Out of the 180 currencies recognized by the United Nations as legal tender, only four (USD/JPY, EUR/USD, GBP/USD and USD/CHF) currency pairs are most heavily traded in the forex market. So, are these currencies the strongest? Not necessarily. These currencies are the most popular and traded, but there are several other currencies that hold more value based on industry factors.

In our article, we will discuss the top 15 strongest currencies in the world based on their comparison with the US Dollar and considering factors like the country’s inflation rate, nominal GDP and more.

The currencies in the world

The US Dollar

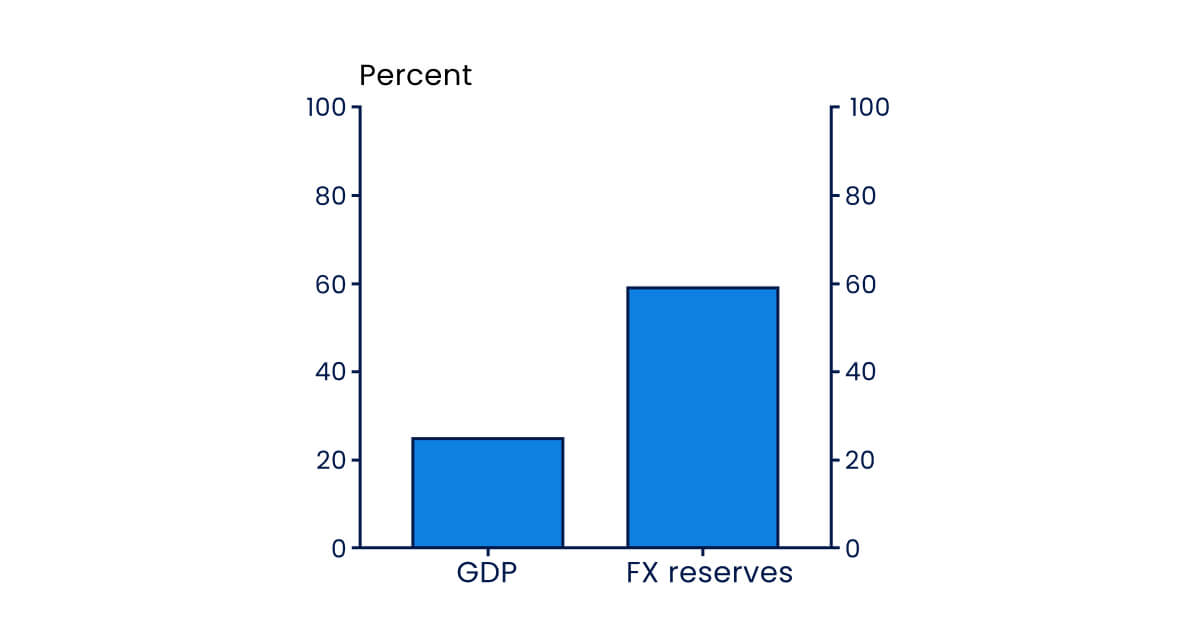

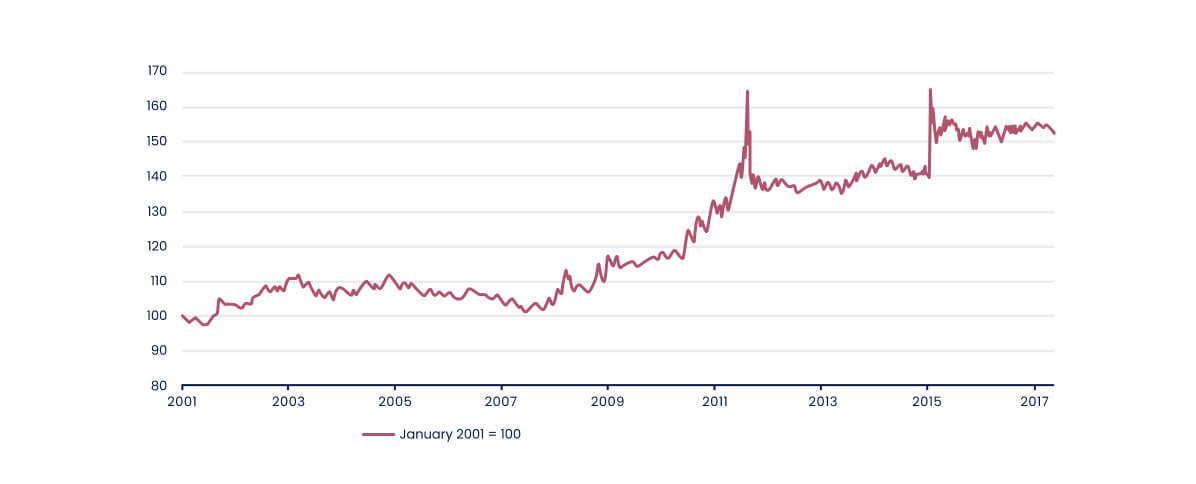

The US Dollar had been widely recognized as the strongest currency in the world. According to the International Monetary Fund (IMF), the US Dollar accounted for approximately 60 percent of global foreign exchange reserves. In addition, the US Dollar comprised about 40 percent of all forex transactions.

