Quiet yet pivotal – the week ahead in forex markets brings a blend of subdued activity and crucial insights. With major economies on holiday and key US data on the horizon, traders brace for a nuanced dance of adaptability and opportunity. #Forex #Trading #MarketInsights

Watch the video to learn more…

Forex Week Ahead Analysis

- After a big week of data, this week is expected to be quieter. This could see volatility shrink especially as we have bank holidays in Australia, New Zealand, Switzerland, Europe, UK and Canada at the end of the trading week.

- In US Data this week, we see Fed Chair Powell and FOMC member Waller speak, this comes after the Federal Reserve left rates unchanged at 5.50% but revised the medium and long term dot plots higher.

- US Final GDP q/q is forecast to remain the same at 3.2%.

- US CORE PCE Price index m/m is forecast to fall from 0.4% to 0.3%, serving as a key measure of inflationary pressures.

As we bid adieu to a bustling week packed with data, the forecast for the week ahead in the forex markets hints at a noticeable calm. Traders may find themselves navigating through quieter waters, with volatility likely to shrink, particularly as several major economies observe bank holidays towards the end of the trading week. Among them are Australia, New Zealand, Switzerland, Europe, the UK, and Canada, contributing to potentially subdued market activity.

However, amidst the relative tranquility, eyes remain fixed on the United States, where pivotal events and data releases are slated to unfold. At the forefront is the anticipated dialogue from Federal Reserve Chair Jerome Powell and FOMC member Christopher Waller. Their speeches come on the heels of the Federal Reserve's recent decision to maintain interest rates at 5.50%, coupled with upward revisions to the medium and long-term dot plots. Insights gleaned from their remarks could offer valuable cues to market participants regarding the central bank's future monetary policy trajectory.

On the data front, market watchers will closely scrutinize the US Final GDP q/q figure, with forecasts suggesting it will hold steady at 3.2%. This metric serves as a crucial barometer of economic health, influencing investor sentiment and, consequently, currency valuations. Additionally, attention will be directed towards the US CORE PCE Price Index m/m, expected to dip slightly from 0.4% to 0.3%. As a key measure of inflationary pressures, any deviations from projections could trigger market reactions, shaping trading dynamics in the forex sphere.

