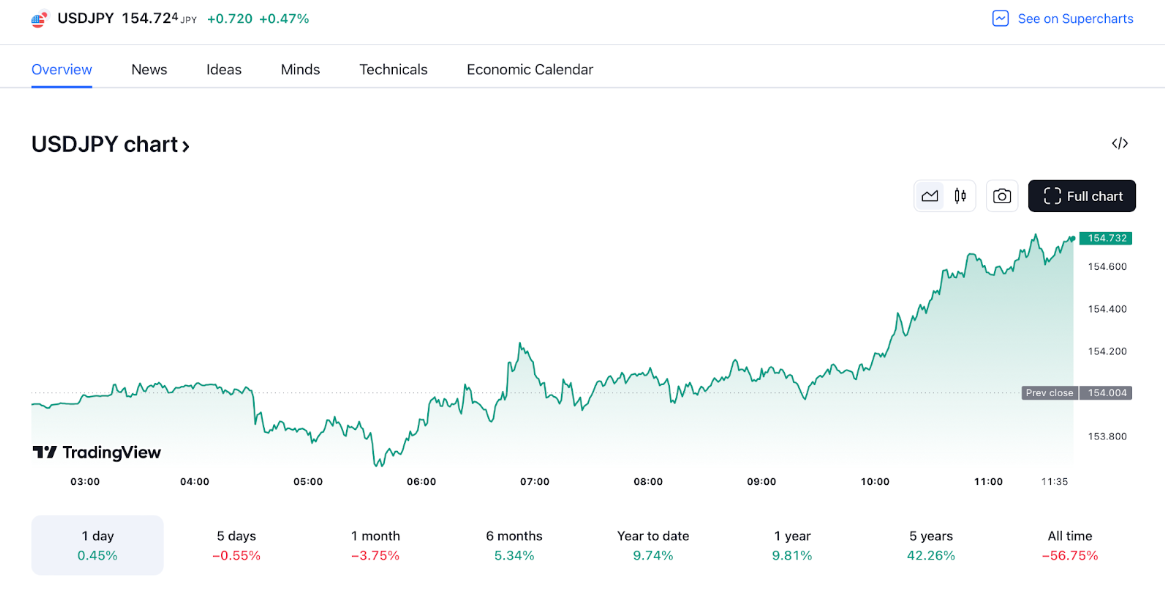

Summary: USD was steady in the last week of July as traders waited for policy decisions by the Federal Reserve, Bank of Japan, and Bank of England. The Yen remained stable after July's third week of a strong rally. This was driven by speculation of a possible BOJ interest rate hike. The Pound and Australian Dollar showed minor fluctuations, while USD/JPY was up by 0.13%.

Key points:

- The Dollar has been stable recently, while the Yen has risen due to interest rate expectations

- The FOMC is expected to maintain rates this week, but the rates might get lowered in the next meeting

- There is a possibility of a dovish hike by the Bank of Japan (BOJ) this week, limiting Yen's appreciation even with US rate cuts

Market impact

Yen's continued strength

Yen's recent surge due to interest rate hike speculation could continue in the short term, impacting other currencies like the Euro and the Dollar. This is because a potential BOJ rate hike would increase the relative attractiveness of holding Yen compared to other currencies with stagnant or declining interest rates.

Potential Fed rate cut

The expected Fed rate cut in September 2024 could weaken the Dollar against currencies with potentially rising interest rates, such as the Yen. A lower Fed rate reduces the incentive to hold Dollars, making USD less attractive to investors seeking higher returns.

Conversely, a potential BOJ rate hike could increase the relative yield differential between Yen and Dollar, accelerating the Dollar's weakening. Despite the potential narrowing of US-Japan yield differentials, the carry trade advantage for Yen is likely to remain substantial in the next two months.

