When trading in forex, your wins depend on the prices and movements of your chosen currencies. Knowing the correct timing in buying and selling is of utmost importance to your trading success.

Getting the timing right is why an objective indicator of price movement directions is essential for traders. Price fluctuations dictate whether you gain a profit or incur a loss. This is where pivot points play an essential role in your forex game. If monitored closely and timed right, you can take advantage of small price fluctuations.

Practice trading with a demo account

Why are pivot points important?

A forex pivot point determines how prices can potentially turn. It is an indicator of how market sentiments could change and the levels of support and resistance in the forex market for a specific day.

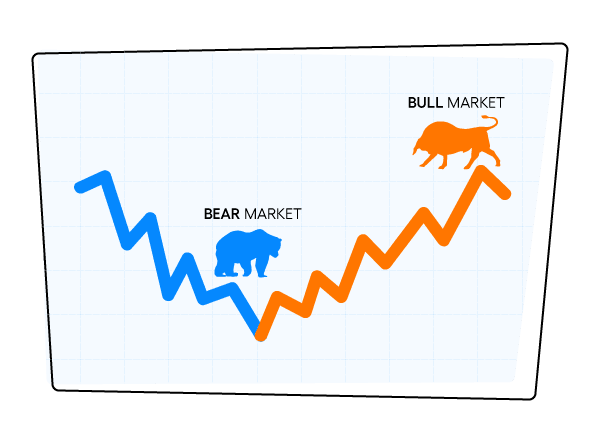

For instance, if the market price goes below the pivot point on the next trading day, this means it reflects a bearish sentiment. If the market price goes higher, then the market shows a bullish sentiment. A bear market has falling prices, while a bull market has rising prices.

Pivot point levels serve as a guide in observing overall market trends. For traders, you would want to know the possible direction of prices because you want to benefit from favorable price changes in trading. A little fluctuation may trigger either a buy or sell decision.

To get a feel of price changes in trading before jumping into it with real capital, you can practice trading with a $50,000 seed fund with a demo account.

How to compute pivot points

To compute for the pivot points, you would need the high, low, and closing prices from the previous trading session. While the forex market is open for 24 hours, New York's closing time (5 PM EST) will determine the previous trading day's close. Therefore, if you want to calculate the levels on a Thursday, you need to use Wednesday's values.

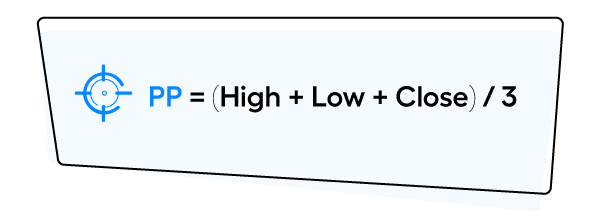

The computation of pivot points, denoted as PP, is expressed in this equation:

Alternatively, you can use a forex calculator to do the math. A calculator will also prove useful if you would like to do a little backtesting to determine how the pivot point levels behaved in the past.

What are Support levels?

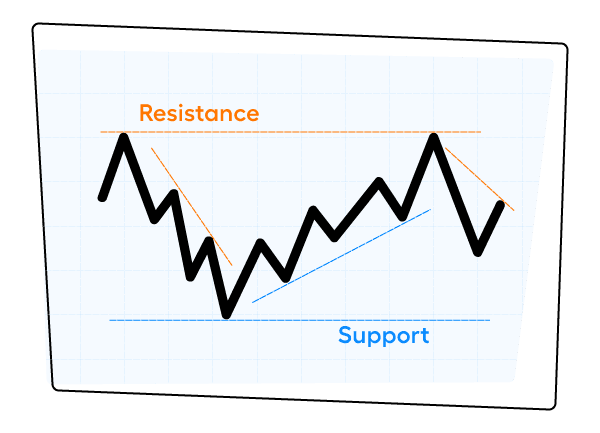

When the forex market prices stop falling and instead start to rise, such as when there is a surplus of buyers due to an increase in demand, the prices in this situation make up Support Levels. There usually are three levels of support levels. For computation purposes, we will refer to Support as S.

To calculate the different support levels, use the formulas below:

First support or S1: (2 x PP) - High

Second support or S2: PP - (High - Low)

Third support or S3: Low - 2(High - PP)

These support levels are better illustrated when combined with resistance and pivot point levels on a graphical presentation. Here is a simple illustration of Support and Resistance:

What are Resistance levels?

Resistance levels show where the forex market would potentially fall. In this case, there is a surplus of sellers due to an increase in supply. Like support levels, there are also three levels, which are denoted by R in the following formulas.

First resistance or R1: (2 x PP) - Low

Second resistance or R2: PP + (High - Low)

Third resistance or R3: High + 2(PP - Low)

Both support and resistance levels are associated with pivot points. Altogether, pivot points, support levels, and resistance levels help traders to determine possible price movement directions objectively. These are more objective than other indicators. Trading strategies integrate these concepts, but that is beyond our target discussion in this post.

Conclusion

Pivot points are essential for determining support and resistance areas. Knowing pivot point analysis is an excellent addition to your arsenal of trading smarts.

There's nothing like getting your feet wet first to build your trading confidence. At Blueberry Markets, you can start trading by funding your live account for as low as $100. We always advise our traders to play it smart. If you need trading advice or any assistance, expert trading veterans and our customer service team are here to guide and help you.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.