Currencycloud: Bank Transfer Solution for Global Clients

Bank wire deposits and withdrawals are transacted via Currencycloud (United Kingdom Financial Conduct Authority registration number 900199).

E-money licenses in the United Kingdom are considered among the best in the world and a benchmark for other countries looking to establish their own regulatory frameworks. Their reputation is based on the FCA rules for e-money license holders covering capital requirements, consumer protection, anti-money laundering, and data protection. These strict FCA standards make UK e-money license holders highly reputable and trustworthy. Currencycloud’s license information can be found here.

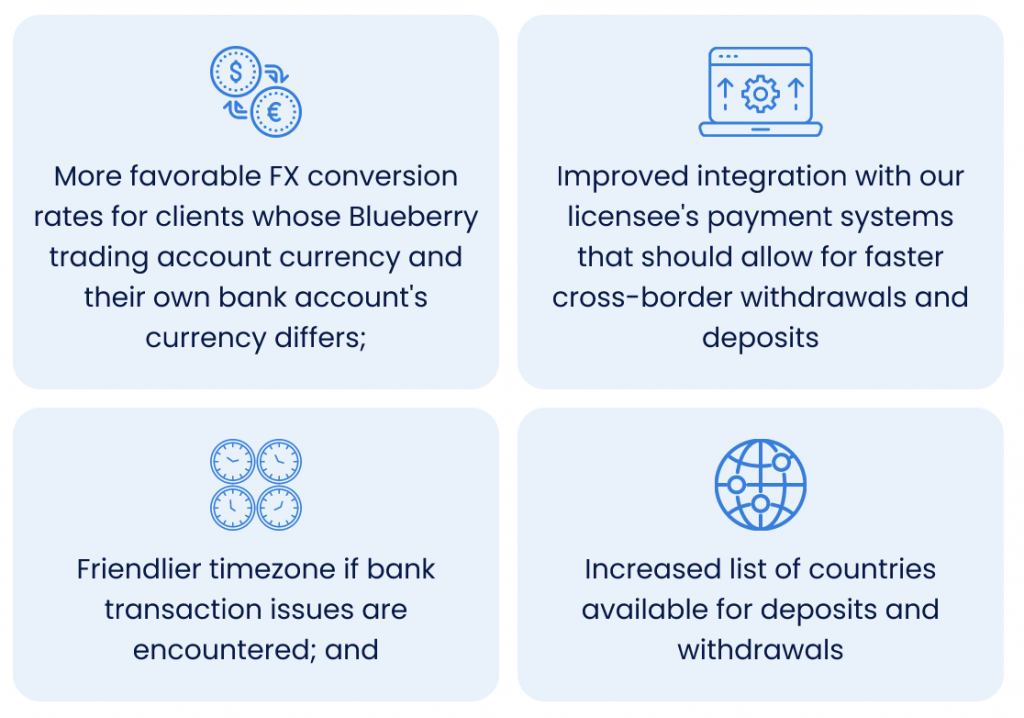

With this in mind and Blueberry Markets’ focus on clients, we achieve the following:

What this means for you

If you use bank wire for your account deposits, you will use Blueberry Markets’ accounts via Currencycloud. Step-by-step instructions can be found here.

Frequently Asked Questions

- Why are you using Currencycloud?

We aim to deliver faster & more efficient withdrawals & deposits for our global customers. CurrencyCloud helps us achieve this through improved integration and friendlier time zones. - Do I have the option to deposit and withdraw through an Australian bank?

No. Blueberry Markets is regulated by the VFSC and does not have any Australian bank accounts to facilitate deposits. - Are there any fees associated with depositing and withdrawing through Currencycloud?

If you experience any deposit fees, we will gladly cover them.

We also don’t charge withdrawal fees, although your bank or intermediary may charge fees. There may also be conversion fees if you withdraw to a different currency. - How long will the withdrawals take?

We process withdrawal requests within 24 hours on business days. How long it will take to receive the funds depends on your financial institution; however, it is usually faster due to improved integration and friendlier time zones for most of our current global clients. - How can I ensure my funds are safe with this financial institution?

Currencycloud has an e-money license (#900199) in the UK through the FCA, which ensures that they comply with strict regulations and safeguards to protect your funds. The e-money licenses in the UK are considered a benchmark for other countries trying to establish their regulatory frameworks. - What happens if your financial institution goes bankrupt?

FSCS protection for banks, building societies and credit unions is up to £85,000 per person per banking licence. This means that if money is spread across the banking sector, yet the firms share a banking licence, the FSCS can only protect up to £85,000. In the case of a corporate or client trust bank account, that account is protected only up to £85,000. This does not cover FCA-regulated e-money licensed companies such as Currencycloud. More information can be found here. - How is my personal information protected?

We take the protection of your personal information very seriously. Please refer to our Privacy Policy regarding how we safeguard your personal information. - What currencies are supported?

To this date, there are 35+ currencies available, including the base currencies we offer for trading accounts with Blueberry Markets.

Some currencies are restricted and can’t be funded directly; if you’re transferring a restricted currency, you must convert to a supported currency before transferring. Please visit this page for further information. - Are there any restricted countries?

Currencycloud supports payments to and from 180 countries. Listed here are the countries NOT supported by Currencycloud.

Please note that we may have a restricted currency from an allowed country, such as PHP in the Philippines. In these cases, the funds must be exchanged first and sent in a supported currency.

ภาษาไทย

ภาษาไทย

Tiếng Việt

Tiếng Việt