Traders can use the buy-and-hold strategy in forex to capitalize on long-term economic trends, reduce trading costs, and avoid short-term market noise. This approach allows for compound growth over time and aligns with fundamental analysis, minimizing the impact of daily volatility.

This article will discuss everything about the buy and hold trading strategy.

What is the buy and hold strategy?

Buy and hold is a long-term trading/investment strategy in which traders purchase currency pairs and hold them for a long period, such as a few months, years, or even decades. A buy-and-hold strategy aims to gain from heavy market fluctuations toward the uptrend over a long period of time.

Top indicators to use with the buy and hold strategy

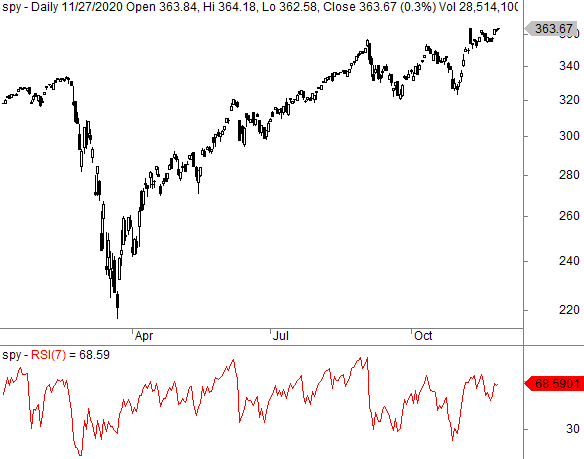

Relative Strength Index (RSI)

The RSI is a momentum oscillator measuring the speed and change of currency pair price movements. It gives values between 0 and 100 to identify overbought and oversold market levels. Traders can use the RSI to identify long-term trends by using longer periods, such as 50 days, to smooth out the RSI.

- Traders can enter a buy and hold order when the RSI consistently trades above 50, suggesting a strong bullish trend.

- Traders can enter a short buy and hold order when the RSI consistently trades below 50, suggesting a bearish momentum.

HODL line

The HODL (hold on for dear life) line focuses on a highly volatile currency pair. It can be used as a trend-following line that helps traders identify market support and resistance levels to maintain the buy and hold strategy.

Traders can use a long-term moving average (MA) line (such as a 200-period SMA) as the HODL line. This line acts like a support level and gives traders a point to keep holding onto a long trade during an uptrend and a short trade during a downtrend with a market continuation expectation. Traders can hold the currency pair as long as the price remains above this moving average for long trades and below this MA for short trades.

- Treat the HODL line as a dynamic support level. As long as the price remains above this line, continue holding the asset.

- Use price crossings below this line as potential signals to re-evaluate or exit if the market's fundamentals have changed.

Fibonacci retracement

Fibonacci retracement levels indicate where a support or resistance level can likely occur in the market, providing traders with entry and exit price levels accordingly. They also help traders identify market reversals. Traders can identify strong support during a pullback by identifying key levels like 3.6%, 38.2%, 50%, 61.8%, and 78.6%. During a bull market, they can enter a long trade during retracements to these levels and vice versa.

- Look for a price break on significant Fibonacci levels within a long-term uptrend. This can be an entry opportunity for long-term positions.

- Look for a price break on significant Fibonacci levels within a long-term downtrend. This can be entry opportunities for long-term, short positions.

How to trade with the buy and hold strategy

Define investment goals

Before traders enter a buy and hold strategy, they must align their goals with the overall financial situation and risk tolerance.

Conduct fundamental analysis

Next, traders must conduct a fundamental analysis that includes evaluating the intrinsic value of any currency pair. It can be done by examining financial statements, economic indicators, and other qualitative factors in the political economy.

Along with GDP growth, employment data, interest rates, and more, traders can also monitor monetary policy changes in the countries in which the traders are trading currencies. A few other things part of the fundamental analysis that the traders should focus on are –

- Examining industry trends, market demand, competition, regulatory environment, and more/

- Considering factors like different country's trade balances, foreign investments, geopolitical stability, and more.

Select appropriate currency pairs

When applying the buy and hold strategy in forex, traders should select an appropriate currency pair with strong historical performance.

The chosen pairs should align with the trader's investment goals while offering long-term growth potential. Major currency pairs are the most suitable for a buy and hold strategy since they have enough liquidity and volatility in the market to sustain in the long run. Traders can also –

- Consider emerging market currencies for higher growth potential, but be mindful of increased volatility and geopolitical risks.

- Select currency pairs with favorable interest rate differentials, as these can lead to positive carry trades.

- Prioritize currencies from countries with stable political and economic environments, as these are less likely to experience drastic devaluations.

Use technical indicators for confirmation

Even though the buy and hold trading strategy strongly depends on fundamental analysis, traders should combine it with technical analysis to confirm long-term trends and entry points.

Technical indicators like moving averages, RSI, Fibonacci retracements, and more can be combined to get appropriate long- and short-term entry points.

Develop a trading plan

Next, the trader creates a comprehensive plan to stay disciplined over the long term and focus on the investment goals even during volatile markets. The trading plan should include details, from position sizing and entry/exit criteria to risk management.

Execute the trade

After developing the trading plan, traders should execute the trade based on their predefined strategy. Traders must ensure that they keep emotions away during this step.

Monitor economic and geopolitical events

Traders must periodically monitor the macroeconomic and geopolitical landscape in the buy and hold trading strategy. This ensures that investment returns are aligned with the goals. Stay abreast of economic releases, sector-specific news, geopolitical events, and more.

Review and adjust positions periodically

Even though the buy and hold strategy focuses on long-term investments, traders must review and adjust their positions periodically. This helps traders stay aligned with changing market conditions.

Balancing long-term growth in forex

The buy and hold strategy minimizes emotional trading by avoiding frequent trades. However, it also exposes traders to market volatility, geopolitical uncertainties, and missed short-term opportunities, requiring patience and discipline. Hence, traders must balance their portfolios to take advantage of both short and long-term opportunities.

Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. As margin FX/CFDs are highly leveraged products, your gains and losses are magnified, and you could lose substantially more than your initial deposit. Investing in margin FX/CFDs does not give you any entitlements or rights to the underlying assets (e.g. the right to receive dividend payments). CFDs carry a high risk of investment loss.