To navigate the forex markets, traders need to understand how to read and understand the forex quotes. When traders are unaware of forex quotes or end up incorrectly reading the quotes, it can lead to several risks, including financial losses, missed opportunities, and failed trading strategies.

Our article will serve as a comprehensive guide to familiarize traders with forex quotes.

What are forex trading quotes?

Forex trading quotes are the current exchange rates between two currencies, consisting of a bid price and an ask price. These quotes indicate what one currency is worth in terms of another and are essential for forex traders to make informed decisions.

The difference between the bid and ask price is known as the forex spread, representing the transaction cost, and is typically expressed in pips (percentage in points). Forex quotes fluctuate constantly due to market forces, economic events, and geopolitical factors, allowing traders to speculate on currency price movements in the forex market.

A forex quote is typically presented in the following format:

[Currency Pair] [Bid Price] / [Ask Price]

Types of forex trading quotes

Direct quote

In a direct quote, the domestic currency (the currency of the quoting country) is the base currency, expressed in terms of a fixed amount of foreign currency.

For example, if a trader is in the United States and the direct quote for the EUR/USD currency pair is 1.2000, it means that 1 Euro is equivalent to 1.2000 US Dollars.

**This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

Indirect quote

In an indirect quote, the foreign currency is the base currency, expressed as a fixed amount of the domestic currency. Using the same EUR/USD example, if the indirect quote is 0.8333, it means that 1 US Dollar is equivalent to 0.8333 Euros. Indirect quotes can provide an alternative perspective on exchange rates.

