Market breadth indicators are useful for both beginner and expert traders as they provide insights into the overall health of the stock and forex markets. While price-based indicators only look at price changes, breadth indicators check how many stocks or currencies move in the same direction. This helps traders understand if a trend is strong or if just a few big players are driving the market.

In this article, we will discuss the top market breadth indicators and how to trade with them.

What are market breadth indicators?

Market breadth indicators analyze the underlying strength or weakness of a currency or stock market. It examines the number of stocks/currencies traded and their behavior. With the help of market breadth indicators, traders can understand if a trend is supported by multiple stocks/currencies or just a few.

Understanding market breadth

Market breadth is the extent to which a financial market’s movements are supported by a broad base of currency pairs. It tells traders if a trend is driven by the majority of the stocks/currencies or only a few major ones.

-

A broad-based trend occurs when most of the currency pairs in a market index or market move in the same direction

-

A narrow trend occurs when a particular market trend is only driven by a few major stocks/currencies

Key market breadth indicators

Some of the popular breadth indicators are -

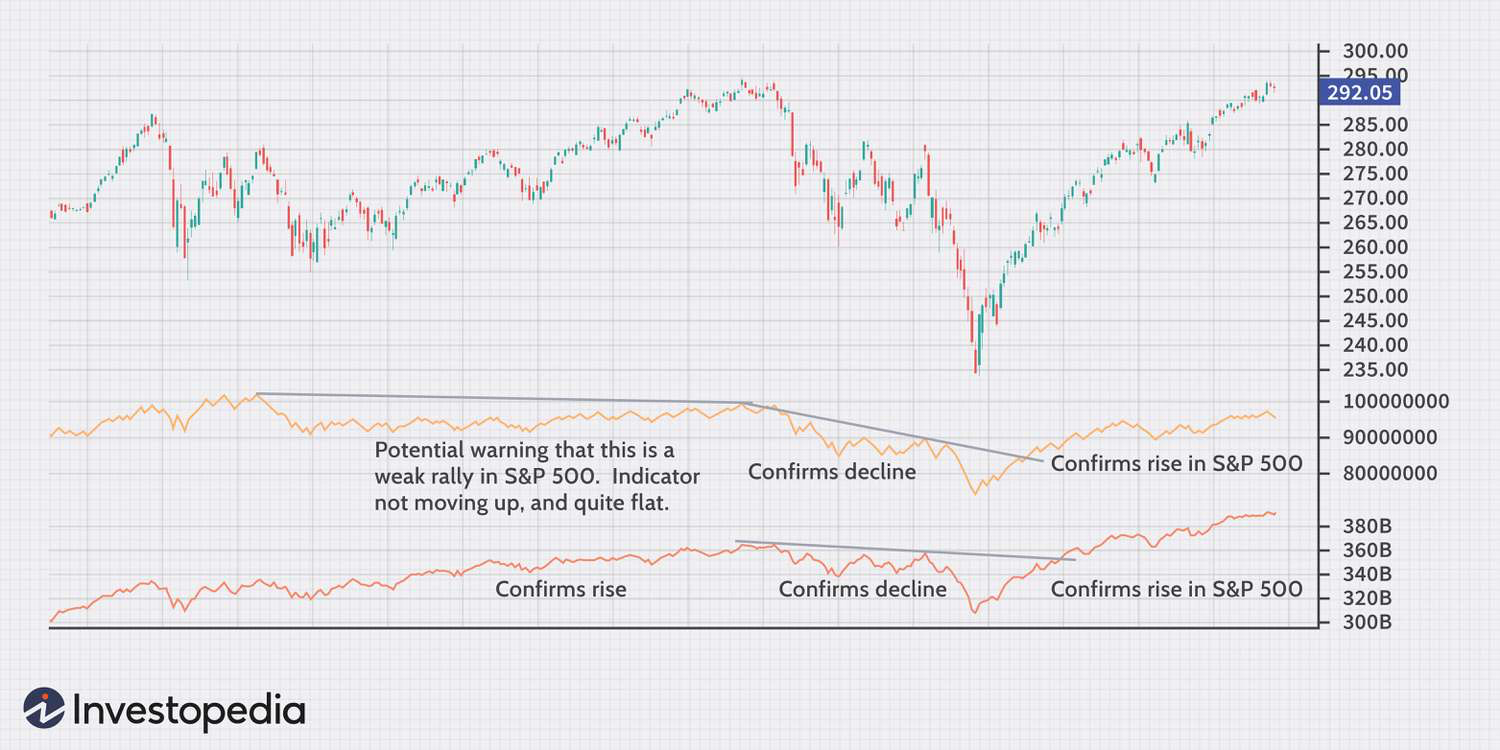

Advance-decline line (AD line)

The AD line tracks the difference between declining or falling stocks/currencies and the number of advancing or rising stocks/currencies. When an AD line is rising, it suggests a broad trend, whereas a falling AD line indicates a trend weakness.

Formula: AD line (current) = AD line(previous) + (Advancing stocks/currencies -declining stocks/currencies)

Image Source

Advance decline ratio