At least $3.8 trillion USD was traded daily in the forex market and the USD was involved in almost 90 percent of all the forex transactions, making it the most highly traded instrument worldwide. The US Dollar’s strength was largely attributed to the strength of the US economy and it was the major contributor to the world’s GDP (approximately $20.89 trillion).

Euro

Euro

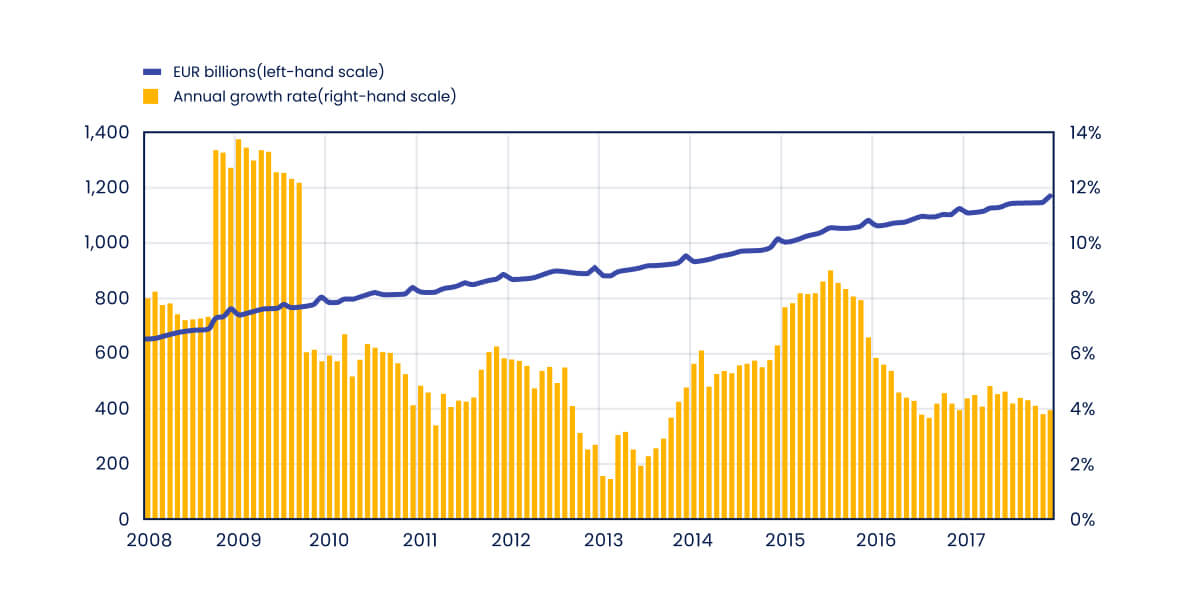

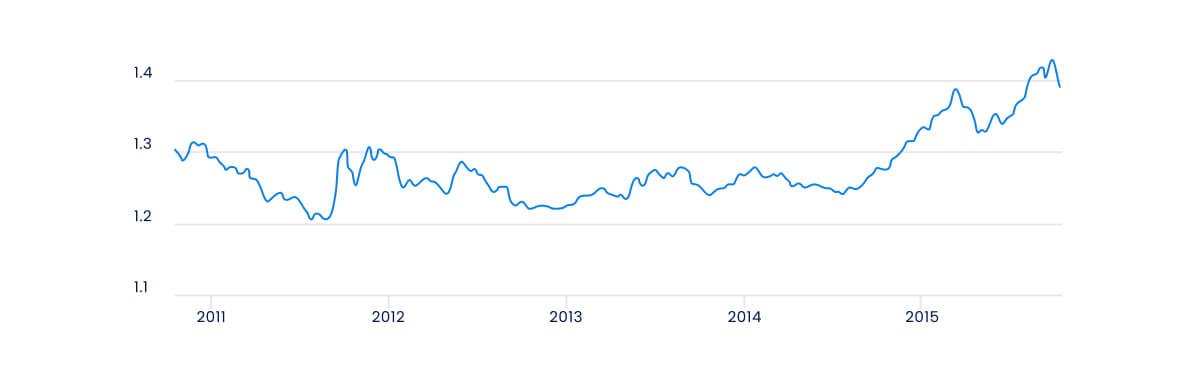

As of 2022, the Euro was the second most widely held reserve currency in the world, accounting for approximately 20 percent of global foreign exchange reserves. Additionally, the Euro was also the second most traded currency in the world, representing approximately 30.5 percent of all forex transactions as of 2022.

