Forex Trading Week Ahead: 2nd September

Another week of high impact data greets us this trading week. From Central Bank announcements to important labor market data out of the US, it’s gearing up to be an interesting one.

Over the weekend China’s manufacturing PMI suffered another setback, contracting for the fourth straight month. The official NBS Manufacturing PMI fell to 49.1 in August vs 49.4 prior. This isn’t new to the market but could have a negative knock on effect with the Australian and New Zealand dollar in the early stages of this week.

All the attention will be back on the USD as we get the last Non-Farm Payroll reports before the September 18th FOMC meeting. In Jackson Hole the Federal Reserve Chairman Jerome Powell signaled cuts will be coming, but the pace will be dictated by the upcoming data. A sharp reduction in jobs created in August and a sharp rise of the unemployment rate could bring a 50 basis point cut. However, it’s important to note, the NFP data has held a strong correlation with its seasonal average over the past 20 years. Typically this time of year we can begin to see a rise in the jobs created, as the summer months roles are added.

Across the border into Canada, the central bank is forecast to cut interest rates by 25 basis points. This will bring rates down for a third consecutive time, with the rate expected to reach 4.25%. GDP in Canada grew by 0.5% in the second quarter of 2024.

DXY (USD Index)

- The USD rebounded from the $101.00 level of weekly support. Strong NFP data this week could help the USD recover towards resistance of $102.50.

- A poor NFP release could fuel speculation of a 50 basis point cut by the Fed which in the near term would be negative USD.

