Choosing the appropriate time frame in crypto trading dictates trend identification, entry/exit points, and risk management. Shorter time frames, like minutes or hours, suit day traders seeking quick gains, while longer time frames, such as daily or weekly, are preferred by investors for spotting long-term trends. Selecting an incorrect time frame can lead to missed opportunities or excessive risk exposure.

In this article, we discuss how to choose the right time frame for crypto trading.

What are the different time frames for crypto trading?

Minute-wise time frames (M1, M5, M15)

M1 (1 minute), M5 (5 minutes), and M15 (15 minutes) time frames are short-term intervals used for intraday trading. Traders analyze price action within these intervals to identify short-term trends and execute quick trades.

Hourly time frames (H1, H4)

H1 (1 hour) and H4 (4 hours) time frames offer medium-term perspectives on price movements. Traders use these intervals to identify broader trends and plan trades that span a few hours to a few days.

Daily time frame (D1)

The D1 (1 day) time frame provides a longer-term view of price action, suitable for swing trading and position trading. Traders analyze daily candlestick patterns and trends to make trading decisions lasting from several days to weeks.

Weekly time frame (W1)

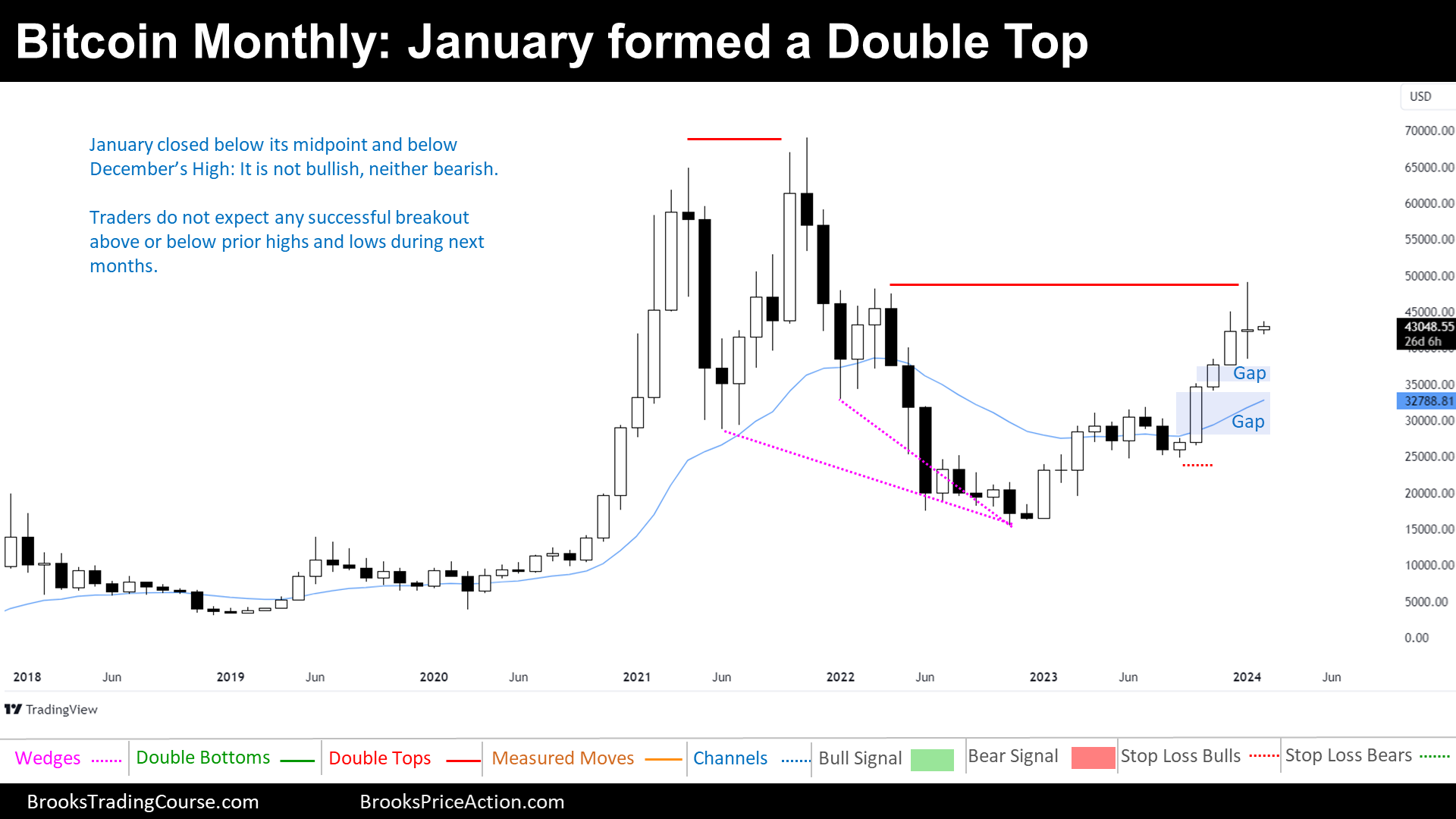

The W1 (1 week) time frame offers a macroscopic view of price movements, ideal for long-term trend analysis and strategic positioning. Traders use weekly charts to identify major trends and plan trades with longer holding periods, spanning weeks to months.

Monthly time frame (MN1)

The MN1 (1 month) time frame provides the broadest perspective on market trends, suitable for long-term investors and trend followers. Traders analyze monthly charts to identify major trend reversals and plan trades with extended holding periods spanning months to years.

Top trading sessions for crypto trading

Asian trading hours

Asian trading hours, which overlap with the opening of the Tokyo and Singapore markets, occur during the late evening and early morning hours in Western time zones (23:00 GMT to 08:00 GMT). These hours are characterized by moderate trading activity and relatively lower volatility compared to other sessions. However, notable price movements may occur in response to news and events specific to Asian markets.

American trading hours

American trading hours coincide with the opening of major financial centers in North America, including New York (13:00 GMT to 22:00 GMT). This session is known for its high liquidity and volatility, with significant trading activity driven by institutional investors, hedge funds, and retail traders. Market-moving events such as economic releases and corporate announcements often occur during American trading hours, leading to sharp price movements in the crypto markets.

