Gap trading offers opportunities to capitalize on price disparities caused by market inefficiencies, news events, or shifts in sentiment during periods of high volatility. Implementing gap trading strategies allows traders to exploit these price gaps for potential gains while managing risk through disciplined trading techniques.

In this article, we discuss the top gap trading strategies for forex trading.

What is gap trading?

Gap trading involves exploiting price gaps on a chart between the previous trading session's closing price and the next's opening price. These gaps can occur due to news events, earnings reports, or market sentiment changes when the market is closed. Traders aim to gain from the price movement that occurs as the market attempts to fill the gap, either by purchasing if the price gaps are up or shorting if the price gaps are down, with the expectation that the price will eventually revert to fill the gap.

What are the top gap trading strategies in forex trading?

Breakaway gap trading strategy

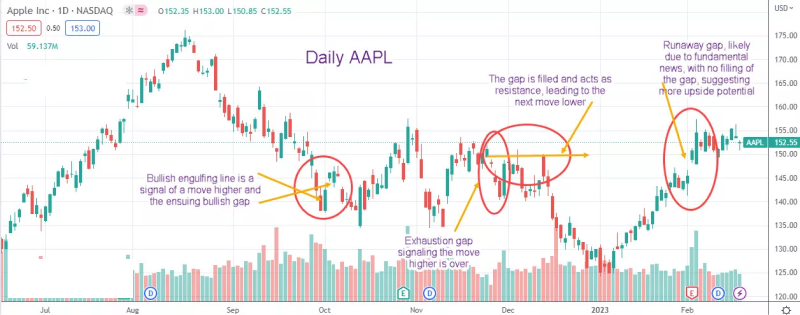

The breakaway gap trading strategy involves identifying price gaps at the beginning of a new trend. These gaps typically signal a significant change in market sentiment and often indicate the start of a strong trend. Traders look for breakaway gaps to initiate positions toward the gap, anticipating further price movement.

This strategy aims to capitalize on the momentum generated by the gap, with traders seeking to ride the trend for substantial gains. To manage risk, traders may use stop-loss orders placed below the gap or the recent swing low, allowing them to exit the trade if the market moves against their position.

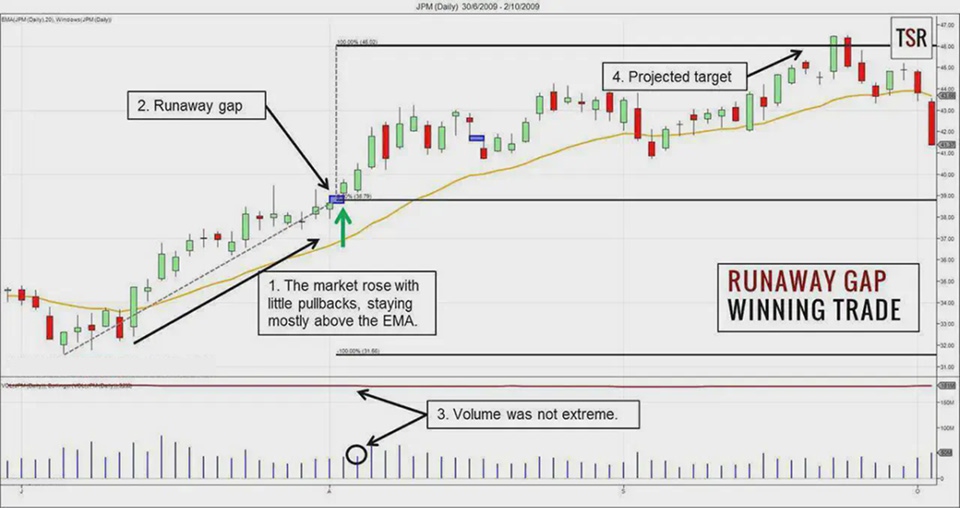

Runaway (measuring) gap trading strategy

The Runaway gap trading strategy, also known as the measuring gap strategy, focuses on identifying gaps within an established trend. These gaps, also called continuation gaps, signal a temporary pause in the trend before resuming in the same direction.

Traders use measuring gaps to confirm the strength of the existing trend and anticipate further price movement in that direction. They may enter trades in the direction of the trend following the gap, aiming to capitalize on the continuation of the trend. To manage risk, traders may employ trailing stop-loss orders, allowing them to lock in gains as the trend progresses while protecting against potential reversals.

