The Non-Farm Payroll (NFP) report serves as a significant driver of market sentiment and can exert considerable influence on the price of gold. Additionally, changes in monetary policy influenced by the NFP report can affect the value of the US Dollar, further impacting gold prices.

In this article, we will learn how NFP affects the price of gold in depth.

Note: Although NFP can potentially affect gold prices, it is not the main driving factor. Please consider all factors when making trades on gold prices.

What is NFP?

The Non-Farm Payrolls (NFP) report is a monthly economic indicator released by the United States Department of Labor. It provides information on the number of jobs added or lost in the non-farm sector, excluding agricultural workers, private household employees, and non-profit organization employees.

The NFP report is considered a key indicator of the overall health and direction of the US economy. The data in the NFP report significantly influences financial markets and can affect various asset classes, including currencies, stocks, and commodities like gold.

NFP factors that affect gold prices

Market sentiment

When the NFP report shows positive employment data, indicating a strong job market and economic growth, it tends to boost investor confidence and risk appetite. In such cases, investors may shift their focus towards riskier assets, such as stocks, which can reduce the demand for assets like gold. As a result, the price of gold may experience downward pressure.

On the other hand, if the NFP report reveals negative employment data, suggesting a weak job market or economic downturn, it can trigger a flight to safety among investors. During times of uncertainty, investors can invest in assets like gold, increasing its demand and potentially driving up its price.

The US Dollar

The NFP report also plays a role in shaping monetary policy decisions by the Federal Reserve. Changes in monetary policy, such as interest rate adjustments, can significantly impact the value of the US Dollar. A weaker dollar tends to enhance the appeal of gold as an alternative investment, leading to increased demand and potentially higher gold prices. Conversely, a stronger dollar can put downward pressure on gold prices.

Employment data

The NFP report provides insights into the number of jobs added or lost in the non-farm sector, which serves as an important gauge of economic growth. Positive employment data indicating a strong job market and economic expansion can reduce the demand for gold, as investors may shift towards riskier assets. This shift in sentiment can put downward pressure on gold prices.

Monetary policy implications

The NFP report plays a crucial role in the Federal Reserve's monetary policy decisions. Positive employment data may lead to expectations of tightening monetary policy, including potential interest rate hikes. Such expectations can strengthen the US Dollar and decrease gold prices. Conversely, weak employment data may lead to expectations of looser monetary policy, which can weaken the US Dollar and potentially support higher gold prices.

Global economic outlook

The NFP report provides insights into the health of the US economy, which has global implications. Changes in the US job market can impact global economic sentiment and investor confidence. If the NFP report reflects a strong US job market, it can bolster global economic optimism, reducing the demand for gold. Conversely, weak employment data can raise concerns about global economic growth and increase the appeal of gold as an investment.

Unemployment rate

The NFP report also provides information on the unemployment rate, which reflects the proportion of the unemployed labor force but actively seeking employment. A declining unemployment rate suggests a healthier job market and improved economic conditions, potentially leading to higher demand for other assets and reduced demand for gold, decreasing its prices. Conversely, an increasing or higher-than-expected unemployment rate can create concerns about economic weakness and drive investors toward gold as an asset, increasing its prices.

Wage growth

Another factor to consider is wage growth, which is often included in the NFP report. Increasing wages can stimulate consumer spending and economic growth. Higher wages may also contribute to inflationary pressures, which can influence the value of currencies and impact gold prices. If wage growth is robust and leads to inflationary concerns, investors may turn to gold as a hedge against inflation, potentially driving up its price and vice versa.

Revisions to previous reports

The NFP report is subject to revisions as more accurate data becomes available. Significant revisions to previous reports can affect market sentiment and investor confidence. Positive revisions indicating better-than-expected job growth or a stronger labor market than the previous report can boost investor optimism and potentially reduce the demand for gold. Conversely, negative revisions may create uncertainty and increase the appeal of gold as a hedge against market volatility, increasing its market price.

How to trade gold with NFP?

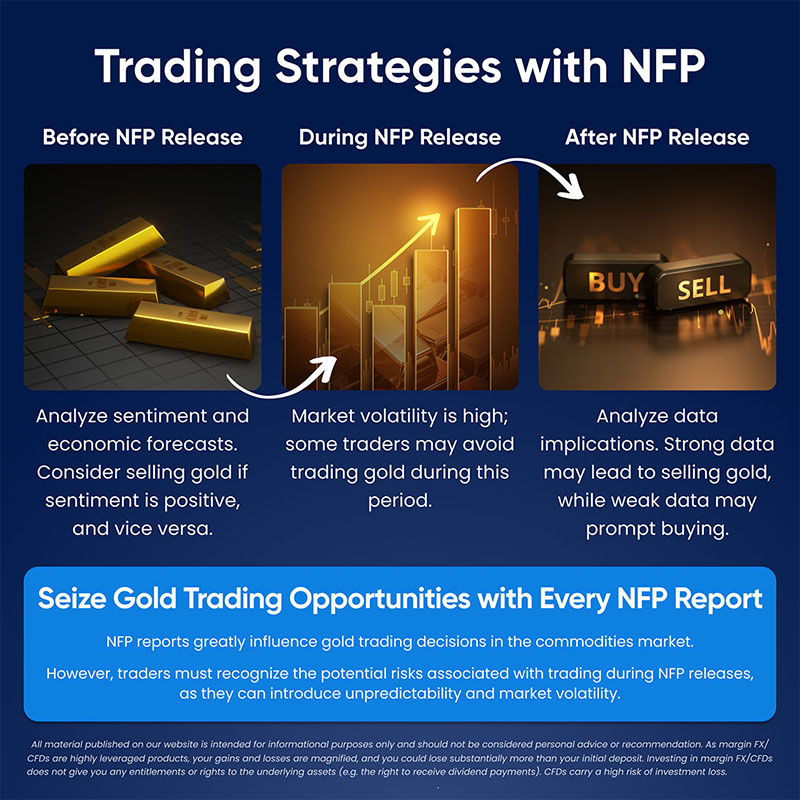

Before the NFP report

Before the NFP report is released, traders can analyze market sentiment and expectations like economic forecasts. If sentiment is leaning towards positive economic data, indicating a strong job market, traders may consider selling gold as risk appetite increases.

On the other hand, if sentiment is more cautious or expectations are for weaker data, traders may consider buying gold as a safe-haven investment.

During the NFP report

During the NFP report release, the market can experience heightened volatility and uncertainty. Due to the unpredictable nature of market reactions during this period, some traders may choose to avoid trading gold during the report release and wait for the initial volatility to settle before making any decisions.

After the NFP report

After the initial market reaction to the NFP report subsides, traders can analyze the data and its implications. If the NFP data is significantly stronger than expected, indicating a strong job market and potential economic growth, traders may consider selling gold as risk appetite increases.

Conversely, if the NFP data is weaker than expected or suggests economic weakness, traders may consider buying gold with an expectation that gold prices may increase in the coming future.

Grab gold trading opportunities with each NFP report release

NFP reports can have a significant impact on a trader's decision to trade gold in the commodities market. At the same time, it's important to be aware of the potential risks involved with trading around NFP data as sometimes NFP reports can also lead to unpredictability and market volatility.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.