European trading hours

European trading hours overlap with the opening of financial centers in London and Frankfurt (08:00 GMT to 17:00 GMT). This session is characterized by high trading activity and liquidity, as European traders participate alongside their American counterparts. European trading hours often witness crypto price trends established during the Asian session continuing or reversing, depending on market sentiment and economic developments.

Weekend trading hours

Weekend trading hours refer to the period when traditional markets are closed, from Friday evening to Sunday evening (GMT) (23:00 GMT Friday to 22:00 GMT Sunday). While crypto markets operate 24/7, trading activity may vary during weekends due to reduced participation from institutional traders and lower overall volume. As a result, crypto prices may experience increased volatility and erratic movements, presenting both opportunities and risks for traders.

Stepwise guide to choose the right time frames for crypto trading

Select a trading style

Understand if one wants to be a day trader, swing trader, or long-term investor. Day traders make multiple trades within a day, swing traders hold positions for a few days to weeks, and long-term investors hold assets for months to years.

Analyze market volatility

Due to crypto market volatility, assessing the comfort level with risk is important. Shorter time frames, such as minutes or hours, may suit day traders who thrive on volatility, while longer time frames, such as daily or weekly, may be better for those who prefer less frequent trading and smoother trends.

Assess time availability

Determine how much time one can dedicate to monitoring the markets. Day trading requires constant attention, while longer time frames allow for more flexibility.

Consider market liquidity

Liquidity varies across different time frames. Higher liquidity usually means tighter spreads and better trade execution. Consider trading when the market is most active, typically overlapping with major trading sessions in different time zones.

Test different time frames

Experiment with different time frames using a demo account or with small amounts of capital. This lets traders see which time frame properly aligns with their trading strategy and preferences.

Adapt to market conditions

Be flexible and adjust the time frame according to market conditions. During periods of high volatility, shorter time frames may provide more trading opportunities, while during stable periods, longer time frames may be more suitable.

