical indicators and market conditions, breakouts from coiled triangles guide forex traders in predicting and capitalizing on substantial price movements. Traders might consider placing short orders if there is a breakout to the downside of the coiled triangle and vice versa.

Navigating forex market challenges with triangle patterns

In forex trading, while identifying a triangle pattern in a price chart, actual skill lies in synthesizing multiple patterns for a comprehensive, accurate analysis. Yet, challenges persist, such as false signals and unforeseen market shifts, emphasizing the need for vigilant scrutiny and strong risk management.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.