The strength of the Euro could be attributed to the strength of the European economy, which was the world’s second-largest economy. The Eurozone has a highly developed market economy with a strong focus on exports. On average, $2.9 trillion worth of Euros was traded daily in the forex market as of 2022.*

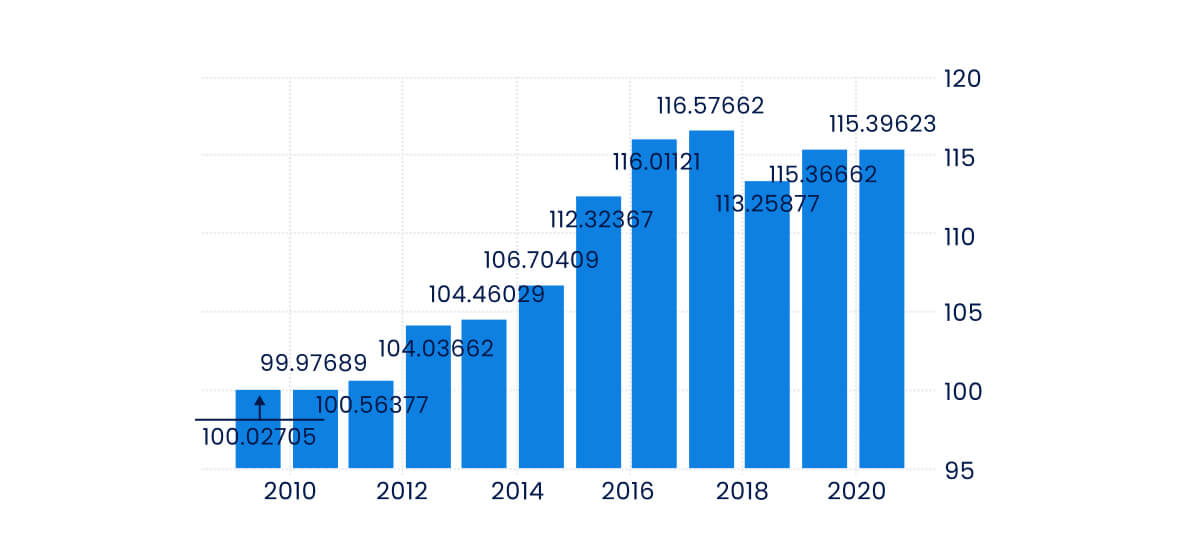

This graph has been recreated from the original source. Please note this image is a representation only and is not provided as general or personal advice.

*Past performance is not a reliable indicator of future performance.