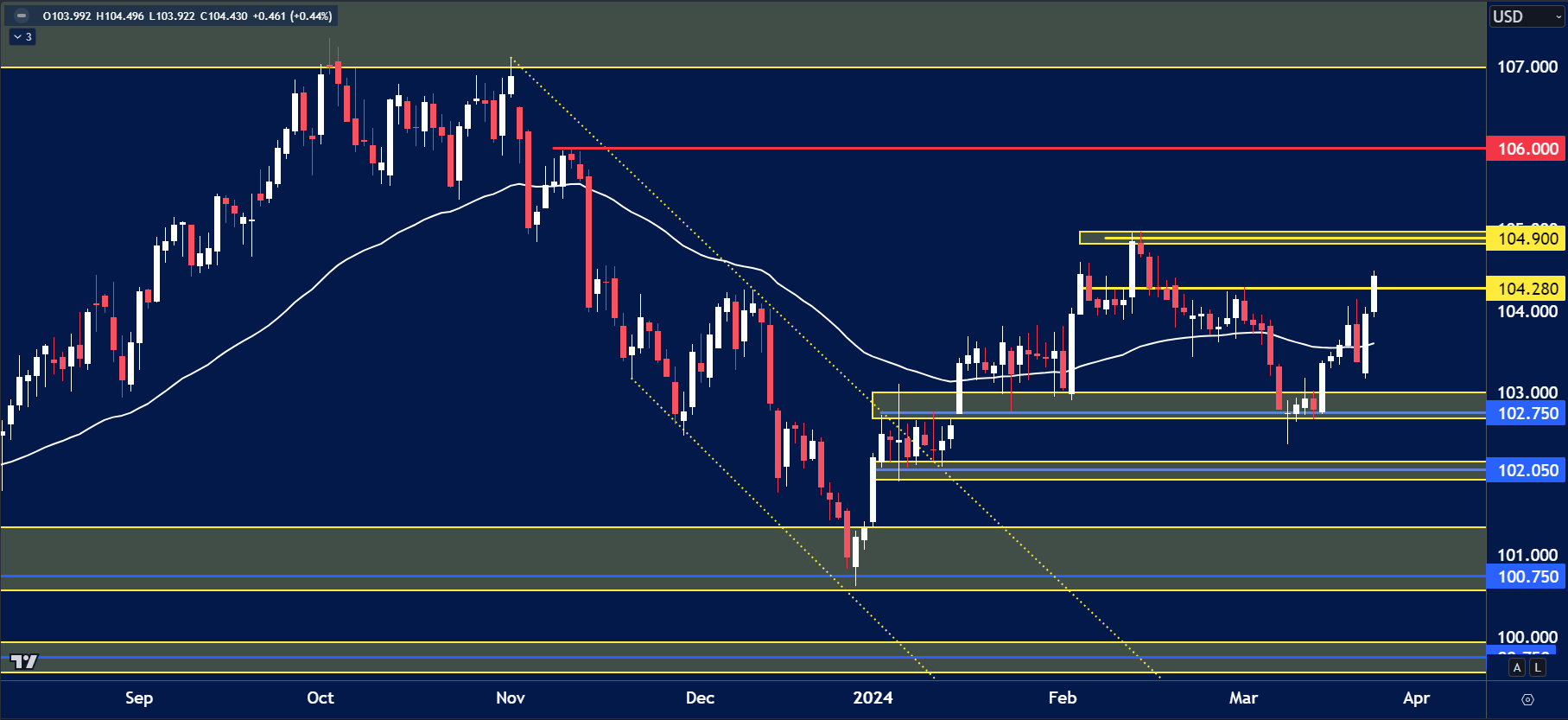

USD Index

The price on the chart has traded through multiple technical levels and some observations included:

- USD Index is trading above recent daily highs of 104.30.

- The Index could continue to move higher with highs of 104.90 formed in February in reach.

