Highly volatile currency pairs go through significant price fluctuations every single day. These rapid price shifts demand using a well-defined trading strategy. A strategic approach can guide traders through the unpredictable price changes in the forex market.

Let's discuss the top strategies for trading volatile forex pairs.

Carry trade strategy

The carry trade strategy involves borrowing a low-interest rate currency (funding currency) and investing it in a high-interest rate currency (base currency). The gain comes from the difference in interest rates between the two currencies. However, sudden currency movements against the base currency can quickly erode gains or even lead to losses if the funding currency strengthens significantly against the base currency.

-

Traders should look for significant interest rate differentials and a stable forex market to minimize the risk of sudden currency movements to enter a trade

-

Traders should close the trade if the interest rate differential narrows or if volatility increases, potentially leading to sharp currency fluctuations against the base currency

Running out of steam strategy

This strategy focuses on catching the tailwind of a strong trend before it loses momentum. Traders can enter short positions in volatile markets by identifying indicators like overbought readings on the Relative Strength Index (RSI) or other technical signals suggesting a potential reversal. The key challenge lies in accurate timing. Due to volatility, false signals can be frequent, leading to premature exits and missed opportunities.

-

To enter a trade, look for signs of trend exhaustion in a strong move, such as overbought readings on RSI or other technical indicators suggesting a reversal. Increased volume on retracements can indicate exit pressure

-

Exit a trade when the price shows signs of reversal or reaches a predefined gain target. Consider trailing stop-loss orders to lock in gains as the price moves in the trader's favor

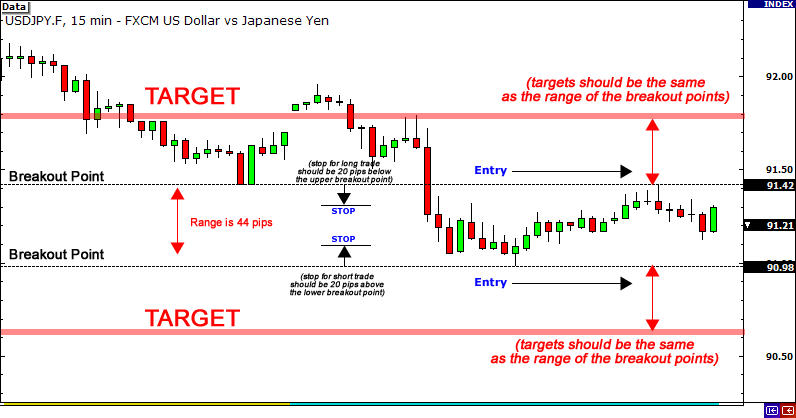

Breakout/breakdown strategy

Breakout/Breakdown strategies aim to capture the initial burst of price movement when a new trend emerges in volatile markets.

Traders look for breakouts above resistance levels (indicating a potential uptrend) or breakdowns below support levels (indicating a potential downtrend) to enter positions. Signals like increased volume on the breakout/downbreak or trendline breaks on higher time frames can provide additional trade confirmation and reduce the risk of chasing fleeting price movements.

-

Enter long positions on a confirmed breakout above resistance with increased volume or short positions on a confirmed breakdown below support with increased volume. False breakouts are common in volatile markets, so wait for confirmation beyond just the price crossing the level

-

Exit trades when the price reaches a pre-defined target or shows signs of losing momentum. Use trailing stop-loss orders to manage risk

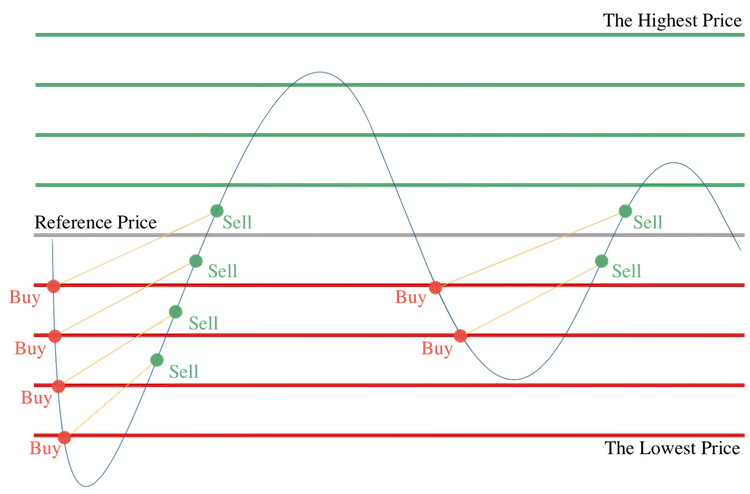

Grid trading strategy

Grid trading involves placing a series of long and short orders at fixed intervals around a predicted price range. This strategy aims to gain from the small, frequent price swings that occur within the range, which are more common in volatile markets. Tight grids offer the potential for more frequent gains but require high volatility for confirmed signals. Conversely, wider grids reduce risk but may capture fewer opportunities.