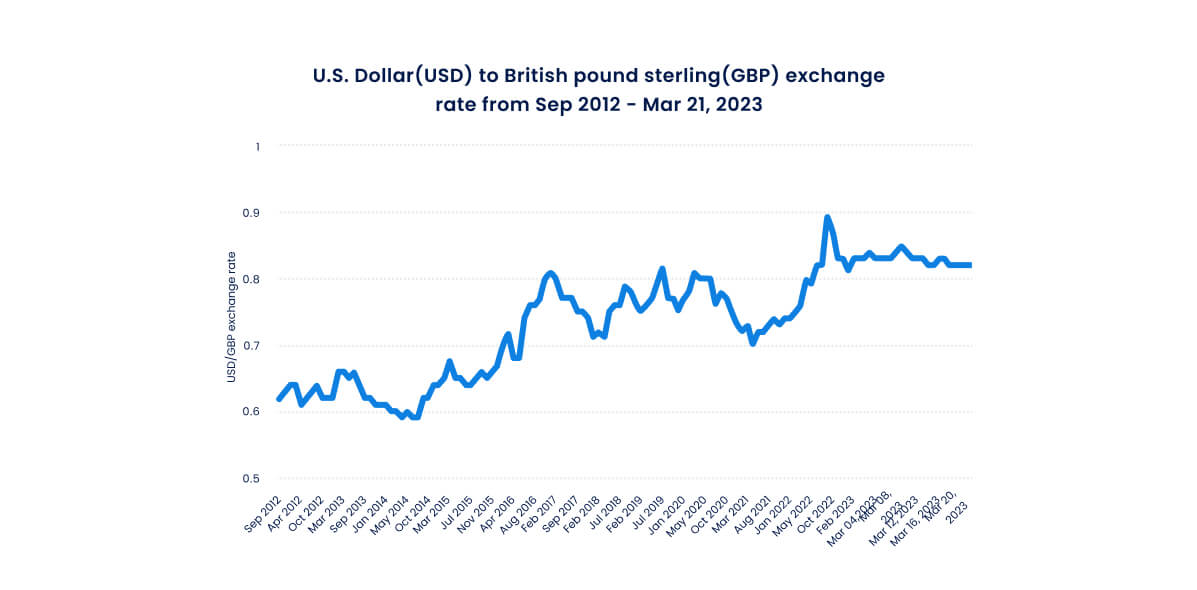

Pound Sterling

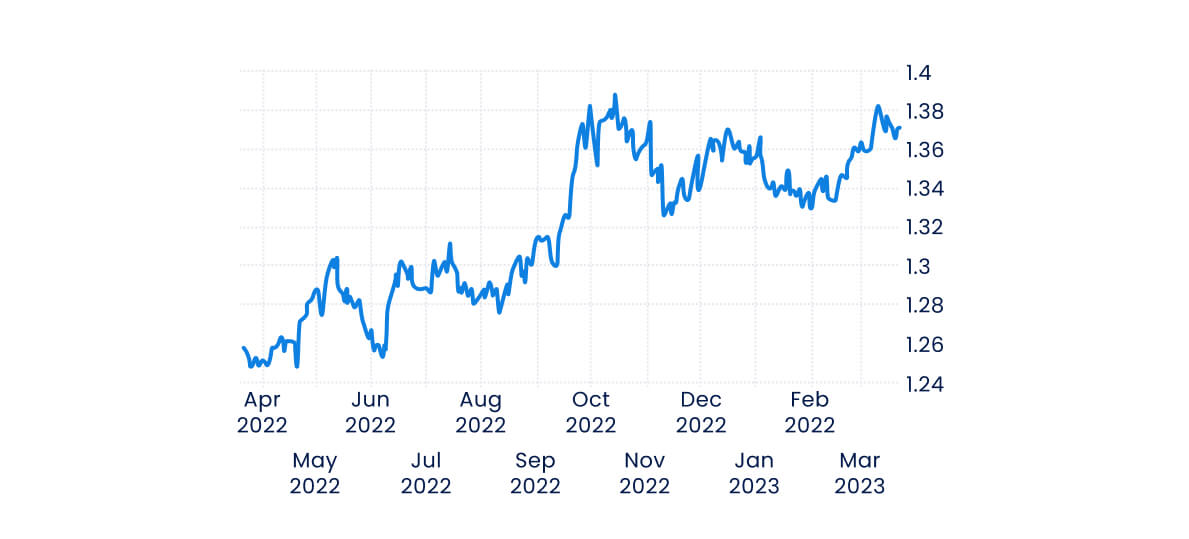

The Pound Sterling, also known as the British Pound, was the fourth most widely held reserve currency in the world. It was also the fourth most traded currency in the world. The strength of the Pound could be attributed to the strength of the UK economy, which was the world’s fifth-largest economy (second-largest in Europe), contributing over 2 percent to the global GDP.

