Traders should use a straddle strategy to gain from significant price movements in either direction without predicting the market's direction. This approach is ideal for uncertain conditions, allowing traders to capitalize on unexpected shifts. It also mitigates directional bias and hedges against unpredictable market fluctuations.

In this article, we will discuss the strategy for straddling options in forex.

What is the straddle options strategy?

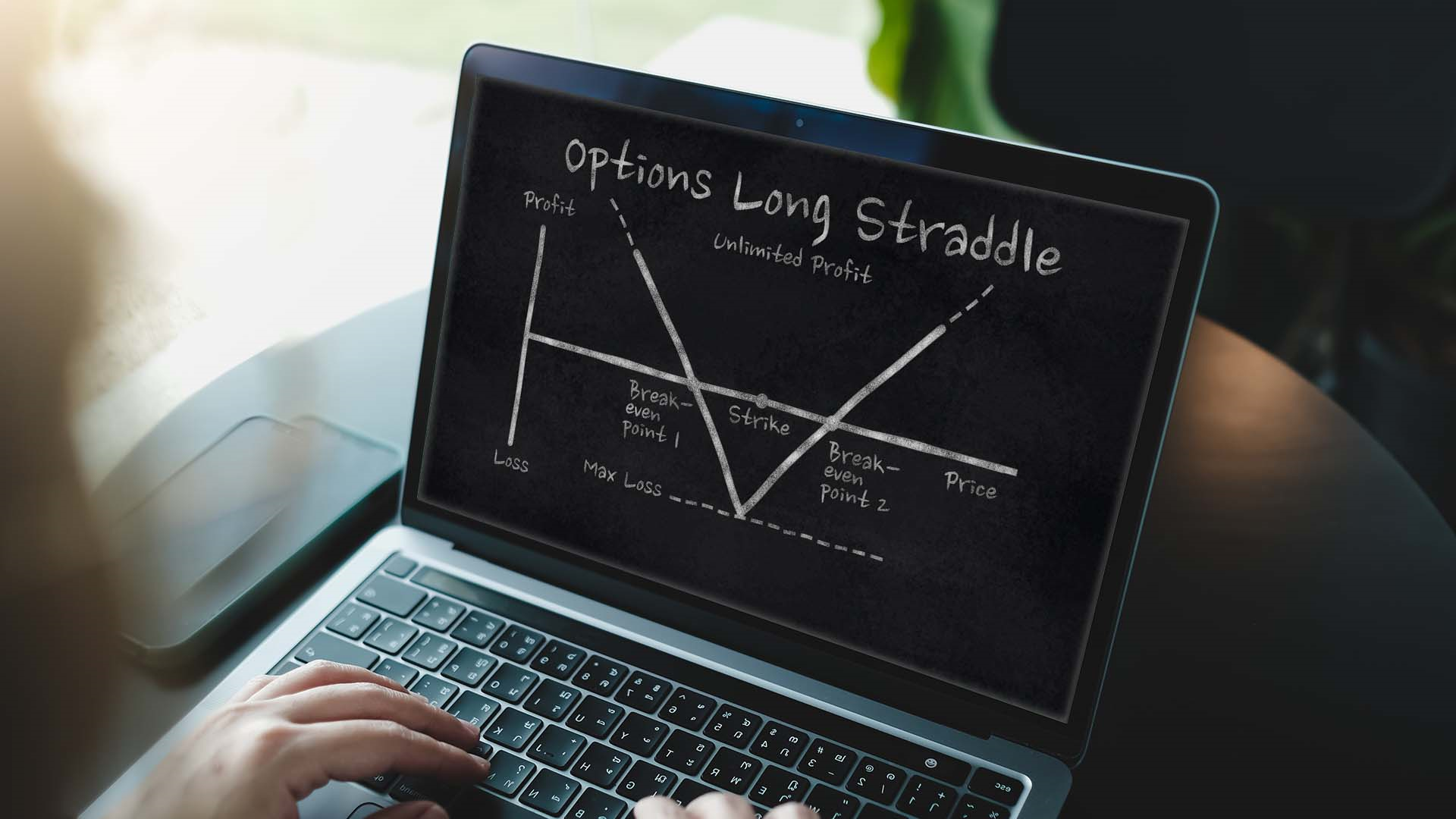

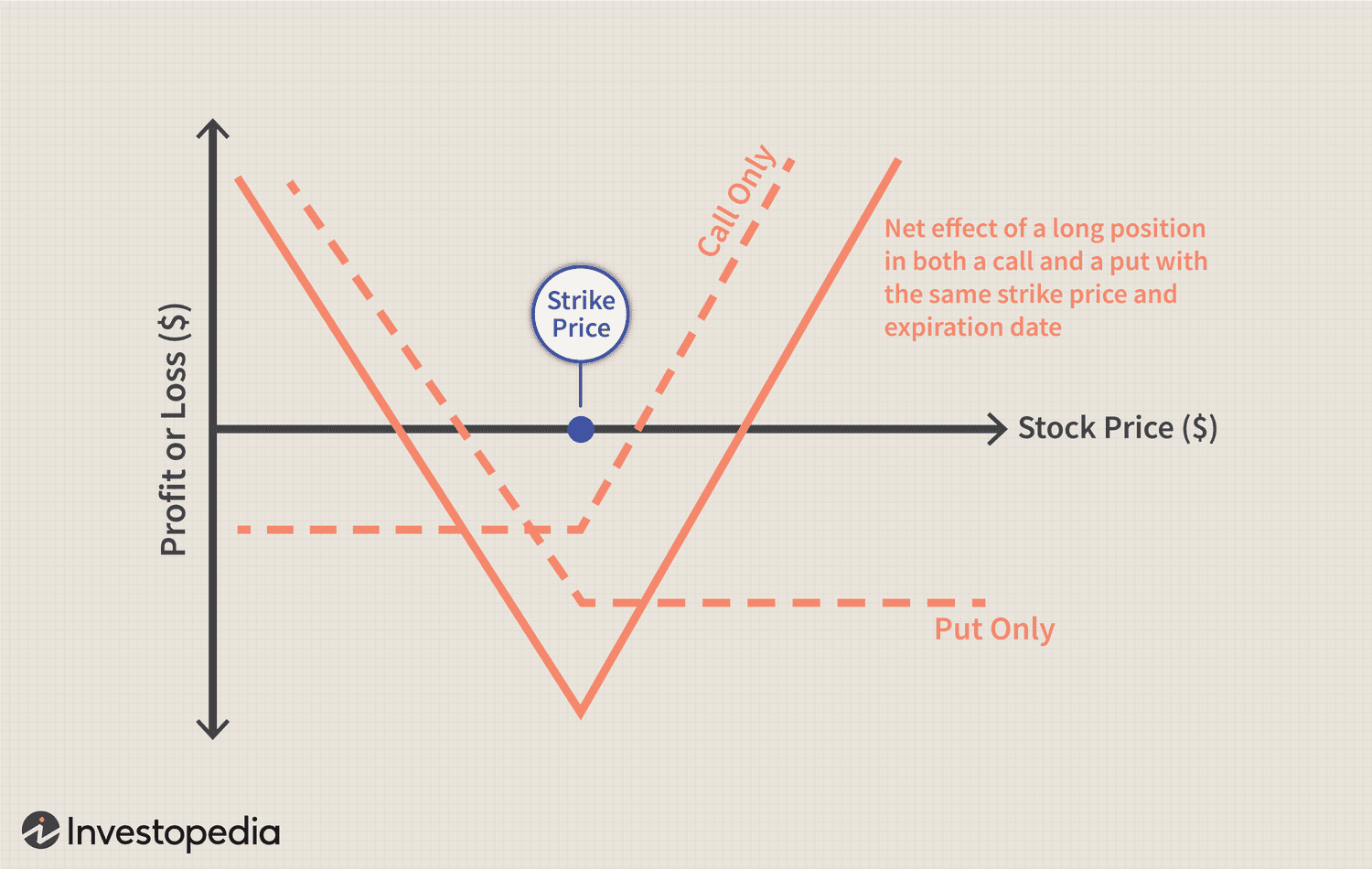

The straddle options strategy involves purchasing both a call and put option to capitalize on significant price moves in rising and falling markets. Both call and option options contracts have the same strike price and expiration date and are purchased for the same underlying asset (a currency pair, in this case).

