Contract for Difference or CFDs is a type of derivative trading that allows you to speculate on the falling and rising prices of fast-moving global financial assets like Commodities, Shares, Forex, and Precious Metals.

CFD trading operates 24/7, giving you ample time to trade whenever you want to, according to your time zone. Trading CFDs is similar to trading Stocks. The only difference is that you do not literally own the underlying Share and only benefit from the price differences.

Here’s everything you need to know about CFD trading:

What is CFD Trading?

A CFD is a short-term contractual agreement between a trader and a seller (e.g. an investment bank, a brokerage, or a spread betting firm). When the buyer wants to end the contract, both parties exchange the difference between the opening and the closing prices of the specific asset. With CFD trading, you can either make a profit or a loss, depending on what direction your selected assets end up moving in.

It gives you an opportunity to profit from price movements of an asset without actually owning or paying the entire amount for it. Essentially, you only pay about 20-25% of the total position size as a leveraged trade.

The value that you pay your broker only depends on the price change of the asset from the time that you bought the CFD until the time your contract terminates or if you decide to sell it. It does not necessarily take the asset’s underlying value into consideration.

Since CFDs come without any stamp duty, it cuts down on the cost and also acts as a great hedging tool by offsetting all losses against profits as a tax deduction.

CFD trading example

Let us assume that Apple trades at $800 in the financial markets. If you wish to take a position, you can either invest in Apple’s stocks or buy Apple's CFDs.

If you choose to buy Apple's CFDs, you can trade by purchasing 100 CFDs at the price of $800. If the market moves to the upside, you can then close the position at $850. The exchange difference you reap from this trade is $50 on each CFD, which makes $5,000 worth of profits in total. This may seem similar to trading Stocks. However, there are a few key differences.

Let’s say the price of Apple's CFD falls to $750.

With CFD trading, you exchange the difference of the opening and closing position in Apple's price. But since the market moved against you, you need to pay your broker $50 per CFD. With this, you also save on additional costs like stamp duties, high commissions, and deposits since you don’t need to pay those for CFDs at all.

On the other hand, if you purchased Apple’s stocks, you would have had to invest the entire $80,000 amount together and later bear the loss of $50 per stock, along with additional costs.

How do CFDs work?

Spreads and commissions

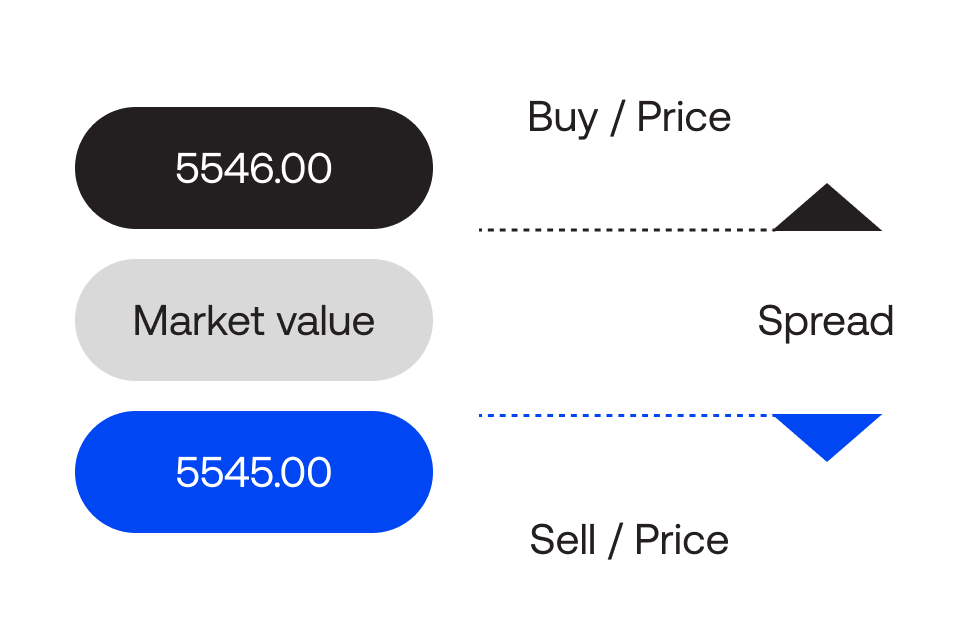

CFD prices are always quoted in buy and sell prices:

- The selling price (bid price) can be used to open a short CFD, which means that you open a selling CFD position to profit from the prices decreasing over time.

