We are heading for another exciting week in the forex markets, fundamental stories of this week include:

- United States: Non-Farm Payrolls expected to add 183K jobs, unemployment rate steady at 4.1%, and wage growth slowing to 0.3%; bond market strength could pressure the USD, historically weak in December.

- China: Manufacturing PMI forecast to grow to 50.2, potentially boosting correlated assets like the Australian dollar and New Zealand dollar.

- Australia: Q3 GDP expected to expand by 0.5%, up from 0.2%, signaling economic improvement.

- Japan: Japanese Yen had its best week in 8 weeks, with focus on BoJ speeches as rate hike speculation grows, fueled by Tokyo’s Core CPI beating expectations at 2.2%.

Forecast for December 2, 2024

USD Outlook

The markets cooled slightly last week as the US celebrated thanksgiving but attention will turn back to the United States dollar. Key data this week includes Non-Farm Payrolls which is expected to add 183k jobs up from 12k in October. The unemployment rate is forecast to remain steady at 4.1%, with wage growth expected to slow to 0.3%.

Last week we targeted the USD weakness within the market as bonds started to climb again. If the bond market continues to trade higher it could lead to further USD weakness. December is the USD worst performing month in history according to seasonal data. The USD Index’s performance this year has a 81% correlation with the 20 year average, which could make the seasonal pattern a strong one.

AUD & NZD Outlook

Over the weekend we will see the release of China’s manufacturing PMI which is expected to grow to 50.2. Strong data in China could help correlated assets such as the Australian dollar and New Zealand dollar. In Australia GDP is forecast to show expansion at 0.5% up from 0.2%. NZDUSD rebounded from the 0.5800 lows last week despite the RBNZ cutting rates by 50 basis points. Hedge fund positioning shows an extreme short being held, which can often lead to a reversal in price.

JPY Outlook

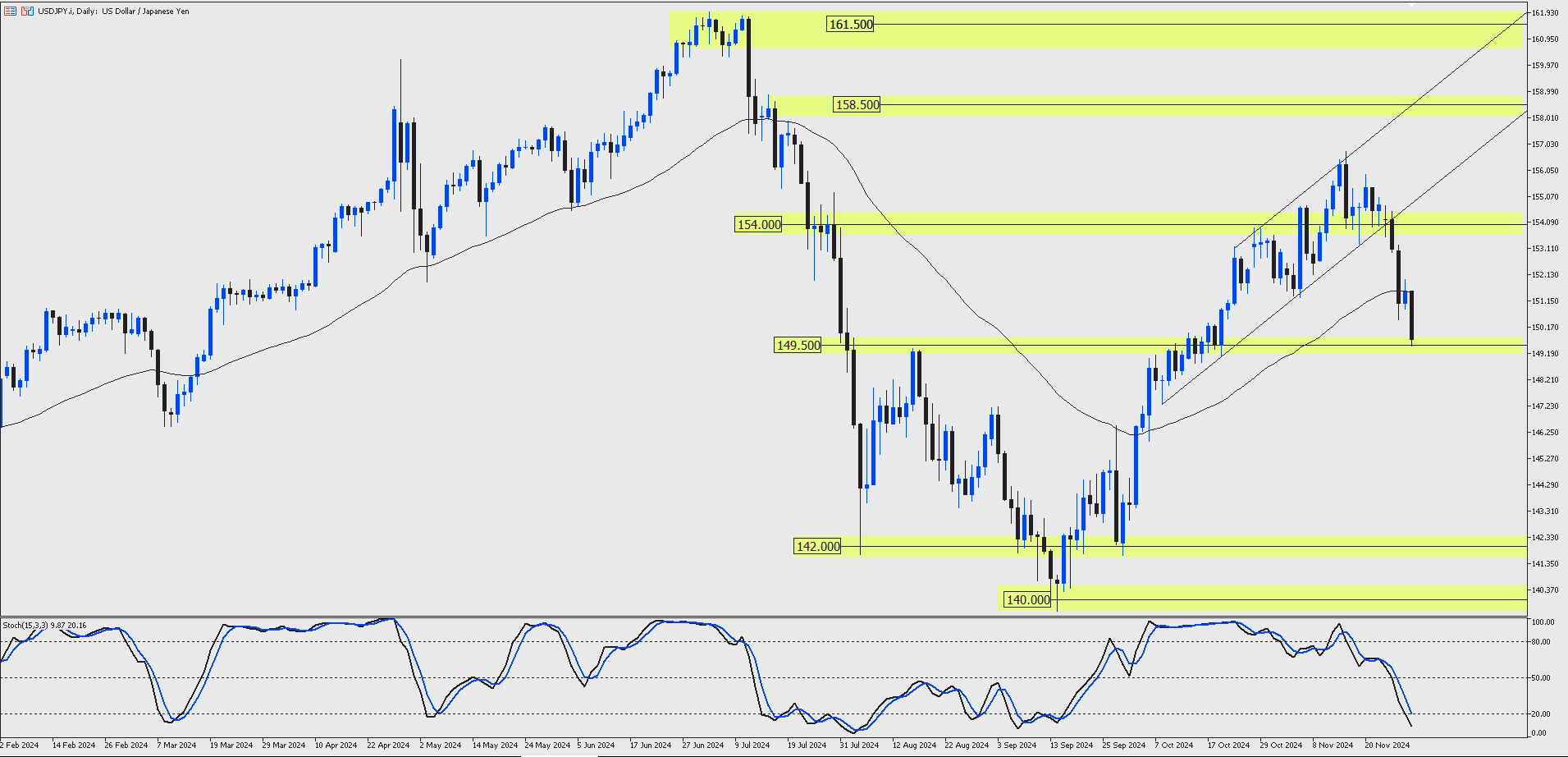

The Japanese Yen had one of its better performing weeks closing higher for the first time against the USD in 8 weeks. Focus will be on the BoJ speeches as speculation of a rate hike at the end of 2024 grows. This could be down to the latest Core CPI data out of Tokyo which beat expectations at 2.2%. USDJPY traded lower by over 3% last week with the price now trading at the support of 1.4950. This zone of support may offer a short term relief rally.