The Forex market offers high liquidity and margin opportunities for you to trade and potentially profit off of exchange rates of currencies. With a daily volume of more than $6.6 trillion in 2019, it is the largest financial market in the world.

Forex, also known as foreign exchange trading or FX trading, is defined as the process of changing one currency into another, for various reasons like commerce, tourism, and economic health. It includes a network of buyers and sellers who transfer currencies among each other at an agreed price. If you apply the right trading strategy, you may be able to make Forex trading your full-time profession.

What is Forex?

The Forex market is a worldwide, decentralized marketplace that allows you to trade currencies from different countries. It is open 24/5, and each transaction is done through a global network of financial institutions and banks.

What is Forex trading?

Forex trading is the process of buying or selling a particular currency to gain profit from another. For example, you want to trade EUR for USD, so you sell your base currency of EUR to buy more USD at the exchange rate in the market. The exchange rates for each currency is determined by multiple factors, which is regulated by the country’s government through central banks.

Understanding Forex currency pairs

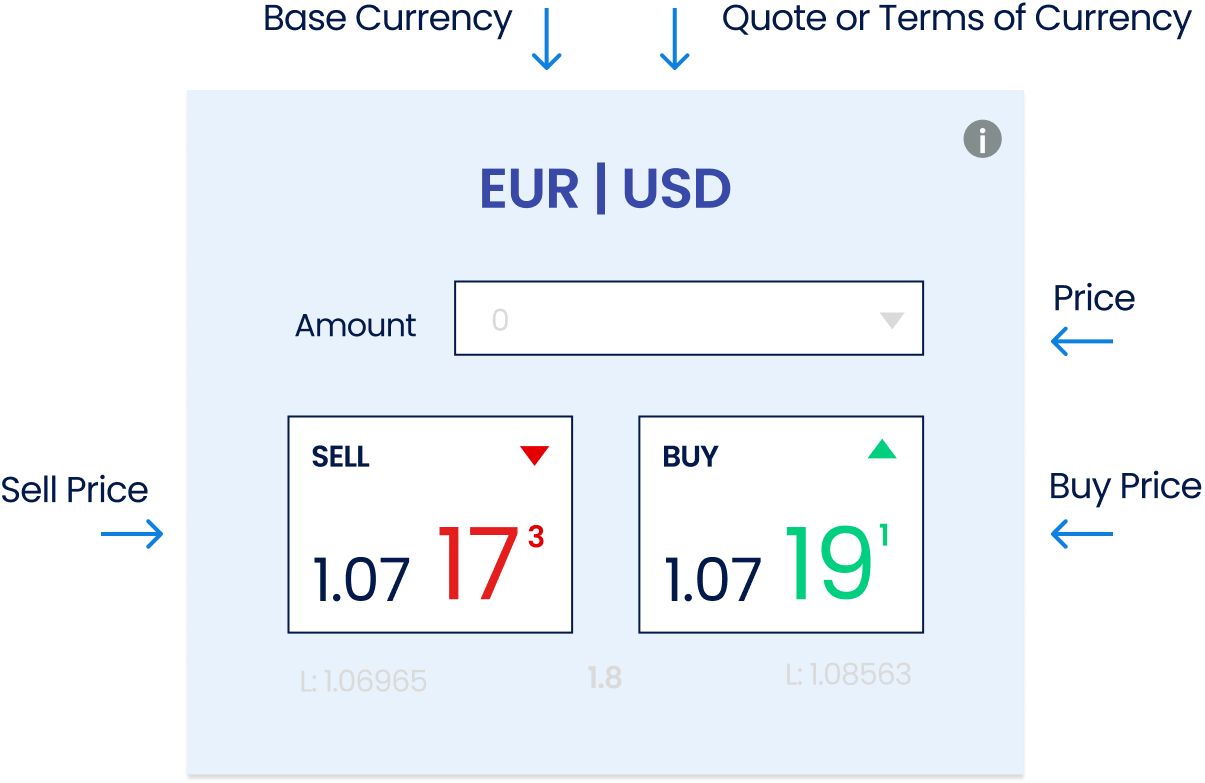

Since currencies are traded in pairs, each transaction includes a quote currency and a base currency.

- The base currency is the sell price and appears on the left side of a currency pair

- The quote currency is the buy price and appears on the right side

- Currency pairs have exchange rates that are based on their bid and ask prices.

- The bid price, also known as buying price, is the amount a broker (buyer) is willing to accept in exchange for a currency or asset.

- The ask price, also known as the offer price, is the amount a trader (seller) is willing to accept in exchange for a currency or asset.

- The difference between the bid price and the ask price of a currency pair is called a spread.

Forex traders buy the base currency and sell the quote currency in exchange. Similarly, you can buy currency pairs from different countries and also sell them in the Forex market. You can also convert them for international investment and trade. For example, the value of EUR as base currency will be quoted against the value of USD as quote currency. This depicts how much USD is needed to purchase 1 EUR.The different types of currency pairs include:

- Major currency pairs: These are responsible for about 80% of Forex trading. They are highly liquid and associated with financially sound and stable economies. The four traditional major currency pairs are EUR/USD, GBP/USD, USD/JPY, and USD/CHF.