Exhaustion gap trading strategy

The exhaustion gap trading strategy involves identifying price gaps that occur near the end of a trend, signaling a potential reversal in market direction. These gaps typically indicate a final surge of trading activity before the trend loses momentum and reverses.

Traders look for exhaustion gaps to initiate contrarian positions to capitalize on the impending trend reversal. They may enter trades against the direction of the gap, anticipating a retracement or reversal in price. To manage risk, traders may use tight stop-loss orders placed above or below the gap, allowing them to exit the trade quickly if the market moves against their position.

Island reversal gap trading strategy

The island reversal gap trading strategy involves identifying a price gap that isolates a small cluster of price bars, creating an island on the chart. This gap pattern typically signals a reversal in market direction, with the isolated price bars serving as a temporary island of support or resistance.

Traders look for island reversal gaps to initiate trades in the direction opposite to the prevailing trend, anticipating a reversal in price. They may enter trades against the direction of the gap, aiming to capitalize on the reversal and gain from the subsequent price movement. To manage risk, traders may use stop-loss orders placed beyond the island formation, allowing them to exit the trade if the market moves against their position.

Gap-and-go trading strategy

The gap-and-go trading strategy involves trading price gaps that occur at the opening of the trading session and continue in the direction of the gap throughout the day. Traders look for gap-and-go setups to enter trades in the direction of the opening gap, anticipating a continuation of the trend for the remainder of the trading session.

This strategy aims to capitalize on the momentum generated by the opening gap, with traders seeking to ride the trend for intraday gains. To manage risk, traders may use stop-loss orders placed beyond key support or resistance levels, allowing them to exit the trade if the market moves against their position.

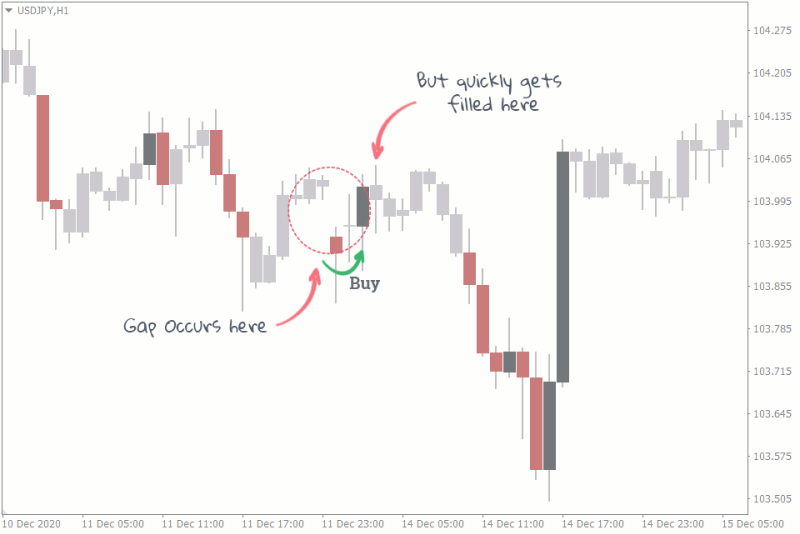

Gap fill trading strategy

The gap fill trading strategy involves trading price gaps with the expectation that the market will fill the gap shortly after it occurs. Traders look for gap fill setups to enter trades in the direction opposite to the opening gap, anticipating a retracement or reversal in price.

This strategy aims to capitalize on the tendency of price to return to fill the gap, often driven by gain-taking or market sentiment shifts. To manage risk, traders may use stop-loss orders placed beyond the high or low of the opening gap, allowing them to exit the trade if the market moves against their position.

Earnings gap trading strategy

The Earnings gap trading strategy involves trading price gaps that occur following a company's earnings announcement. These gaps often reflect market reactions to the earnings report, with significant gaps indicating strong positive or negative sentiment towards the company's financial performance.

Traders look for earnings gap setups to enter trades in the direction of the gap, anticipating further price movement in that direction. This strategy aims to capitalize on the volatility and momentum generated by the earnings gap, with traders seeking to gain from the subsequent price movement. To manage risk, traders may use stop-loss orders placed beyond key support or resistance levels, allowing them to exit the trade if the market moves against their position.

Navigating through the advantages and risks of gap trading in forex

Gap trading offers potential advantages such as capturing rapid price movements and gaining from market inefficiencies. However, it carries risks of false signals, gap continuation, and gaps not filling, leading to losses. Effective risk management and combining it with other strategies can mitigate these risks for proper trading outcomes.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.