The advance-decline ratio is the ratio between the number of advancing stocks/currencies to the number of declining stocks/currencies. A ratio above 1 signals that more stocks/currencies are advancing (leading to a strong broad market uptrend) whereas a ratio below 1 signals that more stocks/currencies are declining (leading to a strong broad downtrend).

Formula: Advance-decline ratio = Advancing stocks/declining stocks

Image Source

McClellan oscillator (MO)

The MO is a technical indicator measuring the difference between the total number of advancing stocks/currencies and declining stocks/currencies in a short time frame. It smooths the data with a moving average to identify potential reversal signals.

Formula: MO = (EMA of 12 periods – EMA of 26 periods)

Image Source

McClellan Summation Index (MSI)

The MSI is a long-term cumulative version of the McClellan oscillator. It adds or subtracts the everyday values of the MO over a long period of time to provide traders with a broader market trend strength and breadth.

Formula: MSI(current) = MSI(previous) + MO

Breadth thrust indicator

Breadth thrust indicators include several market breadth indicators, such as the NYSE Bullish Percentage Index or the Bullish Percentage Index (BPI), which measure the percentage of stocks in the stock market or index that are bullish. When the readings of this indicator are high, they indicate strong market momentum, whereas when they are low, the uptrend market momentum is considered weak.

Percentage of stocks above moving average

The percentage of stocks above the moving average (MA) measures the total percentage of the stocks in a particular index trading above a specific moving average. This moving average can be a short-term moving average like a 50-day MA or a long-term moving average like a 200-day MA, depending on the time frame the trader has considered. The higher the percentage, the stronger the market trend, and vice versa.

Formula: % above MA = (number of stocks or currencies above MA/total number of stocks or currencies)*100

