The markets are awash with red as traders and investors brace themselves for a market correction.

In the video I’m going to show some reasons why we are seeing this correction and where as traders we could position ourselves.

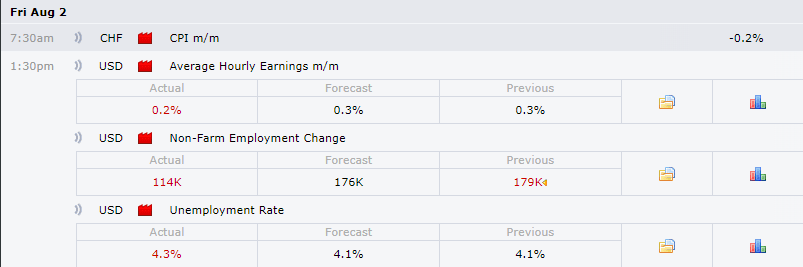

US Employment Slumps

Recession fears are growing in the US after the jobs report on Friday. Where we saw a significant drop in the amount of jobs that were created in July. The unemployment rate rose to 4.3% a 0.2% jump from last month. This was partly due to hurricanes in the US and the impacts of higher interest rates.

Labour market concerns have market pricing in the chance of a 50 basis points move in September rather than 25 basis points.

This is a significant shift in sentiment within the market. Notably the S&P500 is 8% down from the highs and down 6 percent in August alone.

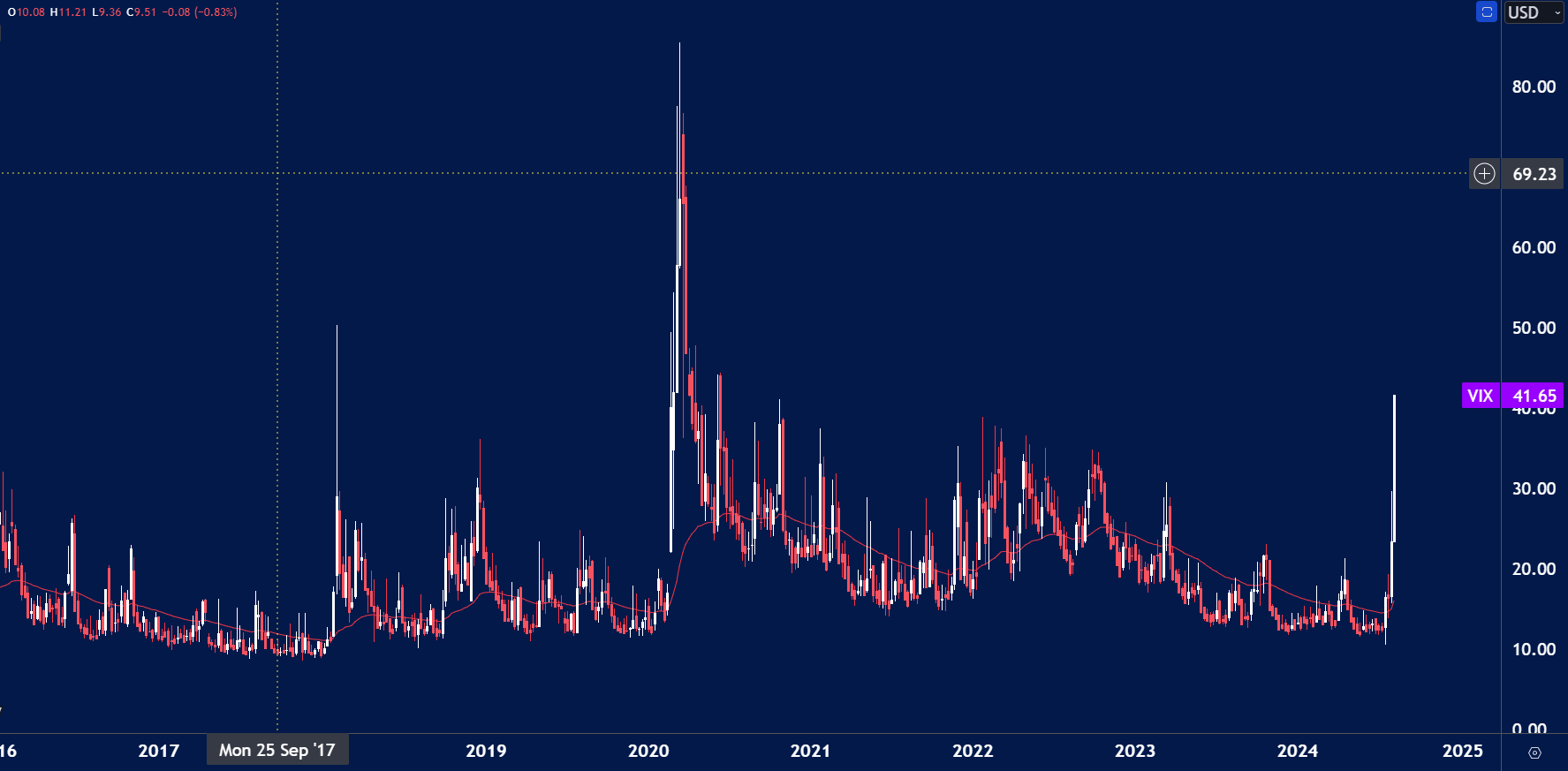

Fear Index

The volatility index (VIX) or the fear index has reached similar levels to that of march 2020, a rise above these levels could trigger further declines in indices.

