Position trading is a longer-term approach, offering insights into broader market trends enabling traders to capitalize on significant price movements over extended periods.

In this article, we discuss everything about position trading and the top position trading strategies one can employ in their forex trading process.

Understanding position trading

Position trading in forex allows traders to benefit from the medium to long-term price movements of currency pairs. Unlike day trading or scalping, which involve frequent trades within a single trading day, position traders hold their positions for an extended period, often ranging from weeks to months and sometimes even years.

Position traders base their decisions on fundamental analysis, studying economic indicators, geopolitical events, and central bank policies to identify trends and potential currency movements. They seek to capitalize on significant price shifts, such as trends that develop over weeks or months and often disregard short-term fluctuations.

Additionally, position trading offers distinct advantages in the forex market as it is less affected by short-term market noise, demands less constant monitoring, and captures long-term trends for potentially substantial gains. This approach also provides traders with greater time flexibility and helps minimize translation costs associated with frequent trading.

However, position trading is not without its risks. Holding positions for extended periods can expose traders to overnight market movements and unexpected news events that can impact their positions. Additionally, missing out on short-term opportunities that shorter-term strategies might capitalize on is a potential downside.

How does position trading work?

Position traders analyze fundamental factors such as economic data, interest rates, geopolitical events, and central bank policies to identify potential currency trends. They often focus on larger economic cycles and long-term market sentiment.

Then, they enter a position based on their analysis of the fundamental landscape. They seek to enter during periods of value when a currency's fundamental outlook aligns with a potential future price increase. Exit points are determined by the achievement of desired benefit levels or changes in the fundamental landscape.

Once a position is established, position traders exhibit patience as they allow their trades to play out over the intended time frame. They are more tolerant of short-term price fluctuations and focus on the broader trend.

Once a position trade order is placed, risk management becomes crucial. Traders typically use wider stop-loss orders to accommodate for the longer holding period and market volatility. Position sizes are often smaller to account for potential adverse market movements. Furthermore, position traders do not monitor their trades every day as closely as day traders but focus on periodic assessments of market conditions and fundamental factors. Adjustments may be made if the fundamental landscape shifts significantly.

Risks associated with position trading

Overnight risk

Overnight risk stems from holding positions during non-trading hours, exposing traders to market gaps when unexpected events occur while markets are closed. These events can lead to sudden price movements that may not align with a trader's position, resulting in unexpected losses when the market reopens.

Increased margin requirements

Holding positions for extended periods might necessitate higher margin requirements. Larger margin commitments can tie up more capital, potentially limiting the number of trades a trader can engage in simultaneously. This can hinder flexibility and impact overall trading opportunities.

Interest rate fluctuations

Position trading can expose traders to changes in interest rates, which affect currency values. If a trader holds a currency with a lower interest rate against one with a higher rate, they might incur negative swap costs. Such fluctuations can impact the success of positions held over the long term.

Market events

Position trading's extended time frames can introduce uncertainties. Market conditions or unexpected events, such as economic data releases or geopolitical developments, can alter long-term trends. Traders might find that their initial analysis no longer holds true, leading to potential adjustments or losses.

Increased transaction costs

Holding positions over longer periods can result in higher transaction costs. Frequent trading fees and commissions accumulate over time, impacting overall gains by diminishing the gains realized from successful trades.

Delayed returns

Position traders often experience slower returns compared to traders using shorter-term strategies. Holding positions for extended periods means that gains might take longer to materialize, which could be frustrating for those seeking quicker gains.

Higher swap costs

Holding positions overnight can lead to higher swap costs due to interest rate differentials between currencies. If the held currency has a lower interest rate, traders may incur negative swap costs, impacting overall gains by reducing gains or increasing losses associated with overnight positions.

Top 8 position trading strategies

Technical strategy

Technical analysis involves studying price charts and employing indicators to predict future price movements. Traders identify trends (uptrend, downtrend, or sideways), chart patterns (head and shoulders, triangles, etc.), and key support and resistance levels. By combining these insights, traders make informed decisions about entering and exiting positions.

Technical strategies can range from simple moving average crossovers to more complex strategies involving multiple indicators. Traders may also use candlestick patterns, trendlines, and Fibonacci retracements to refine their entry and exit points further.

Traders can enter a long position when a shorter-term moving average crosses above a longer-term moving average, indicating an uptrend and vice versa.