- The buying price (offer price) can be used to open a long CFD, which means that you buy a CFD position to profit from the asset’s increasing prices.

The selling prices are always lower than the current market prices, while the buying prices are usually higher. The difference between the buying and selling price is called the spread.

The spread covers the cost needed to open a CFD. However, there are a few exceptions where the buying and selling prices match the underlying asset price. The cost of opening such a CFD position depends on commissions or brokerage charges. It can be as low as 0.1% of the total trade or higher as per your broker’s pricing structure.

An example is a Share CFD. A Share CFD's position is opened in the market by using a fee or commission.

Duration

CFDs do not come with an expiry date. You can simply close a position by placing a trade that is the opposite of the opening trade. For example, a buying position of 500 ABC contracts can be closed by selling 500 ABC contracts. An overnight fee may be charged if you keep a position open after the daily cut-off time, which varies for different international markets.

The only exception is a futures contract, as that does come with an expiry date. When you fix a futures contract with another party, you mutually decide on a date when the contract will terminate. It also includes the overnight fees in the spread itself.

Contract sizes

All CFDs are traded in a standard lot. An individual contract size depends on the asset being traded. For example, Silver (XAG) is usually traded as a commodity in lots of 5,000 troy ounces. The CFD for XAG also has a similar value of 5,000 troy ounces.

Share CFDs also have a contract size of one Share of the company you are trading in. This means that to mimic buying 500 shares of ABC bank, you buy 500 CFD contracts of ABC bank.

Profit and loss

When you multiply the total number of contracts by each contract's value expressed per point of movement, you can calculate the total profit or loss earned from a CFD trade.

From this amount, subtract any costs or fees you paid for the trade, including commissions, stop fees, or overnight charges.

What are the key features of CFDs?

Short and long trading

Through CFD trading, you can speculate price movements in an upward or downward direction. While mimicking a traditional trade reaping profit, you can open a CFD position that will give you profits even with the underlying market asset price decreasing.

For example, if your analysis shows that Apple's prices will fall, you can go short on its Share CFDs before it turns into a loss. This way, you can earn a profit in a price drop. Alternatively, you may experience a loss if the price rises in a short position.

If you short the CFDs at $100, and the price falls to $90, you save yourself from losing $10. Similarly, if you go short for $100, but the price increases to $110, you lose out on the extra $10.

Leverage

Since CFD trading is leveraged, it allows you to spread your capital and gain exposure to significant positions without committing to the total cost of the asset.

For example, if you want to open a position worth 500 Shares of Apple, trading it traditionally means that you need to pay the entire cost upfront. However, with a CFD, you only have to spend about 5% of the total cost as leverage. Since you do not own the asset, you do not have to pay the entire price for it. Being a CFD trader, you just spend a pre-decided margin by the CFD broker and receive revenue according to the price movements of the asset.

This is how leverage makes CFD trading favorable: by depositing only a small percentage of the entire trade value and gaining similar market exposure that you would otherwise.

Margins

CFDs are always traded on margin. This means that you are allowed to borrow money from your broker to increase your position size and, eventually, amplify profits. Margins are the deposits needed to open and maintain CFD positions. This is usually a small percentage of the entire asset value.

There are two margin types in CFD trading:

- A deposit margin, which is used to open a position; and

- A maintenance margin, which is used if your trade gets closer to incurring losses that additional funds will not be able to cover

However, trading on margin could also mean that losses may be amplified. In some cases, you may end up owing your broker more than your initial deposit if your trade happens to go awry.