** This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry providing personal advice.

How to read and understand forex trading quotes

Identify the currency pair

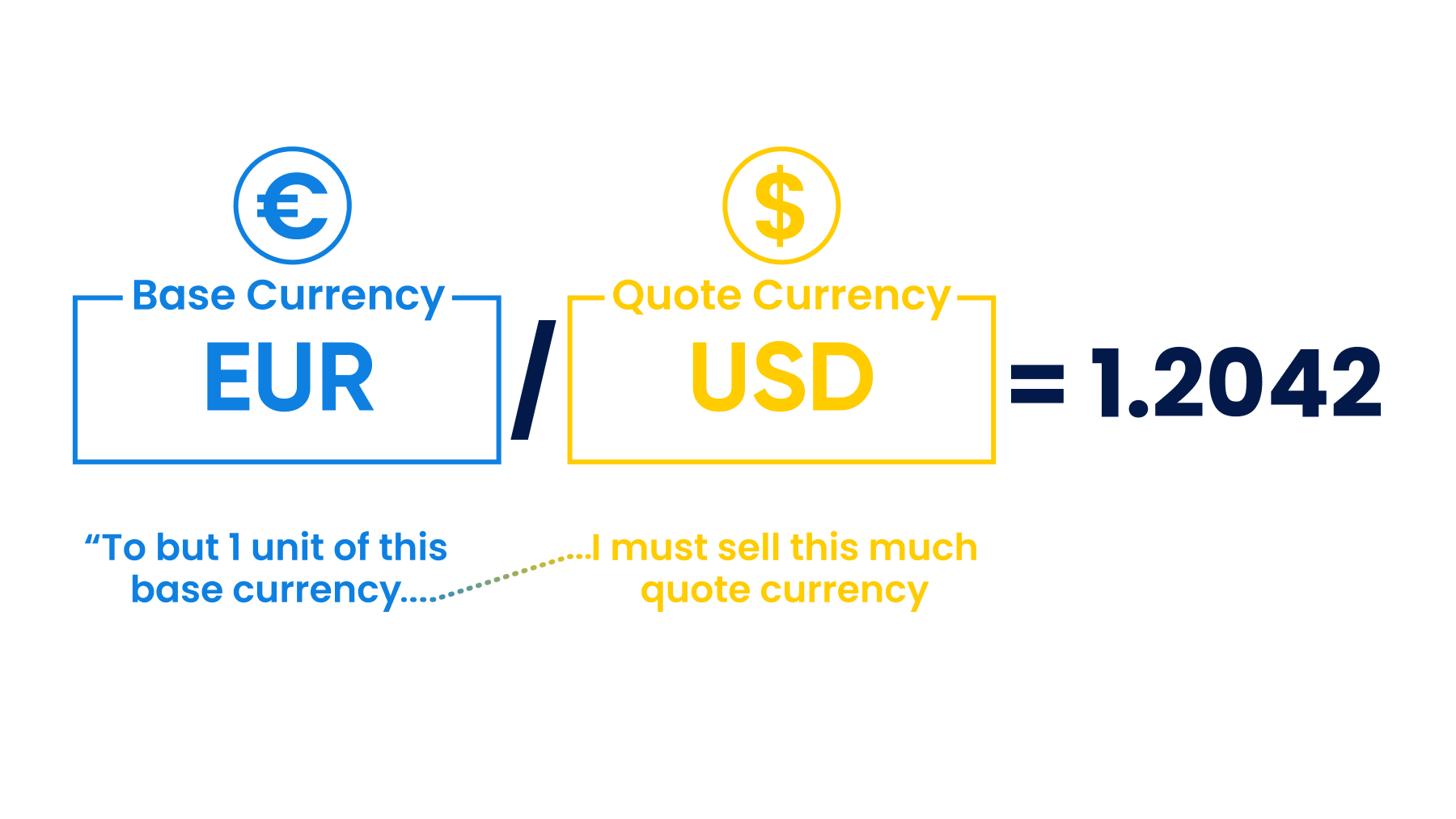

The trader should start by identifying the specific currency pair of interest. Forex quotes are presented in pairs; the first currency represents the base currency, and the second is the quote currency.

For instance, in the case of EUR/USD, EUR serves as the base currency, while USD is the quote currency.

Locate the quote

The trader should find the forex quote for the selected currency pair, typically displayed on trading platforms, financial news websites, or specialized forex charting software.

Identify the bid and ask prices

The quote shows two prices, separated by a slash (/). The first price represents the bid price, while the second is the ask price.

Interpret the bid and ask price

The bid price is the highest price at which a buyer (either a trader or a market maker) is willing to acquire the base currency concerning the quote currency. It signifies the rate at which the individual can exit the base currency if they engage in a trade.

The ask price, also known as the offer price, is the lowest price at which a seller (either a trader or a market maker) is willing to exit the base currency concerning the quote currency. It indicates the rate at which the individual can purchase the base currency if they engage in a trade.

Calculate the bid-ask spread

The trader should determine the difference between the ask and bid prices to calculate the bid-ask spread. This spread signifies the transaction cost or fee linked to the trade and serves as the gain margin for market makers. For example, if the bid price is 1.2000 and the ask price is 1.1000, the spread will be 1.2000-1.1000 = 0.1000.

Interpret the quote

To interpret the quote, traders should consider the bid and ask prices in relation to their trading strategy. If they intend to purchase the base currency, they should employ the ask price, and if they plan to exit a position in the base currency, they should utilize the bid price.

Tips to read the forex quotes accurately

- Use proper decimal places: Remember the decimal places in the forex quote. Most currency pairs are quoted to four or five decimal places. In the EUR/USD pair, for example, a quote of 1.1000 means one Euro is worth 1.1000 US Dollars.

- Practice conversions: If a trader is trading a currency pair with an indirect quote, practice converting it into a direct quote or vice versa. This helps ensure that the trader understands the relationship between the two currencies in the pair.

- Consider particular market conventions: Recognize that forex quoting conventions can vary by region. While direct quotes (such as EUR/USD) are common in many parts of the world, some regions may use indirect quotes (such as USD/JPY).

- Analyze the market trends: Pay attention to the direction in which the bid and ask prices move. If the ask price rises faster than the bid price, it may indicate a bullish trend, while the opposite may suggest a bearish trend. Enter trading positions accordingly.

- Utilize technical analysis: Combine forex quotes with chart analysis and technical indicators to make informed trading decisions. This can help traders identify trends, support, and resistance levels.

Understanding forex quotes for better trading

Grasping forex quotes is like having a key to unlock the forex market. They help make precise trades, manage risk, and seize opportunities. They also act as a way to protect traders against unnecessary setbacks and are crucial for each one's trading journey. However, it's important to remember that the Forex market is inherently volatile and can lead to substantial losses, so a solid understanding of forex quotes is your best defense against these risks.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.