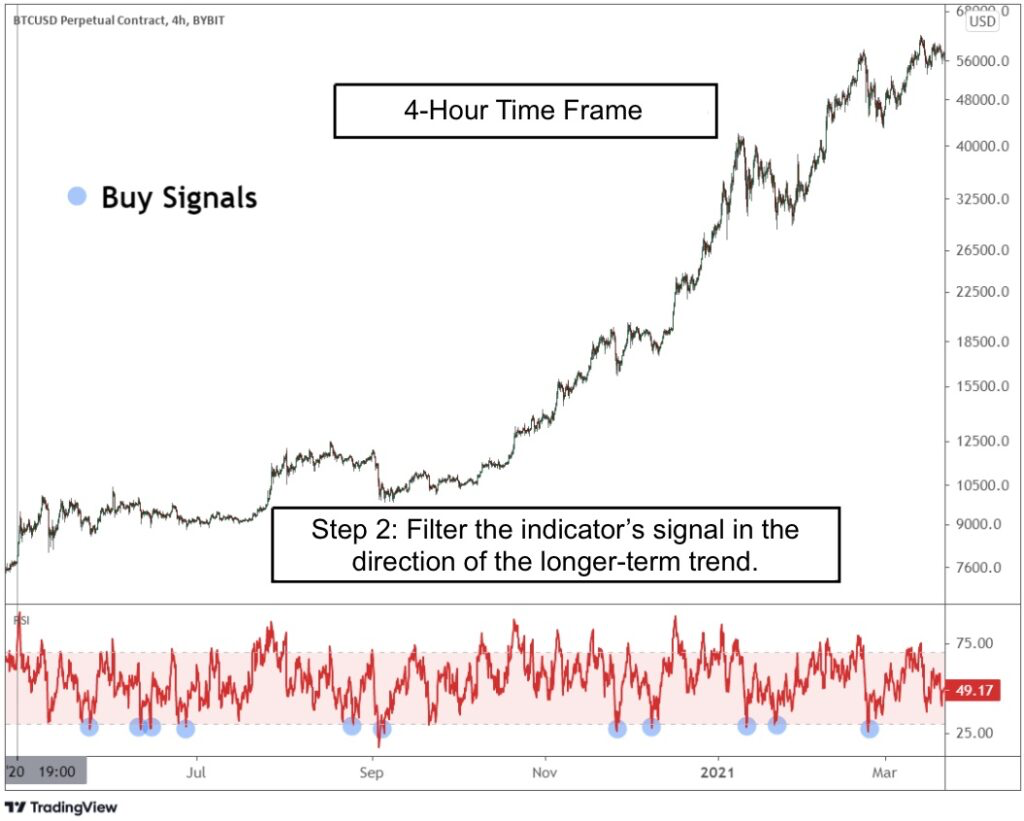

Factor in technical analysis

Different technical indicators and chart patterns may work better on specific time frames. For example, shorter time frames are more responsive to short-term price movements, making them suitable for scalping strategies, while longer time frames are better for identifying long-term trends.

Monitor and adjust

Continuously monitor the chosen time frame and be prepared to adjust if the strategy is not producing the desired results. Markets evolve, so staying adaptable is needed in crypto trading.

