As of July 2021, the global Oil trade industry is worth over $2.1 trillion, with an average Oil trader earning $211,000 every year. You can trade Oil in spot, options, and futures markets to enjoy the high leveraged trading that these three markets offer. Leveraged trading helps magnify your returns (and losses) with minimal investment. You can trade Oil through the commodities market.

Top markets for trading Oil

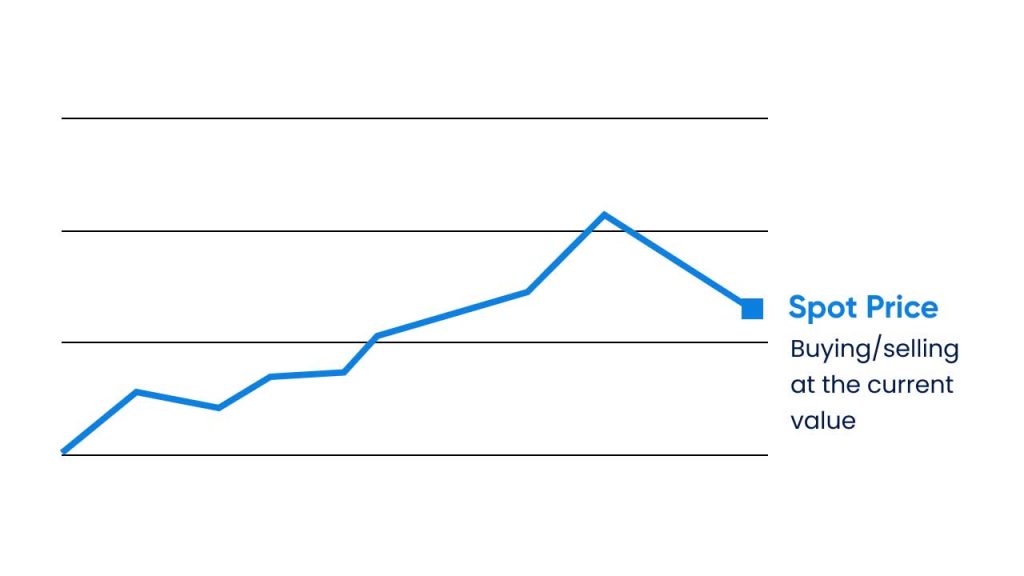

Spot market

Spot prices represent the current worth of Oil. Oil spot prices are determined by buyers and sellers in the market.

Benefits of trading Oil in the spot market:

- You can hold onto a position and exit for as long as you wish.

- High flexibility and liquidity

- Does not involve counterpart delivery failure

- Prices are transparent to sellers and buyers

- Spot market Crude Oil trading does not require any minimum investment amount

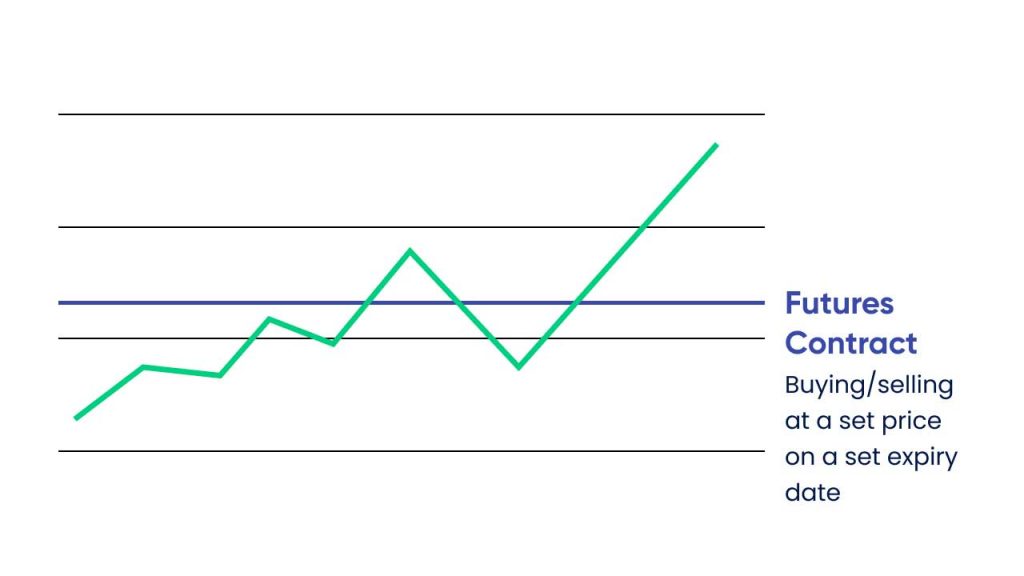

Futures market

Trading in the futures market involves a contract that acts as an agreement between a buyer and a seller to exchange a particular amount at a pre-decided rate and date. Traders can speculate on the future price of Oil on the basis of its past price trend and decide on a current price for the delivery of Oil later.

