Utilizing the three-bar reversal pattern in forex provides traders with a powerful tool to identify potential trend reversals. This pattern's simplicity aids in recognizing entry and exit points, offering clear signals in volatile markets. Its application enhances decision-making precision, making it valuable for traders seeking reliable indications of trend shifts.

In this article, we will discuss the three-bar reversal pattern in depth.

What is the three-bar reversal pattern?

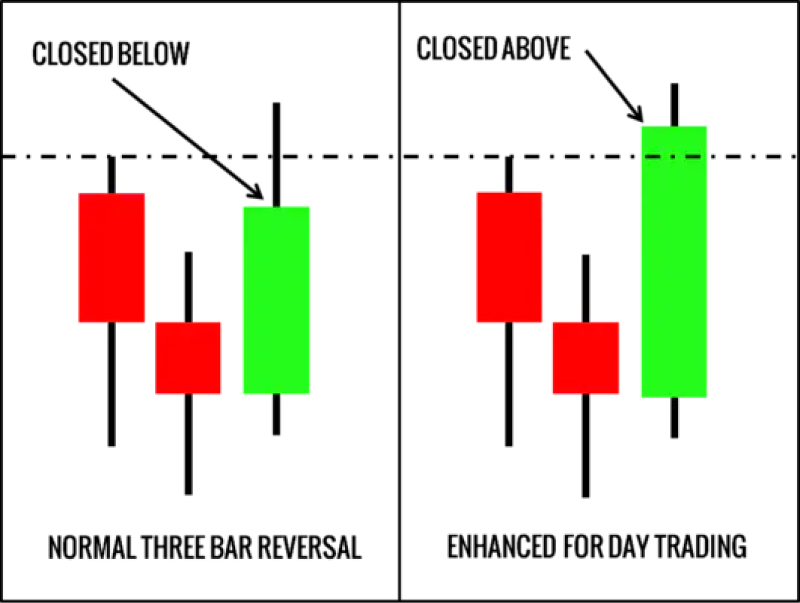

The three-bar reversal pattern is a technical analysis pattern that signals a potential reversal in the prevailing trend. The pattern consists of three consecutive bars: the first bar represents the existing trend, the second bar shows a strong reversal against that trend, and the third bar confirms the reversal by closing beyond the high or low of the second bar. Traders use this pattern to identify potential turning points in the market.

Advantages of three-bar reversal pattern

- Clear signal for reversal: The three-bar reversal pattern provides a clear and visually identifiable signal for a potential trend reversal. Traders look for the specific sequence of three bars, making it easier to recognize turning points in the market.

- Concise entry/exit points: This pattern offers traders concise entry and exit points. The second bar, representing a strong reversal, serves as a trigger for entry, while the third bar's confirmation provides clarity for exit decisions, streamlining the decision-making process.

- Minimal noise: Compared to some other technical patterns, the three-bar reversal pattern is designed to filter out noise and focus on significant price movements. Its simplicity helps traders avoid being misled by minor fluctuations, enhancing the reliability of the reversal signal.

- Applicable across timeframes: The versatility of the three-bar reversal pattern allows its application across various timeframes. Whether on short-term intraday charts or longer-term daily or weekly charts, traders can use this pattern to identify potential reversals in different market environments.

Risks of three-bar reversal pattern

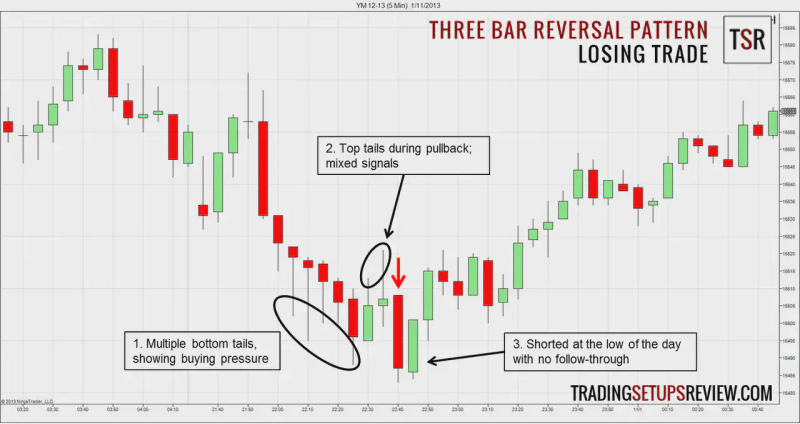

- Market whipsaws: The three-bar reversal pattern is not immune to market whipsaws, where a resumption of the original trend follows a quick, temporary reversal. Traders relying solely on this pattern may experience false signals, leading to potential losses.

- Lack of confirmation: The pattern's effectiveness depends on the third bar confirming the reversal by closing beyond the high or low of the second bar. However, a lack of confirmation can result in false signals, making it essential for traders to wait for confirmation before acting.