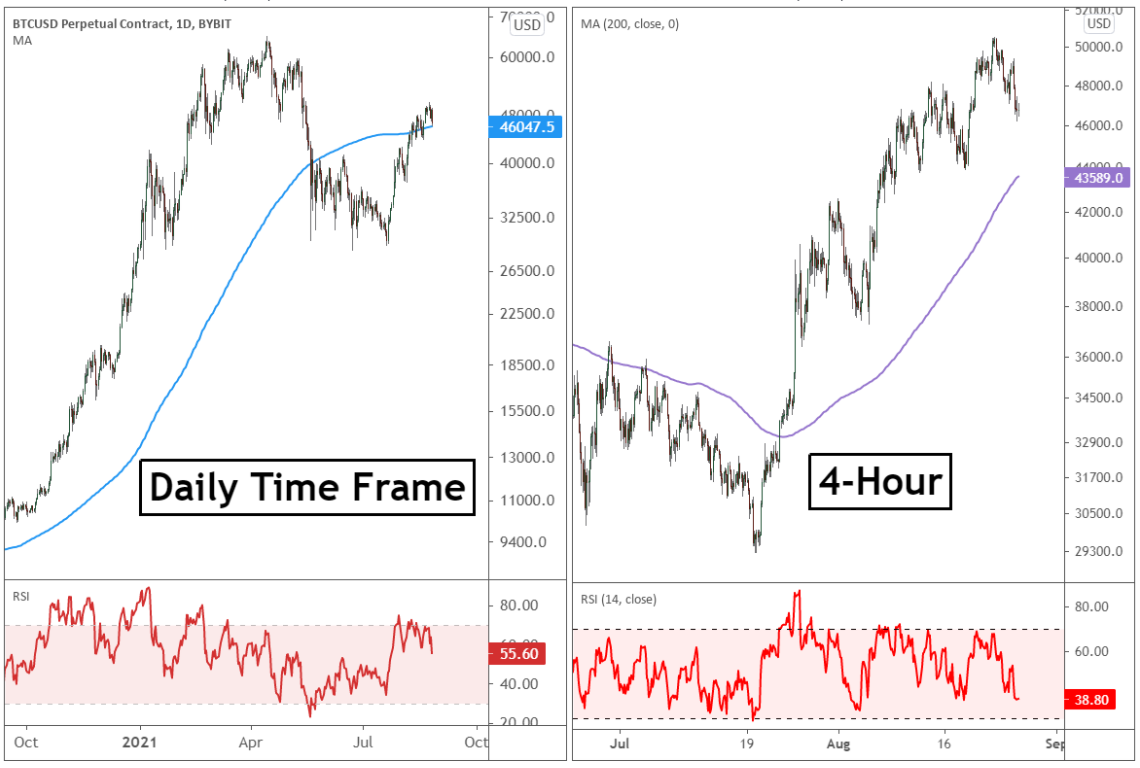

Navigating the crypto markets with multiple time frame analysis

By examining trends across different time frames, traders gain deeper insights into price movements and trend consistency. This allows for better identification of entry and exit points and confirmation of trend strength. Overall, multiple time frame analysis navigates the complexities of the crypto market and improves the trading process.

FAQs

We’re here to help you every step of your trading journey. Here are some answers to the more frequent questions we get asked.

Why is choosing the right time frame important in crypto trading?

Selecting the right time frame ensures accurate trend identification, effective entry/exit points, and better risk management. It aligns your strategy with market conditions, minimizing missed opportunities and excessive risk.

What are the most common time frames for crypto trading?

Common time frames include minute-wise intervals (M1, M5, M15), hourly (H1, H4), daily (D1), weekly (W1), and monthly (MN1). Each time frame suits different trading styles and objectives.

Which time frame is best for day traders in crypto trading?

Day traders typically use shorter time frames such as M1, M5, and M15, as these allow them to capitalize on quick, intraday price movements.

What time frames are suitable for swing traders?

Swing traders often prefer H1, H4, or D1 time frames to capture medium-term trends and hold positions from a few days to weeks.

How does market volatility affect the choice of time frames?

Traders who are comfortable with high volatility may opt for shorter time frames (minutes or hours), while those seeking stability might choose longer time frames (daily or weekly).

What are the most active trading hours for crypto markets?

Crypto markets are most active during overlapping trading sessions, particularly European (08:00-17:00 GMT) and American (13:00-22:00 GMT) hours, offering higher liquidity and more trading opportunities.

Should I use multiple time frames for crypto trading?

Yes, using multiple time frames provides a broader perspective, confirming trend strength and refining entry/exit points for more informed decisions.

How can I test different time frames in crypto trading?

Use a demo account or trade small amounts to experiment with various time frames and identify which best aligns with your strategy and goals.

How do technical indicators vary across time frames?

Shorter time frames react more quickly to price movements, making them ideal for scalping, while longer time frames are better for identifying overarching trends and making strategic trades.

Can I adjust my time frame based on market conditions?

Yes, flexibility is essential. Use shorter time frames during high volatility to seize opportunities, and switch to longer time frames during stable periods for a wider market view.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.