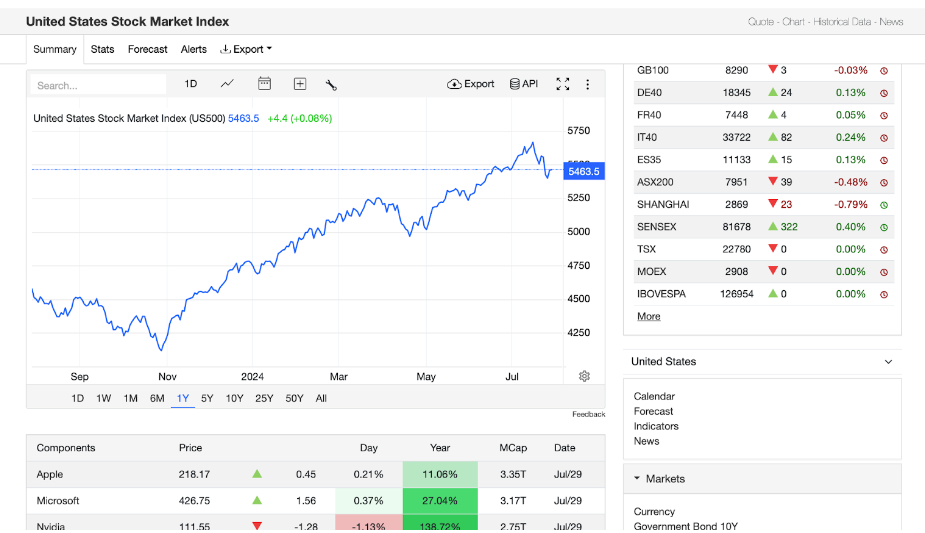

Focus on US equities

If US equities remain volatile, this could lead to increased demand for less risky currencies like the Yen, which can raise the Yen's value. Conversely, if US equities stabilize and market confidence improves, the demand for less risky currencies might decrease, potentially putting downward pressure on the Yen.

Future outlook

- Pound Sterling under pressure: The Bank of England's meeting on Thursday is closely watched. A potential rate cut or dovish stance could weaken the Pound Sterling further, especially if the UK's economic outlook deteriorates

- AUD in downtrend: The falling USD could lead to a decline in commodity prices or increased global economic uncertainty, putting downward pressure on the Australian Dollar

- Potential for currency bloc formation: As global economic and political landscapes evolve, there might be a growing inclination towards currency bloc formation or increased cooperation among nations. This could significantly impact the dynamics of the foreign exchange market and the USD

- USD vs Bitcoin: The potential for a stronger US Dollar due to factors like interest rate hikes could negatively impact Bitcoin and other cryptocurrencies, as BTC often moves inversely to the Dollar

Insights for traders

Increased volatility

The first week of August is packed with central bank meetings (Fed, BOJ, BOE) and the US employment report on Friday. This concentration of events can create significant price swings in the coming days. Be prepared for high volatility across currency pairs.

Yen's potential correction

The Yen (USD/JPY) has recently experienced a strong rally, currently trading at 153.995. However, Win Thin from Brown Brothers Harriman cautions about further upside momentum. Monitor for any signs of a reversal, especially if BOJ interest rate hike expectations weaken or economic data disappoints.

USDX movement to depends on the Fed

The Dollar Index (USDX) is currently at 104.56, showing slight gains. However, with expected rate cuts in September, the Dollar could weaken further in the short term.

Insights for investors

Impact of US earnings season

The upcoming earnings season, featuring major tech companies, is likely to impact market sentiment. Positive earnings reports could boost investor confidence and lead to a rally in US equities. Conversely, negative results could trigger exits in USD and increase holdings in less risky currencies like the Yen.

Global economic outlook

While the focus is on the US and Japan, the broader global economic picture is crucial in the long term. Factors like the Eurozone's economic health, China's economic trajectory, and emerging market trends can significantly impact USD values. Investors should monitor these developments.

Conclusion

Currency markets are on hold as investors wait for multiple central bank decisions in July. The Yen's recent rally due to potential BOJ rate hikes could be short-lived, with a focus on US equities impacting overall market sentiment. The Dollar is predicted to weaken amidst rate-cut speculations and reduced carry trade opportunities. Traders are cautious ahead of these events, with volatility expected in the coming days.

Forecasts and predictions about future performance are inherently uncertain and speculative in nature. While every effort has been made to provide accurate and reliable information, there is no guarantee that the events or outcomes discussed will occur as forecasted. Past performance is not indicative of future results.

Trade smarter with low spreads and lightning-fast executions. Open a live account today and experience unparalleled support from our dedicated customer service team. Blueberry is here to help every step of the way!

Trade Now Open a Demo Account