Hedging

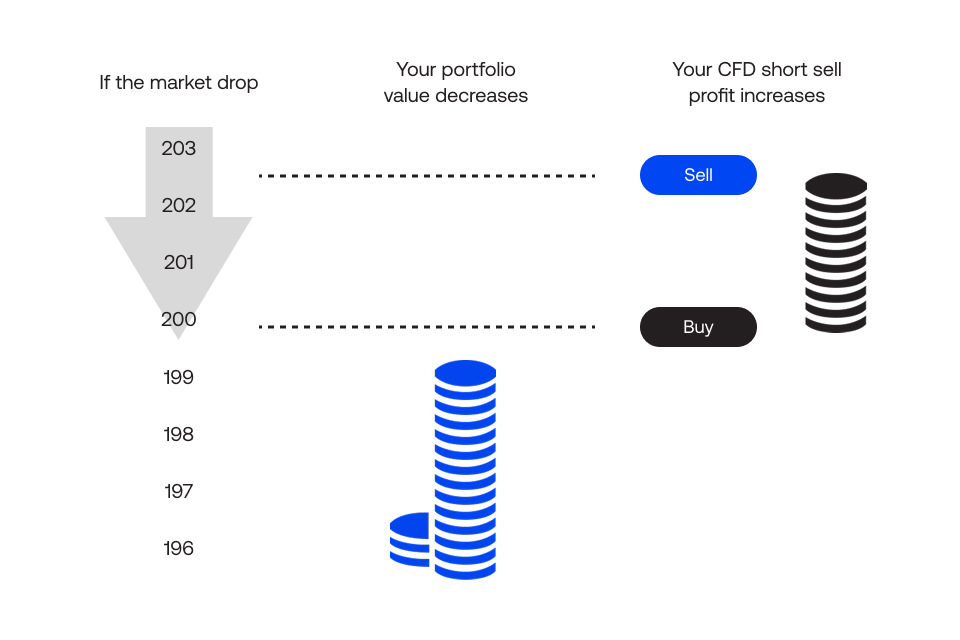

Hedging is one of the most popular risk management strategies. It works by offsetting a loss in an asset by taking an opposite position in another related asset. This means that if you sold asset A and witnessed a loss, you would hedge your position by buying a related asset (asset B). The prices of which are expected to increase in the future to cover losses incurred.

Hedging reduces your investment risks and losses. CFDs also allow you to hedge losses that are present in your existing portfolio.

If you feel that some assets in your portfolio can experience a short-term dip, you can offset those losses by going short on a CFD trade. When you hedge risk like this, any price drop is counterbalanced by gains realised while shorting.

Steps to become a CFD trader

Educate oneself

A prospective CFD trader should begin by understanding fundamental financial concepts such as supply and demand, market trends, and economic indicators. They should also delve into the specifics of CFDs, understanding their mechanics, advantages, and inherent risks.

Choose a reliable broker

Then, the CFD trader should elect a regulated broker with a strong reputation. The broker should offer a user-friendly trading platform equipped with advanced charting tools, real-time market data, and efficient order execution. It's important to understand the fee structure, including spreads, overnight fees, and other charges.

Open a trading account

To begin trading, one must provide the necessary documentation for identity verification and proof of address. Once verified, traders can deposit funds into the account to start trading.

Practice with a demo account

Before risking real capital, practicing with a demo account is advisable. This allows traders to gain hands-on experience in a virtual environment, test different strategies, and analyze their performance without financial consequences.

Develop a trading plan

A well-defined trading plan is the basic trading requirement. It should outline clear financial goals, risk tolerance, and a specific trading strategy. Implementing risk management techniques like stop-loss and take-profit orders is crucial to limit potential losses.