Breakout strategy

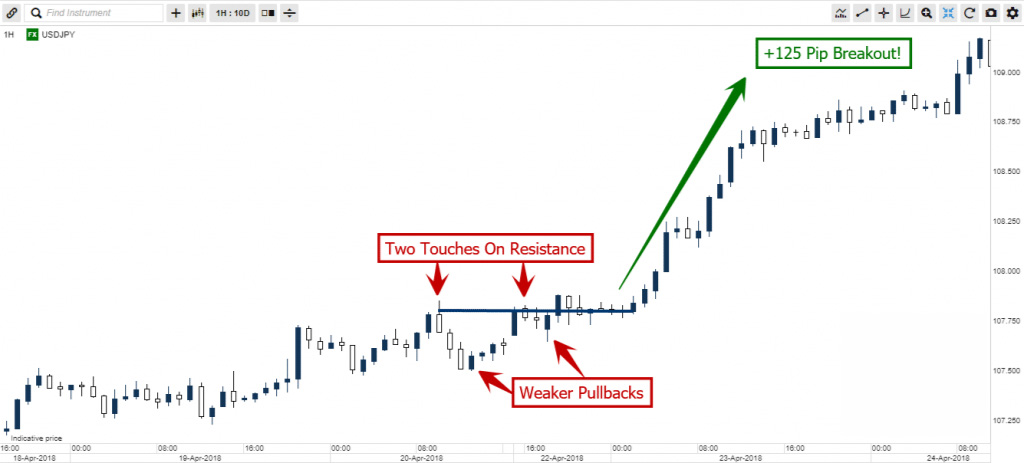

Breakout trading is based on the idea that a significant price movement is likely to follow when an asset's price breaks through a well-established level of support or resistance. Traders monitor consolidation phases and look for strong volume and price momentum when the breakout occurs. Once a breakout is confirmed, traders enter positions in the direction of the breakout. This strategy aims to capture substantial price movements that often accompany breakouts, which can result from fundamental developments or market sentiment shifts.

Range trading

Range trading involves identifying price ranges where a currency pair's price consistently oscillates between support and resistance levels. Traders enter at support and exit at the resistance level, anticipating that the asset will continue to move within the established range. Range trading can be effective in markets with limited volatility, as traders aim to gain from repetitive price patterns within the range. However, successful range trading requires precision in identifying support and resistance levels and a thorough understanding of market conditions.

Fundamental strategy

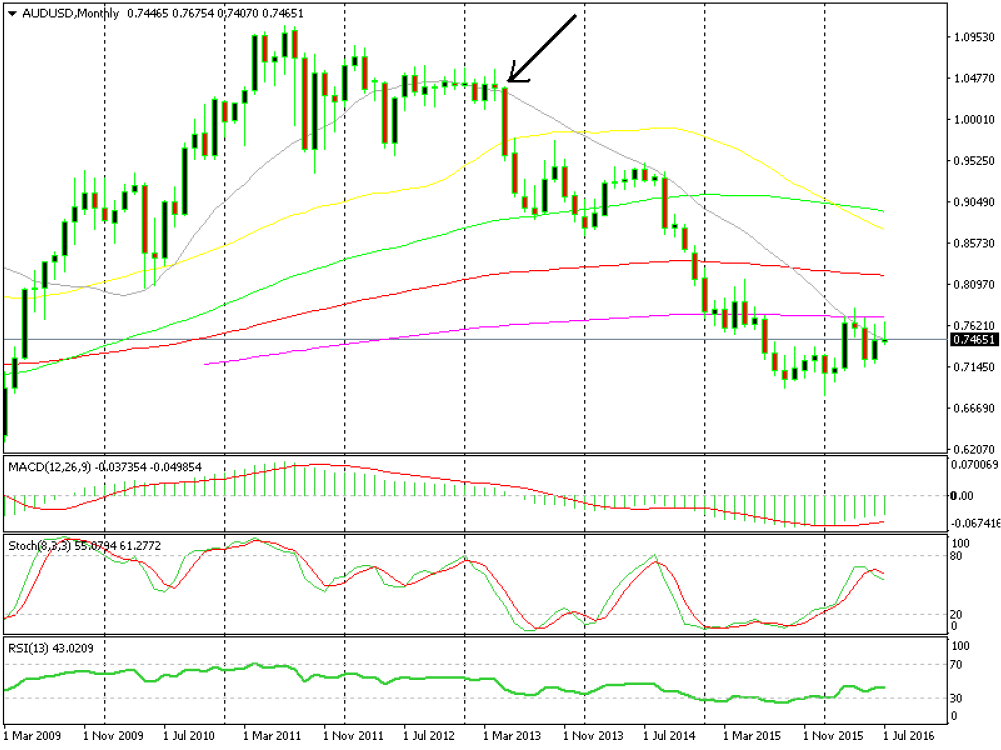

Fundamental analysis focuses on economic indicators, central bank policies, and geopolitical events that influence currency values. Traders assess factors like interest rates, GDP growth, employment data, and political stability.

