The volatility index (VIX), also known as the fear index, is one of the metrics that traders use to measure market fear, stress, and risks. It is the benchmark that lets traders quantify a market's volatility expectations. A higher VIX means that the level of market fear is quite high. This is why there is a sharp increase in the VIX immediately after a market crash. An increase in VIX reflects a drop in the SP500 prices, indicating the right time to enter the market. Similarly, when VIX falls and SP500 prices increase, it signals traders to sell or exit the market.

What is the volatility index (VIX)?

The volatility index is created by the Chicago Board Options Exchange (CBOE). It is a real-time indicator of measuring predicted price fluctuations in the SP500 index options. It is always derived from the prices of SP500 index options with a short-term expiry date and generate volatility projections for the next 30 days. The VIX is also known as the measure of implied volatility because it predicts price changes instead of statistical analyses of historical trends. The predictions are based on a betting format where experienced traders bet on the expected future performance of foreign securities in the SP500.

Why trade the VIX?

VIX is a popular choice among traders as it helps them analyse different markets, diversify and hedge their portfolios, and speculate on price movements. You can link several instruments like Forex, Share CFDs, Gold and Commodities with VIX. That means that any indication of a market possibly crashing would strengthen the trader's outlook in other markets when trading with VIX. However, if a particular market is booming, it could warn traders of other ones potentially falling. Taking a position on the VIX allows you to balance assets in your portfolio by hedging the market exposure. For example, you have a long position on an asset related to SP500. Even though there are some long-term prospects, you choose to cut down on your exposure to short-term volatility. So, you open a position on VIX. Trading the VIX allows you to balance your assets by covering potential losses to cover short-term profits.

How to trade the VIX?

Many securities are based on CBOE VIX pricing, giving traders the benefit of low and high volatility situations. The easiest way to invest in VIX is through exchange-traded funds (ETFs) based on VIX futures. Traders can buy or sell VIX ETFs like usual stocks. Most traders invest in products with a maturity period of 30 days since VIX ETFs are risky. This means that most traders don’t hold positions in the long term. Here’s how you can trade the VIX:

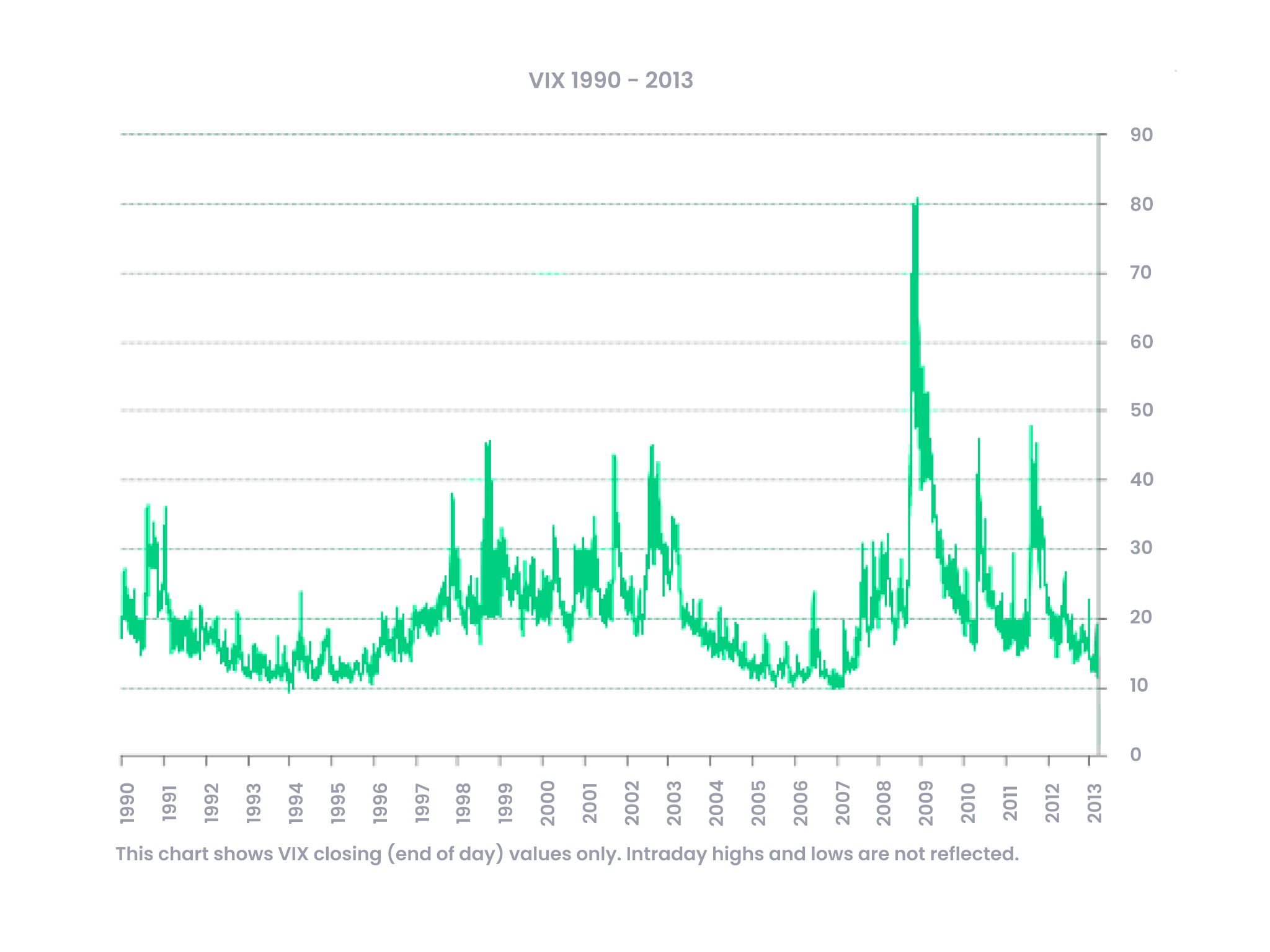

- Learn how VIX works: Learning how VIX works and studying past VIX charts will help you understand the changing prices over the years.

- Decide if you want to go long or short: Going long may be a good move if you believe the VIX will rise. If the VIX is expected to decrease, traders usually take a short position.

- Open an account: You can consider opening a demo account first if you are not confident enough to trade the VIX in a live market.

Take advantage of the market volatility with VIX

The VIX enables you to trade with market volatility and benefit from rising and falling markets. Going long in times of stress and financial instability may result in profit. At the same time, going short in an economically sound and low-interest rate market could prove to be beneficial.

Start trading with a Blueberry account today.

Frequently Asked Questions

What is the Volatility 75 Index?

The volatility 75 index measures the volatility of SP500 securities. A reading above 20 means that the market is fearful, which brings higher volatility. Hence, volatility 75 is often considered a risky and unstable market.

What is the Volatility 10 Index?

The volatility 10 index represents low volatility in the market, which means low VIX. This also shows that there is increased certainty, economic stability, and low investor fear.

How do I find the Volatility Index?

VIX can be calculated in real-time by using the live prices of SP500 futures and options. It expires within 23 and 37 days.

Is a high VIX good or bad?

A high VIX means the volatility in the market is high, which depicts market fear. This can be good if you buy VIX when it is high, then go short as soon as it is low.

What is considered a high VIX?

When the VIX reading is above 20, it is considered a period of high volatility. As soon as the reading crosses 30, the markets are considered at their most elevated fear gauge with an unsettled situation.

Disclaimer:

- All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. Traders should carefully consider their objectives, financial situation, needs, and level of experience before entering into any margined transactions.