- Minor currency pairs: These pairs do not include the US Dollar and are less frequently traded. They are less liquid than the major currency pairs, some examples are EUR/CHF, and GBP/JPY.

- Exotic currency pairs: These currency pairs include a currency from a developing country paired with one of the major currencies. They are less liquid and more volatile. Some of the popular exotic currency pairs are GBP/ZAR and AUD/MXN.

- Regional currency pairs: These pairs are classified according to their particular region. Some examples include EUR/NO, AUD/SGD, and AUD/NZD.

How Forex trading works?

The Forex market is a 24-hour market, offering the opportunity to trade according to different time zones. The market is closed from Friday evening to Sunday evening. The four market sessions are:

- London: 3 AM EST to 12 PM EST

- New York: 8 AM EST to 5 PM EST

- Sydney: 5 PM EST to 2 AM EST

- Tokyo: 7 PM EST to 4 AM EST

Top Forex terminologies you should know

Forex broker

A foreign exchange broker is an individual or a company that sells and buys currency pairs on behalf of the Forex trader. A Forex broker usually acts as a middleman in trading and most charge a fee for their services.

Liquidity

Liquidity in Forex refers to how well a currency pair can be traded in the market without witnessing a drastic change in its exchange rate. The most liquid currencies are the major currencies, which can be bought or sold in significant sizes without much variance in their price level.

Volatility

Volatility in the Forex market is the frequency and the level of change in a currency pair’s value. Volatile markets involve more risk, but experienced traders choose to trade volatile markets as drastic movements may result in potential profits. However, this could also result in significant losses.

Pip

PIP or price in percentage is a unit that measures the movement of a Forex pair. It is the smallest amount by which any currency quote in the Forex market can change. A pip is equal to single-digit movement in the fourth decimal place of any pair. This means that if EUR/USD moves from $1.00061 to $1.00071, it has moved a single PIP.

Spread

The spread is a difference between a currency pair's buying and selling price in the Forex market. Whenever you trade a currency pair, you are given two prices. The first price is the buy price which is used to buy more of the currency pair if you wish to open a long position. The second price is the selling price which is used to sell more of the currency pair when you wish to open a short position. The difference between these two prices is the Forex spread.

Lot

Currency pairs are traded in lots, which can also be called batches. A lot refers to how many currency units are being offered for sale or are available for purchase. Lots can vary in size; a nano lot is 100 units of a base currency, a micro lot is 1,000 units, a mini lot is 10,000 units, and a standard lot is 100,000 units.

Leverage

Leverage in Forex refers to gaining a larger market exposure without investing the entire trade value in the market. You only have to deposit a percentage of the total trade value to hold positions with leverage.

Margin

Margin is related to leverage in a sense that it is your initial deposit to open a leveraged position. The margin requirement depends on your Forex broker and can change anytime. For example, your broker’s margin requirement is 10% to hold a $10,000 position. This means that you only have to deposit $1,000 (10% of 10,000) to open a position.

Long position

A long position is an executed trade where you buy more of the currency pair, expecting it to increase in value. A trader going long on a currency pair that increases in value may earn profits.

Short position

A short position is a trade execution when a trader sells the currency pair, expecting it to decrease in value. A trader going short on a currency pair that decreases in value may earn profits.

Order types

There are mainly two types of orders in a Forex market: a market order and a limit order. A market order is when you buy a currency pair at its prevailing market price. A limit order is executed by your broker once the market price reaches a specified level.

Stop loss

Stop-loss is a function that brokers offer to mitigate losses of their traders, especially during volatile market situations. They allow you to set a stop-loss level which can be triggered if the market does not move in your favor.

How to trade Forex: Steps to make your first trade in Forex

- Open a trading account and select a currency pair

The first thing to do is to create a trading account with a Forex broker you can trust. Next, research and decide on which currency pair you want to trade. - Analyze both currency’s market and economy

Once you have decided the currency pair you want to trade, conduct proper research about it. You can look at the currency pair’s historical and current charts, monitor the economic and political situation of their respective countries, and keep a close eye on all economic announcements. - Develop a trading plan

After studying your desired currency pair, you can move forward with reading the currency pair’s bid and ask prices. From then, devise a trading plan which includes identifying entry and exit points, order types, lot sizes, and risk management. Test your trading plan with a demo account first. - Open a long or short position

Once you are satisfied with your trading strategy, it is time to open a position in the live market. Remember to keep an eye on your trades as the market can experience changes that may or may not be in your favor. You may also factor in how long you plan on holding your position. If you are a short-term trader, you may need to check your trades multiple times a day as small price movements may affect your trades. Alternatively, long-term traders may check their trades once a day or in weekly intervals as they aim to earn profits from significant market movements as opposed to minute price changes.

Start Forex trading with Blueberry

Forex trading never comes without risk, especially for beginners. However, with proper research, determination, and trading psychology, you can turn Forex trading from an alternative income source to a full-time profession. Blueberry is a reputable Forex broker that provides traders with everything they need to begin forex trading.