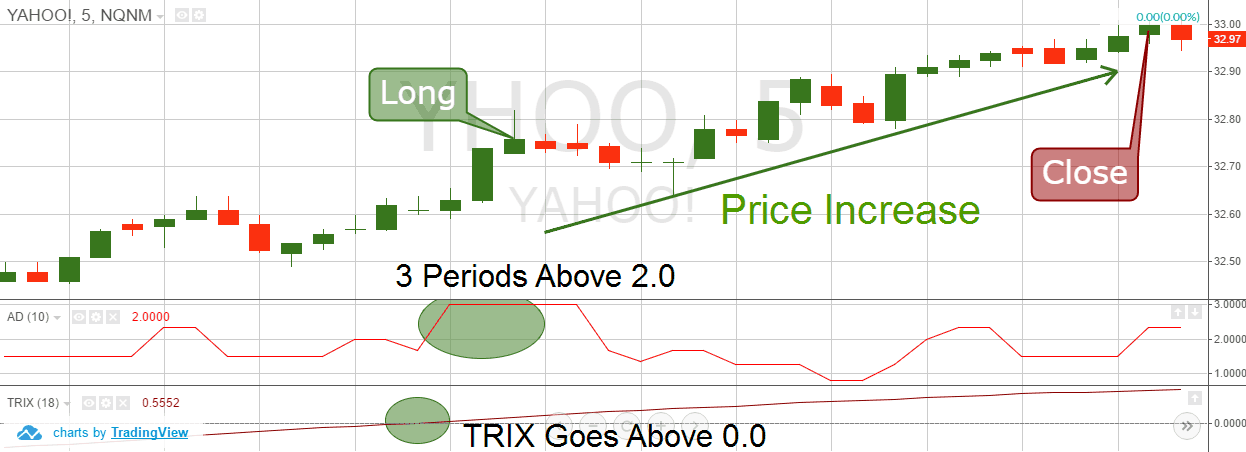

Arms index

The arms index indicator is also known as the TRIN or trader’s index. It measures the relationship between the advancing and declining market trend and market volume.

-

When the TRIN value is more than 1, it indicates a strong bear market sentiment as more volume is toward declining stocks/currencies

-

When the TRIN value is less than 1, it indicates a strong bullish market sentiment as more volume is towards advancing stocks/currencies

Formula: TRIN = (advancing stocks or currencies/declining stocks or currencies)/(advancing volume/declining volume)

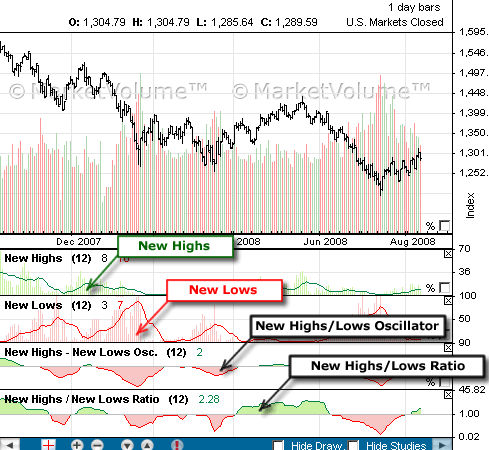

New high-new low index

The new high-new low indicator tracks the total number of new highs and new lows in the financial markets over a specific period of time. It provides traders with insights into market strength and weakness. The traders can subtract the number of new lows from the number of new highs to get to the index’s value.

-

When the new high-new low value is positive and rising, it indicates a strong market condition and positive market breadth

-

When the new high-new low value is negative and falling, it suggests a weak market condition and negative market breadth