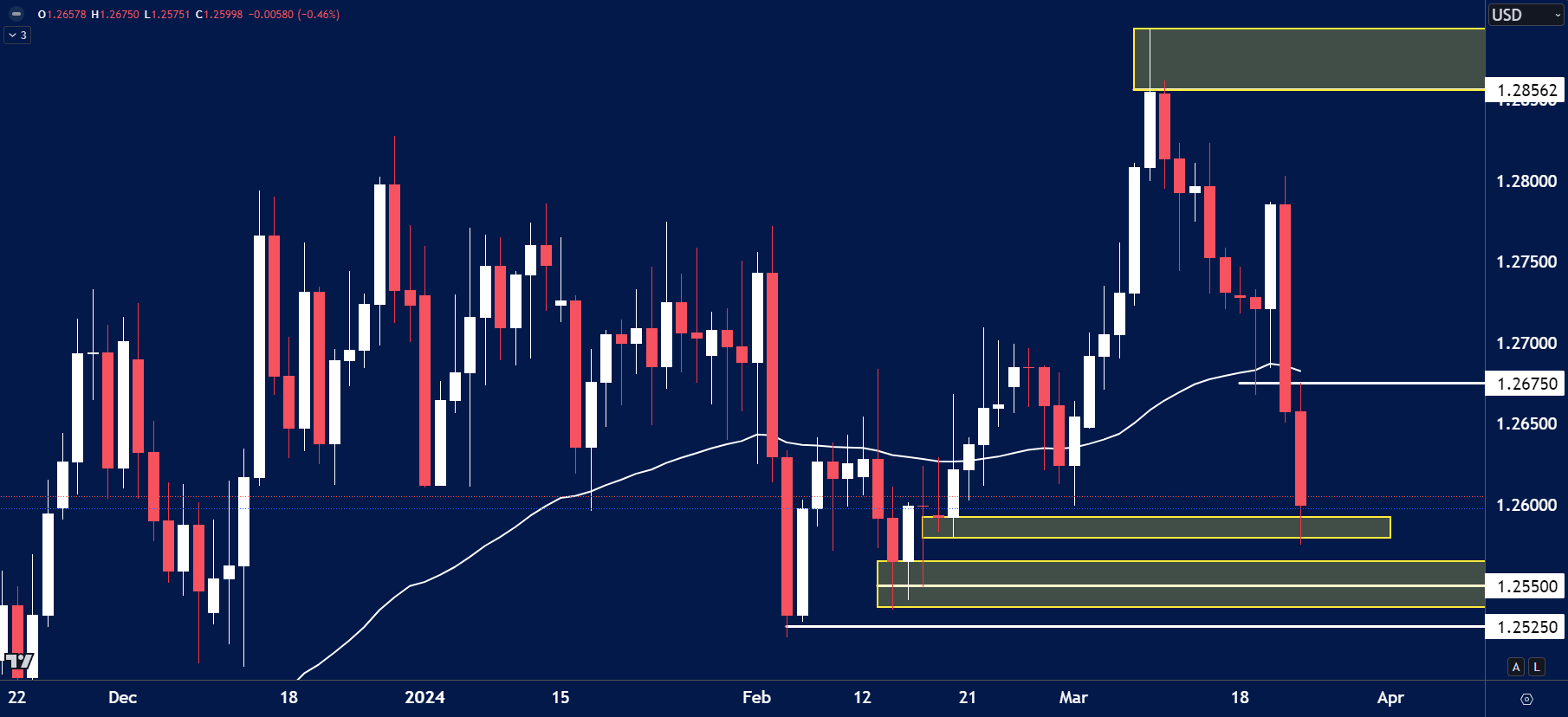

GBPUSD

The price on the chart has traded through multiple technical levels and some observations included:

- Cable fell aggressively from 1.2800 to 1.2600 at the end of last week.

- Momentum may fade this week due to a lack of UK data, however price may continue lower targeting 1.2525, a low that formed in February.

- Sellers looking to get out may influence a short term relief rally to 1.2675.

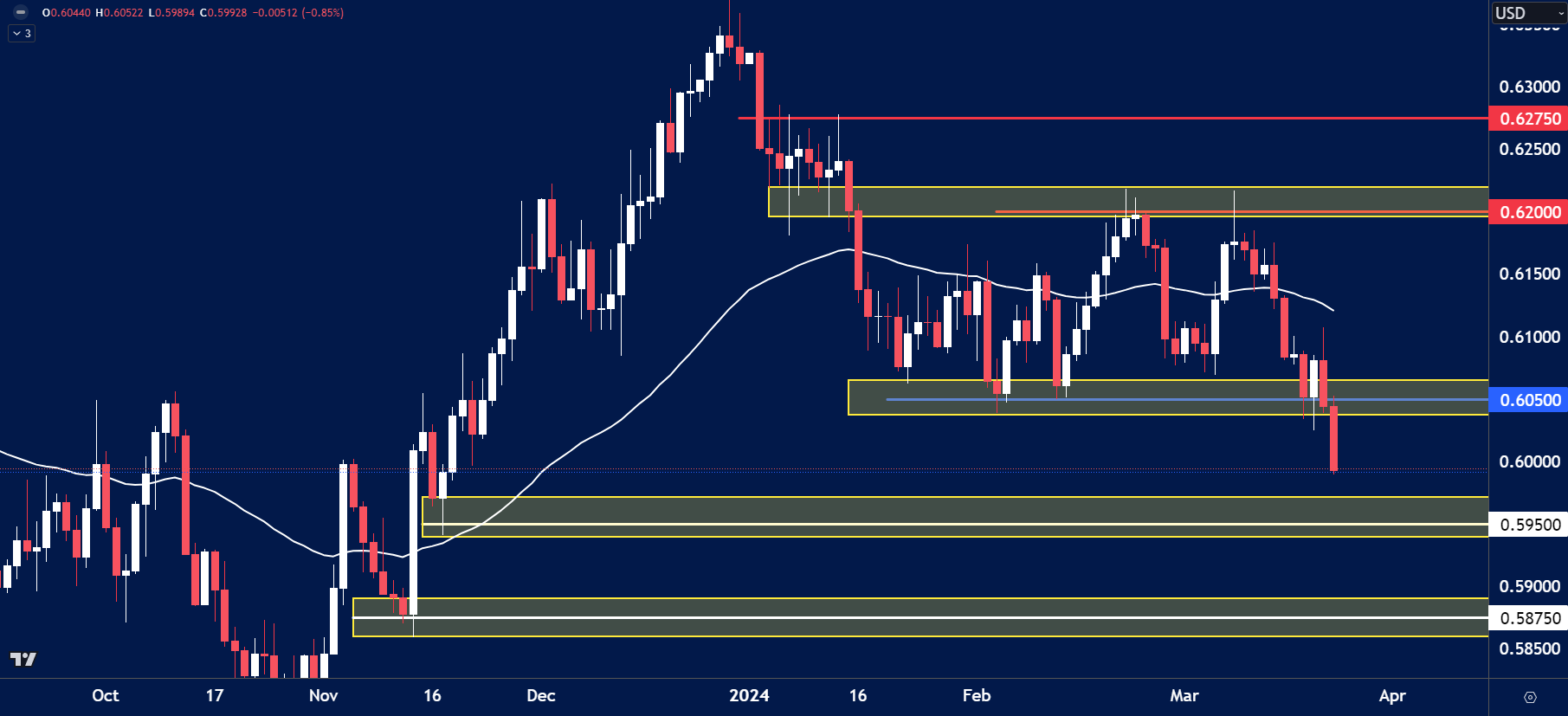

NZDUSD

The price on the chart has traded through multiple technical levels and some observations included:

- NZDUSD has traded through the trading range lows of 0.6050 last week.

