Markets are gearing up for a busy week, with a spotlight on US-China trade tensions and a flood of earnings from tech heavyweights like Apple, Microsoft, Amazon, and Meta. In the US, the first read on Q1 GDP could show a sharp slowdown, while fresh data on jobs, inflation, and manufacturing will also grab attention. Overseas, investors will be watching Eurozone GDP and inflation updates, China's latest PMI numbers, and inflation data out of Australia, with the Bank of Japan expected to hold steady on rates.

Forecast for April 28, 2025

EURUSD Outlook

EURUSD closed last week on a bearish note, slipping back below the key resistance zone around 1.1450. Looking ahead, US data could play a major role in the next move. Consumer confidence is expected to soften, alongside weaker GDP growth, employment numbers, and the PCE price index. If these reports disappoint, it could weigh on the dollar and open the door for a fresh break higher in EURUSD. On the flip side, if the market shrugs off the data or reacts positively, we could see further downside in the pair.

AUDUSD Outlook

AUDUSD remains under pressure, trading below the important 0.6400 mark. However, there are signs that sentiment could turn. Positive Chinese data is generally good news for the Australian dollar, and a pickup in Australian CPI which is expected to rise from 0.2% to 0.8%, could help keep the RBA cautious about cutting rates. A breakout above 0.6400 and the nearby resistance trendline would hint at improving risk appetite. Progress in US-China trade talks would be another big plus for AUDUSD.

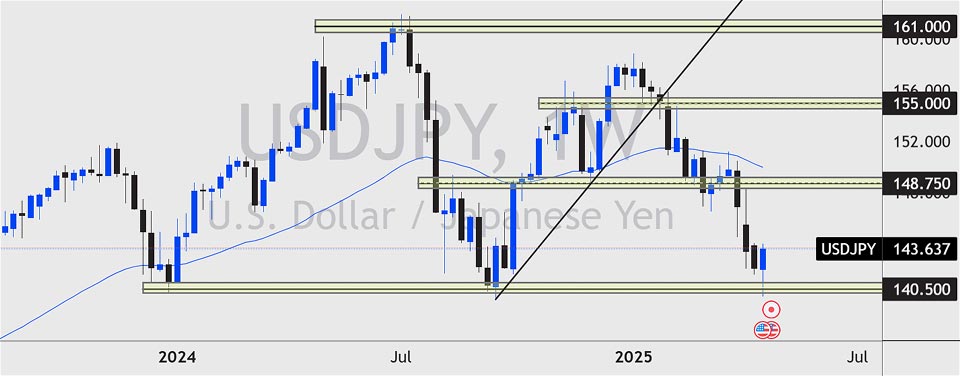

USDJPY Outlook

Tokyo’s core CPI surprised to the upside at 3.4%, above forecasts of 3.2%, which could strengthen the case for a BOJ rate hike. However, USDJPY didn’t react in the way some might expect. The pair actually pushed higher, finding strong support at the 140.50 level and riding a wave of improved risk sentiment, helped by a falling VIX. For now, the path of least resistance may be to the upside, but ongoing uncertainty around US-China trade tensions remains a risk that could weigh on the pair.

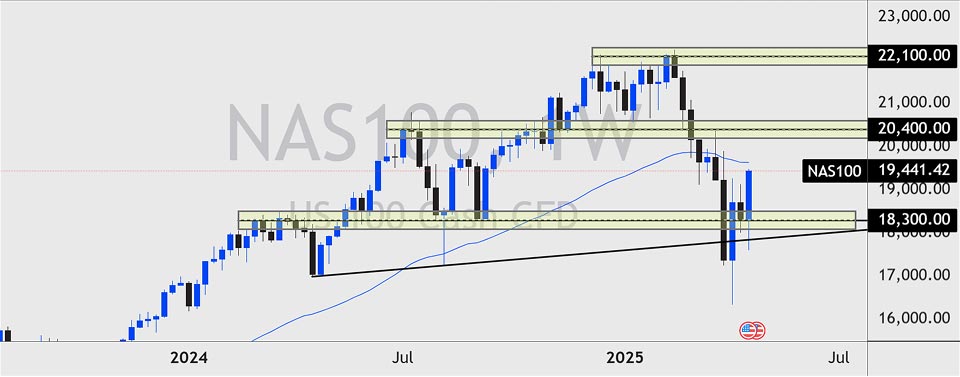

NASDAQ 100 Outlook

The NASDAQ 100 finished last week on a bullish footing as market sentiment shifted more positive. Even though no trade deals have been finalized, investors seem eager to reward any progress on negotiations. This week’s big tech earnings and a packed economic calendar could test that optimism. If results beat expectations, the rally could continue, but any disappointments could quickly cool the momentum.

Trade smarter with low spreads and lightning-fast executions. Open a live account today and experience unparalleled support from our dedicated customer service team. Blueberry is here to help every step of the way!

Trade Now Open a Demo Account