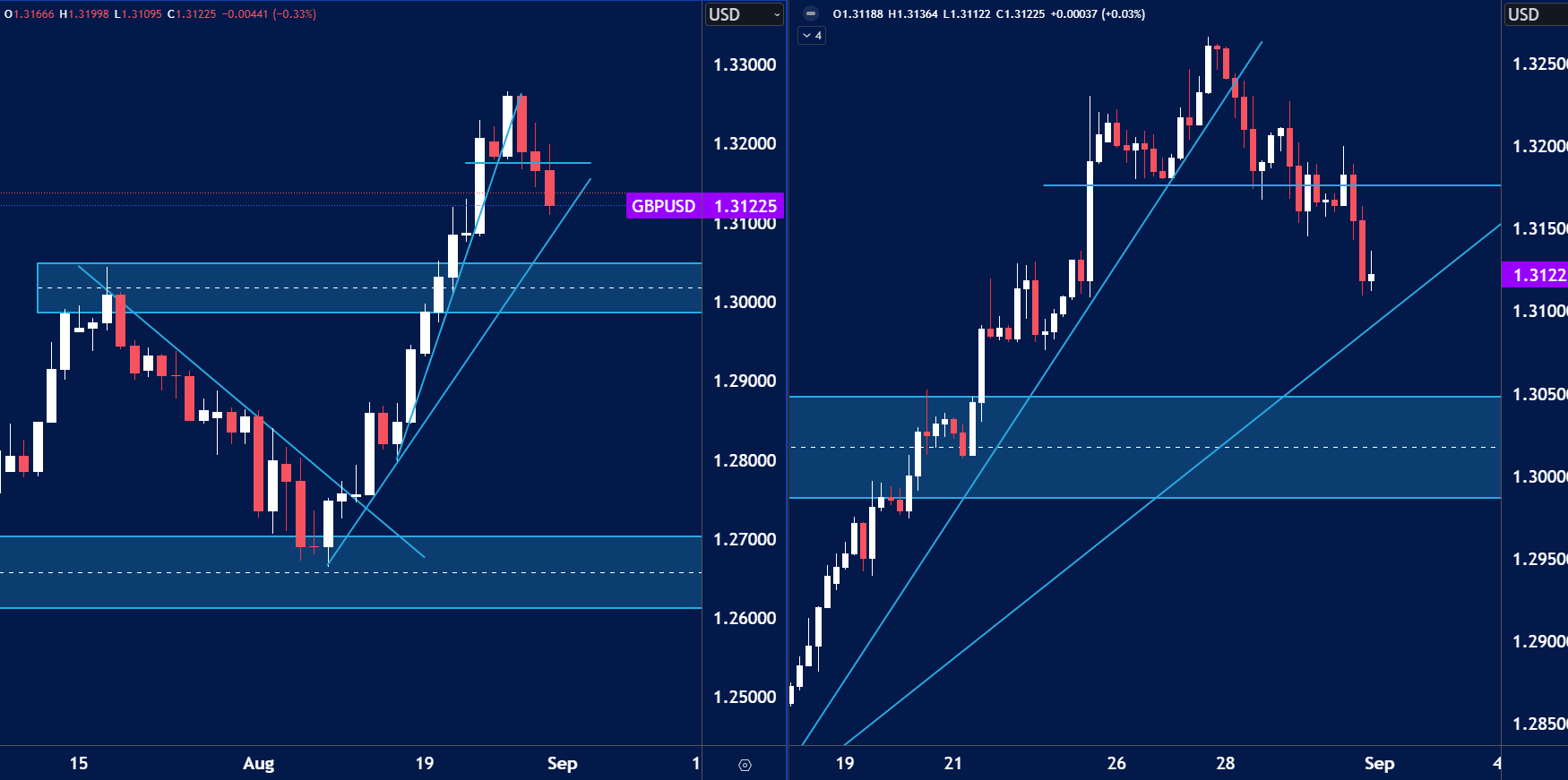

GBP/USD

- The GBP/USD price gave back some if its recent gains closing towards the 1.3100 handle.

- Seasonally the British Pound can be bearish through this period and if we were to follow the seasonal pattern, we could see a push back towards support held at 1.3000.

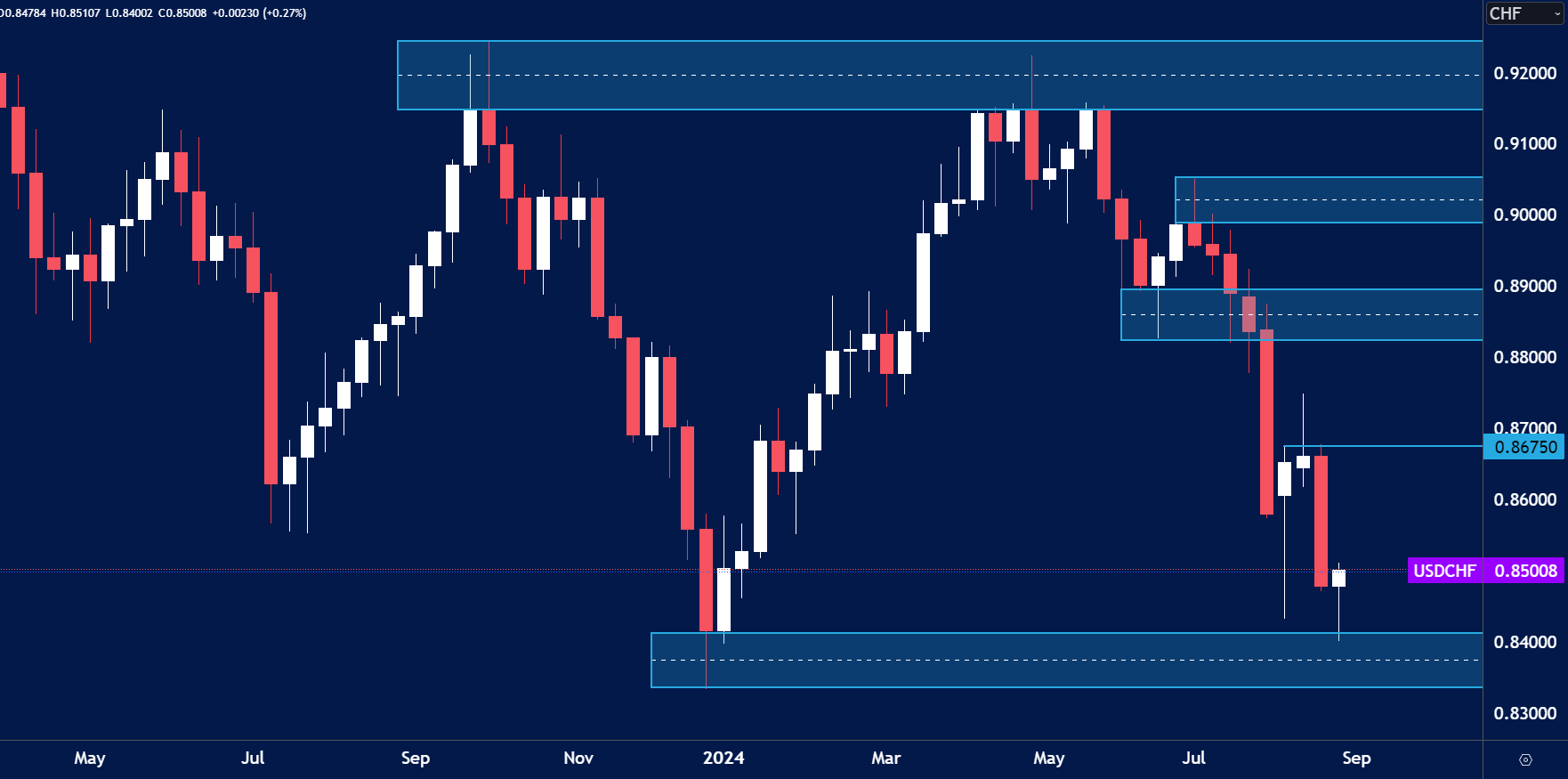

USD/CHF

- The Swiss Franc has been weakening from the reversal zone of the currency strength meter. If the USD rebounds we could see some short-term upside from this support zone of 0.8400.