An example of a straddle options strategy

Suppose a trader wants to trade EUR/USD in a volatile market. Due to the volatility, the trader is unsure if the market will move up or down. To realize gains irrespective of the market direction, the trader enters a call option at a strike price of 1.2000 and a premium of 20 pips, along with a put option with the same strike price and premium.

The total cost of this trade becomes 40 pips. Let's assume the market rises significantly. The outcome from this trade would be that the currency pair increases, with new prices touching 1.2200 and call option values touching 200 pips. No value will be generated since the put option expires due to the continued uptrend. The total gain for the trader becomes 200-40 pips = 160 ps.

On the other hand, if the market falls significantly with a new price of 1.0000, the call option will expire, reaping no value. However, the put option will be executed and gain 200 pips (1.2000-1000). The total gain for this trade would be 200-40 pips = 160 pips.

Risks and advantages of a straddle options strategy

Risks

- High premium costs: Purchasing both a call and a put option can be expensive due to the combined premiums, which increases the potential loss if the prices do not move significantly

- Need for large price movement: The strategy requires a significant price movement in either direction to cover the cost of the options, making it less effective in a stable market

- Time decay: As options approach expiration, their value becomes zero due to time decay. This can result in a loss if the underlying currency pair's price remains near the strike price

- Volatility risk: While the strategy gains from high volatility, unexpected changes in market conditions or lower-than-expected volatility can negatively impact net gains

Advantages

- No directional bias: The strategy gains from significant price movements in either direction, making it useful when the direction of the move is uncertain

- Flexible to market conditions: The strategy is suitable for environments with expected volatility or major events

- Potential for large gains: Large price movements can result in substantial gains, especially if the currency pair moves significantly away from the strike price in either direction

- Hedge against market uncertainty: Provides a way to capitalize on unpredictable price movements and hedge against potential market shifts

How to implement a straddle options strategy

Identify the underlying asset and market conditions

Select the currency pair one wants to trade with an expected significant price movement. Analyzing the market conditions will help the trader determine whether volatility can significantly affect the currency pair's price movement.

Select strike prices for the call and put options

Choose a strike price close to the current price the currency pair is trading at. In the straddle strategy, ensure that the strike price for both call and put options is the same to maximize the strategy's gaining potential.

Choose expiration dates for both options

The expiration date for both the call and put options should be the same and align with the trader's expectation of when the currency pair will significantly move upwards or downwards. The right expiration date can be set a few weeks or months from entering the trade.

Purchase the call option at the selected strike price

After choosing the strike price, purchase the call option. This contract gives traders the right but no obligation to purchase the currency pair at the strike price. Traders can gain if the currency pair prices increase significantly.

Purchase the put option at the selected strike price

Next, traders need to purchase a put option simultaneously with the same strike price and expiration date as the call option. This gives traders the right but no obligation to exit the currency pair at the specific strike price. The trader gains if the currency pair's price falls significantly.

Monitor the price movement of the underlying asset

After entering a call and put options contract, traders should closely monitor the currency pair's price changes. Keep a close eye on any news or event that could impact the currency pair's volatility in the market.

Adjust or close positions

Finally, traders can close or adjust the position based on the currency pair's price movement and realized gains. If the price moves significantly upward or downward, the trader can sell either of the unexpired options to realize gains. The strategy can also be adjusted by rolling the options to different strike prices and expiration dates if the market does not perform as expected.

Straddle options vs covered call options

As discussed, straddle options include purchasing both call and put options at the same expiration date and strike price. They are ideal strategies used in volatile markets when traders cannot anticipate the market's direction.

However, the covered call options strategy allows traders to own an underlying currency pair and sell a call option against it to gain through a premium. This strategy is idle for stable markets when the traders are sure that the market will move upward.

Entering forex trades with a straddle options strategy

The straddle options strategy leverages both call and put options for potential gains from significant price swings. However, this strategy involves considerable risk due to high premiums and time decay, which can lead to losses if the currency pair remains stable. Traders must assess volatility accurately and balance potential gains against costs.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.