Japanese Yen

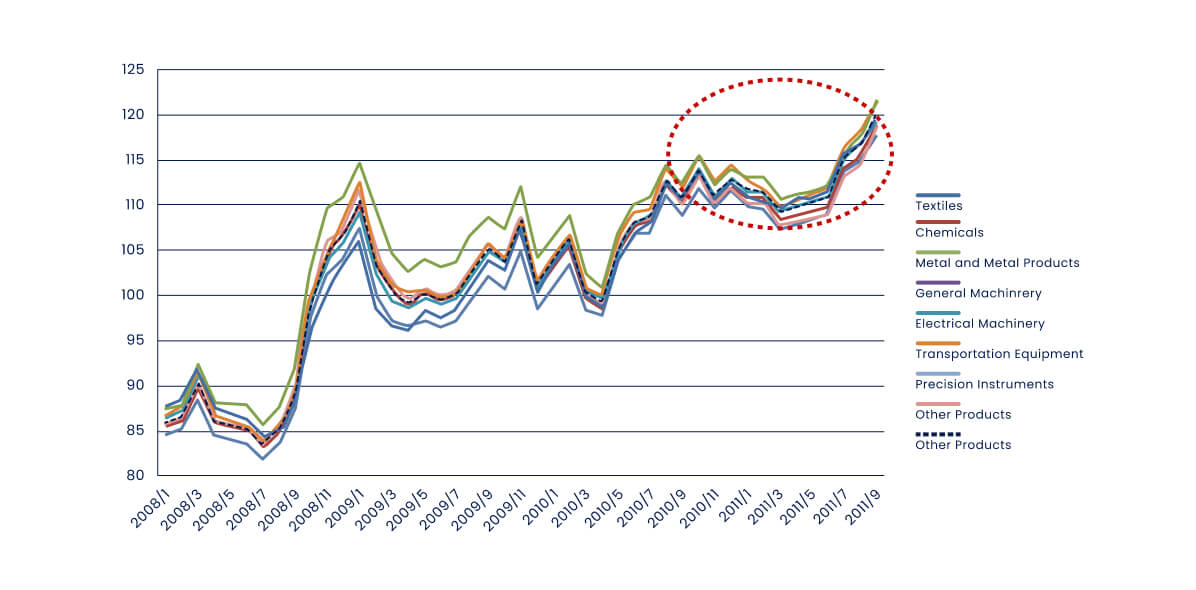

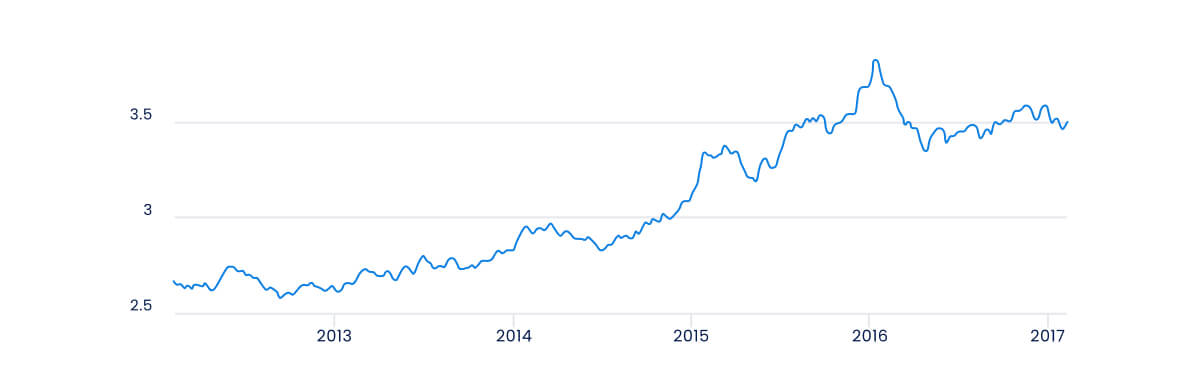

The Japanese Yen was one of the most actively traded currencies in the world, with an average daily trading volume of around $2.1 trillion as of 2022. It had an inverse correlation with global equity markets, which meant that it appreciated when equity markets declined and vice versa. This is because investors typically moved funds from equities to Yen dominated assets during times of market stress. Yen was considered a hard currency which increased demand for the Yen and could even lead to appreciation.

The Japanese Yen was the third most held currency in the world, accounting for around 16.7 percent of the global currency trade.

This graph has been recreated from the original source. Please note this image is a representation only and is not provided as general or personal advice.

Swiss Franc

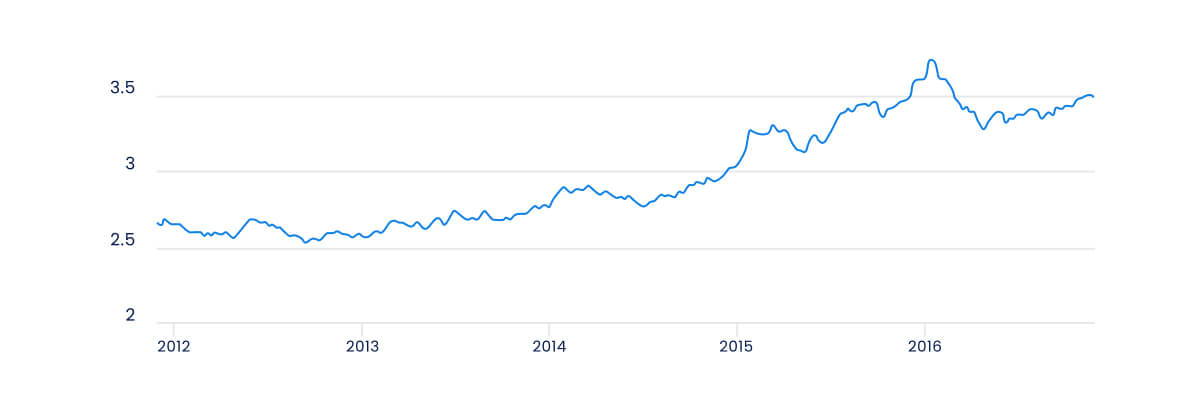

The Swiss Franc was included in the list of hard currencies due to Switzerland’s political stability, and strong economy. As of 2023, the Swiss Franc was the eighth most-traded currency in the foreign exchange market, accounting for approximately 5.2 percent of global currency trading.