- A break above the weekly highs could prompt a move higher towards recent resistance of 0.8675.

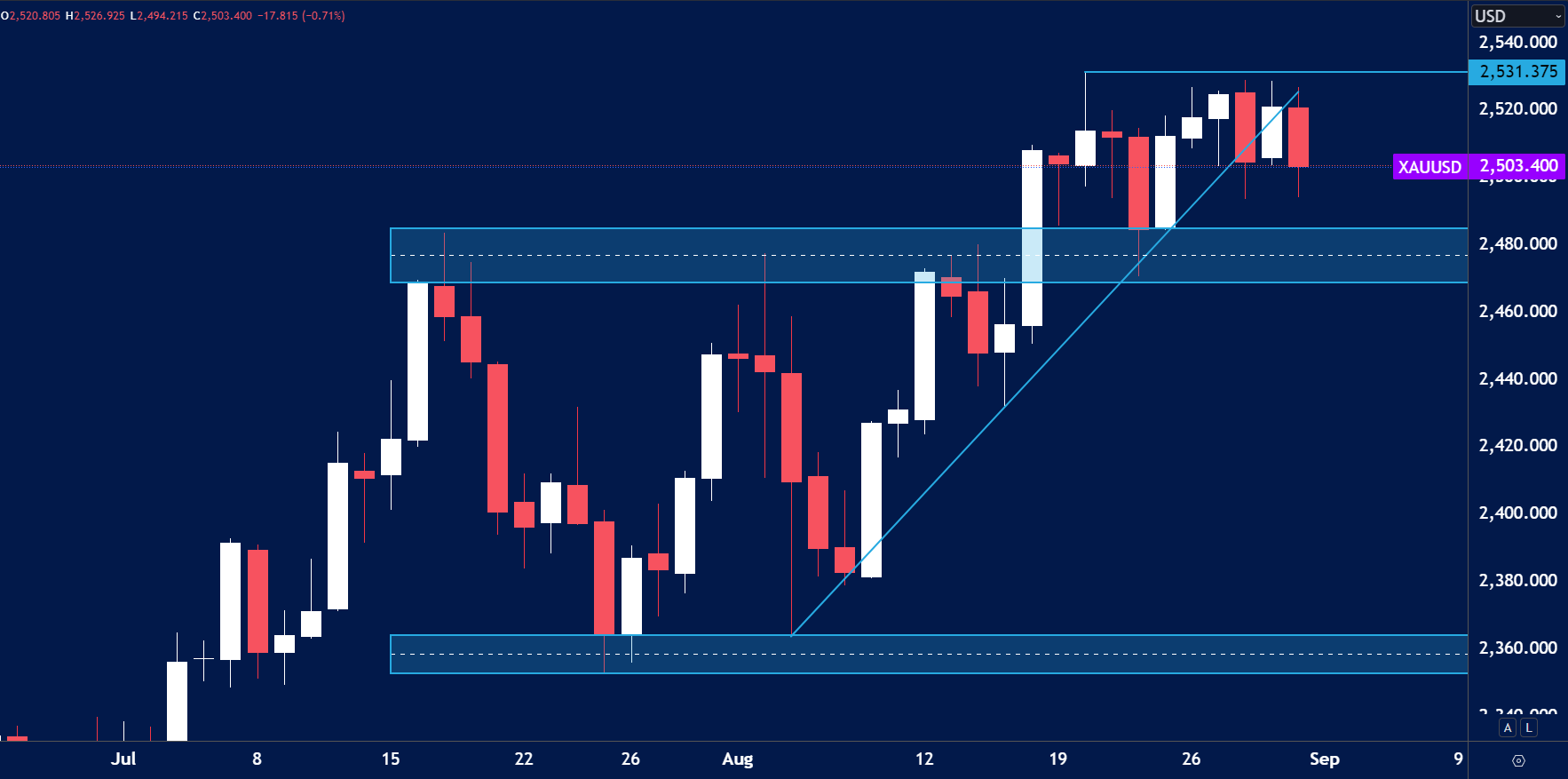

XAU/USD (Gold)

- Gold prices ranged last week at the all time highs. A break higher could be fueled if the USD moves lower.

- CoT reports show short selling coming in on Gold commercials, we could see a short term fall in price.

Trade smarter with low spreads and lightning-fast executions. Open a live account today and experience unparalleled support from our dedicated customer service team. Blueberry is here to help every step of the way!

Trade Now Open a Demo Account