Traders can utilize speed resistance lines in forex trading to visually depict crucial support and resistance levels, aiding in trend identification and strategic decision-making. These lines offer clear entry and exit points, facilitating effective risk management and trade execution. By confirming signals from other indicators, speed resistance lines enhance trading strategies, increasing the probability of accurate trades.

This article will explain everything about the speed resistance lines and how to trade with them.

What are speed resistance lines?

Speed resistance lines, also known as speed lines or Gann fan lines, are a technical analysis tool used in forex trading to identify potential levels of support and resistance based on geometric angles drawn from significant price points.

Speed resistance lines can help traders in several ways in their trading activities

- Trend assessment: They help gauge the strength and direction of trends by observing price interactions.

- Trade timing: Traders can use these lines to time entries and exits based on breaks or failures at key levels.

- Risk management: They assist in placing stop-loss orders by highlighting areas beyond significant levels.

- Confirmation of trend strength: Bounces off these lines validate trend momentum and direction.

- Pattern recognition: Patterns formed by these lines aid in identifying chart patterns and enhancing market analysis.

Advantages and risks of using the Speed Resistance Lines

Advantages

- Visual representation of support and resistance: Speed resistance lines provide a clear visual representation of potential support and resistance levels on price charts. This makes it easier for traders to identify key areas where price action may stall or reverse.

- Trend identification: By observing the angle and direction of the speed resistance lines, traders can quickly determine the prevailing trend in the market. This helps in making informed decisions about whether to trade with or against the trend.

- Entry and exit points: Speed resistance lines can help traders identify optimal entry and exit points for their trades. Breakouts above or below these lines may signal potential entry points, while bounces off these lines may indicate opportunities to take profits or cut losses.

Risks

- Subjectivity: Drawing speed resistance lines requires subjective judgment in selecting anchor points and determining the angle of the lines. Different traders may draw lines differently, leading to varying chart interpretations.

- False breakouts: Like any technical analysis tool, speed resistance lines are not foolproof and can sometimes result in false breakout signals. Traders must exercise caution and wait for confirmation before entering trades based solely on price movements around these lines.

- Over-reliance: Relying too heavily on speed resistance lines without considering other factors, such as market fundamentals or sentiment, can lead to tunnel vision and missed opportunities. It's essential to use them as part of a comprehensive trading strategy.

How to create speed resistance lines

Select anchor points

Identify significant swing highs and lows on the price chart. These points should be recent and relevant to the trading timeframe.

Access drawing tools

Locate the drawing tools menu in the forex trading platform or charting software. This is usually found in a toolbar or menu section labeled Draw or Tools.

Choose speed resistance lines tool

Look for the tool specifically designed for drawing speed resistance lines, often labeled Gann Fan or Speed Lines. Select this tool from the drawing tools menu.

Draw lines

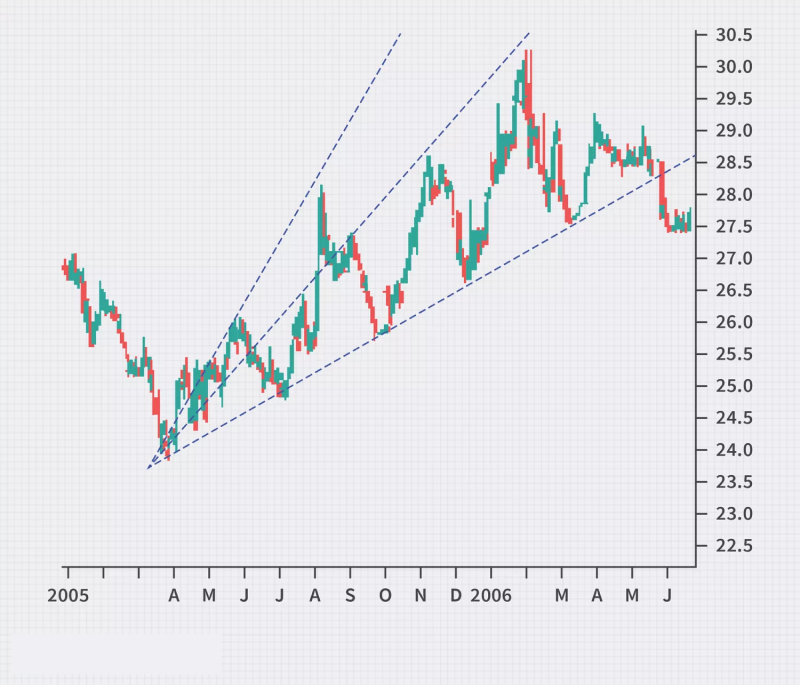

Click on the first anchor point (usually a swing low or high) and drag the cursor to the second anchor point. This action will draw a speed resistance line connecting the two points. The line angle will be based on preset mathematical ratios (such as 1:1, 1:2, 1:3).

Adjust settings

Some trading platforms allow traders to customize the angles or ratios of the speed resistance lines. Traders may adjust these settings according to their trading strategy or preferences.

Repeat for additional lines

Repeat the process for each subsequent anchor point one wants to connect. This may involve drawing multiple speed resistance lines at different angles to capture various support and resistance levels.

Analyze price action

Once the speed resistance lines are drawn, analyze how the price interacts with these lines. Look for bounces, breaks, or consolidations around these levels to inform the trading decisions.

Monitor and update

Prices are dynamic, so monitoring the charts regularly and updating the speed resistance lines as new price data becomes available is essential. Adjusting the lines to incorporate the latest swing highs and lows ensures their relevance and accuracy in the analysis.

What do speed resistance lines signal in forex

Trend direction

Speed resistance lines can provide insights into the direction of the trend. For example, the lines may slope upwards in an uptrend, indicating that the market is making higher highs and lows. Conversely, the lines may slope downwards in a downtrend, signaling lower highs and lower lows.

Reversal points

Speed resistance lines can also identify potential reversal points in the market. When the price approaches a speed resistance line and fails to break through it, it may signal a reversal in the current trend. Conversely, if the price breaks above or below a speed resistance line with conviction, it could indicate a reversal in the opposite direction.

Price projections

While speed resistance lines do not provide explicit price projections, they can be used with other technical analysis tools to estimate potential price targets. Traders may look for confluence between speed resistance lines and other indicators, such as Fibonacci retracements or extensions, to identify possible price projection levels.

Harnessing speed resistance lines in forex trading

Incorporating speed resistance lines into forex trading strategies offers traders a powerful tool for navigating dynamic markets. Despite potential drawbacks such as subjectivity and false breakouts, their inclusion enhances decision-making and augments the effectiveness of trading strategies. Through careful observation and validation with other indicators, speed resistance lines empower traders to seize opportunities confidently while minimizing risks.

Like any technical analysis tool, speed resistance lines have their limitations and drawbacks. By recognizing the risks and exercising caution, traders can effectively harness the power of speed resistance lines while minimizing potential pitfalls in their trading endeavors.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.