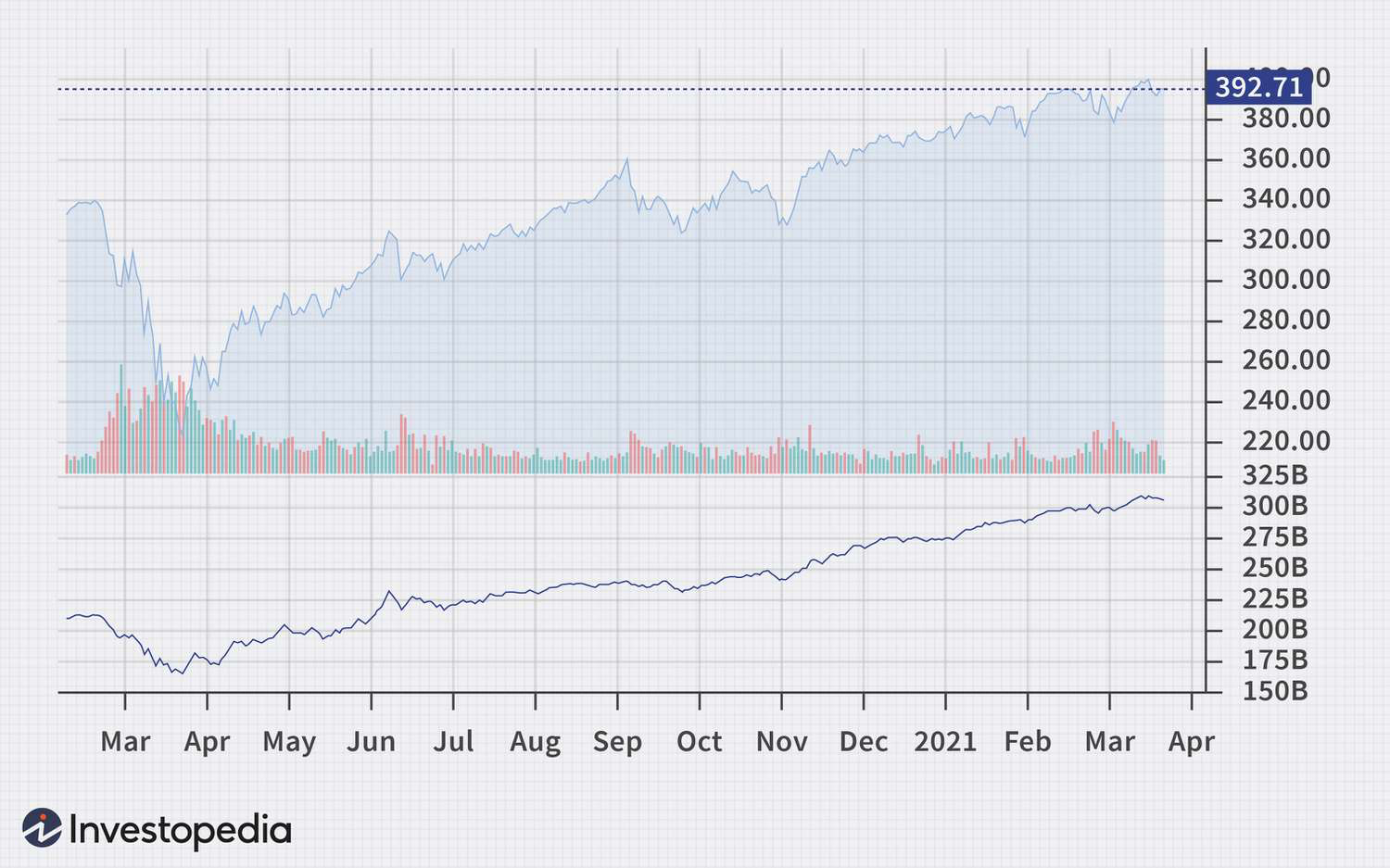

Cumulative volume index (CVI)

The CVI is a market breadth indicator that tracks the cumulative volume of advancing stocks/currencies and declining stocks/currencies over a specific period of time. By analyzing volume accumulation, it provides traders with overall market strength. Traders can calculate the CVI value by adding the volume of advancing stocks/currencies together and subtracting it from the volume of declining stocks/currencies.

-

When CVI is increasing, it signals that more volume is towards advancing stocks/currencies, hence the market is strongly bullish

-

When the CVI is decreasing, it signals that more volume is towards declining stocks/currencies, hence the market is strongly bearish

Formula: CVI(current) = CVI(previous) + (volume of advancing stocks or currencies – volume of declining stocks or currencies)

How to use market breadth indicators in trading

Choose an indicator relevant to the trading strategy

Each trading strategy and goal are different. Hence, traders must choose the market breadth indicators that align with their trading strategy. For example, if a trader is more focused on understanding trend strength, they can use the AD line or MO indicator.

Gather market data

Next, the traders need to collect market data which helps calculate the market breadth indicators. Usually, all indicators require volume data, prices, and a total number of advancing/declining stocks/currencies.

Calculate the indicator

Use the formulas given above to calculate the values of any chosen indicator. Traders can also find built-in tools on trading platforms that automatically calculate and display the indicator values.

Analyze indicator values

Assessing the current values of the indicators provides traders with insights into the ongoing market sentiment. Each indicator signals market breadth in a different way. For example, a rising AD line indicates a broad-based rally, whereas a TRIN value of more than 1 indicates a strong bearish market condition.

Combine multiple market breadth indicators

Analyzing the market with different indicators serves as a confirmation for traders. For example, if the AD line is rising and the MO is also positive, it confirms that the bullish market sentiment is strong and vice versa.

