Heading into a new trading week, the forex markets are gearing up for some interesting moves. This week will observe key developments from the UK, United States, Australia and Japan. We also edge ever closer to the April 2nd tariffs on Canada and Mexico by the US.

Forecast for March 24, 2025

Key events to watch includes:

Monday: United States Services PMI data is forecast to come in higher at 51.2.

Tuesday: Attention will turn to US Consumer Confidence data which is forecast to fall once again. Could this compound the US stock market weakness?

Wednesday: In the UK we see the release of CPI as well as the spring statement from the UK government. In Australia CPI y/y is forecast to remain unchanged.

Thursday: Traders will be eager to see if CPI in Tokyo has moved higher, as they gauge the future rates decision out of the Bank of Japan.

Friday: Retail sales out of the UK is forecast to fall sharply, suggesting consumer sentiment if beginning to shift.

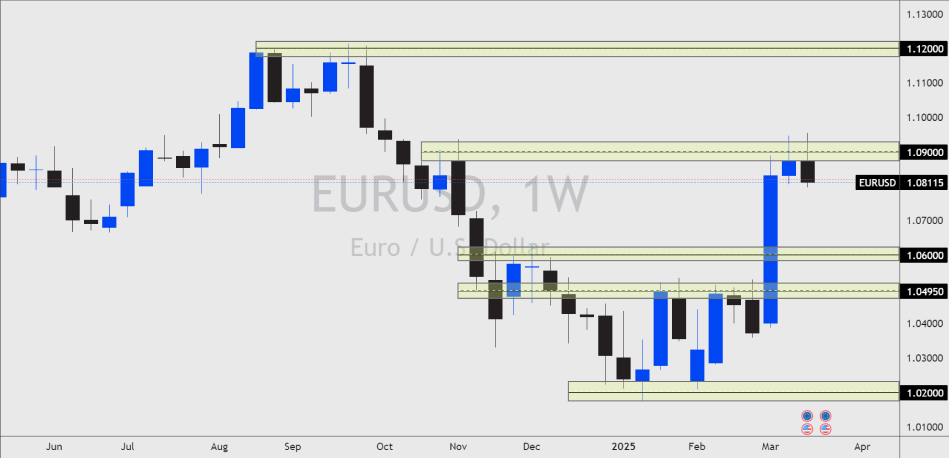

EURUSD Outlook

The price of EURUSD is trading below the resistance of 1.0900 as we saw a return of USD strength last week. Traders will be watching the German manufacturing and services PMI’s at the beginning of the week, both forecasted to grow slightly. If the USD strengthens this week then the price may move lower to re-test 1.0700. A break above 1.0900 would be a statement of interest for the EURO. The latest commitment of trader reports show an incredible 300% increase in long positioning by hedge funds on the EURO.

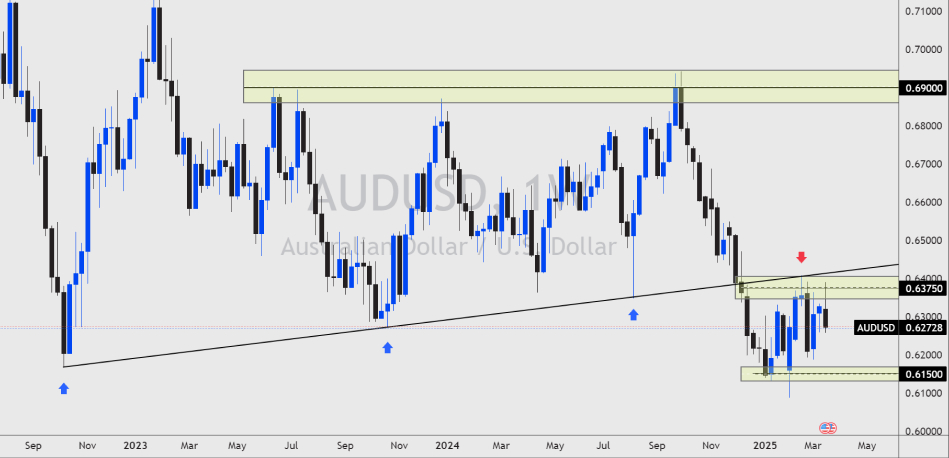

AUDUSD Outlook

The consumer price index y/y is forecast to remain unchanged in Australia at 2.5%. The RBA in their previous meeting talked of needing to see inflation ‘comfortably’ below 3% in order to change interest rates. If this reading rises or comes in unchanged then a rate cut from the central bank will look very unlikely. The CoT reports show hedge funds continue to sell the Australian dollar, which could suggest more downside is likely in the near term. The AUDUSD price rejected the previous weekly highs of 0.6375, this could show us momentum is bearish, and the price could head towards the lows of 0.6150.

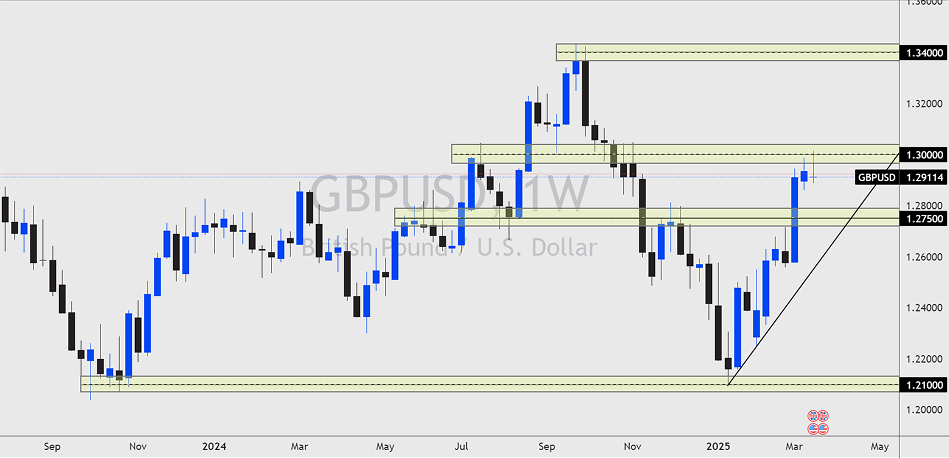

GBPUSD Outlook

The price of GBPUSD could come under some pressure this week as the labour government is to announce further spending cuts and possible tax rises. This could further impact the growth forecasts in the United Kingdom with GDP last week turning negative. To compound this potential weak data, retail sales on Friday is forecast to fall to -0.3% down from 1.7% the previous month. Are consumers in the UK beginning to show frailty? If this continues, maybe we will see a decline in inflation after all.

SILVER Outlook

The Silver price retraced slightly last week after finding resistance at $34.00. However, the upward trend remains, and the price is now testing the previous daily highs around $33.00. If the price rallied from here we could expect a retest of the highs, and perhaps a break towards $34.50.

Trade smarter with low spreads and lightning-fast executions. Open a live account today and experience unparalleled support from our dedicated customer service team. Blueberry is here to help every step of the way!

Trade Now Open a Demo Account