- Subjectivity in pattern recognition: Identifying the three-bar reversal pattern involves subjective analysis, and interpretations may vary among traders. This subjectivity introduces the risk of misinterpreting the pattern, especially for less experienced traders or in volatile market conditions.

- Failure to adapt to changing conditions: Market conditions can change, and relying solely on a specific pattern may not be effective in all situations. Traders using the three-bar reversal pattern should be aware of its limitations and adapt their strategies to evolving market dynamics to avoid missed opportunities or false signals.

How to trade with three bar reversal pattern

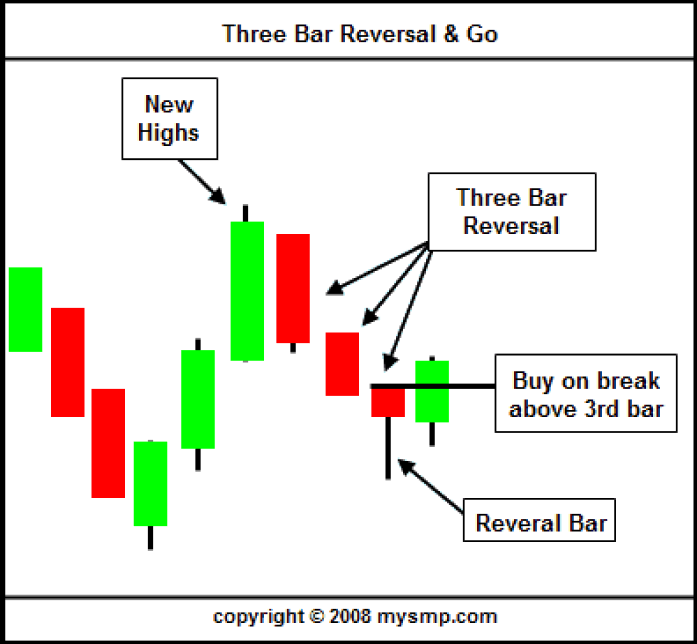

Identify the three-bar reversal pattern

Look for a sequence of three bars on the price chart.

- The first bar represents the prevailing trend in the market. It could be an up or down bar, indicating the current direction of prices, colored green or white during an uptrend and red or black during a downtrend.

- The second bar serves as the reversal signal. It is characterized by a strong move against the existing trend. For an uptrend, this would be a bearish (down) bar colored red or black; for a downtrend, it would be a bullish (up) bar colored green or white.

- The third bar confirms the reversal. It closes beyond the high or low of the second bar, signaling a potential change in market sentiment. The confirmation adds reliability to the reversal signal. Its color depends on the closing position relative to the second bar. If it closes beyond the high of the second bar, it may be bullish. If it closes beyond the low, it may be bearish.

Confirm market conditions

Assess broader market conditions, considering factors like trend strength, support and resistance levels, and overall market sentiment. Confirm that the three-bar reversal aligns with the prevailing market context.

Choose an appropriate timeframe

Select a timeframe that suits the trading strategy and preferences. The three-bar reversal pattern is applicable across various timeframes, so choose one that aligns with different trading styles.

Wait for the confirmation bar

Wait for the confirmation bar to close, ensuring that it validates the reversal pattern. This confirmation adds reliability to the signal and reduces the risk of false alarms.

Set entry and exit points

Determine entry and exit points based on the three-bar reversal pattern. Enter the trade after the confirmation bar and set exit points based on risk tolerance, gain objectives, and the overall market context.

Place a stop-loss order

Implement a stop-loss order to manage risk. Place it beyond the pattern's confirmation point to protect against adverse price movements. Adjust the stop-loss based on market conditions and the specific characteristics of the trade.

Establish a gain target

Set a gain target based on the risk-reward ratio and market conditions. Consider key support or resistance levels, Fibonacci retracements, or other technical indicators to identify potential gain-taking points.

Monitor the trade

Regularly monitor the trade to stay informed about price movements, news, or any developments that may impact the market. Adjust the strategy if necessary and remain attentive to potential changes in market conditions.

Adapt to changing conditions

Be flexible and ready to adapt to changing market conditions. Adjust the approach accordingly if new information emerges or the market shows signs of shifting. Flexibility is key to proper trading.

Review and learn

After the trade concludes, conduct a comprehensive review. Analyze the outcome, identify strengths and weaknesses, and learn from the experience. This reflective process is crucial for refining the trading strategy and improving future decision-making.

Decoding forex trends with the three-bar reversal pattern

While effective for identifying trend reversals, the three-bar reversal pattern in forex carries risks too. Its subjectivity in interpretation and the potential for false signals pose challenges. Yet, its advantage lies in providing traders with a valuable tool when applied cautiously with robust risk management strategies.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.