For instance, if a country's economy is strong and its central bank signals potential interest rate hikes, traders might position themselves to benefit from a stronger currency and enter a position in the same. Successful fundamental trading requires staying updated on economic news, central bank statements, and global events that impact market sentiment.

Pullback and retracement strategy

Pullback strategies involve identifying temporary price reversals against the prevailing trend. Traders enter positions during these pullbacks, anticipating that the broader trend will continue. This strategy allows traders to enter positions at more favorable prices, increasing the potential for successful trades. Successful implementation requires confirming the end of the pullback through technical indicators or chart patterns before entering the trade.

Support and resistance strategy

Support and resistance levels are critical in technical analysis as support represents a price level where demand is strong enough to prevent further decline, while resistance levels signify areas where supply pressure becomes significant. Traders often enter positions when prices bounce off support or break through resistance, aligning with the prevailing trend. This strategy requires accurate identification of these levels, often using historical price data and technical analysis tools.

Techno-fundamental strategy

Techno-fundamental trading combines technical and fundamental analysis. Traders analyze both charts and economic data to make comprehensive trading decisions. For example, a trader might use technical indicators to identify a potential breakout but only enter the trade if the fundamental analysis supports the move. This approach aims to benefit from the synergies of both analysis methods, offering a more well-rounded trading strategy.

Event-based trading strategy

Event-based traders anticipate market reactions to significant events such as economic data releases (like GDP reports), earnings announcements, or geopolitical developments. These traders position themselves ahead of the event, aiming to gain from increased market volatility and potential price movements. Strategies can involve entering or exiting a position depending on the expected outcome of the event. This strategy requires a deep understanding of market sentiment and the ability to quickly assess and respond to rapidly changing conditions.

- Traders can enter positions before a significant event that is expected to impact the market. For instance, if a major economic report is anticipated to be positive, it might enter a long position.

- Traders can exit after the market has absorbed the event's impact or when price targets are met. They might exit the trade once the initial market reaction subsides.

Stepwise guide to trade forex through position trading

1- Understand position trading

Position traders look at a lot of information about countries' economies, like how well they're doing and what their plans are. They also use charts and patterns to figure out which currency pairs are likely to change a lot over a long period.

2- Learn forex basics

Understand the basics of forex trading, including currency pairs, pips, lots, and how the forex market operates. Familiarize oneself with major, minor, and exotic currency pairs.

3- Choose currency pairs

Select a few currency pairs that the trader would like to focus on for position trading. Look for pairs with strong historical trends and sufficient liquidity.

4- Perform fundamental analysis

Conduct a thorough fundamental analysis of the economies related to the chosen currency pairs. Consider factors such as interest rates, economic indicators, geopolitical events, and central bank policies.

5- Analyze long-term trends

Using weekly or monthly charts, identify long-term trends using technical analysis tools like moving averages, trendlines, and MACD (moving average convergence divergence). Look for sustained trends that can last for weeks or months.

6- Entry and exit strategy

Define clear entry criteria for position trades. This could involve waiting for a significant retracement within a long-term trend. Set strict criteria for entry to avoid impulsive trades. Identify potential exit points based on major support or resistance levels.

7- Position sizing and risk management

Determine the appropriate position size based on the risk tolerance level and the distance to the stop-loss level. A common rule is to only risk a small percentage of the trading capital on each trade.

8- Place the trade

Execute the trade using the chosen trading platform. Set the stop-loss levels according to the pre-defined strategy. Remember, these levels should be based on longer-term price movements.

9- Monitor the trade

Unlike day trading, position trading doesn't require constant monitoring. Check-in on the trades periodically to ensure they are progressing as expected, but avoid making hasty decisions based on short-term price fluctuations.

10- Adjust the trade strategically

If new information emerges that affects the trade's long-term prospects, consider adjusting the stop-loss levels. Be cautious not to overreact to minor market fluctuations.

Balance long-term risks and rewards with position trading

Position trading offers traders the opportunity to capitalize on long-term trends in the market, allowing for potentially substantial gains over time. However, position trading comes with risks such as overnight gaps, higher margin requirements, and potential exposure to market events.

Traders must carefully weigh the benefits of success potential against the risks of extended market exposure, ensuring robust risk management practices to navigate the complexities of this strategy effectively.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.