The AUD started high at the beginning of 2023 and gained 3.7% as the first month ended, with an overall bullish outlook for AUD/USD throughout the year. However, there are also factors that pose a risk to this bullish outlook, such as economic uncertainties and geopolitical events. These factors can potentially impact the currency pair.

Knowing how to trade AUD/USD can help traders make the most of the existing forex market price fluctuations.

In this article, we dive deeper into the effective trading strategies for AUD/USD.

Top strategies to trade AUD/USD

Carry trade strategy

The Carry trade strategy involves taking advantage of interest rate differentials between two currencies. In the context of AUD/USD trading, if the Reserve Bank of Australia has a higher interest rate than the US Federal Reserve, traders may go long on AUD/USD to earn interest rate differentials.

However, traders must be aware of the risks with carry trade, especially if there are sudden shifts in market sentiment or unexpected economic events related to interest rate differentials or potential currency appreciation/ depreciation.

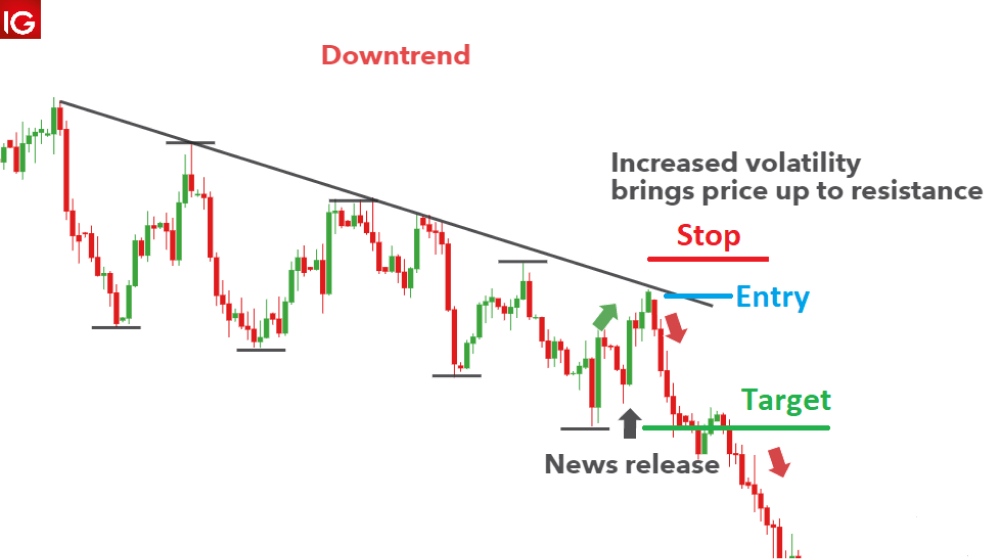

Volatility breakout strategy

It involves identifying key support and resistance levels and entering trades when the price breaks out of these levels, accompanied by increased volatility. While trading AUD/USD, traders may look for periods of consolidation marked by narrow price ranges. When volatility expands, and the price breaks out of this range, it signals a potential trend continuation or reversal. This strategy requires careful analysis of price patterns, and traders often use technical indicators to confirm breakouts. Additionally, staying informed about economic events and data releases that may impact the volatility of the AUD/USD pair is crucial for the right implementation.

Correlation trading strategy

It involves analyzing the relationships between different financial instruments to make trading decisions. It may involve monitoring the relationship between the Australian Dollar and other assets, such as commodities like gold or global equity markets.

For example, since Australia is a major commodity exporter, positive correlations may exist between AUD/USD and commodity prices, which means any increase in the commodity prices in Australia will appreciate its currency due to an increase in exports and vice versa. Traders could use this information to anticipate potential movements in the currency pair based on changes in correlated assets.

*This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry. providing personal advice.

Range trading strategy

Range trading involves identifying price ranges where the AUD/USD pair tends to fluctuate and executing trades based on the expectation that prices will remain within those boundaries for some time. Traders identify support and resistance levels and place long orders near support and short orders near resistance. This strategy is effective during periods of low volatility when the market is consolidating. Traders must be patient and disciplined, waiting for clear signals of a price bounce or reversal at the identified support or resistance levels. Technical indicators such as oscillators can help confirm potential entry and exit points within the established range.

News trading strategy

News trading involves making trading decisions based on the immediate market reaction to significant economic events, data releases, or geopolitical news. For AUD/USD, traders focus on Australian and US economic indicators, central bank statements, and global events impacting the market sentiment of the two countries.

Rapid price movements often occur when unexpected news is released, creating short-term trading opportunities. Traders must react quickly and efficiently, with a well-defined strategy for entering and exiting positions. While news trading can be lucrative, it carries a high risk due to potential market volatility and unpredictable outcomes.

Risk management is crucial, and traders often use limit orders or stop-loss orders to manage exposure during volatile periods.

Top tips to trade AUD/USD

Monitor commodity prices

Keeping a close eye on commodity prices is crucial for trading AUD/USD. Australia is a major exporter of commodities, particularly iron ore and other minerals. The demand and prices of these commodities often influence the value of the Australian Dollar. When commodity prices rise, the AUD tends to strengthen, and when they fall, the AUD may weaken. Traders should stay informed about global economic trends, especially those affecting commodity markets, as this knowledge can provide valuable insights into potential movements in the AUD/USD currency pair.

Consider interest rate differentials

Interest rate differentials between Australia and the United States significantly impact the AUD/USD exchange rate as higher interest rates in Australia relative to the US can attract foreign capital, leading to an appreciation of the Australian Dollar. On the other hand, lower interest rates may result in a weaker AUD against the USD. Any changes in interest rates or indications of future monetary policy decisions can positively and negatively influence the currency pair.

Stay informed about RBA and Fed announcements

The Reserve Bank of Australia and the US Federal Reserve play pivotal roles in shaping monetary policies that impact the AUD/USD pair positively and negatively.

Traders should closely monitor the central banks' announcements, statements, and policy decisions. Interest rate decisions, economic outlook assessments, and any hints at future policy shifts can cause significant movements in the currency pair.

Staying informed about economic indicators and attending press conferences or policy statements helps traders gauge the overall economic health of both countries and anticipate potential market reactions, contributing to well-informed AUD/USD trading strategies.

Navigating AUD/USD market dynamics

Adapting to changing conditions, employing risk management techniques, and staying informed about news impacting Australia and the US are important while trading AUD/USD. Ultimately, the correct approach in AUD/USD trading lies in a comprehensive understanding of chosen strategies, disciplined execution, and a continuous commitment to staying abreast of relevant market factors, as discussed in this article.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.