More central bank announcements will dominate the markets this week with decisions coming from the Federal Reserve, Bank of Japan and Bank of England. We will also see key inflation data from Canada and the United States. In the Eurozone the German Manufacturing PMI will be watched for any positivity as well as many more key data drops.

Forecast for December 16th, 2024

USD Outlook

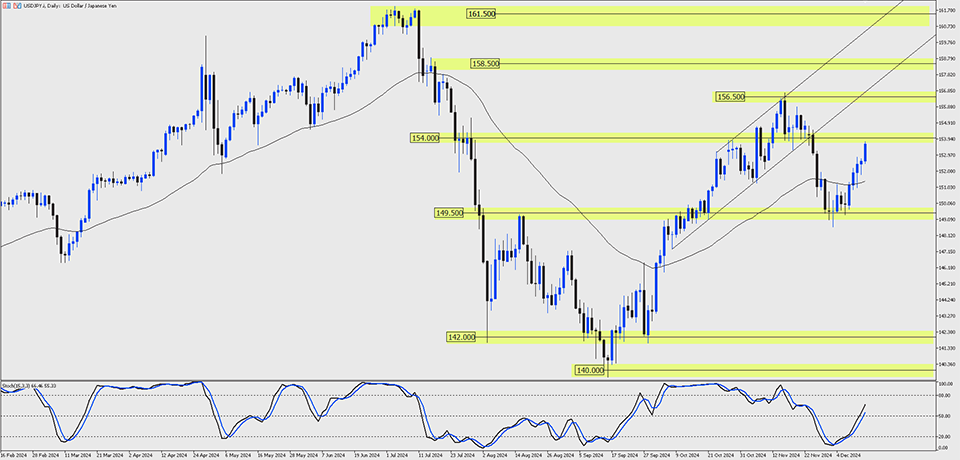

The USD ended up being the strongest currency of last week strengthening against all of its major counterparts. USD/JPY in particular taking the headlines climbing 2.47% on the week. The Japanese central bank governor Ueda said that rate hikes could be likely but not by the end of this year which prompted traders into selling the JPY. Comparing this with the US Federal Reserve which is likely to cut interest rates this week you would have expected the opposite to happen. However it seems to be that the market is pricing in the chance of no change in the 29th January 2025 meeting.

The CME FedWatch Tool tracks the probability of changes to the Fed rate according to interest rate traders. For the 18th December meeting the tool shows a 96% chance of a cut of 25 basis points by the Fed. However in January the tool suggests the Fed will hold interest rates, as a probability of a hold is at 78%.

The Federal Reserve will meet on Wednesday and with the market pricing in a cut, the language from the central bank will be of utmost importance. Will this be a hawkish cut? Is a question on most minds as inflation in the US remains sticky. US 2 YR yields remain high and a cut would bring the interest rate in line with bond traders expectations.

EUR Outlook

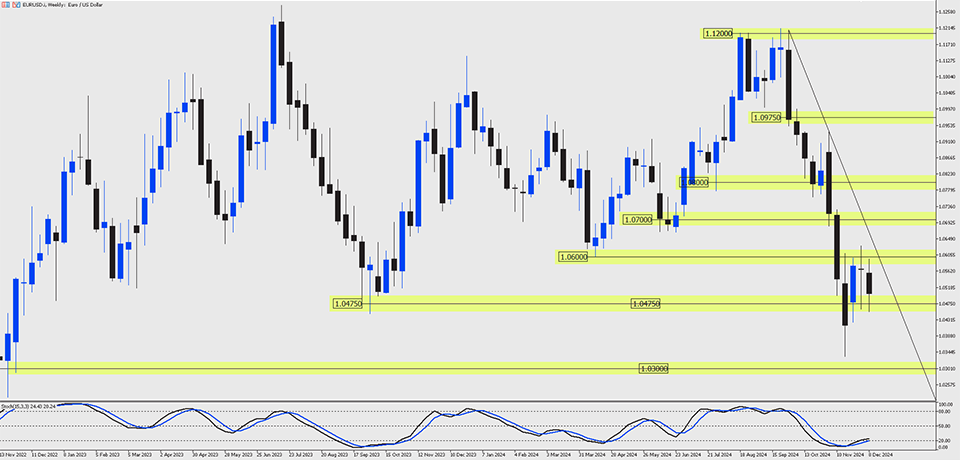

The EURO was the 4th strongest currency of last week only losing out to the USD and AUD. This week could be pivotal for the currency as we see an assortment of manufacturing and services PMIs. German manufacturing has been a key player in the Euro’s demise in the fourth quarter, any upside surprises could bring some positivity to the currency, a downside release doesn’t really change anything and will probably be met with little movement from the market.

On another note the Commitment of Trader report now shows that hedge funds are selling the EUR futures at levels we haven’t seen since September of 2022. The commercials are also buying EUR futures at levels at extremes over a similar time period. This can be a sign or a pending reversal for the currency which has shown some strength of late.

Key markets to watch could include EUR/GBP as growth in the UK came in lower than expected last week. Traders could favour the EUR over the GBP in the near term and with the price of the forex pair at a major point of support the price could trade higher.

CAD Outlook

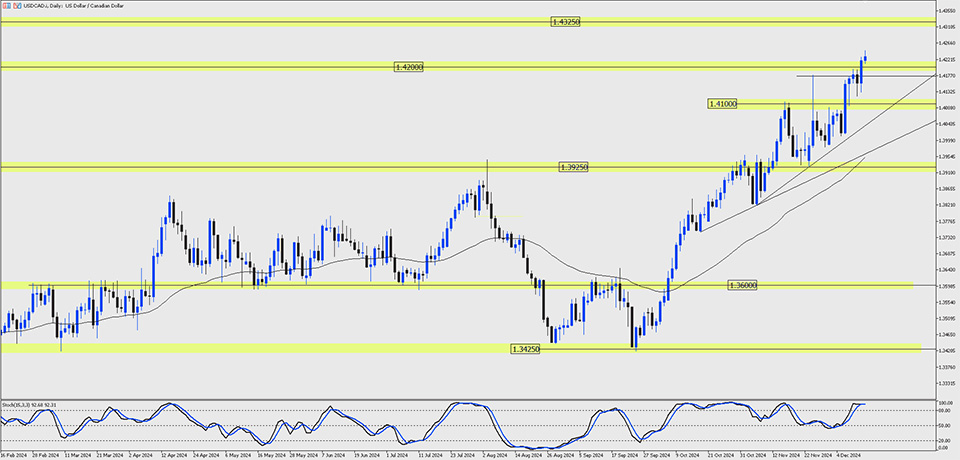

The Canadian dollar was the third strongest currency of last week despite the Bank of Canada cutting interest rates to 3.25%. Canada’s unemployment rate climbed to a 3 year high in November at 6.8%. January could bring fresh problems for the Canadian economy as Donald Trump begins to threaten large tariffs on its neighbour. The Bank of Canada could continue on its current cutting path to try and stimulate its economy.

USD/CAD prices traded above the key psychological zone of 1.4200 with the next resistance being higher towards 1.4350. If the price fails to continue higher and closes back below the key 1.4200 level then it could become a false breakout.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.