Volatility is the name of the game again, which is typical in September markets. But how much of an impact is this going to have on forex markets going into this trading week? Let’s take a look.

Friday bought some strength back to the USD after a mixed Non-Farm Payroll report. Average hourly earnings was the only positive really, seeing a jump to 0.4%. Jobs created in August did rise to 145k above the previous figure, but July’s jobs were revised down from 114k to 89k.

The Volatility Index (VIX) finished higher this week, showing the market is now back to favoring risk off assets. The Japanese Yen and Swiss Franc performed well in these conditions against the commodity backed currencies like the Australian dollar and New Zealand dollar.

We could expect this momentum to continue at least for the next two weeks or so as we head into the major risk event of the month on the 18th September. This is when the Federal Reserve will announce their rate cuts, the pace of which is still largely up for debate.

In other central bank news the European Central Bank (ECB) is forecast to bring their rates down to 3.65% down from 4.25%. This is a large cut from the central bank which looks to bring rates down for 60 basis points. The data out of Europe hasn’t been the greatest for a while and with German Manufacturing PMI seeming to underperform again it seems more action is needed.

Inflation data out of the US will be watched closely with the Consumer Price Index (CPI) year on year forecast to come in at 2.6%. If this data were to be released in line with expectations then the Fed could cut rates by 50 basis points. However, a sticky inflation would prevent this move, with the Fed likely to take a more cautious approach.

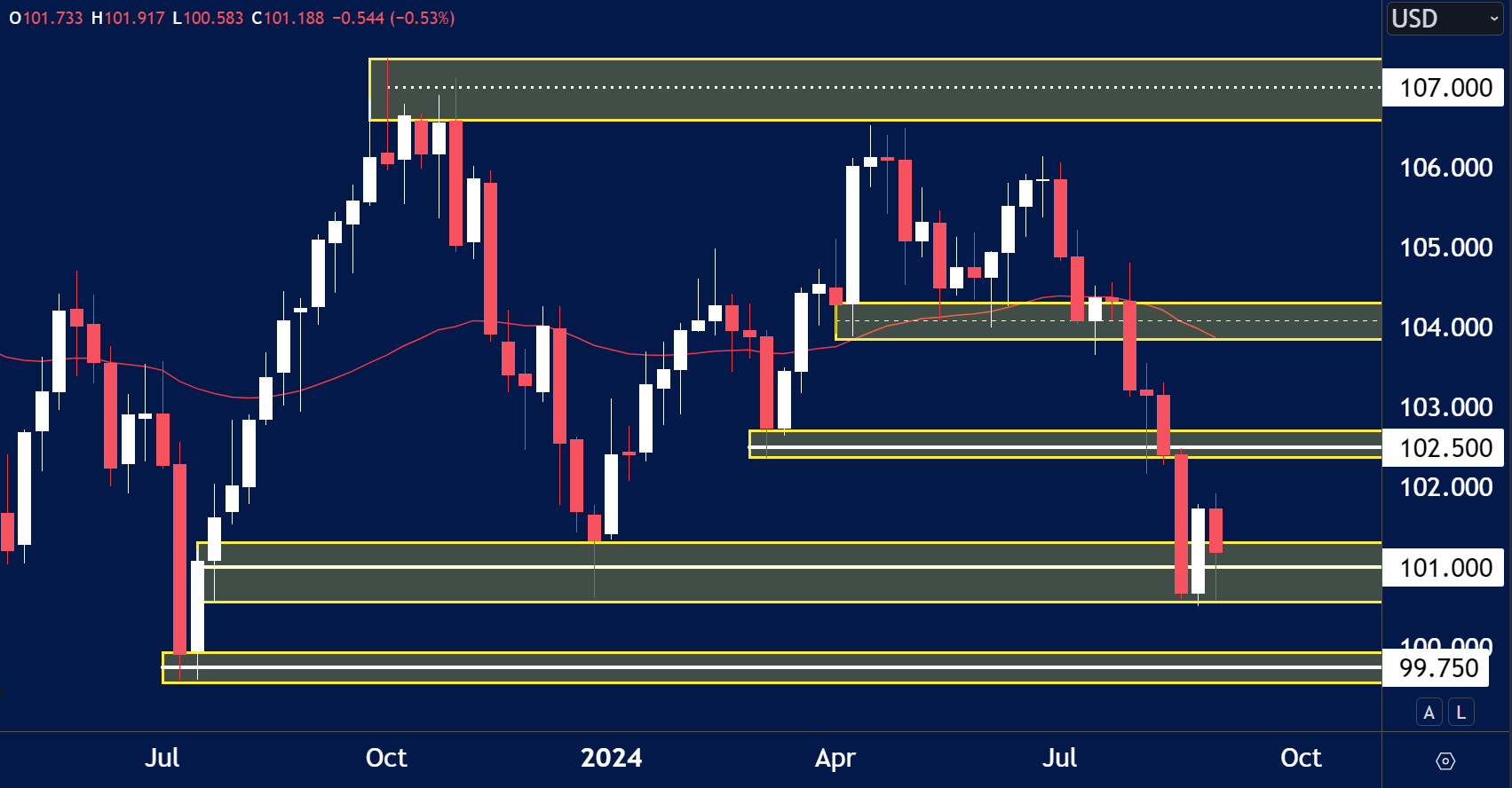

DXY (USD Index)

- The USD remained range bound last week with the price closing above the $101.00 handle.