- This could open the door for a move towards the lows around 0.5950.

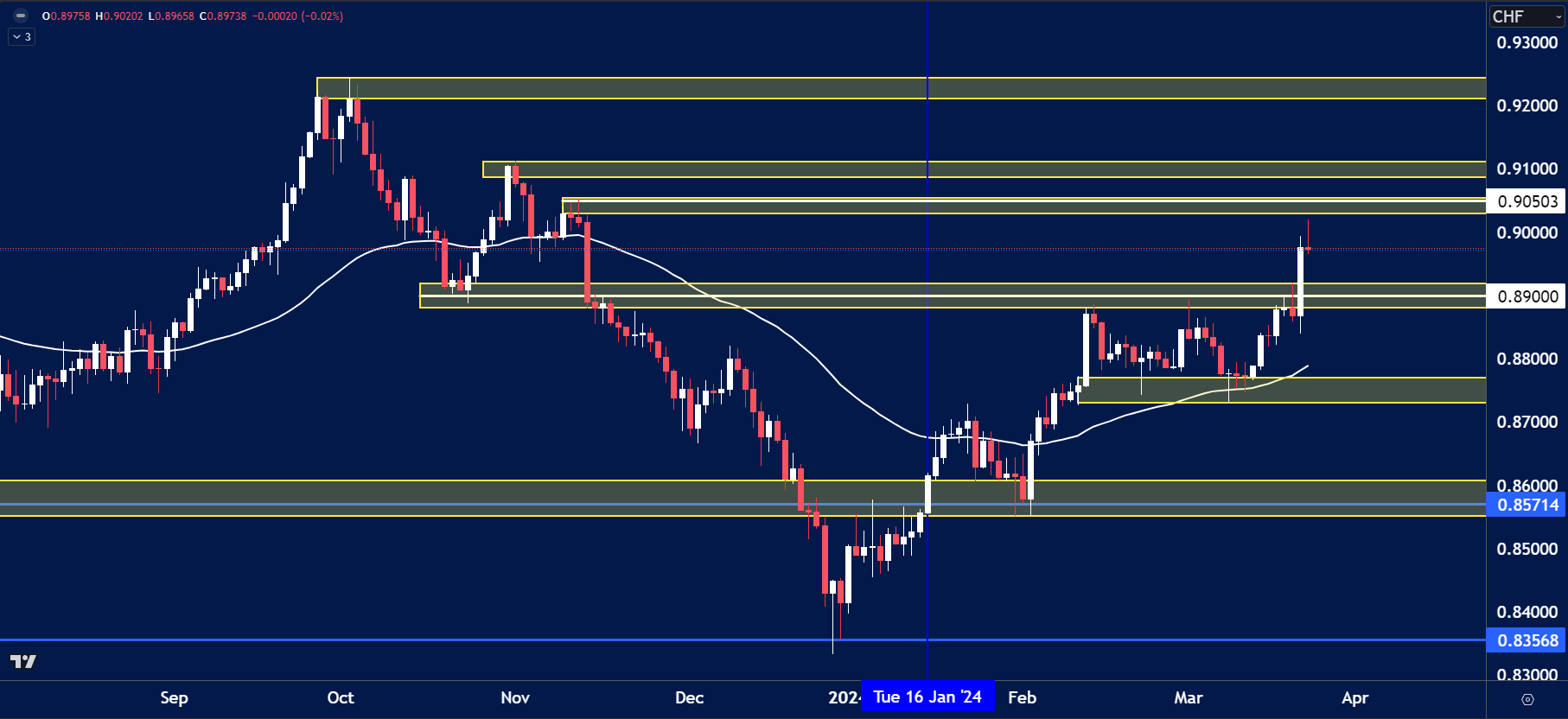

USDCHF

The price on the chart has traded through multiple technical levels and some observations included:

- USDCHF traded higher last week, helped by the SNB who cut interest rates in Switzerland.

- The Swiss Franc could continue to weaken, offering traders an opportunity.

- USDCHF is trading above resistance of 0.8900, which could be used as support for traders looking to go long.

Are you trading on the go? See our MT4 trading guide here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.