Additionally, the Swiss Franc had consistently ranked among the top currencies in the world in terms of its value relative to other major currencies. For example, in September 2021, the Swiss Franc had a higher exchange rate against the US Dollar than any other currency in the world, with one Swiss Franc equal to approximately 1.10 US Dollars. The low inflation rate in Switzerland, which had averaged around 0.5 percent in recent years (3.5 percent in 2022), also contributed to the stability and strength of the Franc*.

*It is important to note that past performance is not a reliable indicator of future performance.

This graph has been recreated from the original source. Please note this image is a representation only and is not provided as general or personal advice.

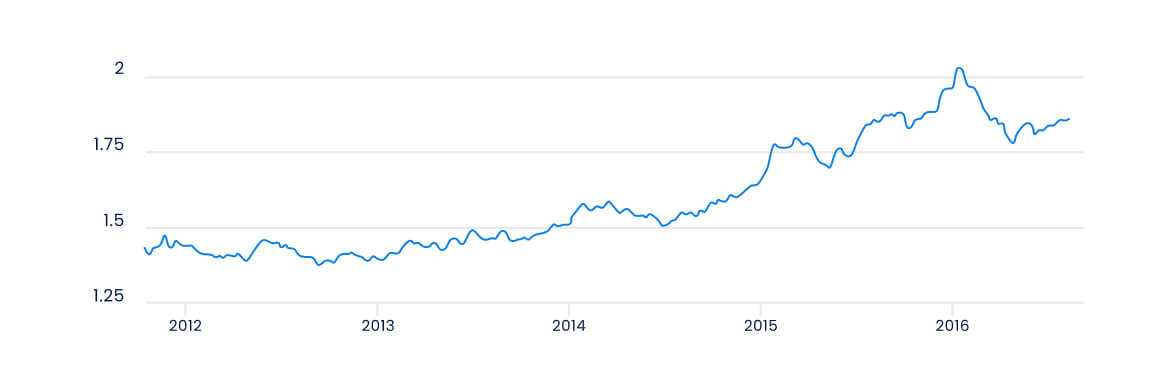

Canadian Dollar

The Canadian economy had shown strong growth in recent years, with a GDP growth rate of 11 percent in 2022. The Canadian Dollar had also consistently been one of the strong currencies of the world due to Canada’s stable political environment, sound economic policies, and the country’s rich natural resources like natural gas, gold, nickel and more.

As one of the largest exporters of crude oil (62 percent of the total imports by the US) to the United States, Canada’s currency was often closely tied to the price of oil. When oil prices rose, the Canadian Dollar appreciated as well.

For example, the CAD/USD exchange rate steadily appreciated from a low in March 2020, to an exchange rate of around 0.87 USD per CAD as of 2022*.

*However, exchange rates are not fixed and It is important to note that past performance is not a reliable indicator of future performance.

This graph has been recreated from the original source. Please note this image is a representation only and is not provided as general or personal advice.