Benefits of trading Oil in the futures market:

- Margin trading

- High liquidity of assets

- Potential profit from minimal Oil price movements

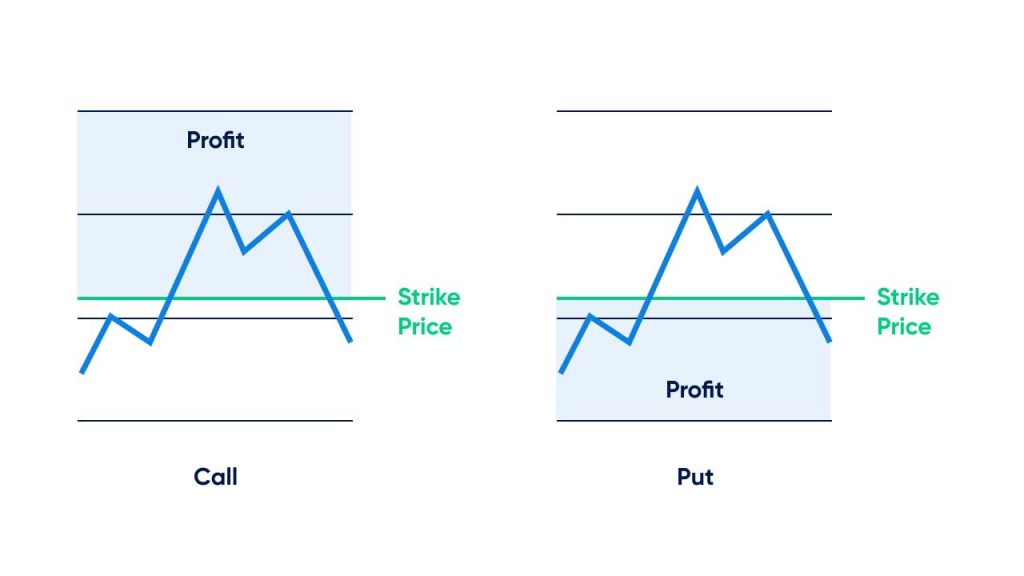

Options market

Trading Oil through options is somewhat similar to Oil futures trading. The only difference is that when you trade Oil options, you are not obligated to execute the trade if you change your mind. The price for Oil is fixed with an expiry date, but you can choose not to execute and let the contract expire.

Benefits of trading Oil in the options market:

- Leveraged trading

- Allows you to mitigate risks

- Take advantage of both rising and falling markets

How do you trade Oil?

1. Study Oil prices

Whether you trade Oil in spot, futures, or options market, prices are affected by the demand and supply of Oil in the market. Various factors like the global economic performance, influence of the Organization of the Petroleum Exporting Countries (OPEC) on the supply of Oil and its prices.

When the global economy booms, the demand increases, shooting up Oil prices and vice versa. When countries part of OPEC increase the supply of Oil, its prices fall and vice versa. When the demand falls short of production, the surplus Oil is stored. However, only a certain quantity of Oil can be stored, and when the surplus exceeds, Oil prices fall significantly. Oil alternatives lower the demand, thus, cutting down on prices.

2. Strategize your trade

You can trade in spot, futures, or options markets either directly or through a Contract for Difference (CFD). It should be noted that all profits are earned based on the actual price movement of the Oil in the commodities market.

3. Create a trading account

Create a trading account with a broker that offers Oil CFD trading. You can also start trading with a demo account to see how the market works without investing real money. Keep an eye on the Oil market. Monitor critical price levels to find the perfect opportunity to enter the Oil market.

4. Place your first trade

Depending on your prediction of Oil prices, you can choose to enter either the spot, futures, or options market and place your first trade. Monitor how the Oil price changes after you place your first trade.

Start trading Oil today

Oil commodity trading in the spot, futures, and options market opens you to diverse opportunities and advantages that come with each type of market. Blueberry offers trading Oil through CFDs. Open an account today.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.