The Forex Market Wrap is here!

Watch the video to learn what key levels have been hit this week!

USD Index

The USD had a mixed week despite positive news from the Fed. Earlier this week the Federal Reserve left rates unchanged however they mentioned that they could start to taper and it complete by early next year. This is a switch from their previous stance at Jackson Hole where Chairman Powell played down the taper due to Covid risks.

Looking at the USD Index chart we can see that the price has rejected the previous swing highs where selling pressure was before. If this continues we could see another move lower for the USD.

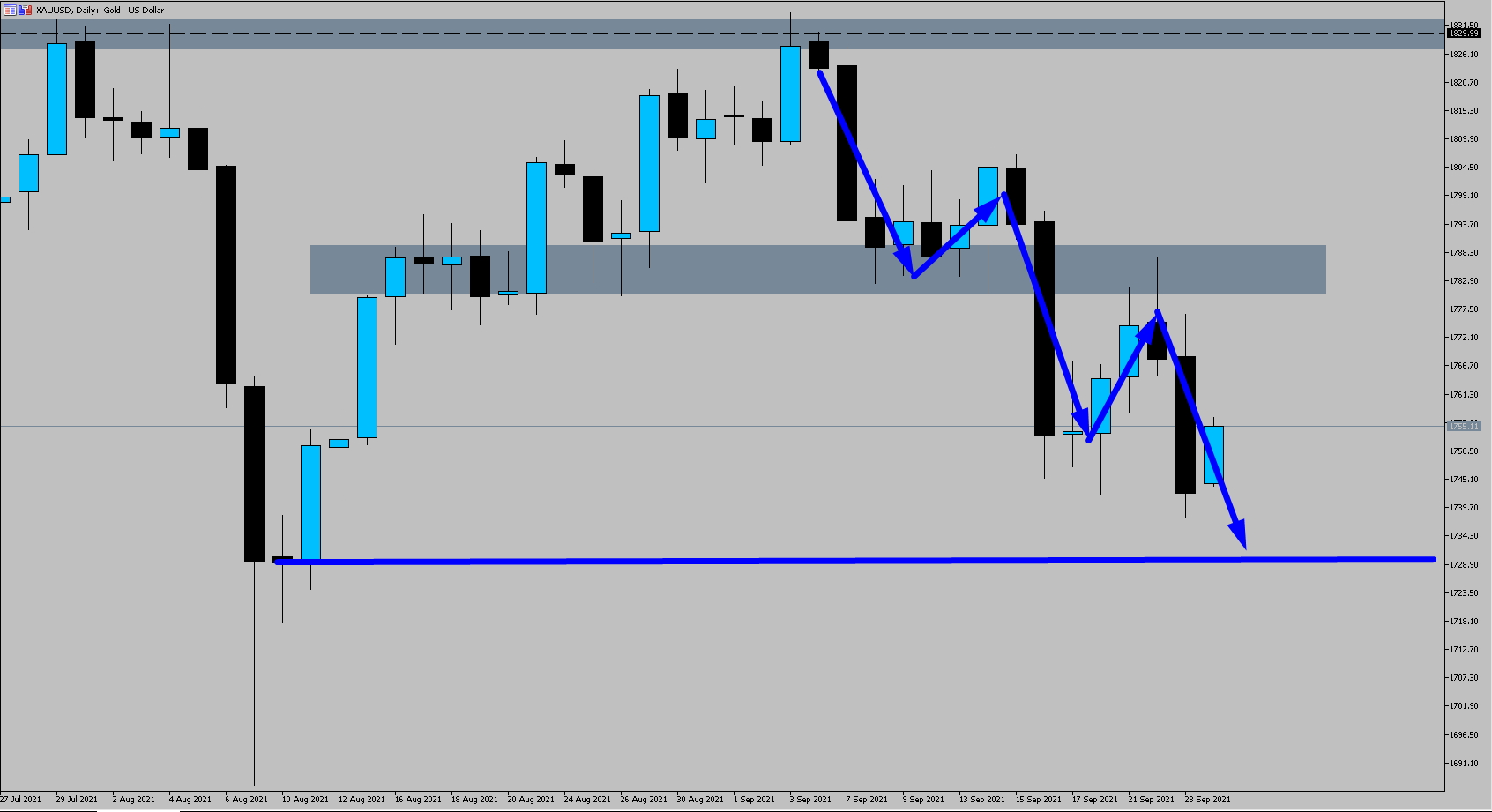

GOLD

In our previous video this week on Gold we discussed two trading opportunities. One opportunity was a long back to resistance on the lower time frames before looking for the daily downtrend to continue. We looked at the short on the daily time frame which made it back to the lows and looks likely to continue to the major support around $1730.00.

AUDJPY

The price of AUDJPY is interesting to us due to a number of factors. Firstly, the Commitment of Trader reports show that commercials have increased their long positions to levels mid pandemic where we saw a significant decrease in the price. Following those long positions, prices rallied significantly higher. This could happen again as long contracts are at similar levels and price is at major support.

The weekly close is looking bullish here suggests we could be forming a higher low, this could lead to a move back to the major swing highs.

GBPUSD

The Bank of England this week surprised a few investors when they announced they could begin to hike interest rates before March 2022 if they need to. This was seen as a Hawkish comment from the central bank and sparked life back into sterling after a recent decline.

Looking at the market we can see that price has rejected the range lows and has formed a change of trend on the 4hr time frame. This could lead to a rally through next week if the price forms a bullish rejection of the previous swing highs.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you from your quick account setup to any future concerns. Start trading with Blueberry Markets today.

ภาษาไทย

ภาษาไทย

Tiếng Việt

Tiếng Việt