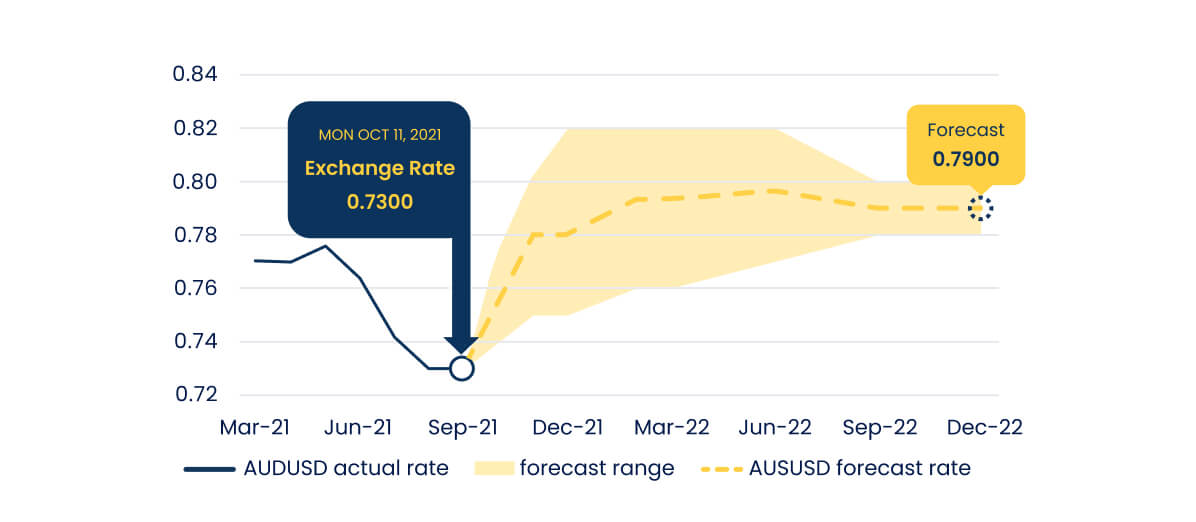

Australian Dollar

Australia was a major exporter of natural resources, particularly minerals and mining products. In 2022, the country’s exports of iron ore alone were worth approximately $133 billion USD, which previously helped support the value of the Australian Dollar.

Additionally, Australia had one of the lowest debt-to-GDP ratios in the world, around 56.73 percent as of 2022, indicating high economic stability. In the forex market, AUD was the fifth most traded currency, contributing approximately 6.8 percent of the daily currency turnover and an average of 1.8 million trades being placed every day as of 2022.

This graph has been recreated from the original source. Please note this image is a representation only and is not provided as general or personal advice.

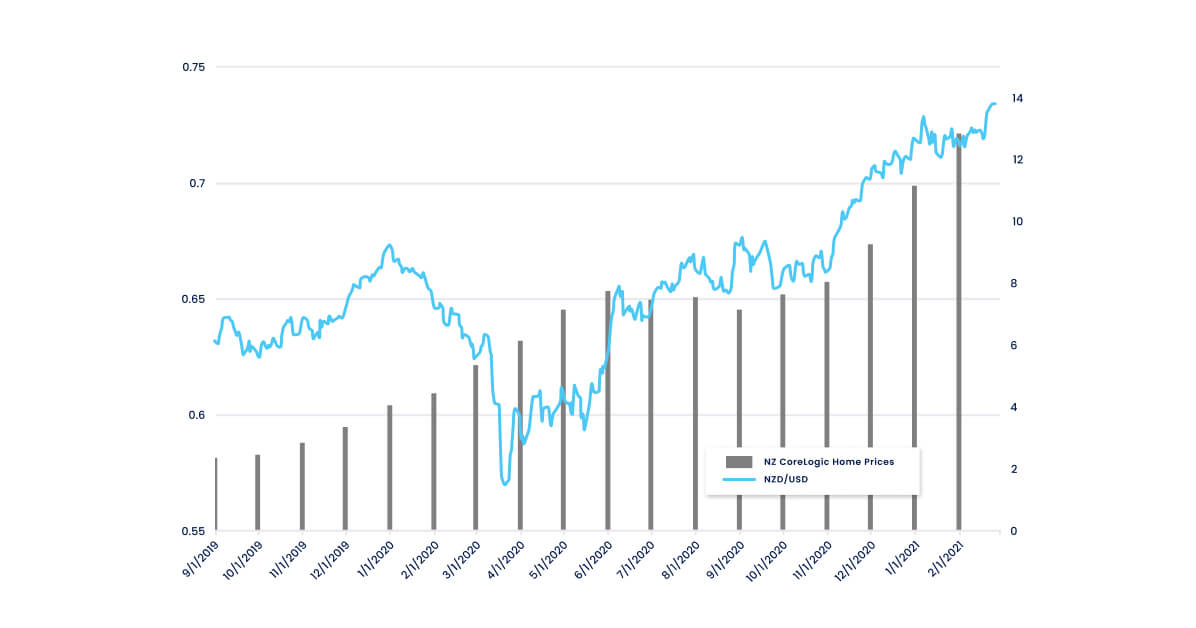

New Zealand Dollar

In 2022, New Zealand’s GDP growth rate was 2.2 percent, higher than many other developed countries. This growth rate was a positive indicator of the strength of the currency. New Zealand’s interest rates were also relatively high compared to other developed countries.

As of March 2023, the official cash rate set by the Reserve Bank of New Zealand was 4.75 percent. This was higher than the interest rates in the United States, the Eurozone, Japan, and many other developed countries. High-interest rates often attract foreign investors, which could increase demand for the currency. Nearly $105 billion worth of New Zealand Dollars was traded daily in the global forex market, making it the 14th most traded currency globally as of 2022.

This graph has been recreated from the original source. Please note this image is a representation only and is not provided as general or personal advice.