- We could begin to see a reversal in USD according to the currency strength meter.

VIX Futures

- The VIX rallied and closed bullish last week showing the risk off environment within the market.

- This helped the JPY and CHF continue to gain strength against commodity currencies.

AUD/USD

- The AUD/USD price seems to be forming a bearish head and shoulders pattern on the daily chart with the price now below the neckline support.

- If sentiment remains we could see the price move lower towards the key support of 0.6600.

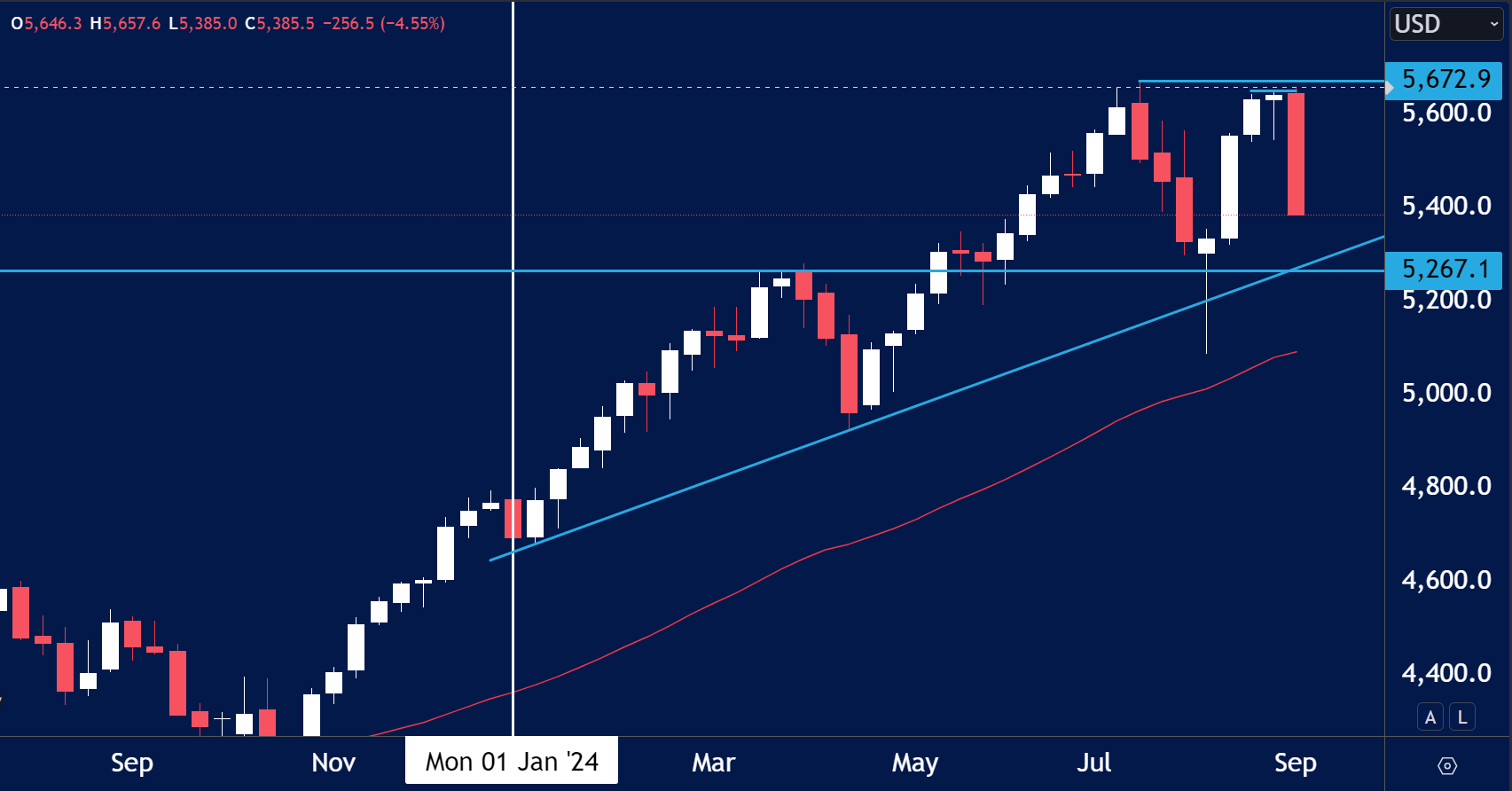

US500 (S&P500)

- US500 closed bearish with the strongest fall of the week for the year.

- Seasonally stock markets are bearish this time of year and if the sentiment remains we could see prices trade towards support.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.