Bloomberg is reporting that traders are pricing in a 60% probability that the Fed will emergency cut this week! Again adding fuel to the fire of ‘fear’.

Another story being thrown around is that Berkshire Hathaway's Warren Buffet has liquidated a significant amount of Apple shares, however he still holds a large stake in Apple. But this could help drive the fear trade right now.

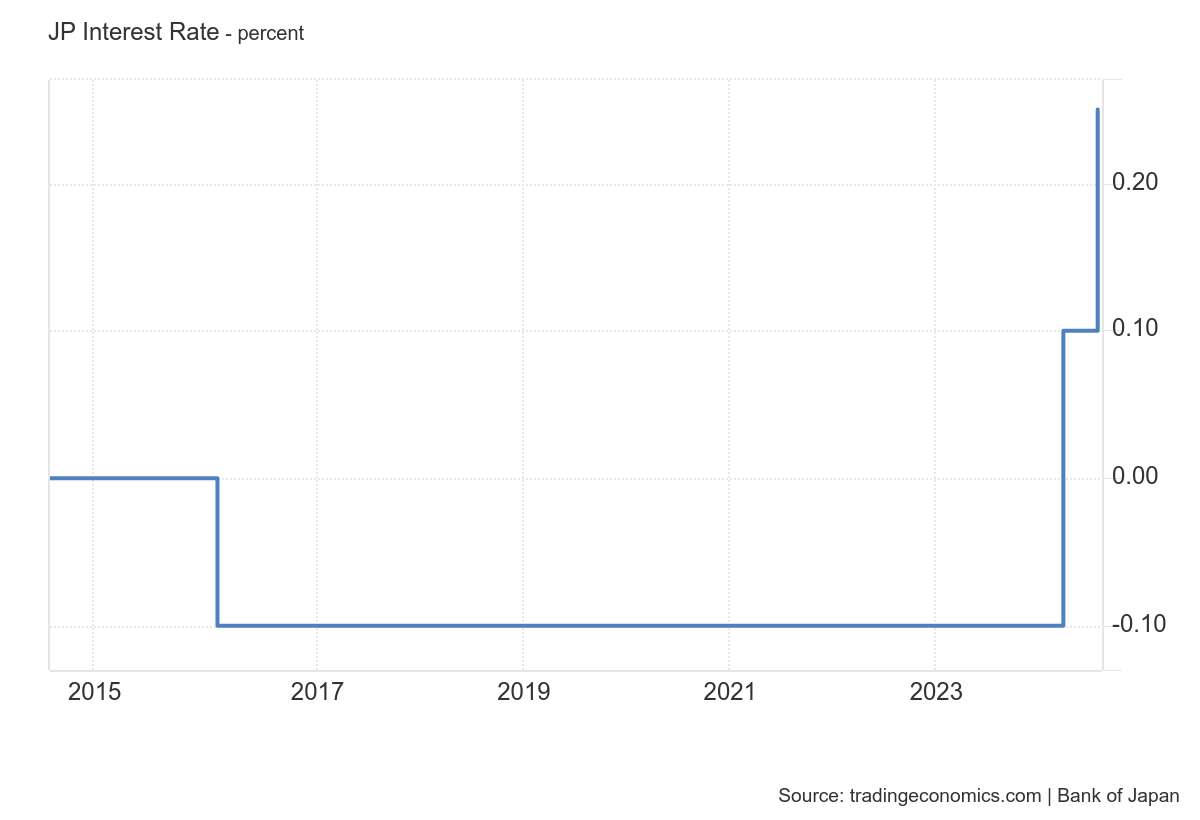

BoJ Hikes Rates

In Japan we’ve arguably seen a hawkish shift for the first time in a very long time. The Bank of Japan hiked interest rates to 0.25% last week causing the market to move away from the carry trade. The Nikkei was down over 12%.

War

We also have the potential for war between Iran and Israel after Israel targeted and killed the leader of Hamas in Iran which Iran has said was a ‘Big Mistake’. This is being felt in the oil markets as they have erased this year's gains.

Risk Sentiment

Risk assets have been beaten to the ground with Bitcoin in particular reaching the $50k level this is a decline of over 20%.

The market is very much in risk off mode, this is something we have covered for a while in terms of buying JPY, CHF and Gold.

This is reflected on the currency strength meter as well, with AUD and NZD being the worst impacted.

What Next?

Will this change? Yes it will, but is that this week? I’m not so sure, I think the risk off is still in play until the VIX shows signs of slowing down, this means I still like the yen, Swiss franc and gold in the near term.

We also have to consider what’s changed in the world or stocks, nothing really, which means we could see a rebound as earnings have been ok of late especially from NVIDIA. This could be the levels that traders and investors have been waiting for to get discounted prices.

US ISM Services PMI coming up will be interesting! A number lower than 50 will compound the move! If we see a number above 50 then we may see some calm in these rocky waters.

Have you watched our latest video update? You can see it here.

Enjoy low spreads and quick trade executions with a live account. Our highly committed customer support team will assist you with your quick account setup for any future concerns. Start trading with Blueberry.

Trade smarter with low spreads and lightning-fast executions. Open a live account today and experience unparalleled support from our dedicated customer service team. Blueberry is here to help every step of the way!

Trade Now Open a Demo Account