Start trading

Finally, the CFD trader can begin with smaller positions to minimize risk. As experience grows, traders can gradually increase their position size. It's important to monitor trades closely and adjust strategies as needed. Analyzing past trades can help identify areas for improvement.

Continuous learning

Traders should stay updated with market news and economic events to stay ahead. Attending webinars/workshops and joining trading communities can provide insights and networking opportunities.

Top CFD trading tips

Use leverage wisely

For forex CFDs, beginners should consider starting with lower leverage ratios, like 10:1 or 20:1. This reduces risk and gives one more breathing room before a small price movement triggers a margin call or stop-out. Use leverage only with a strong risk management strategy and trading plan.

Monitor economic calendars

Forex markets are highly sensitive to economic data releases. Events like interest rate decisions, inflation reports, or employment data can cause sudden price fluctuations. A well-informed trader should keep an eye on the economic calendar and prepare for potential volatility. For example, if the US Federal Reserve is expected to raise rates, this might strengthen the USD, making it a good time to consider shorting EUR/USD.

Manage overnight risk

CFDs have financing costs when held overnight, known as the overnight rollover or swap fee. These costs can eat into gains if one is holding trades for multiple days. Make sure to account for these fees when planning longer-term trades. If the financing cost is too high, closing the trade before the rollover period may be more beneficial, or considering trading intraday to avoid these costs.

Watch for spread changes

Spreads in forex CFDs can widen significantly during periods of low liquidity (such as during major news releases or outside of regular trading hours). Wider spreads can reduce potential gain margins, especially for scalpers and day traders. Be cautious when trading during off-peak hours or high volatility events, as entering or exiting trades at these times might cost more than anticipated.

Stay aware of leverage-induced margin calls

High leverage can lead to margin calls if the market moves against one's position. A margin call occurs when the equity in their account drops below the required margin level to maintain their position. To avoid this, regularly monitor the margin level and keep sufficient funds in the trading account. Reducing position sizes or adjusting leverage can also help prevent forced liquidation of the trades.

Advantages and Disadvantages of CFDs

Advantages

- Leverage: CFDs allow traders to control larger positions with a low initial investment, magnifying gains and losses. For instance, with a leverage of 1:100, a $100 deposit can control a $10,000 position, amplifying gains and increasing risks.

- Short selling: One can gain from declining markets by taking short positions, a strategy not always available with traditional forex trading. This means one can potentially gain from downward price movements.

- Diverse markets: CFDs enable access to several global markets, including forex, commodities, stocks, indices, and more. This allows for diversification and strategic trading across different asset classes.

- Hedging strategies: CFDs can implement hedging strategies, allowing traders to mitigate risks associated with their existing positions. For example, a trader holding onto a long position in a particular currency pair can use a short CFD position to offset potential losses if the market moves against them.

Disadvantages

- High risk: Leverage amplifies both potential gains and losses, making CFDs a high-risk investment. A small adverse price movement can lead to significant losses, potentially exceeding your initial investment.

- Lack of ownership: Unlike traditional investments, CFDs do not give one ownership of the underlying asset. This means they don't have any voting rights or dividends associated with the asset, limiting the potential gains of long-term holding.

- Margin calls: If the market moves against one's position, the trader may receive a margin call. This requires them to deposit more funds to maintain their position. Not being able to meet a margin call results in the liquidation of their position, leading to potential losses.

- Counterparty risk: As CFDs are often traded over-the-counter, there's a risk that the broker may default on their obligations. Choosing a regulated broker is needed to minimize this risk.

Trade CFDs today

With CFD trading, you can speculate on asset prices without really owning them. This gives you a chance to maximize profits with price speculations and avoid extra handling fees.

However, like every trading, CFD trading comes with its own set of risks. This is why it is advisable for you to try out strategies and trading plans that fit you best with a demo account.

Once you know which strategies work best for you, you can enter the real market and start trading with a live account. At Blueberry, we offer reliable sources in our digital library to learn more about CFDs and a dedicated account manager who can assist you in mitigating risk strategies.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.