Weekly Forex Trading Ideas- 5th August

Well we got last week out of the way which was an eventful one to say the least. This week looks to be much calmer from a data front, but we may see the market continue to digest the data from last week.

At the end of the week the market had a shock to the Non-Farm Employment change which showed a job growth of 114k for July. This was the lowest job growth since February 2021. We also saw June’s numbers revised down to 179k from 206k. A scary statistic was provided by the Unemployment Rate which rose to 4.3% a jump from 4.1%. Now the market has been pricing in a cut from the Federal Reserve in the US to come in September, and this kind of data will only enforce that theory.

Data in the US all week had been poor, we saw a decline in the Manufacturing PMI and ADP Non-Farm employment change. This caused the USD to weaken significantly against its counterparts. The USD Index (DXY) a basket of currencies vs the USD fell below the key support of $104.00 highlighting the weakness of the greenback.

The market effectively remains in the ‘risk off’ environment which can be seen via the VIX (Volatility Index). This measures the fear in the markets and is now at levels similar to that which we saw back in April of this year. In that period the S&P500 fell over 6.5%, which paints us a picture of what is to come this time around. The S&P500 is already down 6.54% so we will see if this week brings some calm to the markets.

In terms of high impact data, we have nowhere near as many releases as we had last week, but still some events of importance.

Most notably the RBA in Australia will announce their latest decisions on rates, with the market expecting a hold of 4.35%. The Australian dollar (AUD) has been on a poor run of form largely due to the risk sentiment within the markets. But also partly to poor data out of China, and considering they are close trading partners the AUD has been the currency to take the brunt of it.

In the US we will see the release of the ISM Services PMI and forecasts are showing potential growth. USD bulls (if they’re any left) will be hopeful of a reading better than what they had with the manufacturing PMI last week. Forecasts show expectations of a reading of 51.4 vs the previous 48.8.

USD Index

- The USD Index weekly chart shows the price closing below the key support of $104.00. If the sentiment remains this week then price could trade lower.

- Sellers could look to target the next level of support which rests around $102.50.

USD/CAD

- The price of USD/CAD could be one to watch this week as the price reaches the weekly resistance zone of 1.3900.

- CoT reports show a significant level of buying from the commercials which could indicate a market top is coming.

- CAD has remained weak against the USD similar to many of the other commodity backed currencies.

USD/JPY

- The price of USD/JPY looks to be making a significant shift with the price now trading at 146.50.

- The next level of support for traders is towards the 144.00 level, and with the BoJ raising interest rates, we could expect further JPY strength.

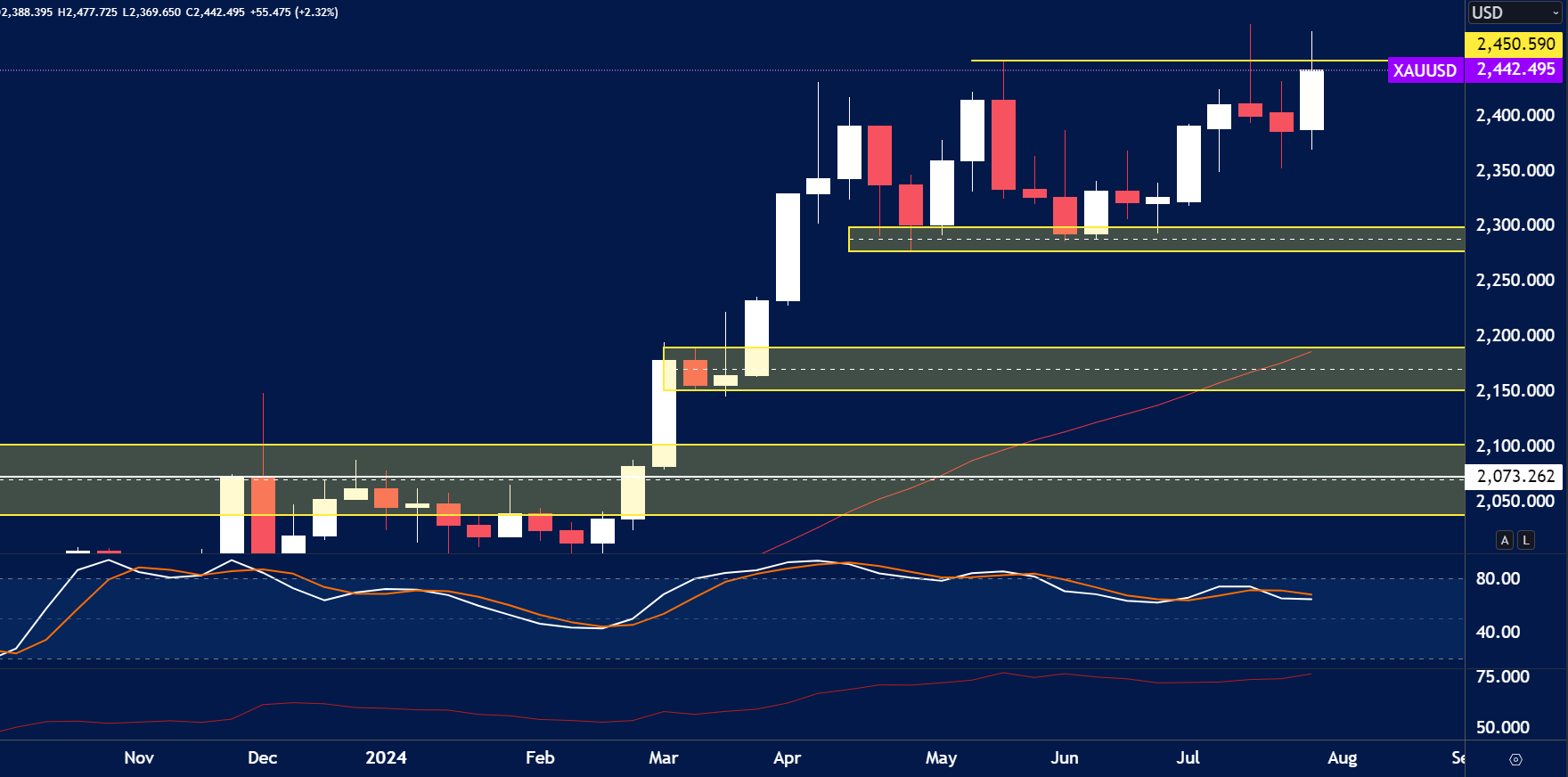

GOLD

- The Gold price traded higher as expected last week, with the price trading back towards the all time highs.

- Risk off sentiment can see investors head towards Gold and a breakout could be expected.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.