Overlay with charts

The next step is to overlay the breath indicator with other technical analysis tools like moving averages, trend lines, and more to gain double confirmation of the market signals. This helps traders place accurate entry or exit orders.

Place an order

Once the trader has analyzed the market breadth with the market breadth indicators, it is time to place a trade accordingly. For example, if the combined analysis shows a strong market breadth in an uptrend, traders can place a long order and vice versa.

*This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

Limitations and challenges of market breadth indicators

Lagging indicator

Market breadth indicators are lagging indicators as they usually lag behind the market prices. This means that a market breadth indicator might signal a trend momentum after it has already begun. This can cause missed opportunities and late entries for traders.

False signals

Market breadth indicators can sometimes give false signals, especially when they are not combined with other technical indicators. For example, a sharp spike in the AD line might suggest a bullish trend, but if the overall market sentiment is negative (as per other indicators), it could mean that the sudden spike is only a false signal, and traders should hold onto their positions.

Data quality

The accuracy of market breadth indicators depends on the quality of the data collected. If the trader collects incomplete or inaccurate data, it will lead to inaccurate indicator readings and hence, false signals.

Over-reliance risk

Over-relying only on market breadth indicators and not considering other technical indicators can be risky. Traders must use market breadth indicators with other technical analysis tools to get a better view of market sentiment.

Different indicators give different messages

Different market breadth indicators can sometimes give conflicting signals for several reasons, such as data mismatch, unexpected short-term price rise/decrease, and more. For example, the MO can be bullish, while the TRIN indicates bearish conditions due to the trader not mentioning data for the same time period. Navigating through such contradictions can be tricky.

Ideal practices for market breadth analysis

Understand the overall market context

Different market breadth indicators can behave differently in various market conditions. Hence, traders must know whether the market is trending, ranging, or volatile. This helps interpret what the breadth indicators are actually signaling.

Stay updated on data quality

Accurate data is the backbone of reliable market breadth indicator readings. Traders should ensure that their data sources are reliable and updated to avoid misleading signals that emerge from outdated and incorrect information.

Use multiple timeframes

Market breadth indicators can give different signals in different time frames. For example, the AD line might be rising in the short term but, when analyzed for the long term, might give decreasing signals. Hence, traders should consider multiple timeframes to check the actual signals indicated by the market breadth indicators to understand both long-term and short-term trends.

Watch for divergences

A divergence between market breadth indicator values and currency price movements can signal a trend reversal opportunity. For example, if the forex market is making more new highs than new lows but the AD line is falling, it might signal that the current market strength is weakening, and traders should enter the opposite position of the current trend.

Avoid over combining

Although combining multiple indicators for a confirmed signal is necessary, avoid using too many indicators at once as it can lead to analysis paralysis. Traders should stick to a pre-decided number of indicators and focus on them to understand the market strength.

Tips to use market breadth indicators

-

Stay updated on market news: Keep an eye on current events and news that might impact the market, as they can affect the reliability of the indicators

-

Regularly review indicator performance: Periodically assess how well the indicators are working and adjust the trading approach based on the same

-

Be cautious with extreme values: Watch out for extreme indicator readings which might signal overbought or oversold conditions, as these areas are potential reversal zones

-

Monitor indicator correlations: Be aware of how different indicators interact with each other as inconsistencies might highlight issues or signal changes in market behavior

-

Avoid overfitting: traders should ensure their strategies based on breadth indicators are not overly optimized for historical data, as this can lead to poor performance in live markets

-

Check for market anomalies: Be watchful for unusual market conditions or anomalies that might distort the typical behavior of breadth indicators

Trading forex with market breadth indicators

There are over 128 forex currency pairs that can be traded, and understanding the behavior of each currency is crucial to analyzing the forex market. The market breadth indicators can help traders analyze whether most of the currencies are advancing or declining and place forex orders accordingly.

Traders must also combine these market breadth indicators with other technical analysis indicators to ensure they do not enter inaccurate trades and positively confirm trends and each signal.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.