-

Place initial long or short orders around a predicted price range based on technical analysis or support/resistance levels

-

Close individual grid positions as the price moves in the trader's favor, taking gains at predefined levels. Consider adjusting the grid as price changes to maintain efficiency. Exiting the entire grid can be done if the price breaks out of the predicted range or volatility subsides significantly

Mean reversion strategy

Mean reversion strategies exploit the tendency of prices to revert to a historical average after deviating significantly, especially with volatile currency pairs. Tools like Bollinger Bands can help identify conditions such as overbought (prices trading near the upper band) or oversold (prices trading near the lower band). However, volatility can extend these periods. Consider additional confirmation signals like price approaching critical support or resistance levels before entering a trade.

-

Enter long positions when the price reaches oversold areas (such as near the lower Bollinger Band) or enter short positions when the price reaches overbought areas (such as near the upper Bollinger Band)

-

Exit a position when the price shows signs of returning toward the historical average or reaches a predefined target. Volatility can extend overbought/oversold conditions, so be patient and use trailing stop-loss orders to manage risk

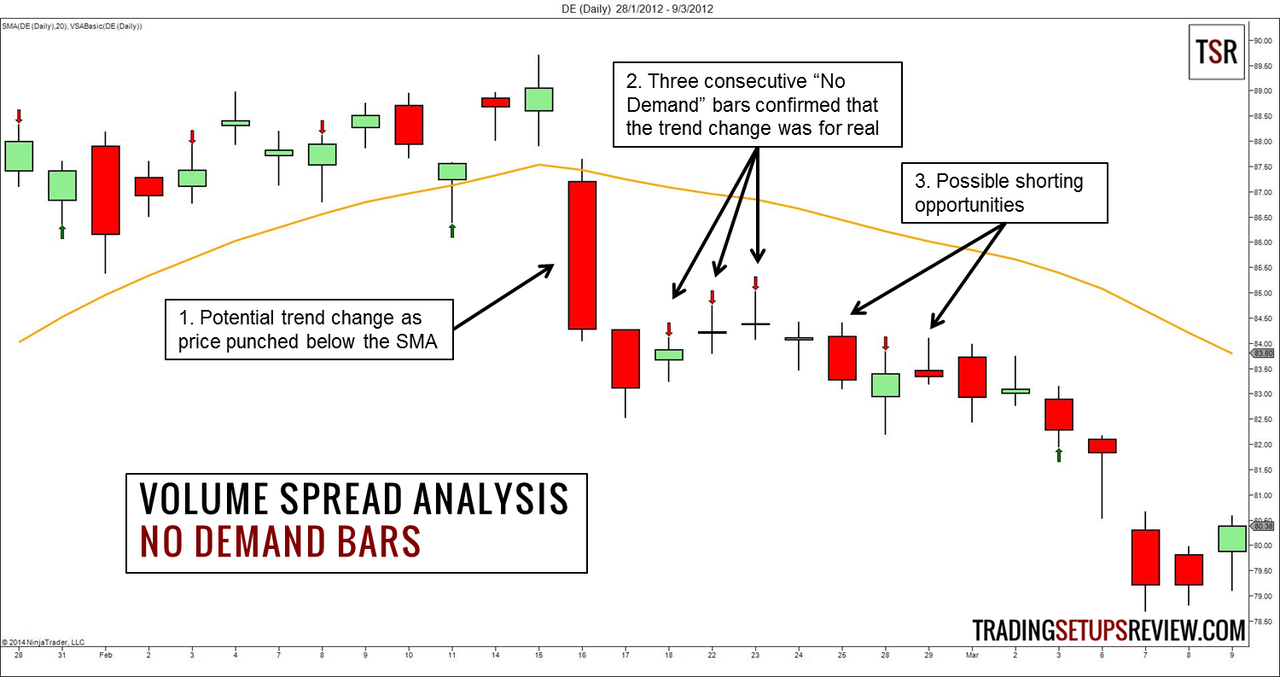

Volume spread analysis (VSA) strategy

VSA analyzes price action and volume to understand the underlying market for volatile currency pairs. By focusing on the relationship between price movements and trade volume, traders can identify strong directional moves based on specific price patterns accompanied by high-volume spikes. It helps traders gauge the strength of a move and identify potential turning points.

VSA doesn't offer specific entry and exit points but rather helps identify potential turning points based on price action and volume patterns in volatile markets. Look for specific VSA reversal patterns like pin bars and engulfing bars, as they combine price action and volume changes to suggest a potential shift in momentum. Look for VSA patterns indicating the trend might be losing steam (for long positions) or regaining strength (for short positions).

Straddle trading strategy

Straddle trading involves purchasing both a call option and a put option on the same currency pair with the same strike price and expiry. This strategy allows traders to gain from large price movements in either direction, which is more likely in volatile markets. However, the cost of options premiums can be high. To gain, the underlying currency pair needs to experience a significant price swing in either direction before the options expire.

-

Enter the trade when volatility is high, and the market is expected to make a significant move in either direction

-

Close the trade if the price makes a substantial move in the trader's favor to capture gains before the options expire. If the price remains stagnant, traders may need to close the trade at a loss to avoid further premium decay

Trade with combined forex strategies

Traders can identify high-probability entry and exit points, capitalizing on amplified price movements by combining different trading strategies. However, volatile currency pairs can yield large gains but can also lead to significant losses. Hence, strict adherence to the strategies, including stop-loss orders, is crucial to mitigate risk.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.