Singapore Dollar

In 2021, the SGD was the tenth most traded currency globally and had a market share of 1.8 percent. By 2022, the currency had appreciated by 9 percent year-on-year, whilst other Asian currencies had fallen instead. Singapore’s foreign reserves were one of the largest in the world, standing at over $566 billion as of January 2023. This gave the country a significant buffer against economic shocks and allowed it to maintain a stable currency.

This graph has been recreated from the original source. Please note this image is a representation only and is not provided as general or personal advice.

Bahraini Dinar

The Bahraini Dinar was one of the highest currencies in the world in terms of its exchange rate. As of March 2023, the exchange rate of the BHD to the USD was 2.65. Bahrain had a stable and diversified economy, which was one of the reasons for the strength of the BHD. In 2022, Bahrain’s GDP grew by 4.2 percent year-on-year, and the country had a low unemployment rate of around 4.7 percent. As of 2022, Bahrain’s FDI inflow had increased by 73 percent, reaching a $1.6 trillion level.

This graph has been recreated from the original source. Please note this image is a representation only and is not provided as general or personal advice.

Omani Rial

The Omani Rial had one of the most stable exchange rates in the world and was probably the only currency to have maintained a fixed exchange rate of 1 OMR = 2.6008 USD since 1986. Oman had a relatively low inflation rate compared to many other countries, which helped to maintain the value of the Omani Rial. In 2021, Oman’s inflation rate was only 1.55 percent, which was well below the global average of 3.5 percent.

Oman’s foreign reserves were a significant source of strength for its currency. As of February 2023, Oman’s foreign exchange reserves stood at $15.1 billion, which was equivalent to almost 10 months of imports. This level of reserves provided a cushion against external shocks and helped to maintain confidence in the Omani Rial.

This graph has been recreated from the original source. Please note this image is a representation only and is not provided as general or personal advice.

Jordanian Dinar

The Jordanian Dinar had maintained a relatively stable exchange rate against major currencies such as the US Dollar (USD) and the Euro (EUR) for many years. The country had experienced a relatively stable economic growth rate, averaging around 2.5 to 3 percent per year over the past decade, and the GDP had grown from approximately $27 billion in 2010 to over $45 billion as of 2021.

Jordan had implemented several investment-friendly policies to attract foreign investment, including free trade zones and special economic zones. Its thriving tourism industry contributed to over 19 percent of the country’s GDP. The currency was significantly important and used by tourists to see Jordan’s cultural and historical sites, such as Petra, one of the Seven Wonders of the World.

This graph has been recreated from the original source. Please note this image is a representation only and is not provided as general or personal advice.

Cayman Islands Dollar

The Cayman Islands Dollar (KYD) has had a relatively stable and reliable exchange rate over the past few years. In September 2023, the KYD was valued at 1.20 USD, which had remained relatively consistent over the past few years. The Cayman Islands also had a strong economy, with a GDP per capita of approximately $86,568, one of the highest in the world.

The country’s financial sector, which included offshore banking and insurance services, was a significant contributor to its economic growth and stability. Overall, the Cayman Islands Dollar’s strong performance could be attributed to its stable economy and a low inflation rate of 4.9 percent as of 2022 and an average of 2.3 percent since 2001. The country’s total reserves were relatively high, at around $2 billion in 2020.

This graph has been recreated from the original source. Please note this image is a representation only and is not provided as general or personal advice.

Gibraltar Pound

The Gibraltar Pound was pegged to the British Pound Sterling (fixed at 1:1), which had a stable exchange rate and a strong economy. This stability provided certainty to investors and businesses and helped maintain the purchasing power of the currency. The territory’s unemployment rate was only 1 percent in 2022, one of the lowest in the world. In 2022, Gibraltar’s total merchandise trade was over £6.4 billion, with the majority of exports going to the United Kingdom and Spain, demonstrating strong demand for the Gibraltar pound.

This graph has been recreated from the original source. Please note this image is a representation only and is not provided as general or personal advice.

Kuwaiti Dinar

In March, one Kuwaiti Dinar was worth approximately $3.26. The Kuwaiti dinar was also one of the most stable currencies, based on the country’s large reserves of oil and gas providing a continuous source of income for the government.

In the forex market, Kuwaiti Dinar is a minor currency but was widely used in the international oil market, reflecting its demand as a relatively stable currency to trade.

This graph has been recreated from the original source. Please note this image is a representation only and is not provided as general or personal advice.

What factors should be considered when deciding which currencies to invest in?

From the resources above, it indicates that a strong economy, political stability, and low inflation rates typically back the world’s strongest currencies. These currencies are in high demand among investors and traders and could have worthy trading opportunities. Take a look at their potential by considering your own personal circumstances.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.